Updated February 19, 2024

A New Jersey rental agreement allows a landlord and tenant to set terms for the renting of commercial or residential property. In either type of property, the landlord will usually ask the tenant for their consent to run a credit report to verify their income and employment. If approved, a lease will be negotiated and signed. At the time of authorization, the tenant will commonly be responsible for the payment of the security deposit, first month’s rent, and any other required fees or deposits by the landlord.

Table of Contents |

Agreement Types (7)

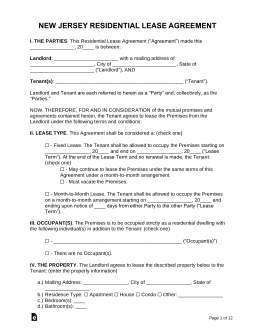

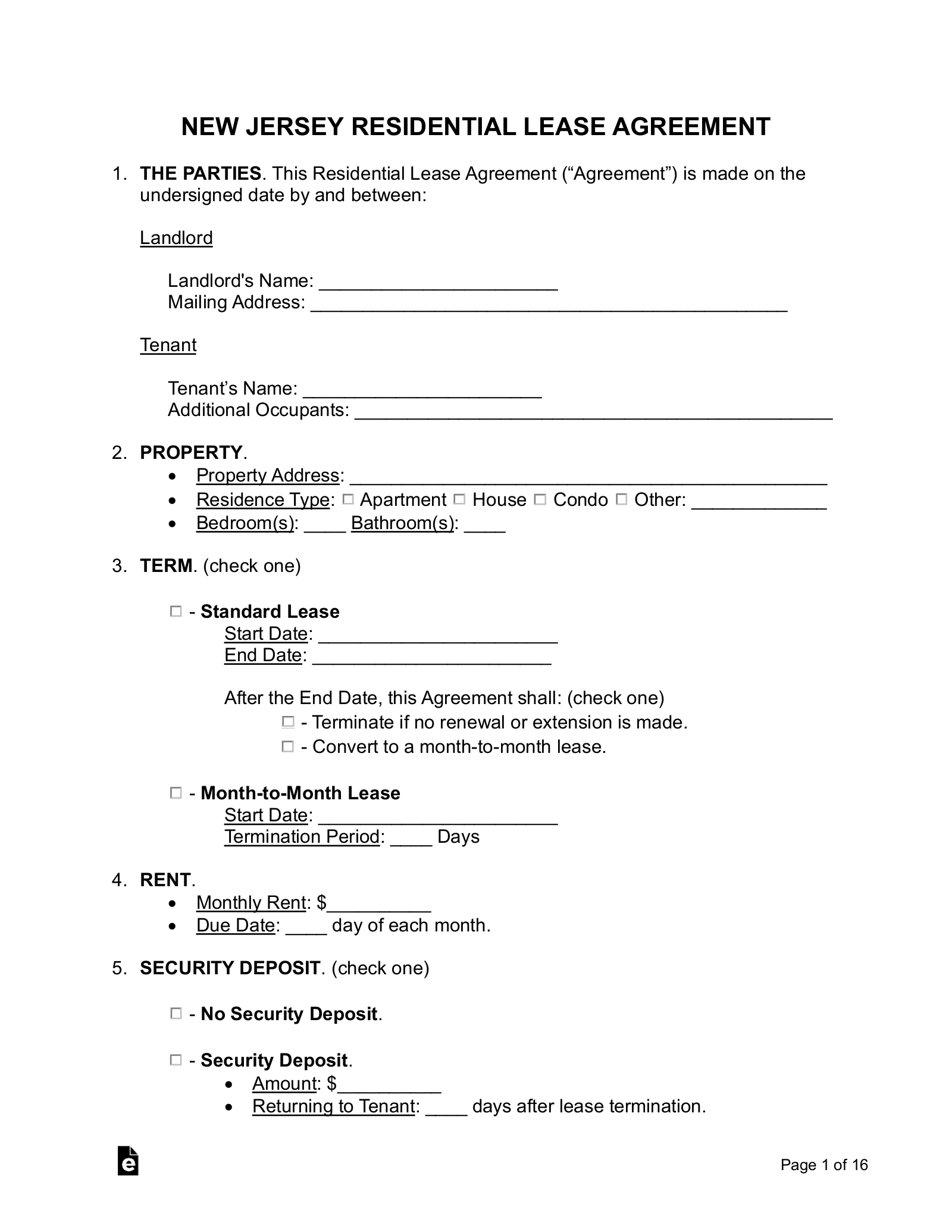

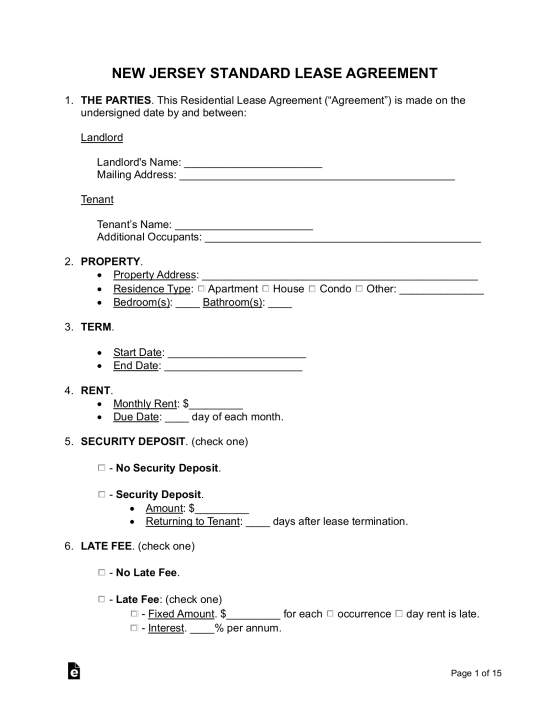

