Updated September 12, 2023

A loan personal guarantee is a document that allows an individual (guarantor) to be held responsible for money loaned if a borrower does not pay it back. This gives a lender added security that the loaned amount will be repaid, especially for borrowers with fair or bad credit.

For those with good credit, having someone else personally guarantee a loan will oftentimes allow for better financing terms, including a lower interest rate.

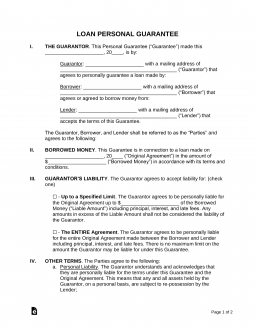

Sample

LOAN PERSONAL GUARANTEE

I. THE GUARANTOR. This Personal Guarantee (“Guarantee”) made this [DATE] is by:

Guarantor: [FULL NAME] with a mailing address of [MAILING ADDRESS] (“Guarantor”) that agrees to personally guarantee a loan made by:

Borrower: [FULL NAME] with a mailing address of [MAILING ADDRESS] (“Borrower”) that agrees or agreed to borrow money from:

Lender: [FULL NAME] with a mailing address of [MAILING ADDRESS] (“Lender”) that accepts the terms of this Guarantee.

The Guarantor, Borrower, and Lender shall be referred to as the “Parties” and agrees to the following:

II. BORROWED MONEY. This Guarantee is in connection to a loan made on [DATE] (“Original Agreement”) in the amount of $[AMOUNT] (“Borrowed Money”) in accordance with its terms and conditions.

III. GUARANTOR’S LIABILITY. The Guarantor agrees to accept liability for: (check one)

☐ – Up to a Specified Limit. The Guarantor agrees to be personally liable for the Original Agreement up to $[AMOUNT] of the Borrowed Money (“Liable Amount”) including principal, interest, and late fees. Any amounts in excess of the Liable Amount shall not be considered the liability of the Guarantor.

☐ – The ENTIRE Agreement. The Guarantor agrees to be personally liable for the entire Original Agreement made between the Borrower and Lender including principal, interest, and late fees. There is no maximum limit on the amount the Guarantor may be liable for under this Guarantee.

