Updated November 23, 2023

A Massachusetts lease agreement is a written contract for the renting of real estate between a landlord and a tenant. The contract becomes legally binding after it is signed with the role of the tenant to occupy and make payment to the landlord every month. The landlord will typically require a credit check and verify the tenant’s income to make sure the tenant is able to afford the monthly rent amount.

Table of Contents |

Agreement Types (8)

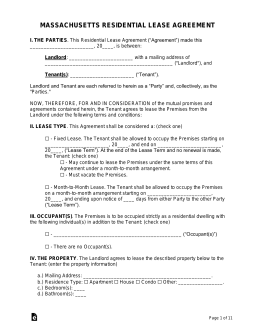

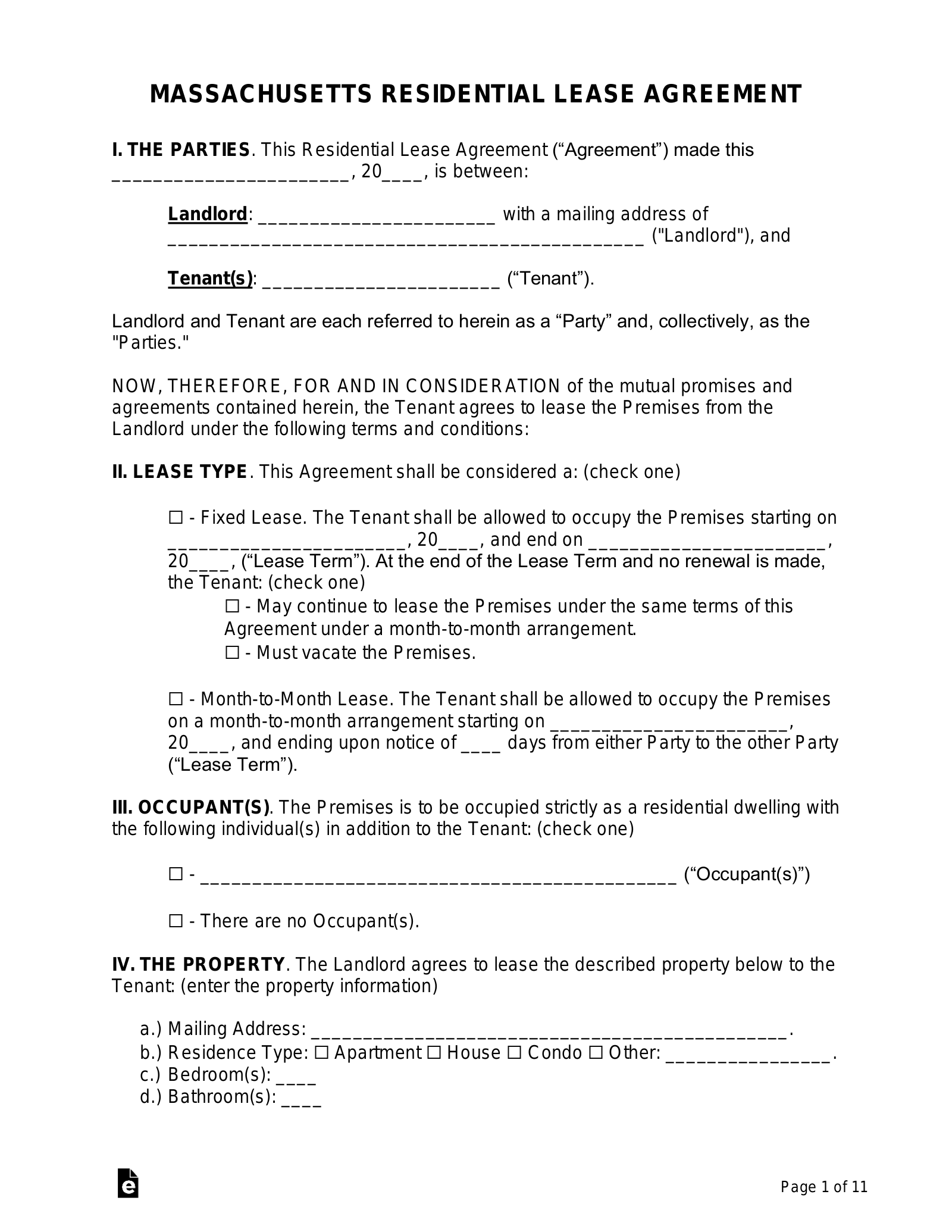

Standard Residential Lease Agreement – Fixed-term rental arrangement. For any residential housing such as an apartment, condominium, house, or any other type. Standard Residential Lease Agreement – Fixed-term rental arrangement. For any residential housing such as an apartment, condominium, house, or any other type.

Download: PDF, MS Word, OpenDocument |

Association of Realtors Residential Lease Agreement – For all rental arrangements with a fixed beginning and end date. Association of Realtors Residential Lease Agreement – For all rental arrangements with a fixed beginning and end date.