Standard Residential Lease Agreement – General contract for a fixed term of usually one year. Standard Residential Lease Agreement – General contract for a fixed term of usually one year.

Download: PDF, MS Word, OpenDocument |

Association of Realtors – Provided by the Association of New Jersey Realtors for a fixed-term arrangement. Association of Realtors – Provided by the Association of New Jersey Realtors for a fixed-term arrangement.

Download: PDF |

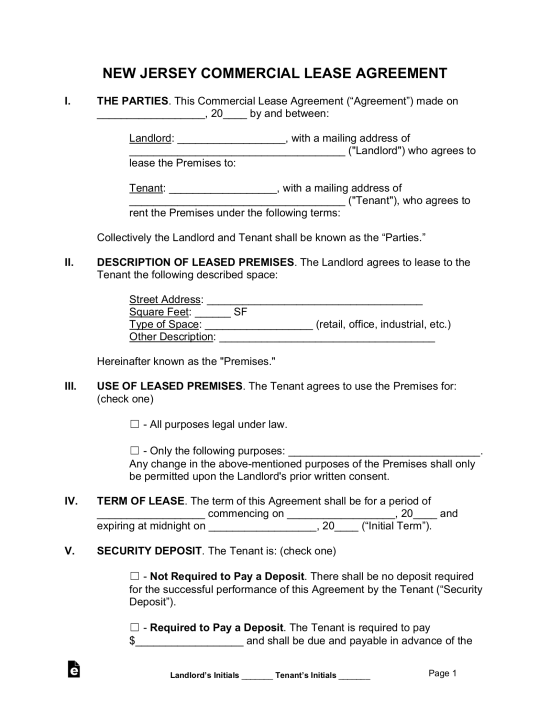

Commercial Lease Agreement – Used to rent a property for the purposes of a business-related venture, such as industrial operations, office space, etc. Commercial Lease Agreement – Used to rent a property for the purposes of a business-related venture, such as industrial operations, office space, etc.