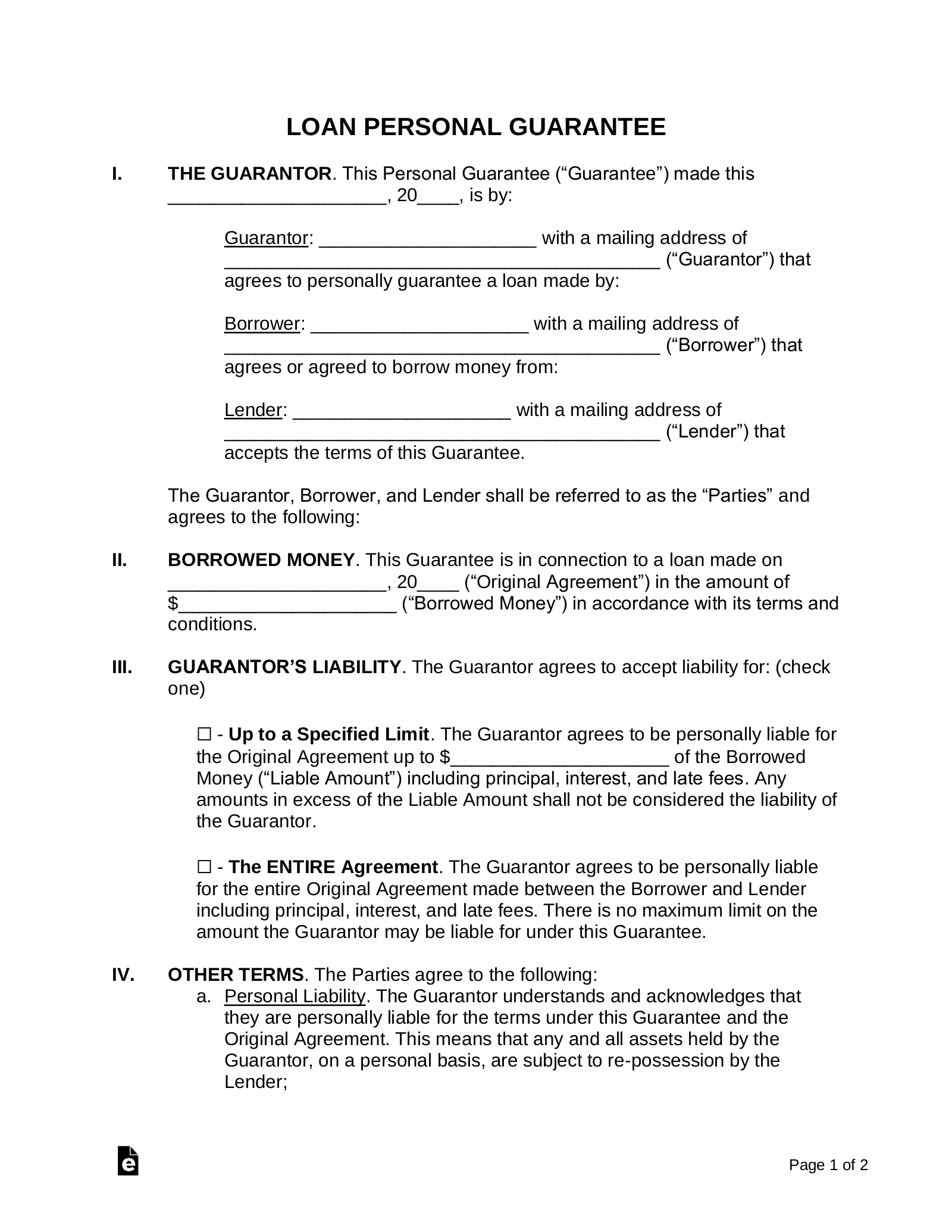

IV. OTHER TERMS. The Parties agree to the following:

-

- Personal Liability. The Guarantor understands and acknowledges that they are personally liable for the terms under this Guarantee and the Original Agreement. This means that any and all assets held by the Guarantor, on a personal basis, are subject to re-possession by the Lender;

- Prompt Payment. The Guarantor agrees to promptly pay the full amount of the principal, interest, and late fees due as mentioned in the Original Agreement, in addition to any other liabilities, within 30 days of the Borrower’s default.

- Borrower’s Liability. In the event the Borrower defaults on the Original Agreement, such default shall not waive their liability of the debts accumulated and paid by the Guarantor. The Borrower shall remain liable for the monies paid by the Guarantor to the Lender. The Borrower acknowledges that the Original Agreement shall transfer the terms from the Lender to the Guarantor, with the Guarantor having the right to enforce any and all commitments made by the Borrower.

- Disputes. Any dispute arising hereunder may only be brought to a court of the Lender’s preference (“Governing Law”). If a dispute arises and the court of preference cannot be agreed upon, a court that governs the Lender’s mailing address shall serve as the Governing Law.

- Severability. If any provision of this Guarantee or the application thereof shall, for any reason and to any extent, be invalid or unenforceable, neither the remainder of this Guarantee nor the application of the provision to other persons, entities, or circumstances shall be affected, thereby, but instead shall be enforced to the maximum extent permitted by law.

- Entire Agreement. This Guarantee contains all the terms agreed to by the parties relating to its subject matter, including any attachments or addendums. This Guarantee replaces all previous discussions, understandings, and oral agreements. The Parties agree to the terms and conditions and shall be bound until the Borrowed Money is repaid in full.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the day and year first above written.

Guarantor’s Signature: _____________________ Date: _____________

Print Name: _____________________

Borrower’s Signature: _____________________ Date: _____________

Print Name: _____________________

Lender’s Signature: _____________________ Date: _____________

Print Name: _____________________

Related Forms

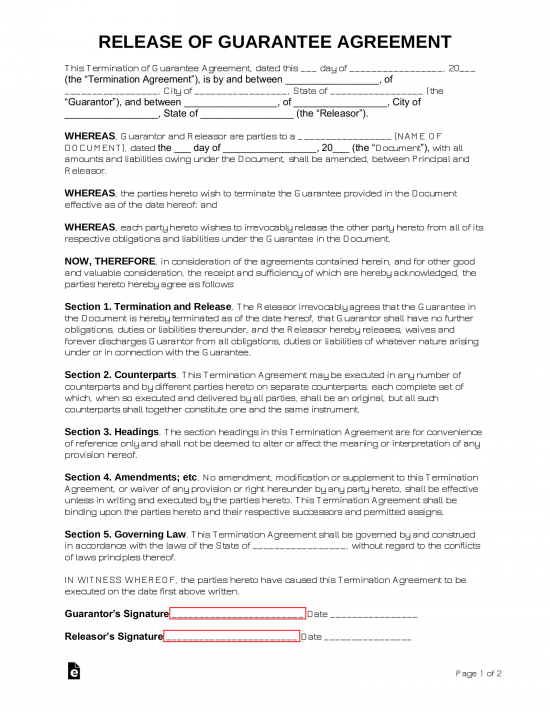

Real Estate Guarantee Agreement

Real Estate Guarantee Agreement

Download: PDF, MS Word, OpenDocument

Download: PDF, MS Word, OpenDocument