Updated January 31, 2024

A Nevada lease agreement is written to allow a landlord and tenant to come to terms over the use of a property. The contract usually outlines the monthly payment amount, the term of the lease, and any other conditions agreed upon by the parties. Once the document has been written and signed, it becomes legally binding to both the landlord and tenant.

Table of Contents |

Agreement Types (7)

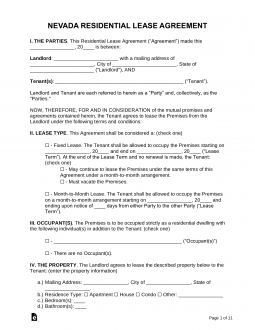

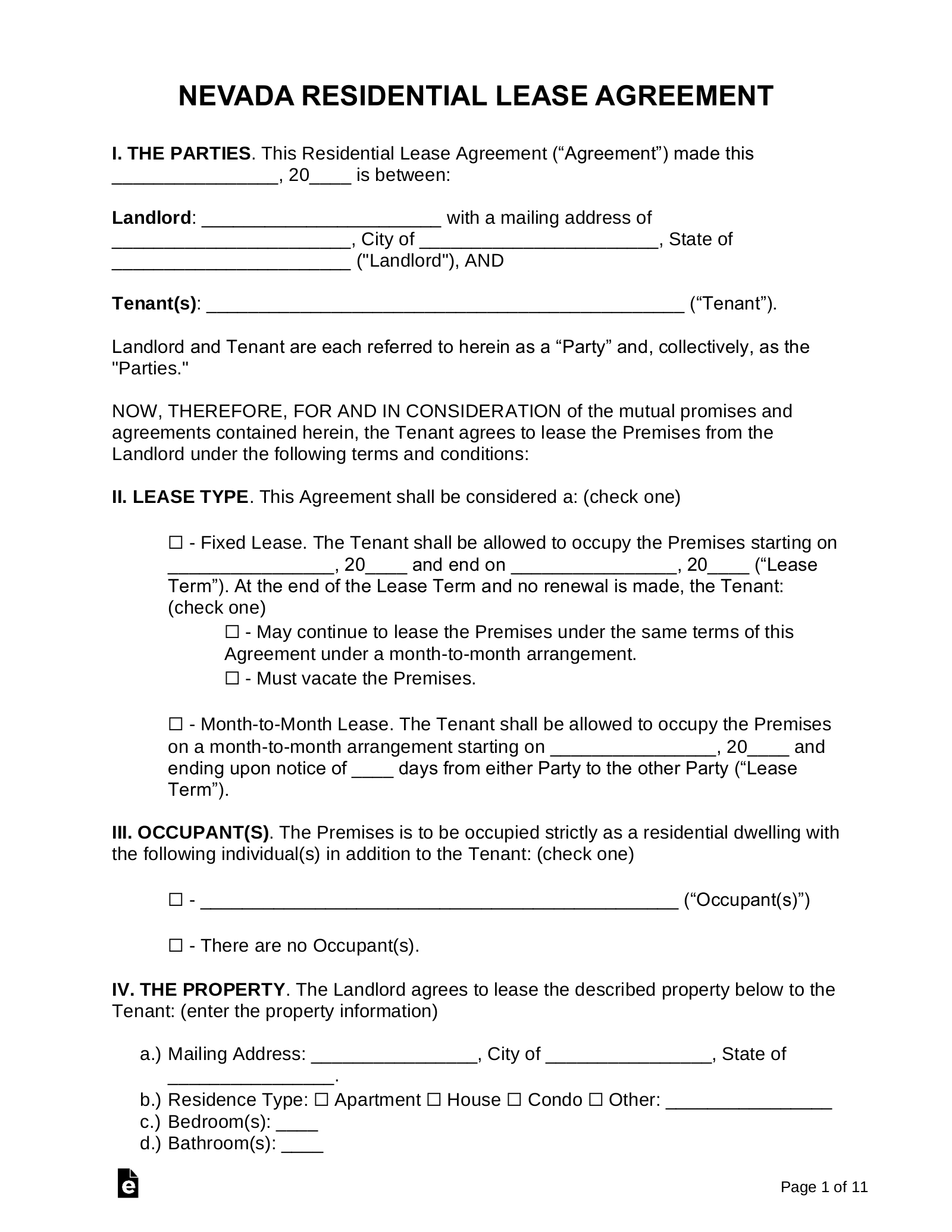

Standard Residential Lease Agreement – For a fixed-term arrangement usually lasting one year. Standard Residential Lease Agreement – For a fixed-term arrangement usually lasting one year.

