Updated March 15, 2024

An Alaska power of attorney allows a person to handle the needs of someone else for financial or medical reasons. All power of attorney documents in Alaska must be signed in the presence of a notary public or to (2) witnesses. After the form has been signed, it can be used and must be presented each time the agent performs on behalf of the principal.

Durable (Statutory) Power of Attorney – Solely for the use of a financial representation of an individual or business. The document remains in effect if and when the principal should become in a mental state of incapacitation. Durable (Statutory) Power of Attorney – Solely for the use of a financial representation of an individual or business. The document remains in effect if and when the principal should become in a mental state of incapacitation.

Download: PDF, MS Word, OpenDocument Signing Requirements (AS 13.26.600): Notary public. |

Advance Health Care Directive – To elect an agent to handle health care decisions in the chance that the principal is not able to do so on their own. It combines a living will and medical power of attorney. Advance Health Care Directive – To elect an agent to handle health care decisions in the chance that the principal is not able to do so on their own. It combines a living will and medical power of attorney.

Download: PDF, MS Word, OpenDocument Signing Requirements (AS 13.52.010(b)): Two (2) witnesses or a notary |

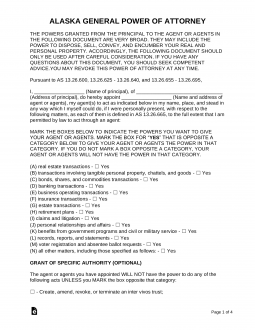

General (Financial) Power of Attorney – Used by a principal to select someone else to handle their personal monetary or business decisions, although unlike the durable, does not remain in effect if the principal should become incapacitated. General (Financial) Power of Attorney – Used by a principal to select someone else to handle their personal monetary or business decisions, although unlike the durable, does not remain in effect if the principal should become incapacitated.

Download: PDF Signing Requirements (AS 13.26.600): Notary public. |

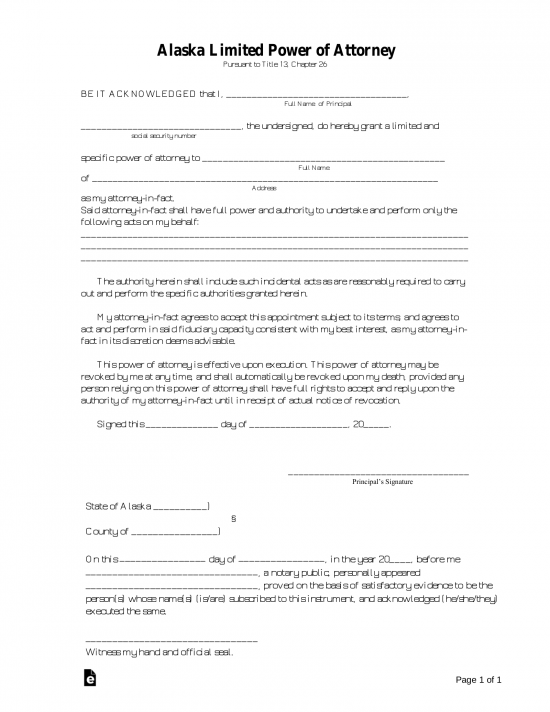

Limited (Financial) Power of Attorney – A principal that would like the agent to make decisions, conduct, or manage a clearly defined financial-related act. Limited (Financial) Power of Attorney – A principal that would like the agent to make decisions, conduct, or manage a clearly defined financial-related act.

Signing Requirements: Notary public. |

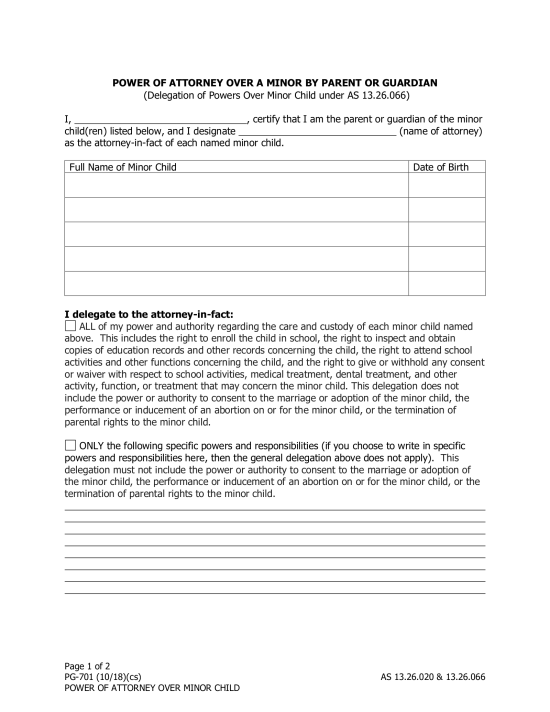

Minor (Child) Power of Attorney – A parent may have another person handle the responsibility of their children with this form for a period of up to one (1) year. Minor (Child) Power of Attorney – A parent may have another person handle the responsibility of their children with this form for a period of up to one (1) year.

