Updated November 20, 2023

A Connecticut lease agreement is a legal contract written between an owner or agent and a tenant for a rental property. The tenant agrees to use the premises, either for residential or commercial purposes, for an agreed-upon length of time in exchange for a monthly payment to the landlord. Both parties are bound to the terms of the lease until its termination.

Table of Contents |

Agreement Types (7)

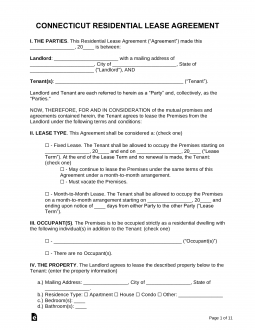

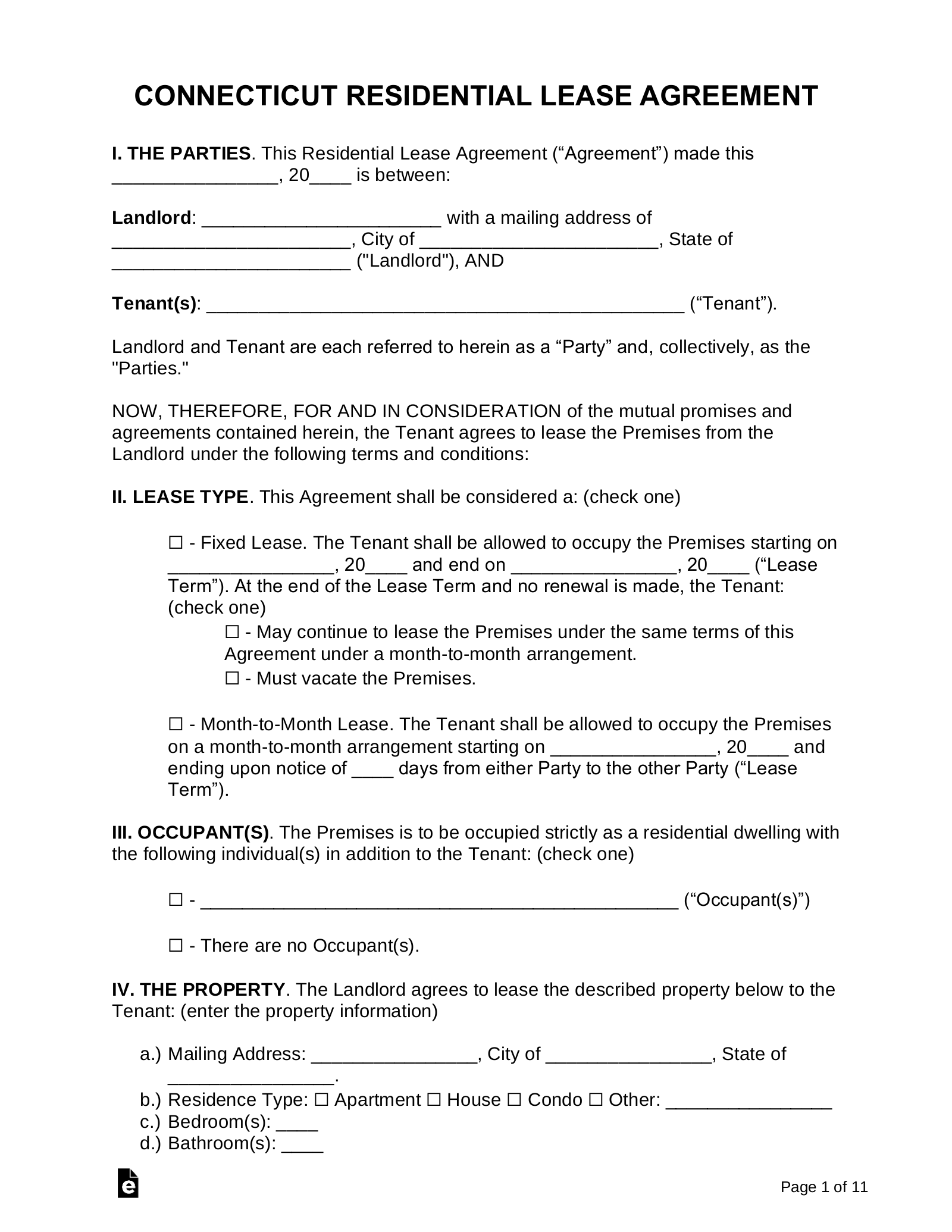

Standard Lease Agreement – The standard template for an arrangement between a landlord and tenant for the use of a residential property. Standard Lease Agreement – The standard template for an arrangement between a landlord and tenant for the use of a residential property.