Download: PDF, MS Word, OpenDocument |

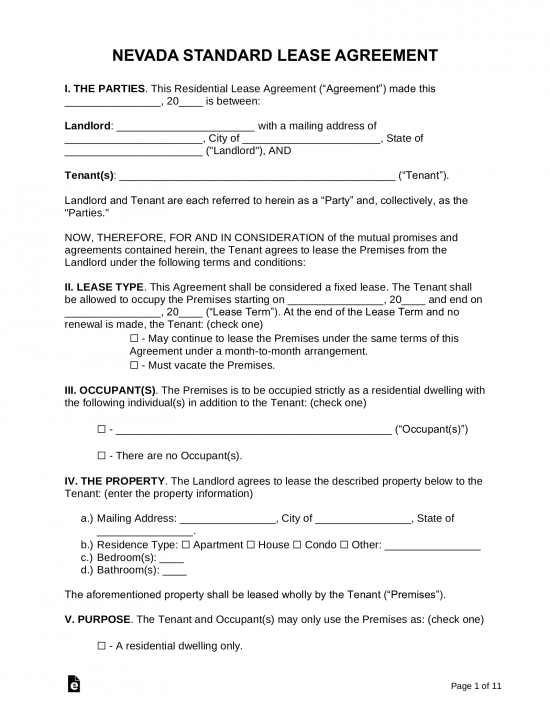

Association of Realtors – Provided by the Greater Las Vegas Association of Realtors for all residential tenancies. Association of Realtors – Provided by the Greater Las Vegas Association of Realtors for all residential tenancies.

Download: PDF |

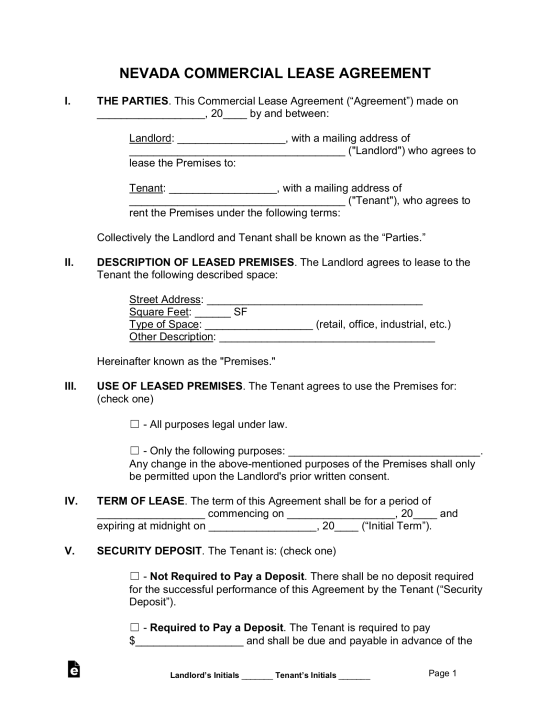

Commercial Lease Agreement – In accordance with Chapter 118C this form is designated for property related to business use. Commercial Lease Agreement – In accordance with Chapter 118C this form is designated for property related to business use.

