Updated February 27, 2024

A Texas lease agreement is a legal document that allows a landlord to rent commercial or residential property to a tenant. Before signing, the landlord will typically verify a new tenant’s credit and income. Once the lease is signed, it is legally binding on both parties.

Table of Contents |

Agreement Types (8)

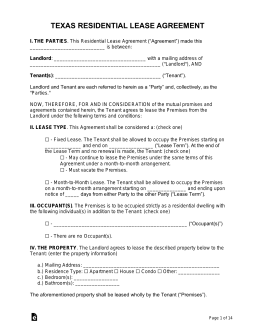

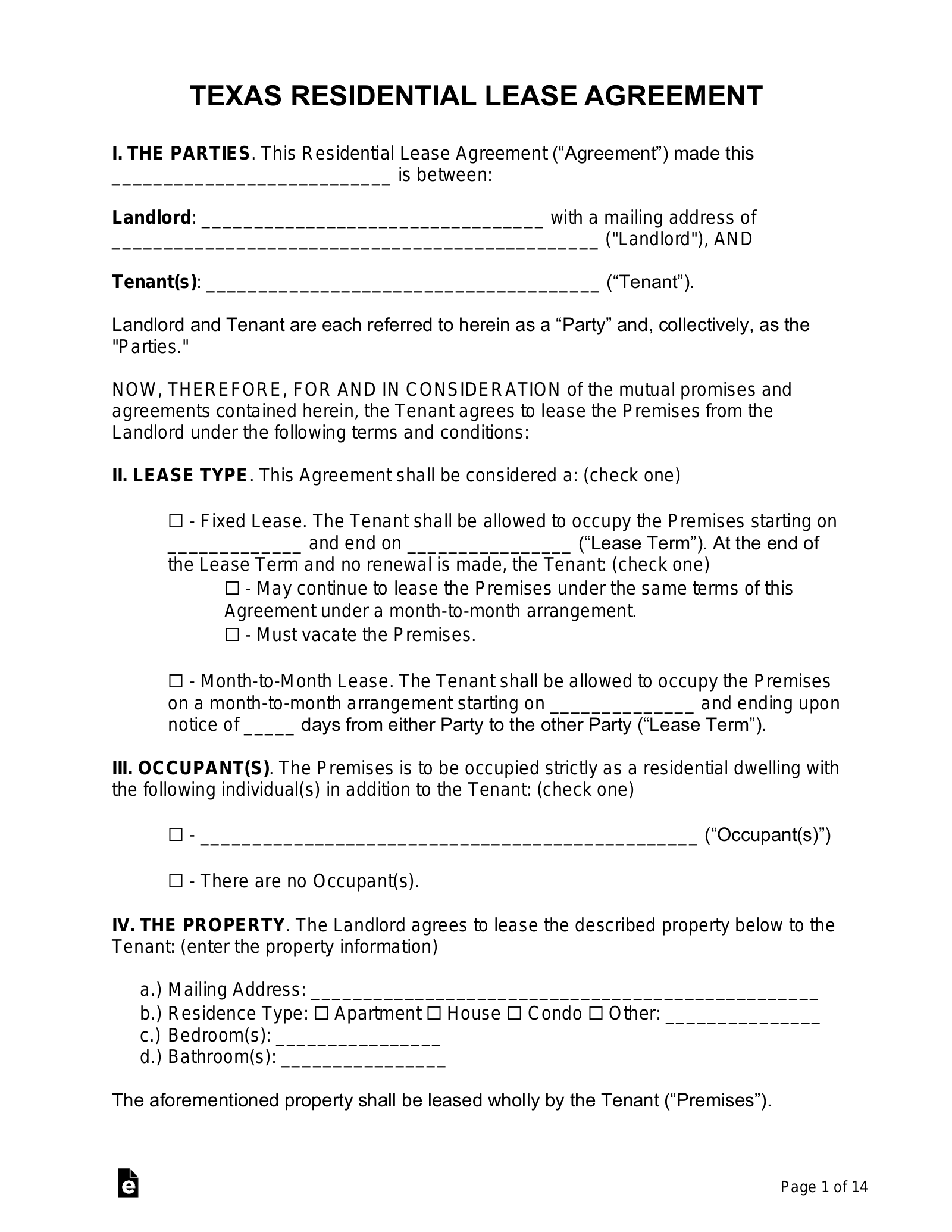

Standard Residential Lease Agreement – Most common fixed-term contract. Standard Residential Lease Agreement – Most common fixed-term contract.

Download: PDF, MS Word, OpenDocument |

Apartment Association Lease Agreement – Provided by the Apartment Association of Texas. Apartment Association Lease Agreement – Provided by the Apartment Association of Texas.

Download: PDF |

Assoc. of Realtors – 2022 version provided by the Texas Assoc. of Realtors. Assoc. of Realtors – 2022 version provided by the Texas Assoc. of Realtors. |

