Updated March 01, 2024

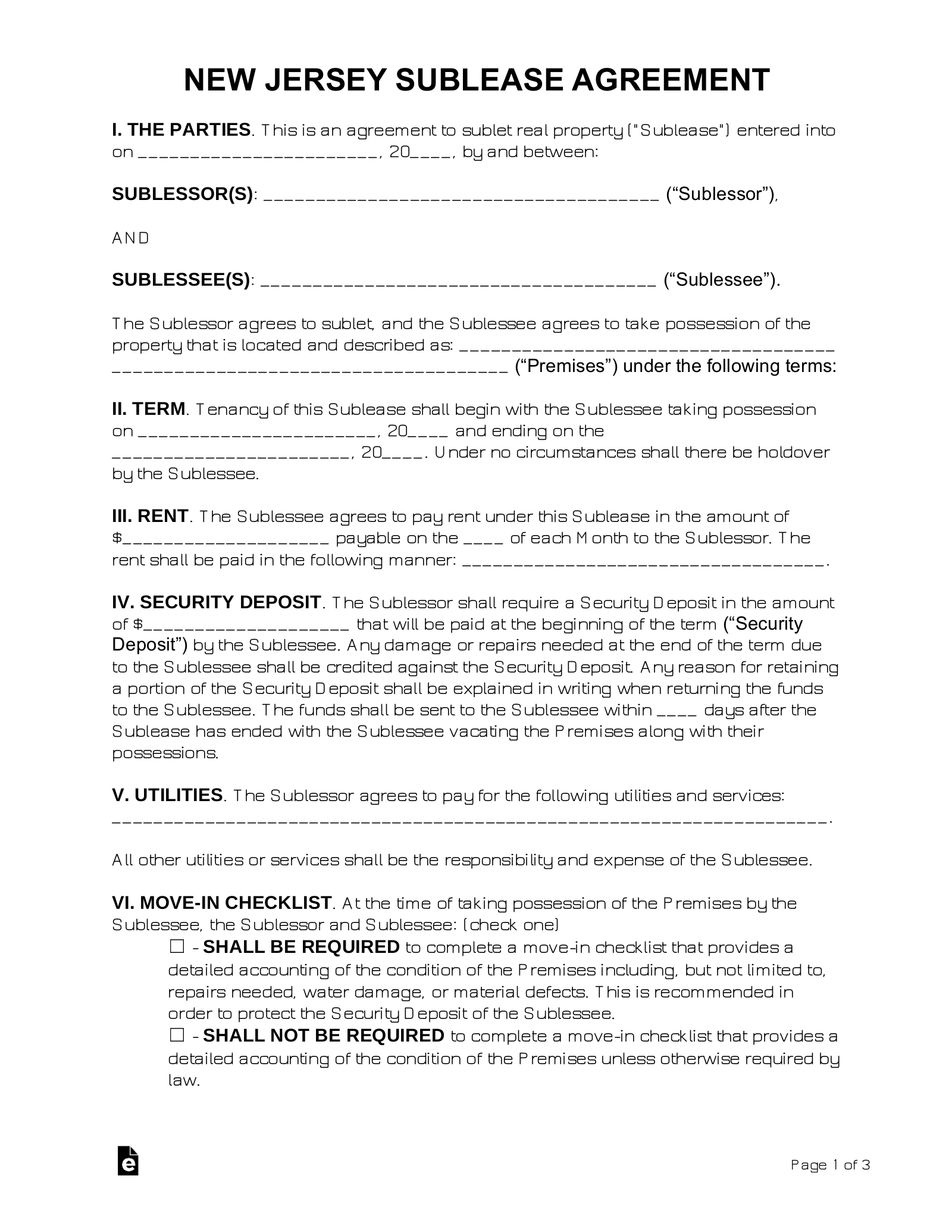

A New Jersey sublease agreement is a rental contract made between the original tenant (sub-lessor) and a sub-tenant (sub-lessee) for the purpose of subletting a residence. A sublease provides the sub-lessee the legal right to either share or completely occupy the rented premises from the sub-lessor. Sub-lessees pay rent directly to sub-lessors for the duration of the original lease.

Right to Sublet

New Jersey state law does not explicitly address subleasing. Whether or not a tenant can sublet is typically described in the original lease. The lease may prohibit such activity completely, or it may define the conditions under which subletting is permitted. Oftentimes, the landlord’s written permission and approval will be required.

Open communication with the landlord is recommended if the lease is unclear or silent on the matter of subleasing. When permission is desired or required, consider using a Landlord Consent Form.

Short-Term (Lodgings) Tax

New Jersey Division of Taxation levies taxes against “transient accommodations” (short-term rentals) on properties offered for fewer than 90 days.[1]

New Jersey short-term rental taxes statewide:

Individual counties and cities may levy additional taxes, which will vary by location. For example, accommodations in the Meadowland area are subject to the 3% Meadowlands Regional Hotel Use Assessment.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF