Updated May 05, 2022

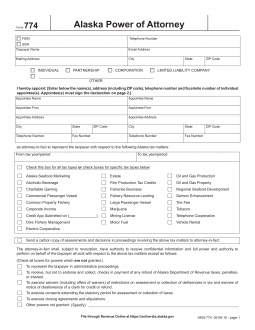

An Alaska tax power of attorney (POA 774) is used by the Department of Revenue for individuals that are reporting taxes within the State, to elect an agent to handle the filing on their behalf. After the form is completely filled in by the principal and agent, they sign the document and attach it to any and all filings sent regarding the principal’s taxes.

Signing Requirements – Principal Only

How to Write

1 – Access the Alaska Tax Power of Attorney (Form 774_POA)

This file may be downloaded as a PDF document by selecting the PDF button on the right below the image. If the preparer does not have a PDF program or form-friendly browser to input information directly on screen then, it should be printed to have the information entered manually.

2 – The Principal Taxpayer and the Agent

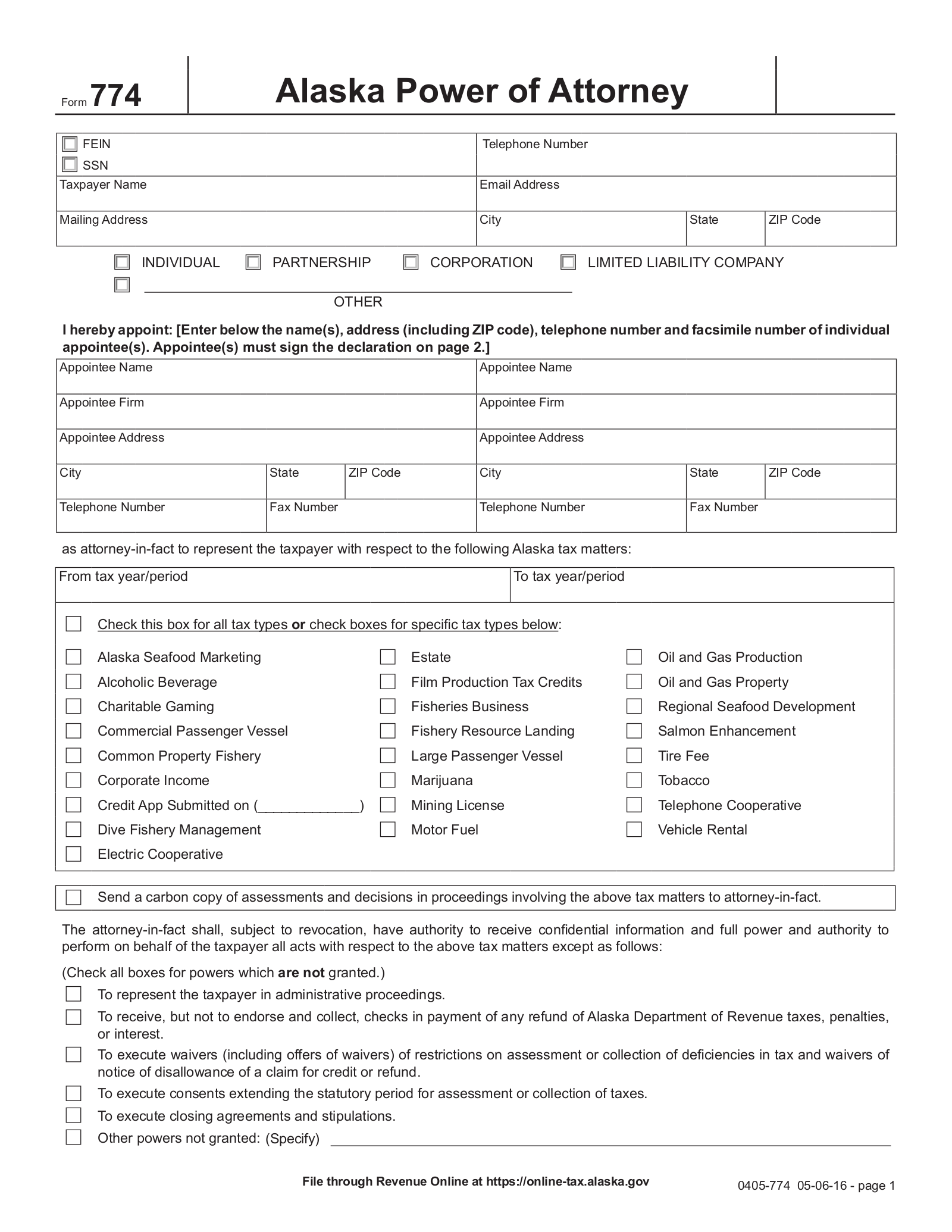

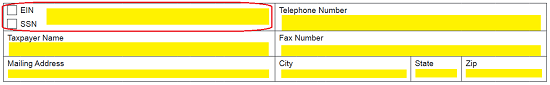

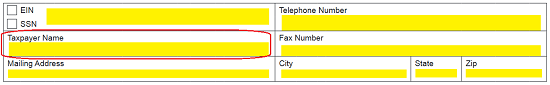

The beginning of this form will require information to be entered into a small table of two rows. In the first column on the first row, report the Tax Payer’s Entity Identification Number (and check the box labeled “EIN”) or the Tax Payer’s Social Security Number (and check the box labeled “SSN”)

Locate the cell labeled “Telephone Number,” in the next column, then report a well-maintained Telephone Number where the Principal can be reached.

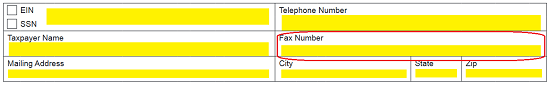

The first cell on the next row, labeled “Taxpayer Name,” must have the Full Name of the Principal granting Power presented.

Enter the Fax Number in the next cell (labeled “Fax Number”).

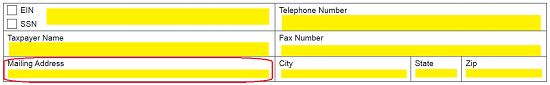

The first cell in the next row, labeled “Mailing Address,” requires a reliable Mailing Address for the Principal listed above. This must be the Building Number, Street, and Apt/PO Box Number of the Principal’s Mailing Address.

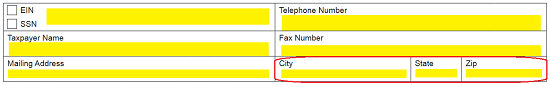

Next, in the last three cells in the last row, enter the “City,” “State,” and “Zip Code” of the Principal’s Mailing Address

Below this table, you must indicate the status of the Taxpayer acting as Principal. You may do this by selecting one of the following boxes: Individual, Partnership, Corporation, Limited Liability Corporation, or you may enter the entity type of the Taxpayer on the blank space labeled “Other” and check the corresponding box.![]()

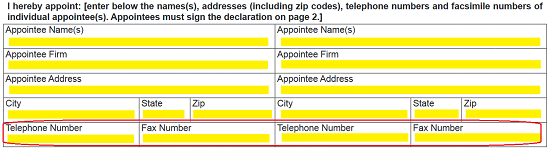

3 – Appointee Information

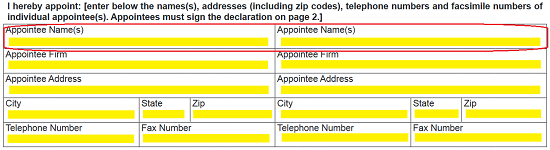

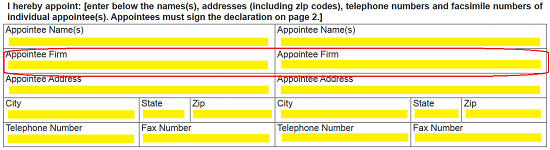

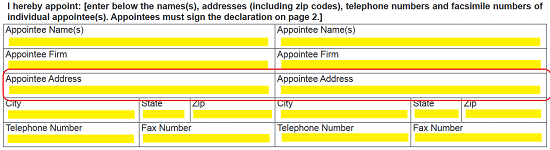

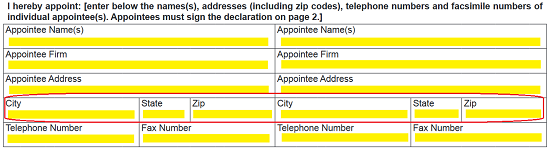

The next area will also have a table requiring information. This information will serve to identify the Agent who will exercise Authority in the matters defined by this document. There will be enough room to declare two Appointees or Agents. Generally, this is done as a failsafe in case the primary Agent cannot carry out his or her duties. Each Agent will have a column where his or her information should be reported.