Download: PDF, MS Word, OpenDocument |

Association of Realtors Residential Lease Agreement– From the Northern Fairfield County Association of Realtors but may be used statewide between a landlord and tenant. Association of Realtors Residential Lease Agreement– From the Northern Fairfield County Association of Realtors but may be used statewide between a landlord and tenant.

Download: PDF |

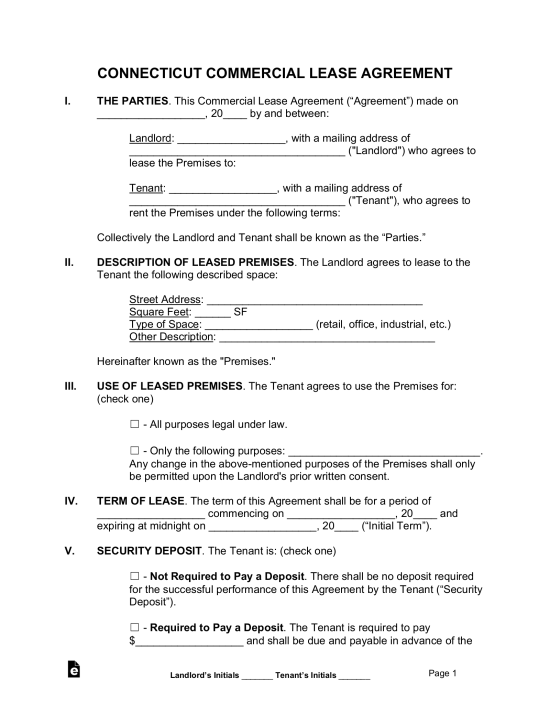

Commercial Lease Agreement – For any business-related use such as office, retail (store, restaurant, etc.), or industrial type of space. Commercial Lease Agreement – For any business-related use such as office, retail (store, restaurant, etc.), or industrial type of space.

Download: PDF, MS Word, OpenDocument |

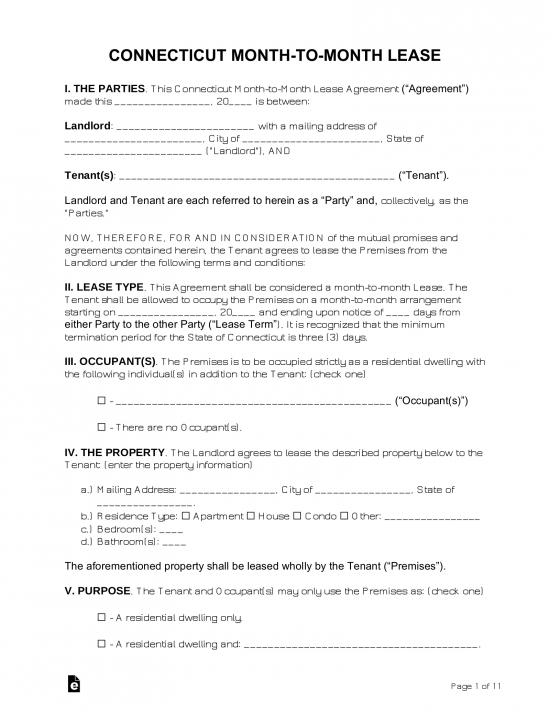

Month-to-Month Rental Agreement – Known as a “tenancy at will” with no end date in the contract. It is terminated via notice through a lease termination letter. Month-to-Month Rental Agreement – Known as a “tenancy at will” with no end date in the contract. It is terminated via notice through a lease termination letter.

