Updated January 10, 2024

An Illinois lease agreement is a document between a landlord and tenant for the use of residential or commercial property in exchange for the payment of rent. The tenant should first view the space and, if interested, should request to submit their credit and background details through a rental application.

Once the landlord has reviewed their credentials and the tenant is approved, the negotiations will begin for rent, security deposits, and the responsibilities of each party.

Table of Contents |

Agreement Types (7)

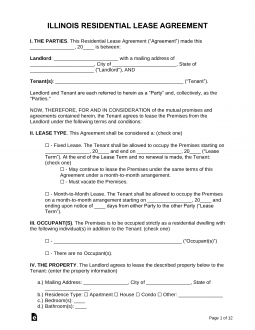

Standard Residential Lease (Chicago Only) – For a fixed term, usually one year, for any residential unit within Chicago city limits. Standard Residential Lease (Chicago Only) – For a fixed term, usually one year, for any residential unit within Chicago city limits.

Download: PDF |

Standard Residential Lease (Outside Chicago) – For a fixed term, usually one year, for any residential unit outside Chicago. Standard Residential Lease (Outside Chicago) – For a fixed term, usually one year, for any residential unit outside Chicago.

Download: PDF, MS Word, OpenDocument |

Commercial Lease Agreement – For a landlord-tenant relationship over the use of business-oriented space such as office, industrial, or retail-related. Download: PDF, MS Word, OpenDocument |

Month-to-Month Rental Agreement – A tenancy-at-will or a document that binds a landlord and tenant with no end date. Either party may cancel using the termination letter with at least 30 days’ notice. Month-to-Month Rental Agreement – A tenancy-at-will or a document that binds a landlord and tenant with no end date. Either party may cancel using the termination letter with at least 30 days’ notice.

Download: PDF, MS Word, OpenDocument |

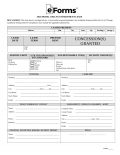

Rent-to-Own Lease Agreement – Contract used for a typical rental arrangement with the added course of action to purchase the residence. Rent-to-Own Lease Agreement – Contract used for a typical rental arrangement with the added course of action to purchase the residence.

Download: PDF, MS Word, OpenDocument |

Roommate (Room Rental) Agreement – A contract amongst persons living in a shared home with each individual having a bedroom. Roommate (Room Rental) Agreement – A contract amongst persons living in a shared home with each individual having a bedroom.

Download: PDF |

Sublease Agreement – Allows a tenant to re-rent their space with the landlord’s permission. The tenant may not have the subtenant stay longer than their master lease. Sublease Agreement – Allows a tenant to re-rent their space with the landlord’s permission. The tenant may not have the subtenant stay longer than their master lease.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (6)

- Carbon Monoxide Detectors – A landlord must provide a carbon monoxide detector within 15 feet of where the tenant sleeps. Information regarding the detectors must be listed in the lease.[1]