Download: PDF Signing Requirements (AS 13.26.066(f)) : Notary public. |

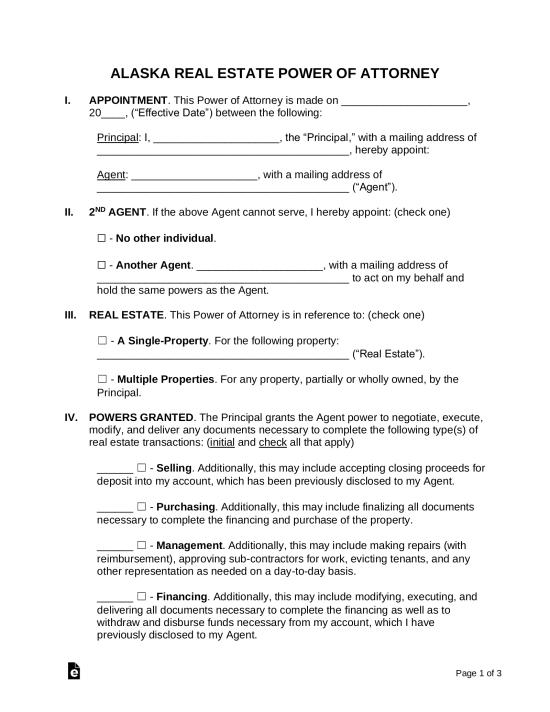

Real Estate Power of Attorney – Elect another person to sell, manage, or have the power to refinance the premises. Real Estate Power of Attorney – Elect another person to sell, manage, or have the power to refinance the premises.

Download: PDF, MS Word, OpenDocument Signing Requirements (AS 13.26.600): Notary public. |

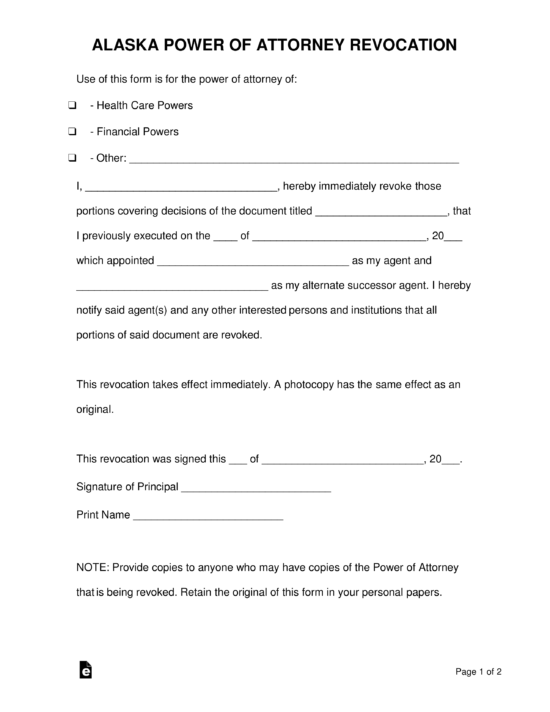

Revocation of a Power of Attorney – To cancel a presently valid power of attorney form. Revocation of a Power of Attorney – To cancel a presently valid power of attorney form.

Download: PDF, MS Word, OpenDocument Signing Requirements: No laws but recommended to be notarized. |

Springing Power of Attorney – Allows a durable power of attorney to ‘kick-in’ upon a principal’s subsequent incapacity. Springing Power of Attorney – Allows a durable power of attorney to ‘kick-in’ upon a principal’s subsequent incapacity.

Download: PDF, MS Word (.docx), OpenDocument Signing Requirements: Notary public. |

Tax Power of Attorney (774 POA) – Used by a filer to have someone else, usually a certified public accountant (CPA), to handle all their tax preparation needs with the Department of Revenue. Tax Power of Attorney (774 POA) – Used by a filer to have someone else, usually a certified public accountant (CPA), to handle all their tax preparation needs with the Department of Revenue.

Download: PDF Signing Requirements: Principal only |

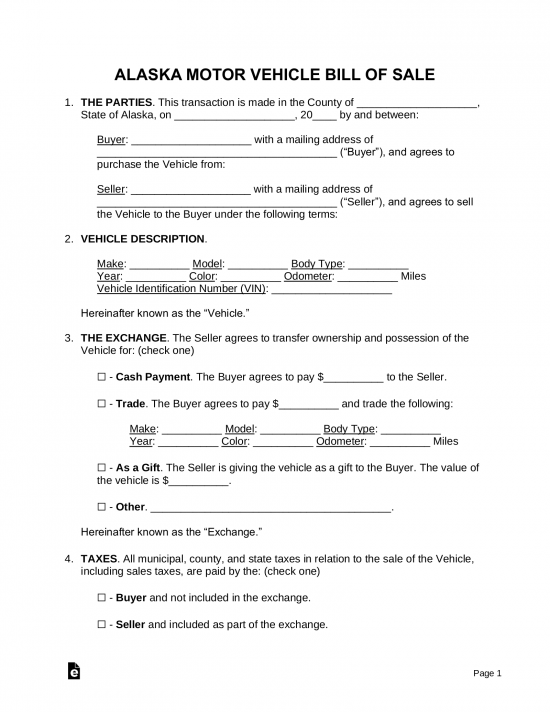

Vehicle Power of Attorney (Form 847) – Used by an owner of a vehicle to choose someone else to sign any and all documents relating to title and registration for the following vehicle. Vehicle Power of Attorney (Form 847) – Used by an owner of a vehicle to choose someone else to sign any and all documents relating to title and registration for the following vehicle.

Download: PDF Signing Requirements: Notary public. |