Download: PDF, MS Word, OpenDocument |

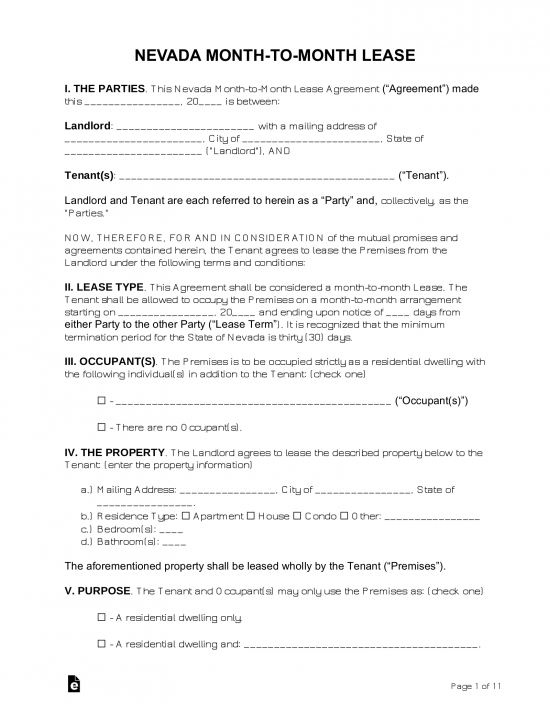

Month-to-Month Lease Agreement (NRS 40.251) – Allows for the occupation of property that can be canceled at any time with at least 30 days’ notice by either party. The landlord requires an additional 30 days for tenants who are 60 years of age and older. Month-to-Month Lease Agreement (NRS 40.251) – Allows for the occupation of property that can be canceled at any time with at least 30 days’ notice by either party. The landlord requires an additional 30 days for tenants who are 60 years of age and older.

Download: PDF, MS Word, OpenDocument |

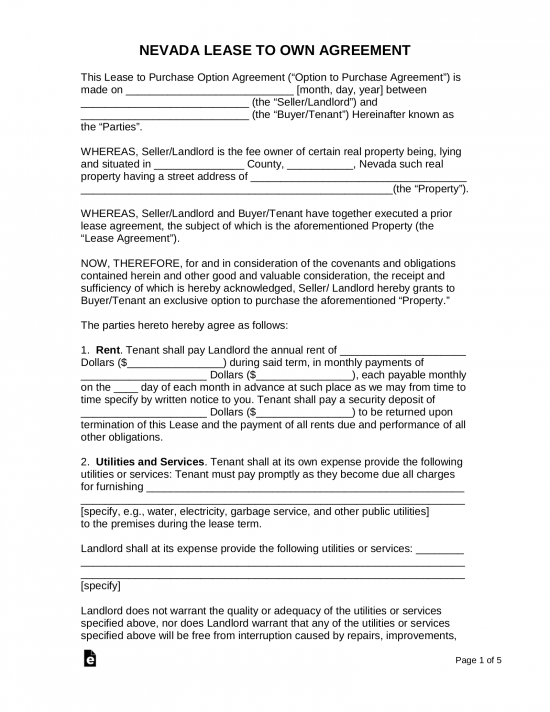

Rent-to-Own Lease Agreement – Standard residential contract that offers the tenant the right to buy the property in accordance with the agreed-upon provisions. Rent-to-Own Lease Agreement – Standard residential contract that offers the tenant the right to buy the property in accordance with the agreed-upon provisions.

Download: PDF, MS Word, OpenDocument |

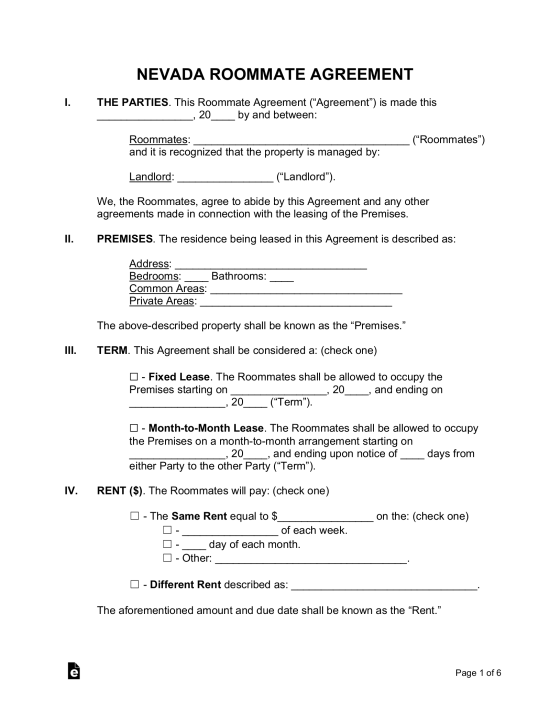

Room Rental (Roommate) Agreement – Created for multiple persons living in a shared residence to establish rules and how much each individual must pay for utilities and expenses on the property. Room Rental (Roommate) Agreement – Created for multiple persons living in a shared residence to establish rules and how much each individual must pay for utilities and expenses on the property.