Download: PDF, MS Word, OpenDocument |

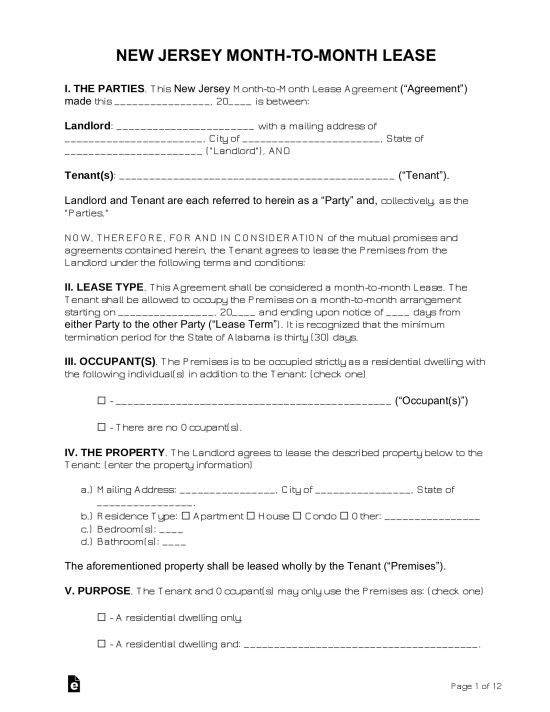

Month-to-Month Lease Agreement – Known as a tenancy at will that can be terminated at any time with a notice to quit with one (1) month’s notice. Month-to-Month Lease Agreement – Known as a tenancy at will that can be terminated at any time with a notice to quit with one (1) month’s notice.

Download: PDF, MS Word, OpenDocument |

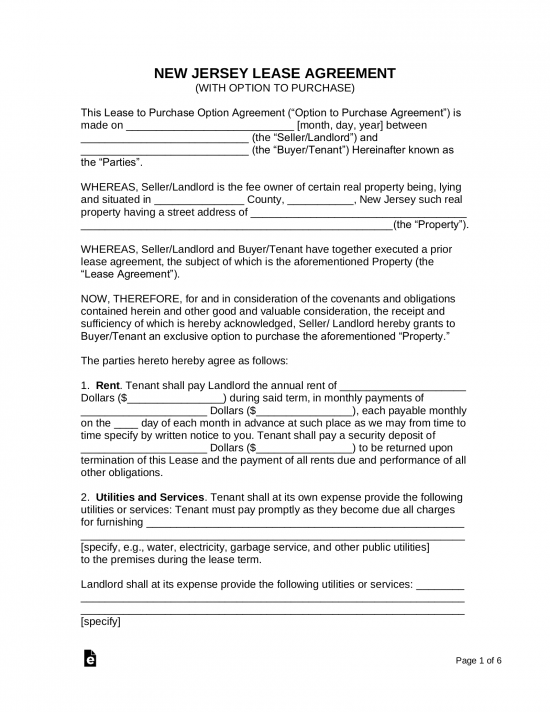

Rent-to-Own Lease Agreement – Form that gives the tenant the right to buy the premises for an agreed-upon amount. Rent-to-Own Lease Agreement – Form that gives the tenant the right to buy the premises for an agreed-upon amount.

