Updated March 18, 2024

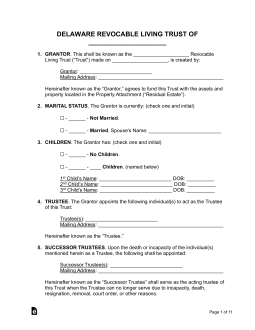

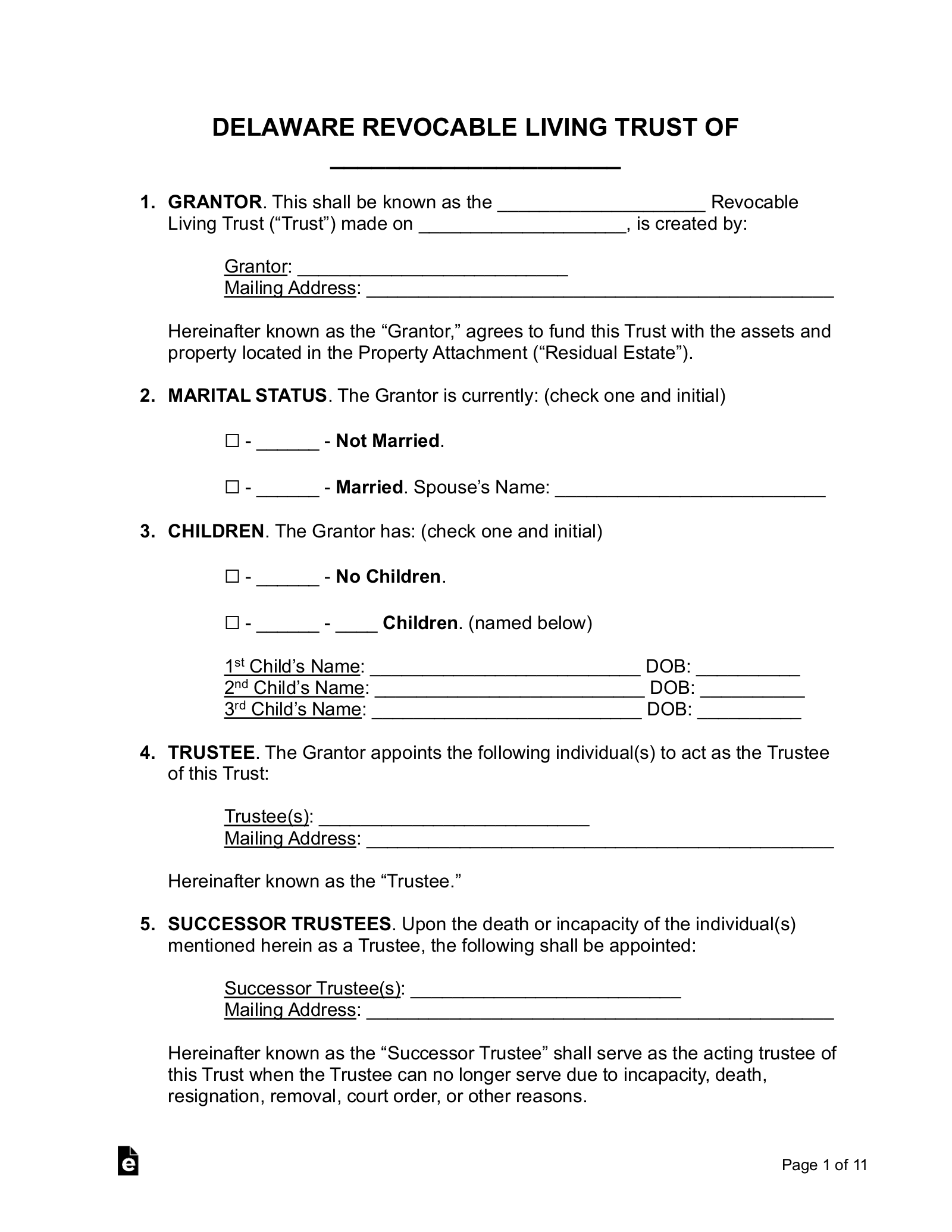

A Delaware living trust allows a grantor to set aside their assets to be received by designated beneficiaries upon the grantor’s death. The grantor must nominate a trustee to manage the trust during their lifetime. In a revocable trust, the grantor may serve as the trustee.

Requirements (2)

Registration

Only foreign statutory trusts are required to register with the Secretary of State.[3]

Laws

Amending/Revoking – The creation, modification, or revocation of a trust must be done in writing by the grantor or by a trustee who is considered a “disinterested person.”[4]

Certification of Trust – A certification of trust, including the name of the trust and the name and address of at least one trustee, must be filed for any statutory trust.[2]

Co-Trustees – If a co-trustee is given exclusive authority by the written instrument to take certain actions or direct the actions of other trustees, the excluded trustee is generally not liable for any loss resulting from the actions taken or directed by the co-trustee.[5]

Contesting a Trust – A proceeding to contest a trust must be initiated within two years of the grantor’s death or within 120 days of the date that the trustee gave notice to a third party of the trust’s existence, whichever is later.[6]

Costs Related to the Trust – If the trustee finds that the administration costs for a trust are so high as to defeat the purpose of the trust itself, they may terminate the trust and distribute its property to the beneficiaries after giving written notice to all interested persons.[7]

Jurisdiction – A statutory trust made in another state must register with the Delaware Secretary of State before it can do business in the state.[3]

Oral Trusts – If a trust is set up to benefit someone upon the death of the grantor, then the creation, modification, or revocation of that trust must be executed in writing.[4]

Pet Trusts – A trust for the care of an animal is valid, so long as the animal is living at the time of the grantor’s death. The trust terminates upon the death of the relevant animal or animals.[8]

Signing Requirements – If a trust must file a certification with the office of the Secretary of State, that certification must be signed by all of the trustees.[9]

Spendthrift Provision – The written instrument establishing a trust may include language that expressly defines and limits the rights of a creditor of a beneficiary to that beneficiary’s interest in the trust.[10]

Trustee’s Compensation – Trustees are entitled to reasonable compensation as set out by the governing instrument[11] or as determined by the Delaware Court of Chancery.[12]

Trustee’s Duties – The trustee must act with “care, skill, prudence, and diligence” when making decisions regarding the management of trust property.[13]

Trustee’s Powers – In addition to any powers established by the written instrument and other powers set out by law, the trustee is empowered to collect, acquire, sell, exchange, or otherwise change the nature of trust property.[14]