Download: PDF, MS Word, OpenDocument |

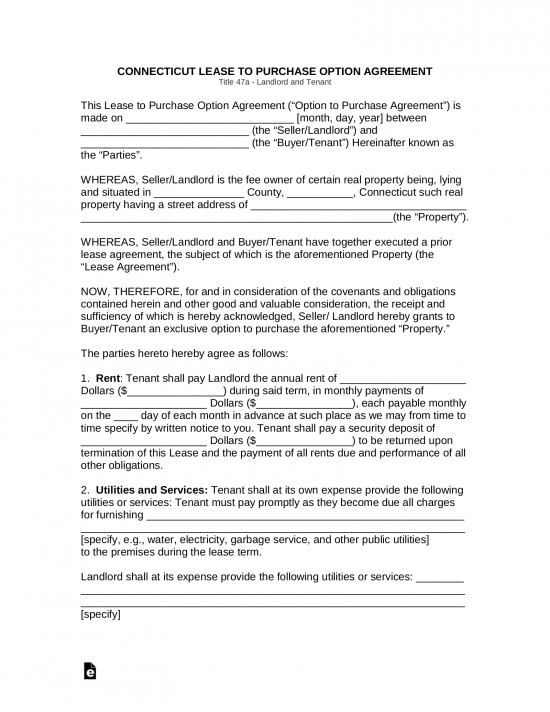

Rent-to-Own Lease Agreement – Period of time allowed for the tenant to purchase the property at a pre-determined amount stated in the contract. If the option is not used by the tenant, the form works as a standard lease. Rent-to-Own Lease Agreement – Period of time allowed for the tenant to purchase the property at a pre-determined amount stated in the contract. If the option is not used by the tenant, the form works as a standard lease.

Download: PDF, MS Word, OpenDocument |

Roommate (Room Rental) Agreement – For parties living in a shared housing arrangement. Roommate (Room Rental) Agreement – For parties living in a shared housing arrangement.

Download: PDF, MS Word, OpenDocument |

Sublease Agreement – Allows the tenant of a property to accept a subtenant to take their place. The original tenant remains responsible until the end of the term. Sublease Agreement – Allows the tenant of a property to accept a subtenant to take their place. The original tenant remains responsible until the end of the term.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (4)

- Lead-Based Paint Disclosure – According to federal law, all residential units built prior to 1978 must include this disclosure.

- Sprinkler Disclosure – The lease must include whether or not a sprinkler system is installed. If so, the date of the last inspection must be mentioned.[1]

- Landlord’s Identity – The landlord must identify themselves in the lease and include the address where the tenant can send legal notices.[2]

- Condominium Interest Community Disclosure (conditional)– If the residence is located in a common-interest community, this disclosure must be attached.[3]

Security Deposits

Collecting Interest – Landlords are required by law to keep security deposits in an escrow account and pay interest upon returning the deposit.[4][5]

Maximum Amount – The landlord may request up to the equivalent amount of two months’ rent from individuals under the age of 62, and one months’ rent for those older than 62. If a tenant turns 62 during their tenancy, the portion exceeding one months’ rent must be returned.[6]

Returning –Tenant is due their deposit back, along with any accrued interest, within 21 of handing the premises back to the landlord or within 15 days of receiving the tenant’s forwarding address, whichever is later.[7]

When is Rent Due?

Grace Period – There is a nine day grace period in Connecticut. The landlord cannot begin charging for late fees or start an eviction process with a 3-day notice to quit until the 10th day.[8]

Maximum Late Fee ($5/day or 5%) – A landlord may charge a late fee if their tenant fails to pay rent nine days after its due date. Connecticut law sets a cap on the amount a landlord may charge:[9]

- $5.00 per day, up to a maximum of $50.00;

- 5% of the delinquent rent payment; or

- In the case of a rental agreement paid in whole or in part by a governmental or charitable entity, 5% of the tenant’s share of the delinquent rent payment.

NSF Fee – For a tenant writing a bad check, the maximum fee is $20.[10]

Withholding Rent – If the landlord is required to provide essential utilities or services and fails to do so, the tenant can deduct from their rent the cost of procuring those services.[11] Tenants can also withhold rent if the property is seriously damaged by a fire or other casualty not caused by the tenant.[12]

Right to Enter (Landlord)

Standard Access – The landlord must give the tenant reasonable notice prior to entering the premises for any repair, inspection, or need for the agent to show the property.

Immediate Access – In emergency circumstances or pursuant to a court order, the tenant’s consent is not required to access the property.[13]

Abandonment

Absence – If the occupants vacate the premises with no intent to return, the landlord can deliver a notice of belief of abandonment stating that the property will be reclaimed and the lease agreement terminated within ten days of receipt.[14]

Breaking the Lease – If the landlord terminates the rental agreement because of the tenant’s breach, they are entitled to unpaid rent that the tenant would owe under the agreement. However, the landlord must make efforts to re-rent the property to mitigate any damages.[15]

Tenant’s Utility Shutoff – The law does not directly mention the responsibility of tenants to maintain essential utilities. However, tenants are obligated to maintain the property for the health and safety of its occupants, and to “reasonably” use electrical, plumbing, HVAC, and other utilities and services.[16]

Unclaimed Property – If personal property is left behind by a former tenant, the landlord must inventory the items and hold them for 30 days, during which time the owner can reclaim them. The landlord can dispose of the items after 30 days.[17]