Download: PDF, MS Word, OpenDocument |

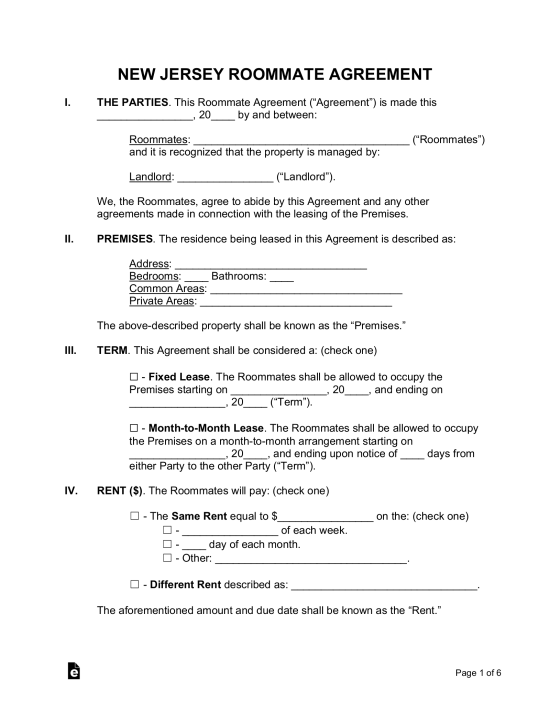

Room Rental (Roommate) Agreement – To establish the terms of a living situation between the members of a housing arrangement where the activities of cleaning and paying bills are shared. Room Rental (Roommate) Agreement – To establish the terms of a living situation between the members of a housing arrangement where the activities of cleaning and paying bills are shared.

Download: PDF, MS Word, OpenDocument |

Sublease Agreement – Used by a tenant who decides to rent their space to someone else. In most cases, the subtenancy is conditional upon the landlord’s approval. Sublease Agreement – Used by a tenant who decides to rent their space to someone else. In most cases, the subtenancy is conditional upon the landlord’s approval.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (4)

- Flood Zone (conditional) – If the landlord’s property is located in a flood zone, this must be disclosed to the tenant. New Jersey state law requires that this disclosure include information written in a particular way.[1]

- Lead-Based Paint Disclosure – Federal law requires that all property owners of units built before 1978 inform their tenants of the presence of this type of dangerous paint.

- Truth in Renting Act – The landlord must provide each of their tenants with a copy of the annual statement produced by the Department of Community Affairs outlining the rights and responsibilities of tenants and landlords in New Jersey.[2]

- Window Guard Disclosure – The lease must include a notice, written in bold font, advising tenants of their right to request window guards if children 10 or younger will be living in the unit. This notice must be written using particular language.[3]

Security Deposits

Maximum Amount – The landlord may not charge more than one and a half months’ rent for the initial deposit. If the landlord collects an additional amount of security deposit, the additional amount may not be more than 10% of the existing deposit.[4]

Collecting Interest – The landlord must place the security deposit in either an interest-bearing account at a bank or savings and loan association, or an insured money market fund established by an investment company based in New Jersey.[5]

Returning – The landlord must return the security deposit and accumulated interest, minus any withheld amounts, within 30 days of the termination date.[6]

- Itemized List – When returning the security deposit, the landlord must provide the tenant with an itemized list of any deductions from the amount, as well as interest or earnings on the initial deposit.[6]

When is Rent Due?

Grace Period – A tenant is allowed five business days to pay rent. Late rent fees or penalties cannot be assessed during such periods.[7] After this period, if rent is not paid, the landlord can serve the tenant a 30-day notice to quit.

Maximum Late Fee – New Jersey state law does not establish a maximum penalty for the late payment of rent.

NSF Fee – $20 is the maximum amount a tenant may be charged for a bad check.[8]

Withholding Rent – New Jersey state law empowers tenants to deposit their rent with a court-appointed administrator if the rental unit fails to meet minimum standards of safety and sanitation.[9]

Right to Enter (Landlord)

Standard Access – The landlord must provide at least one day’s notice to the tenant before entering the property for the purpose of making inspections or repairs.[10]

Immediate Access – The landlord may have immediate access to the property in the case of safety or structural emergencies.[10]

Abandonment

Absence – There is no statute establishing a length of time that a tenant must be absent for a rental property to be considered abandoned.

Breaking the Lease – A tenant may terminate their lease, effective 30 days after giving notice to the landlord, if they or their child face an imminent threat of domestic violence by remaining on the leased premises.[11]

Tenant’s Utility Shutoff – If the tenant’s failure to maintain utilities violates the rules and regulations outlined in the lease agreement, the landlord will have grounds for their removal.[12] The landlord may serve the tenant a 30-day notice to quit.[13]

Unclaimed Property – The landlord must give written notice of their intent to dispose of any personal property left behind by a tenant.[14] They must hold the property in storage for at least 15 days before it can be disposed of.[15]