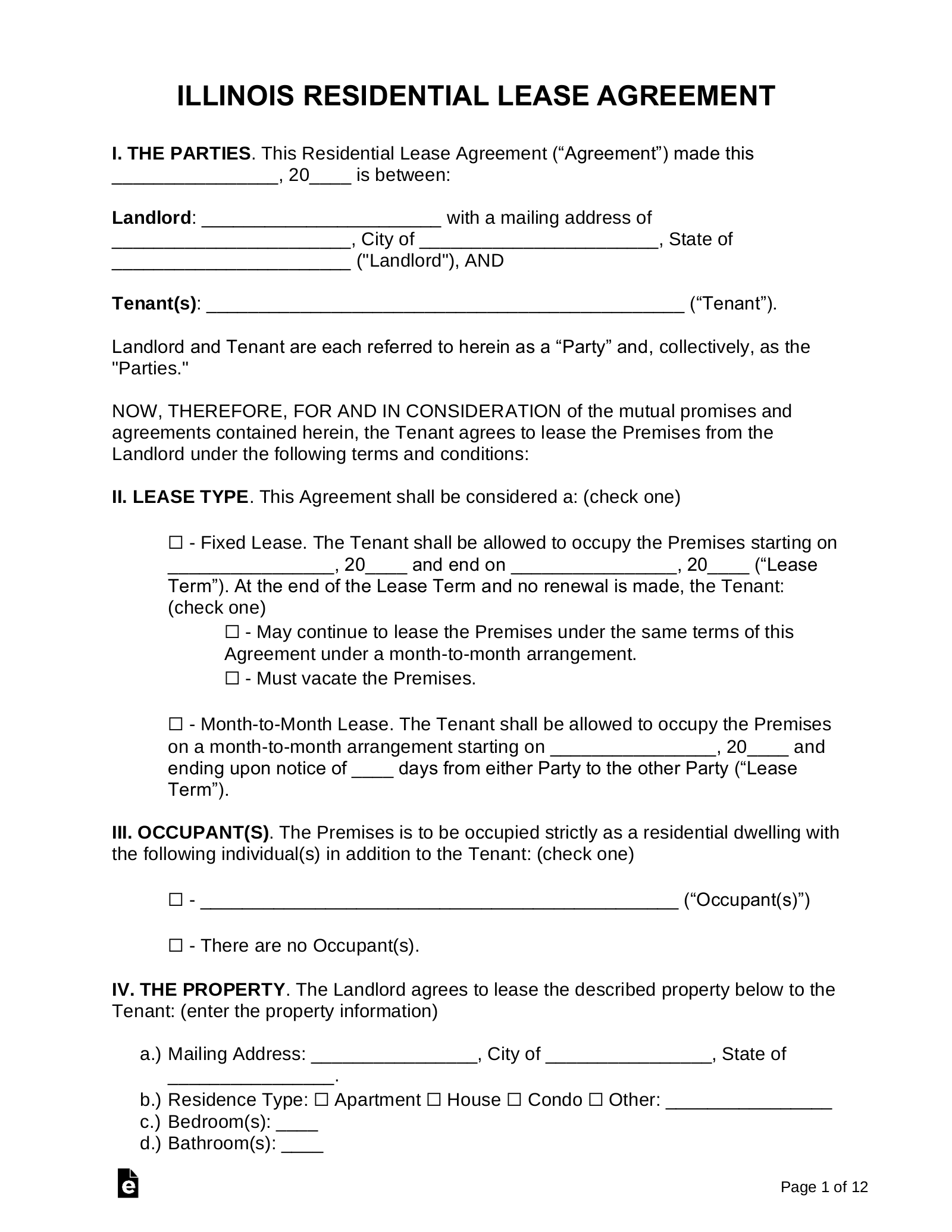

- Concession Granted – Any concession for rent is required to be mentioned in the lease. When entered into the page, the header with the words “Concession Granted” should be at least one-half inches in height on the document. Failure on behalf of the landlord to write this, if there is a concession, is considered a misdemeanor in the State of Illinois.[2]

- Lead-Based Paint Disclosure – Any residence constructed prior to 1978 is required to have this addendum attached to any agreement to inform the tenant(s) of this hazard.

- Disclosure of Information on Radon Hazards – Landlords must provide tenants with an informational disclosure on radon hazards. In addition, the “Radon Guide For Tenants” Pamphlet must be given to the tenant.[3]

- Smoke Detectors – It is the responsibility of the landlord to provide smoke detectors throughout the premises. Although, during the lease term, the tenant will be responsible for their maintenance and functionality. Use the Carbon Monoxide and Smoke Detector Agreement to ensure a tenant maintains the detectors throughout the lease term.[4]

- Shared Meter (conditional) – If a tenant must pay a portion of a master utility, the landlord must share the formula to calculate the tenant’s responsibility.[5]

Security Deposits

Collecting Interest – If the landlord owns more than 25 rental units, they will be forced to place the security deposit in an interest-bearing account to be at least the interest rate in the State of Illinois on the previous December 31 of the most recent year.[6]

Returning – The landlord has 30 days to release the security deposit to the tenant. If there are deductions to the deposit, then the landlord must list and send the deductions to the tenant(s) within 30 days and release the remaining security deposit amount within 15 days after that (45 days total).[7]

- Itemized List – If deductions are made to the tenant’s security deposit to cover the costs of necessary cleaning or repairs, the landlord must provide an itemized statement of the damage and the estimated or actual costs of repair within 30 days.[7]

When is Rent Due?

Grace Period – There is a five-day grace period for rent in Illinois. A late fee penalty cannot be issued until the sixth day. If rent is not paid, the landlord has the option to give a five-day eviction notice to the tenant.[8]

Maximum Late Fee – $20 or 20% of the rent amount, whichever is greater.[9]

NSF Fee – $25[10]

Withholding Rent – There is no state law in Illinois that allows a tenant to withhold rent. Illinois law does allow tenants, under certain circumstances, to pay for the costs of necessary repairs themselves and deduct those costs from their next rent payment.[11]

Right to Enter (Landlord)

Abandonment

Absence – There is no Illinois state law specifying the number of days that a tenant must be absent for a rental property to be considered abandoned.

Breaking the Lease – If a tenant terminates a lease before the lease end date, the landlord must take reasonable measures to mitigate the damages.[12] If the landlord is unable to find a new tenant for the property, the tenant may be liable for the remaining rent owed on the lease.

Tenant’s Utility Shutoff – If a lease makes a tenant responsible for paying for utilities, and the tenant fails to pay, the landlord can deliver a 10-day notice to quit.[13]

Unclaimed Property – There is no Illinois state law dictating the steps a landlord must take if a tenant leaves personal items on the property after the lease ends.