Updated March 26, 2024

An Indiana living trust is a document that enables a grantor to place their assets in a trust to be distributed to designated beneficiaries after their death. The trust assets are managed by a trustee who, in the case of a living trust, may also be the grantor. The benefit of a living trust is that a grantor’s assets are not subject to the probate process.

Requirements (3)

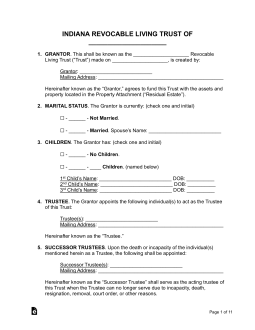

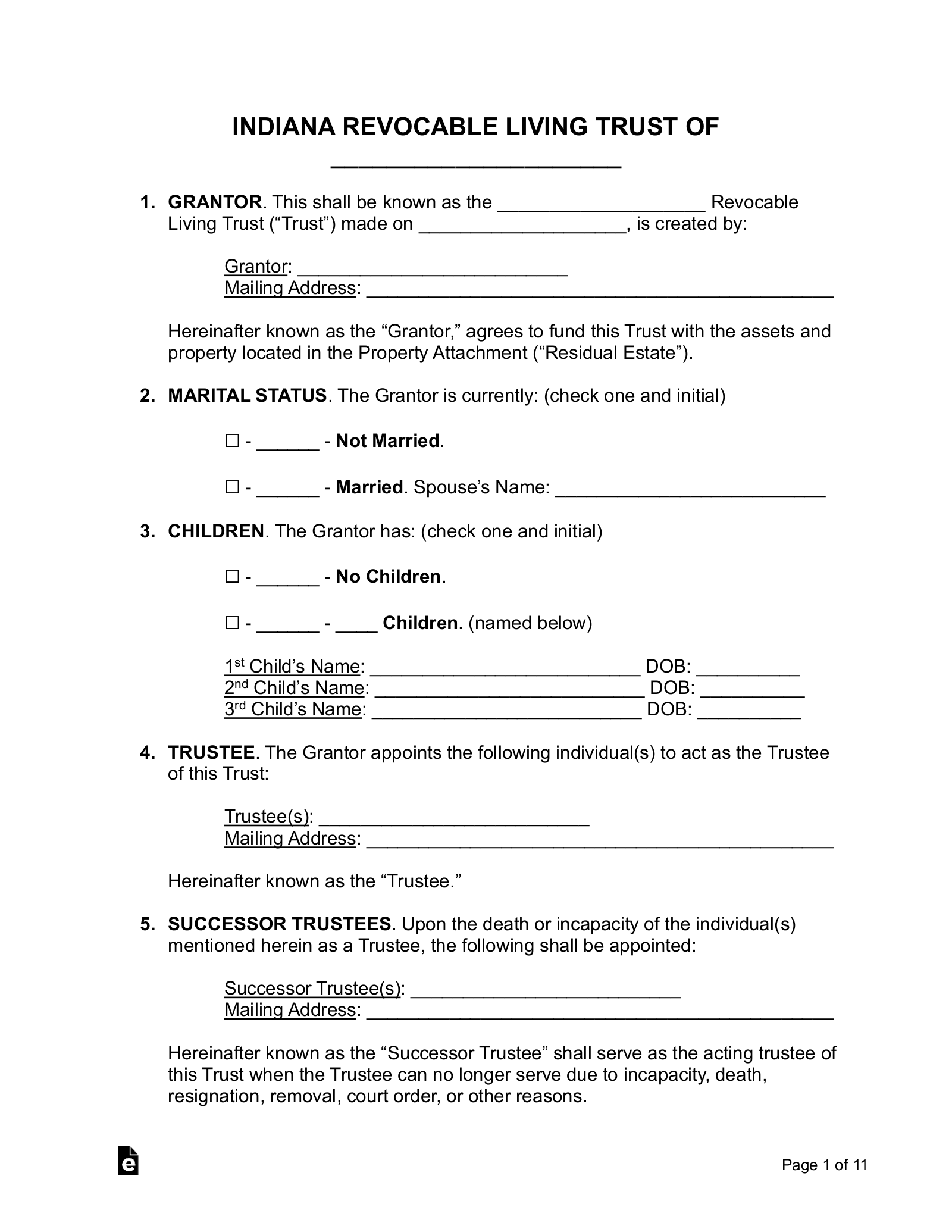

- Written and Signed: A trust must be written and signed by the grantor or the grantor’s agent in order to be valid.[1]

- In Compliance with the Law: A trust’s creation, if not by a will, must have been in compliance with the laws of the jurisdiction in which the trust instrument was executed.[2]

- Ascertainable Details: The terms of a trust must be written so that the trust property, the identities of the trustee and the beneficiary, the nature of their interest, and the purpose of the trust can be readily ascertained.[3]

Registration

There is no registration requirement for living trusts under Indiana state law.

Laws

Amending/Revoking – Unless the terms of the trust expressly state that it is irrevocable, the grantor may revoke or amend the trust.[4]

Bond Requirement – A trustee is not required to provide a bond unless this requirement is established in the terms of the trust.[5] If a trust is under judiciary supervision, however, a court may order the trustee to put a bond forward.[6]

Certification of Trust – A trustee may present a person who is not a beneficiary with a certification of trust instead of a copy of the trust instrument. This certification must include the date of the trust’s creation, the identity of the grantor, the name and address of the trustee, the trustee’s powers, and whether the trust is revocable.[7]

Co-Trustees – Co-trustees must exercise their powers by majority decision.[8] If co-trustees are unable to reach a majority decision, and there is a risk of immediate damage to the trust property, any trustee may act individually to administer the trust and petition the court for approval afterward.[9]

Contesting a Trust – An action to contest a trust’s validity must begin within 90 days of the date that a person received notice of the trust’s existence, or within three years of the grantor’s death, whichever is earlier.[10]

Costs Related to the Trust – A trustee may only incur reasonable and appropriate costs in administering the trust.[11]

Jurisdiction – A trust is valid if its creation is in compliance with the laws of the state where the trust instrument was executed.[2]

Oral Trusts – Oral trusts are not valid in Indiana. A trust must be written to be valid.

Pet Trusts – A valid trust may be created for the care of an animal that is alive during the grantor’s lifetime. The trust may provide for the care of one or more animals, and it expires upon the death of the last living animal.[12]

Signing Requirements – The terms of a trust must be written and signed by the grantor or the grantor’s authorized agent.[13]

Spendthrift Provision – The grantor may set out in the terms of a trust that a beneficiary’s interest cannot be voluntarily or involuntarily transferred before they have been delivered that interest by the trustee.[14]

Trustee’s Compensation – Unless the terms of the trust establish otherwise, the trustee is entitled to reasonable compensation.[15]

Trustee’s Duties – The trustee’s duties include administering the trust in accordance with its terms, maintaining control over and preserving trust property, and managing the trust property in the interest of the beneficiary.[16]

Trustee’s Powers – In addition to those powers enumerated in the terms of the trust and in Indiana law, the trustee has the power to buy, sell, exchange, invest, and otherwise manage trust property.[17]