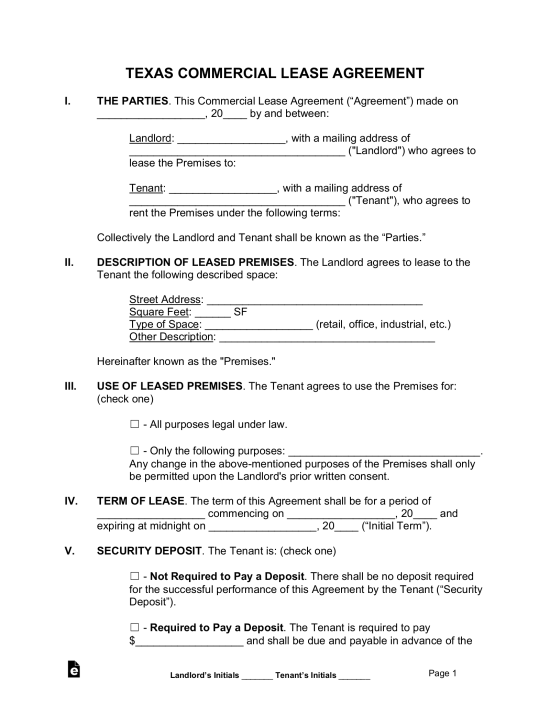

Commercial Lease Agreement – Between a landlord and tenant of a property to be used for a business or professional use such as office, industrial, or retail-related. Commercial Lease Agreement – Between a landlord and tenant of a property to be used for a business or professional use such as office, industrial, or retail-related.

Download: PDF, MS Word, OpenDocument |

Month-to-Month Lease Agreement – Can be canceled at any time with at least one month’s notice from the landlord or tenant. However, the contract may impose other terms for termination. Month-to-Month Lease Agreement – Can be canceled at any time with at least one month’s notice from the landlord or tenant. However, the contract may impose other terms for termination.

Download: PDF, MS Word, OpenDocument |

Rent-to-Own Lease Agreement – Standard residential contract with an added clause that allows the tenant to buy the premises. Rent-to-Own Lease Agreement – Standard residential contract with an added clause that allows the tenant to buy the premises.

Download: PDF, MS Word, OpenDocument |

Room Rental (Roommate) Agreement – For the individuals involved in a housing arrangement that is shared with each party receiving a bedroom and allocate the common expenses amongst themselves. Room Rental (Roommate) Agreement – For the individuals involved in a housing arrangement that is shared with each party receiving a bedroom and allocate the common expenses amongst themselves.

Download: PDF, MS Word, OpenDocument |

Sublease Agreement – For the use of a tenant that would like to rent their space to someone else also known as a “sublet.” Most real estate contracts ask for the landlord’s consent before the subtenant may be authorized on the premises. Sublease Agreement – For the use of a tenant that would like to rent their space to someone else also known as a “sublet.” Most real estate contracts ask for the landlord’s consent before the subtenant may be authorized on the premises.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (7)

- Agent/Owner Identification – The name and address of the owner of the property, as well as that of any off-site entity responsible for managing the property, must be disclosed to the tenant in writing.[1]

- Copy of Lease – Within three business days of the date of signature, the landlord must provide a complete copy of the lease to at least one of the tenants included in the agreement.[2] Any other tenant on the lease may also request a copy.[3]

- Lead-Based Paint Disclosure – Federal law requires that any landlord of a residence built before 1978 inform their tenants of the possible existence of hazardous lead paint on the property.

- Parking Rules Addendum (conditional) – The landlord of a multiunit complex must provide the tenant with a written copy of the rules or policies governing parking on the property, which the tenant must sign.[4]

- Special Conditions to Cancel Agreement – The lease must state that a tenant may have the right to terminate the lease early in situations involving family violence or a military deployment.[5]

- Tenant’s Remedies – The lease must include language in bold or underlined print that informs the tenant of their remedies under the law if and when the landlord fails to adequately maintain the property.[6]

- 100-Year Flood Plain (conditional) – If a property is located in a 100-year floodplain according to the Federal Emergency Management Agency (FEMA), the landlord must disclose this information to the tenant using particular language.[7]

Security Deposits

Maximum Amount – Texas state law does not impose an upper limit on the amount that a landlord can request for a security deposit.

Collecting Interest – Texas landlords are not required to collect or pay interest on security deposits.

Returning – The landlord must return the security deposit to the tenant within 30 days of the tenant surrendering the property.[8]

- Itemized List – If the landlord retains any portion of the security deposit, they must provide the tenant with a written description and itemized list of all deductions when they return the balance of the deposit.[9]

When is Rent Due?

Grace Period – The landlord cannot charge the tenant with a late fee until at least two days after the rent due date.[10] If rent is not paid after this grace period, the landlord can charge a fee and/or send a three-day notice to quit.

Maximum Late Fee – A late fee cannot be more than 12% of the monthly rent for residential properties with four or fewer units, or 10% of the rent for properties with five or more units.[11]

NSF Fee – $30 is the maximum amount that a landlord can charge a tenant for a bad check.[12]

Withholding Rent – If the landlord fails to repair a condition materially affecting the health and safety of the tenant, the tenant may have the condition repaired and deduct up to one month’s rent or $500, whichever is greater, from their next rent payment.[13]

Right to Enter (Landlord)

There are no statewide laws in Texas related to a landlord’s right to enter a tenant’s property. However, it is generally recommended that a landlord provide 24 hours’ written notice before accessing the property.

Abandonment

Absence – Texas state law does not establish a specific amount of time that a tenant must be absent before a residential property may be considered abandoned.

Breaking the Lease – The tenant may terminate the lease early without penalty if they are a victim of family violence,[14] a victim or the parent of a victim of certain sex offenses or stalking,[15] or a member of the military.[16]

Tenant’s Utility Shutoff – If the tenant’s failure to maintain utilities on the premises constitutes a violation of the lease agreement, the landlord may begin eviction proceedings by issuing a three-day notice to quit.[17]

Unclaimed Property – In commercial tenancies, the landlord must store any abandoned personal property left behind by the tenant for 60 days, after which time they may dispose of it.[18]