Download: PDF |

Commercial Lease Agreement – For businesses located in an office, retail or industrial space. Commercial Lease Agreement – For businesses located in an office, retail or industrial space.

Download: PDF, MS Word, OpenDocument |

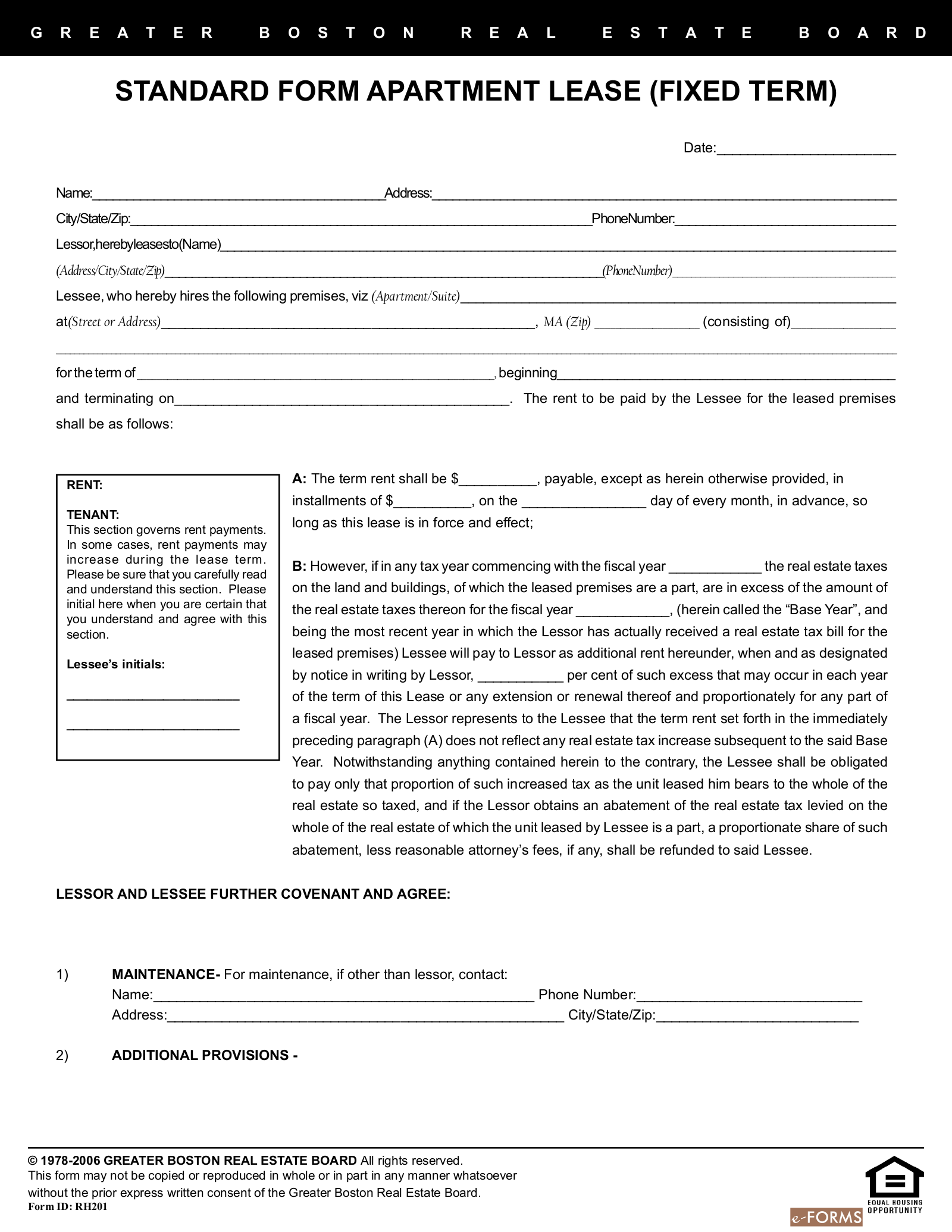

Greater Boston Residential Lease Agreement – Specifically for any type of unit located in the Greater Boston area. Greater Boston Residential Lease Agreement – Specifically for any type of unit located in the Greater Boston area.

Download: PDF |

Lease with Option to Purchase (Lease to Own) Agreement – Standard contract with the option to buy the premises. Lease with Option to Purchase (Lease to Own) Agreement – Standard contract with the option to buy the premises.

Download: PDF, MS Word, OpenDocument |

Month-to-Month Rental Agreement – A residential contract with no end date and may be terminated at any time within 30 days’ notice per Chapter 186, Section 12. Month-to-Month Rental Agreement – A residential contract with no end date and may be terminated at any time within 30 days’ notice per Chapter 186, Section 12.