Download: PDF, MS Word, OpenDocument |

Sublease Agreement – Allows a tenant who is seeking to get out of their lease early to allow someone else (“subtenant”) to take their place and continue making payments on their behalf. Sublease Agreement – Allows a tenant who is seeking to get out of their lease early to allow someone else (“subtenant”) to take their place and continue making payments on their behalf.

Download: PDF, MS Word, OpenDocument |

Required Disclosures (7)

- Fees – Any non-refundable fee that the tenant must pay must be disclosed in the rental contract.[1]

- Foreclosure (conditional) – If the property has foreclosure proceedings pending, this must be disclosed to the tenant.[2]

- Lead-Based Paint Disclosure – The landlord of a residence built prior to 1978 must inform the tenant of the potential existence of lead paint in the interior walls and ceilings

- Move-in Checklist – A signed accounting of the property’s current condition must be completed at the start of the tenancy.[3]

- Nuisance/Violation Guide – The landlord must provide the tenant with a guide on the steps to reporting a nuisance or violation on the premises to the proper government authorities.[4]

- USA Flag (Right to Raise) – The landlord must give the tenant information on their right to wave the American flag on the premises.[5]

- Security Deposit Receipt (conditional) – The landlord must provide the tenant with a receipt for the security deposit if the tenant requests it.[6]

Security Deposits

Maximum Amount – The landlord may not demand more than the equivalent of three months’ rent.[7]

Collecting Interest – Nevada state law does not require the landlord to collect or pay interest on the tenant’s security deposit.

Receipt – Upon the request of the tenant, the landlord must provide a signed receipt for the security deposit.[6]

Returning – Within 30 days of the end of tenancy, the landlord must return the security deposit, minus any withheld amounts, to the tenant.[8]

- Itemized List – If the landlord withholds any portion of the security deposit to cover the costs of repairs to the unit or any unpaid rent, they must provide the tenant with an itemized accounting of how the withheld funds were used.[8]

When is Rent Due?

Grace Period – The landlord cannot charge a late fee until at least three days after the date rent was due.[9] If the tenant is in default in paying rent, the landlord can serve a seven-day notice to quit.[10]

Maximum Late Fee – The landlord can charge the tenant a maximum late fee of 5% of the monthly rent amount.[11]

NSF Fee – The landlord cannot charge more than $25 for a bad check.[12]

Withholding Rent – If the landlord fails to comply with the rental agreement or to maintain the unit in a habitable state, the tenant may pay for repairs or other necessary work on their own and deduct up to 1 month’s rent from their next payment.[13]

Right to Enter (Landlord)

Standard Access – Except in the case of an emergency, the landlord must provide at least 24 hours’ notice before entering the tenant’s leased premises and may only enter at reasonable times during normal business hours.[14]

Immediate Access – The landlord can enter the unit without the consent of the tenant in the case of an emergency.[15]

Abandonment

Absence – If the tenant has been unexpectedly absent from the unit for a period of time equal to one-half the time for periodic rental payments, and if they are behind on rent, then the landlord may presume that the tenant has abandoned the rental unit.[16]

Breaking the Lease – The tenant has the right to terminate the lease if a physical or mental condition requires them to relocate in order to receive treatment,[17] or if they are the victim of domestic violence, harassment, sexual assault, or stalking.[18]

Tenant’s Utility Shutoff – If the tenant’s failure to maintain essential utilities on the property constitutes noncompliance with the rental agreement or with their basic obligations, then the landlord may deliver a five-days’ notice to vacate.[19]

Unclaimed Property – The landlord must store any personal property left behind after the end of tenancy for 30 days, after which time they may dispose of it. They must also give the tenant written notice of their intent to dispose of the property after 30 days.[20]

Sources

- NRS 118A.200

- NRS 118A.275

- NRS 118A.200(k)

- NRS 118A.200(3)(m)

- NRS 118A.325

- NRS 118A.250

- NRS 118A.242(1)

- NRS 118A.242(4)

- NRS 118A.210(4)(a)

- NRS 40.253(1)

- NRS 118A.210(4)(b)

- NRS 360.238

- NRS 118A.360(1)

- NRS 118A.330(3)

- NRS 118A.330(2)

- NRS 118A.450

- NRS 118A.340(1)

- NRS 118A.345(1)

- NRS 118A.430(1)

- NRS 118A.460(1)