To fill in the information for the first Agent, locate the cell in the first column and first row. Report the full Name of the Agent. If there are two Agents, then report one Agent’s information in each column. If there is only one Agent, then only fill in the first column with the Agent’s information.

Below this, report the Firm the Agent works for or represents.

In the third cell down, labeled “Appointee Address,” document the Street Address of the Agent

The fourth row will contain three separate cells: City, State, Zip in each column. Make sure to list the City, State, and Zip Code for the Agent’s Street Address in the appropriate column.

The last row will have two cells in each column. Use these to report the Agent’s Telephone Number in the first box and the Agent’s Fax Number in the second box

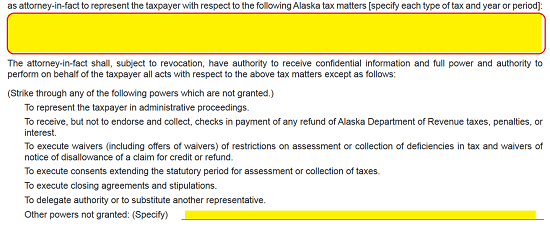

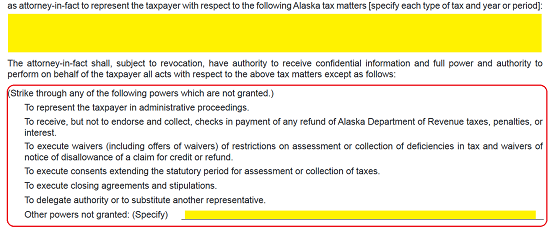

4 – Define Appointee Power

In the blank area beneath the table, identify each Tax Matter along with the Time Period (during which) the Agent will have Authority over.

There will be several statements defining actions the Agent or Appointee may take with Principal Power. Read these carefully. If a statement does not apply strikethrough the sentence with a horizontal line from the beginning through the end of it. If, there is an action the Agent may take that is not defined, then report it in the blank space available.

Next, mark the appropriate checkbox stating whether the Department of Revenue should send notices/returns to the Taxpayer or the Attorney-In-Fact.![]()

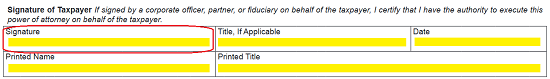

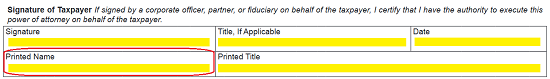

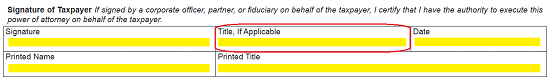

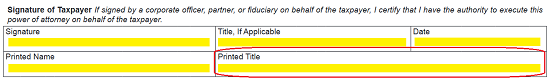

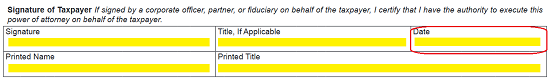

5 – Taxpayer Signature

Locate the table below the paragraph beginning with “Signature of Taxpayer.” The Principal must Sign his or her Name in the first cell.

The Principal’s Name must appear in Print directly below the Signature.

Next, in the cell labeled “Title, If Applicable,” the Principal should report any Title he or she may hold.

If the Principal does carry a Title, the Title should appear in Print below the area the Principal has filled it in.

Finally, the Signature Date must be reported in the cell labeled “Date.”

6 – Appointee Signature

The next page will be titled “Declaration of Representative. Each Appointee must Sign the blank line then provide the current Date.

The form should be signed and handed over to the accountant, or agent, for their use and filing with the State.