Download: PDF, MS Word, OpenDocument |

Room Rental (Roommate) Agreement – For the shared living situation of roommates within a single unit. The City of Boston allows for a maximum of four individuals to occupy a single housing unit. Room Rental (Roommate) Agreement – For the shared living situation of roommates within a single unit. The City of Boston allows for a maximum of four individuals to occupy a single housing unit.

Download: PDF |

Sublease Agreement – For a tenant to seek another individual to occupy the space they have under lease for a portion or the remainder of the term. Sublease Agreement – For a tenant to seek another individual to occupy the space they have under lease for a portion or the remainder of the term.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (5)

- Fire Insurance – The landlord must disclose the terms and conditions of the fire insurance on the property within 15 days of the start date of the lease.[1]

- Inventory Checklist – Within 10 days of either receiving the security deposit or the date of commencement, whichever is later, the landlord must issue a checklist that allows the tenant to note any defects or needed repairs on the premises. The tenant has 15 days to return the inventory checklist to the landlord. Massachusetts law requires a particular notice to appear at the top of the statement.[2]

- Lead-Based Paint Disclosure – Federal law requires any landlord of a residence built before 1978 to disclose to their tenants that lead paint may be present in the property.

- Security Deposit Receipt – The landlord must provide a signed receipt for any security deposit received from the tenant. They must issue this receipt upon receiving the security deposit or within 10 days of the commencement of the tenancy, whichever is later.[3]

- Follow-up Deposit Statement – Within 30 days of receiving the security deposit, the landlord must issue a separate statement to the tenant indicating the amount of the deposit, the name and location of the bank in which it is held, and the account number for the deposit.[4]

Security Deposits

Maximum Amount – The security deposit may not be greater than the amount of the first month’s rent.[5]

Collecting Interest – The security deposit must be held in an interest-bearing account in a bank located in Massachusetts. For leases of at least one year, the landlord must pay up to 5% interest to the tenant each year, or whatever lesser interest rate paid by the bank.[6]

Returning – The landlord must give back the deposit within 30 days after the tenant has vacated the property.[7]

- Itemized List – If the landlord retains any of the security deposit to cover the costs of damages, they must provide an itemized list of damages and necessary repairs to the tenant within 30 days of the end of the tenancy.[8]

When is Rent Due?

Grace Period – The landlord cannot charge a late fee until 30 days after the date that rent is due.[9] However, once the tenant is late on rent, the landlord can begin eviction proceedings the next day by issuing a 14-day notice to quit.[10]

Maximum Late Fee – There is no statutory limit on late fees in Massachusetts. The landlord can charge as much as desired in the lease.

NSF Fee – The maximum allowable fee is 1% if the check amount for $2,500 or more, and $25 may be assessed for amounts under $2,500.[11]

Withholding Rent – If the landlord or property owner has been given notice of defects in a rental unit that impair the health or safety of the occupant, then the tenant may, after five days, repair the defects and deduct the costs of repairs from their rent.[12]

Right to Enter (Landlord)

Standard Access – The landlord may enter a rental unit in accordance with a court order, in order to conduct an inspection during the last month of the tenancy, or if the unit appears abandoned.[13] Before entering the property to make any necessary repairs, the landlord must give reasonable notice to the tenant.[14]

Immediate Access – Massachusetts state law does not specify the circumstances in which a landlord may have immediate access to a rental property.

Abandonment

Absence – Massachusetts state law does not specify a length of time that a tenant must be absent for a rental unit to be considered abandoned.

Breaking the Lease – A tenant may terminate the lease agreement if a member of the household is a victim of domestic violence, rape, sexual assault, or stalking.[15]

Tenant’s Utility Shutoff – The landlord may give seven days’ notice to quit to a tenant at will if that tenant’s failure to keep essential utilities on the property causes substantial damage to the unit or impacts the comfort or safety of the landlord or other tenants.[16]

Unclaimed Property – Within three days of the day that the rental unit was vacated, the landlord or designated agent must inspect the property for the presence of abandoned animals.[17] Massachusetts state law does not otherwise require the landlord to store personal property left behind by the tenant.

Sources

- Chapter 186, Section 21

- Chapter 186, Section 15B(2)(b)

- Chapter 186, Section 15B(2)(c)

- Chapter 186, Section 15B(3)(a)

- Chapter 186, Section 15B(1)(b)(iii)

- Chapter 186, Section 15B(3)

- Chapter 186, Section 15B(4)

- Chapter 186, Section 15B(4)(iii)

- Chapter 186, Section 15B(1)(c)

- Chapter 186, Section 11

- Chapter 60, Section 57A

- Chapter 111, Section 127L

- Chapter 186, Section 15B(1)(a)

- Sanitary Code (410.810)

- Chapter 186, Section 24(a)

- Chapter 186, Section 17

- Chapter 186, Section 30