Updated September 12, 2023

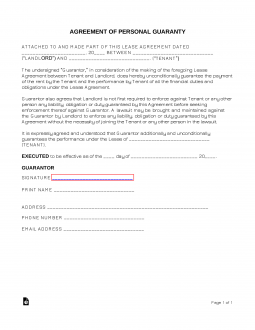

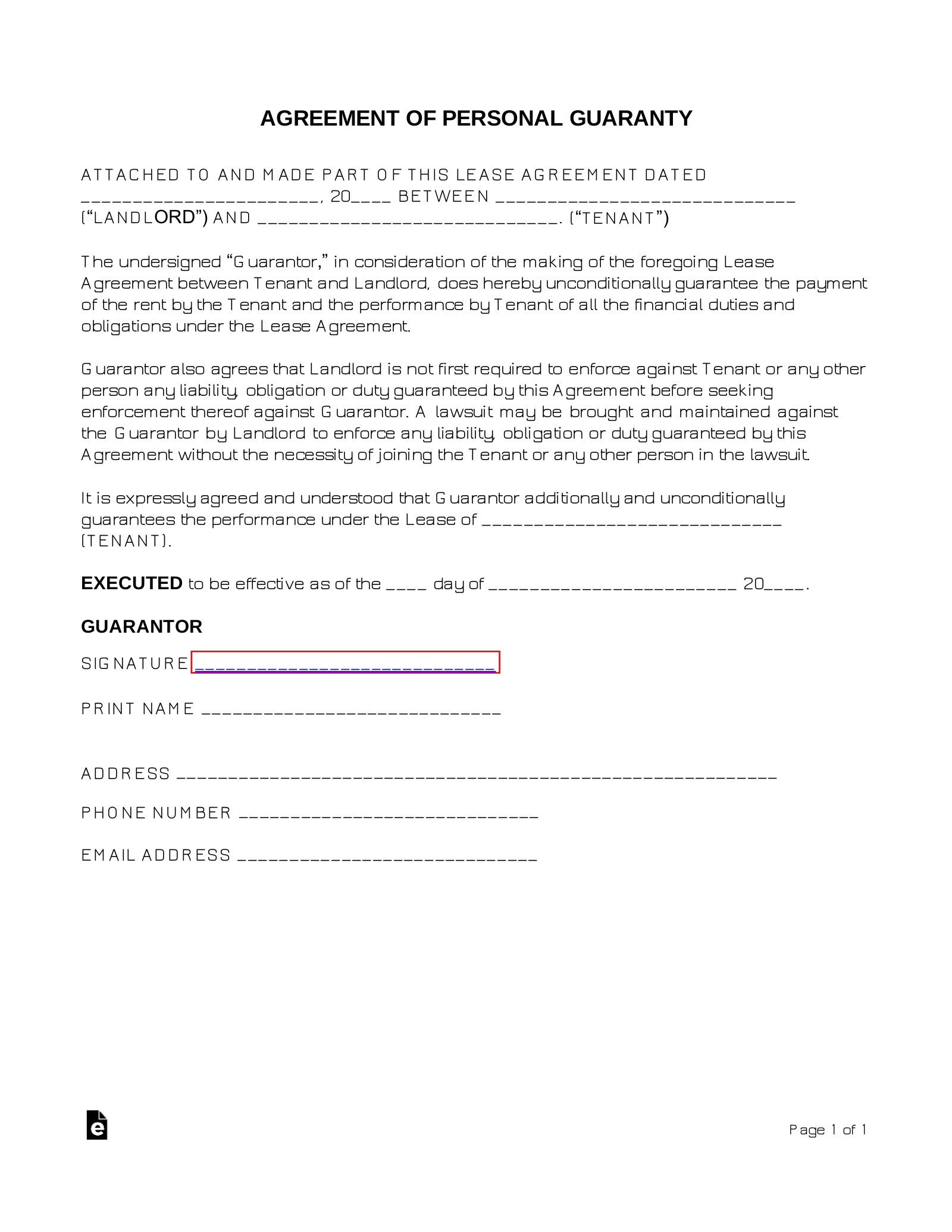

A real estate (lease) personal guarantee requires a third party (guarantor) to fulfill the lease obligations in the event of default by the tenant under a rental contract. If the tenant doesn’t pay rent or breaks the lease for other reasons, the guarantor would be held liable.

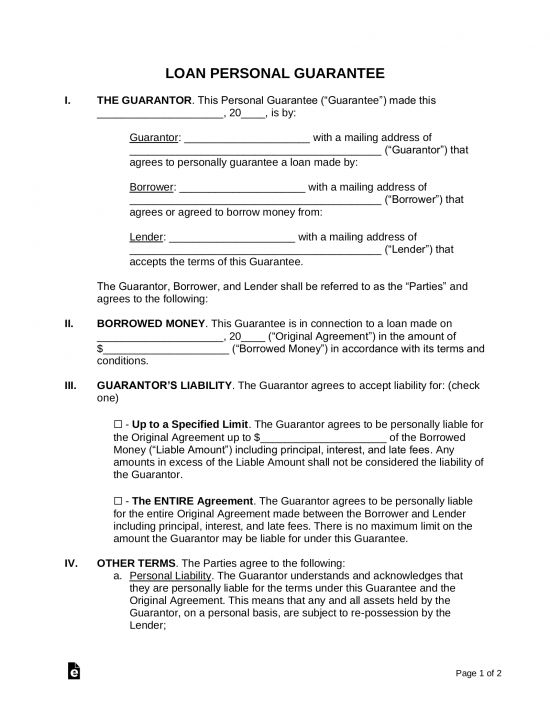

Release of Personal Guarantee – To be executed at the completion of a lease or if the guarantor is to be released for another reason.

Related Forms

Download: PDF, MS Word, OpenDocument

Release of Personal Guarantee – To be executed at the completion of a lease or if the guarantor is to be released for another reason.

Release of Personal Guarantee – To be executed at the completion of a lease or if the guarantor is to be released for another reason.

Download: PDF, MS Word, OpenDocument