Updated January 25, 2024

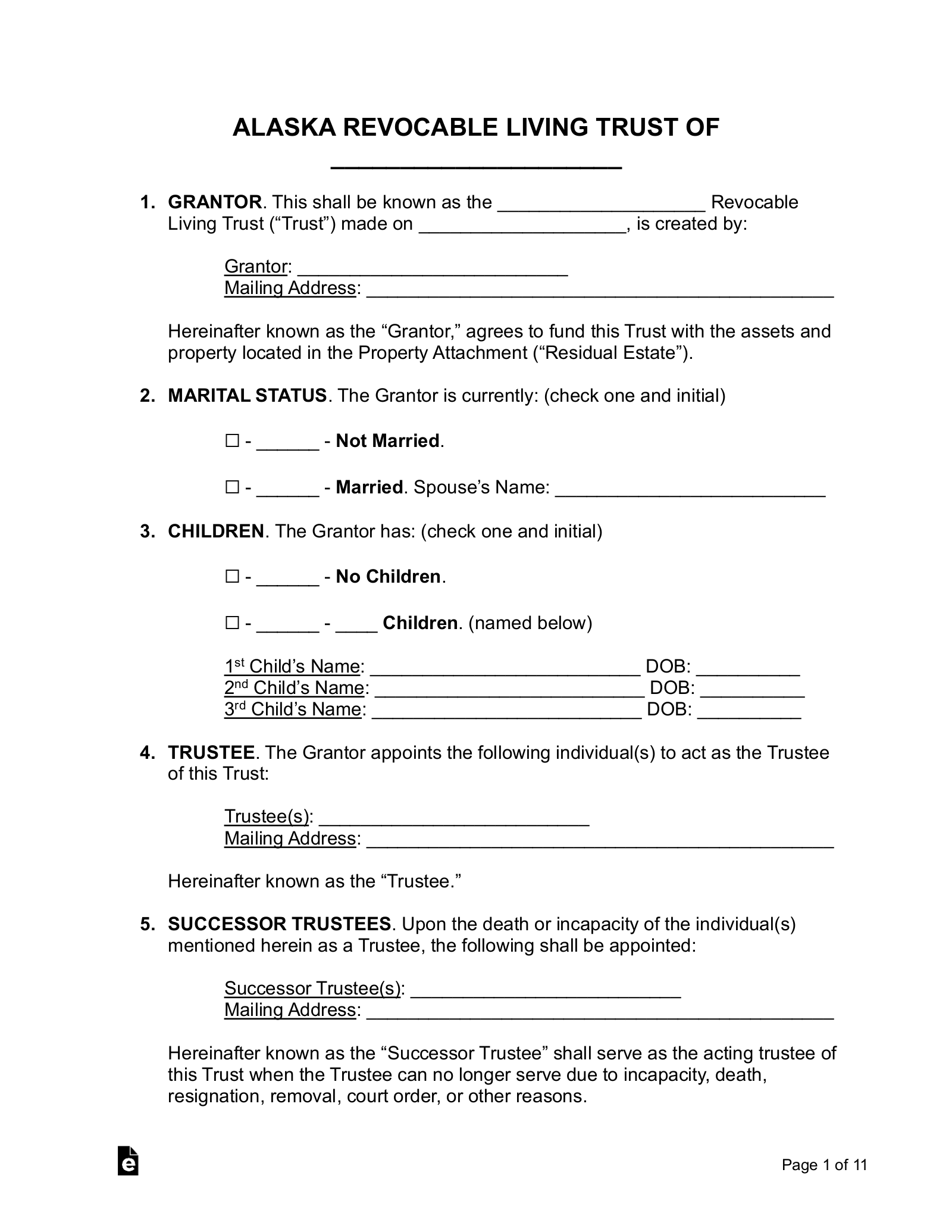

An Alaska living trust is a legal document that allows an individual (grantor) to place assets and property into a trust that transfers to beneficiaries upon the grantor’s death. The trust is managed by a trustee, commonly the same person as the grantor, and becomes managed by a successor trustee after the grantor dies or becomes incapacitated.

Registration

It is required to register a trust in Alaska.[1] Complete Form P-200 and file it with the trustee’s Local Court.[2] If a trustee does not register a trust after 30 days of being notified to do so by the grantor, the trustee can be subject to removal of their duties.[3]

Laws

Amending/Revoking – Unless a trust specifically mentions it is irrevocable, it is revocable.[4] A trust can amended in writing during the grantor’s lifetime. If there is more than one grantor, each may modify the trust in relation to the property they’ve contributed.[5]

Attorney-in-Fact – An attorney-in-fact mentioned in a power of attorney cannot modify a trust unless specifically mentioned in the trust document.[6]

Bond Requirement – A trustee must obtain a bond equal to the value of the trust if required by the terms of the trust or a local court.[7]

Oral Trusts – Oral trusts can be created.[8][9]

Review of Compensation – Any trustee or person employed under a trust may have their compensation reviewed if an “interested person,” such as a beneficiary, submits a petition to the court.[10]

Signing Requirements – There are no State requirements. However, it is recommended a trust be witnessed by two individuals and a notary public.

Trustee’s General Duties – A trustee’s general duty is to administer a trust for the benefit of the trust’s beneficiaries.[11]

Trustee’s Liability – A trustee is personally liable for the ownership or actions made under the control of the trust estate.[12]

Trustee’s Specific Powers – If mentioned in the trust, the trustee has the right to buy, sell, or modify any asset placed in a trust for its protection and safeguarding.[13]