Updated April 22, 2024

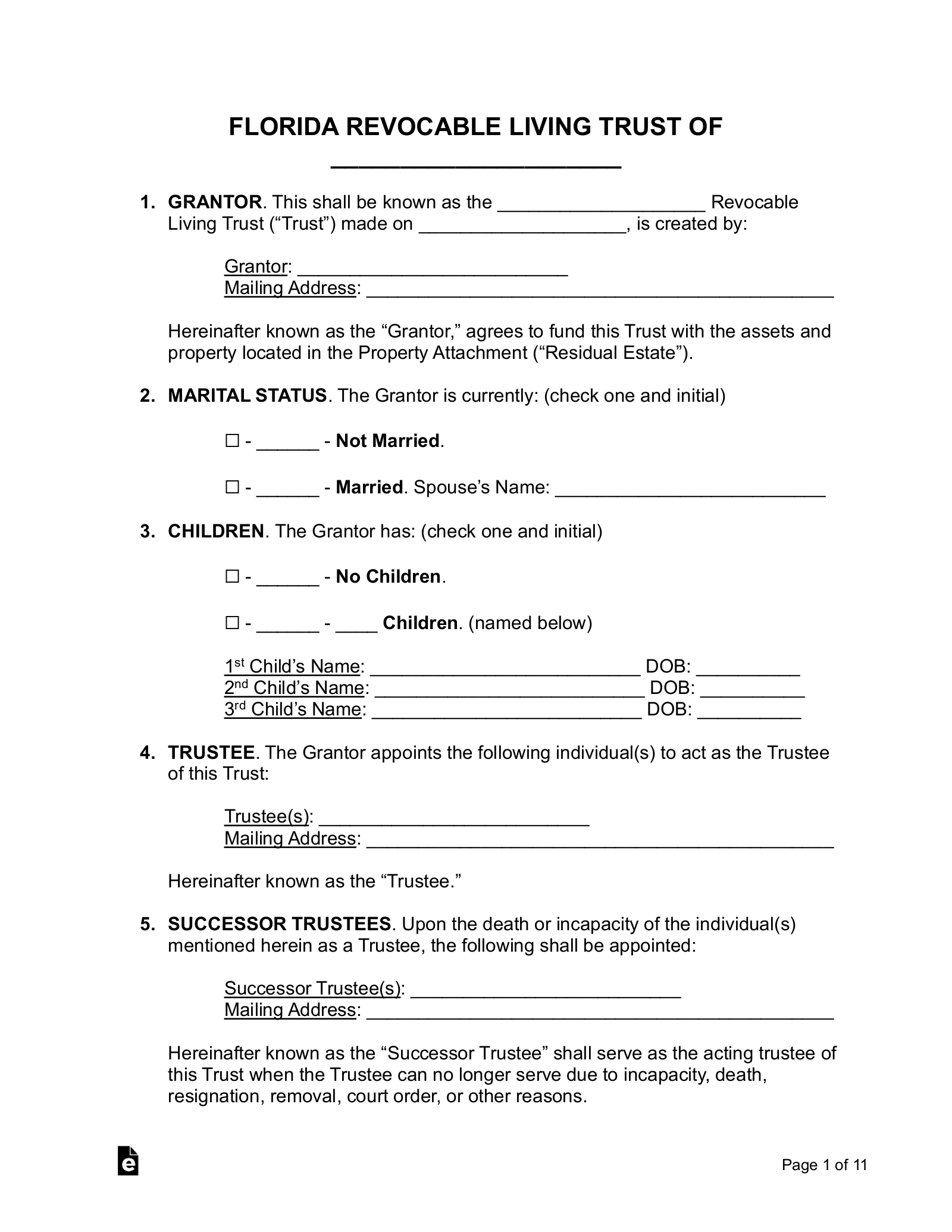

A Florida living trust allows a person (the grantor) to hold their assets in trust during their lifetime for the benefit of designated beneficiaries. The beneficiaries receive the assets directly after the grantor passes away. The trust is managed by a trustee selected by the grantor, although a grantor can also act as their own trustee.

Requirements (5)

- Capacity: The grantor must have the mental capacity to create a trust.

- Intention: The grantor must indicate their intention to create a trust.

- Beneficiary: The trust must have a definite beneficiary, unless it is a charitable trust or one that meets the legal requirements for the creation of a trust without an ascertainable beneficiary.

- Trustee’s Duties: The trustee must have duties to perform.

- Sole Trustee Cannot be Sole Beneficiary: A sole trustee cannot be the same person as a sole beneficiary.[1]

Registration

Most trusts are not required to register in Florida. However, a family trust company must register with the Office of Financial Regulation before doing business in the state. To register, submit Form OFR-162-02 along with a $5,000 application fee.[2]

Laws

Amending/Revoking – A revocable trust may be amended or revoked according to the procedures and limits laid out in the terms of the trust.[3]

Bond Requirement – A trustee must provide a bond if this is a requirement under the terms of the trust or if the court has found that such a bond is necessary to protect the interests of the beneficiaries.[4]

Certification of Trust – A person other than a beneficiary may be given a certification of trust in lieu of a copy of the trust instrument. The certification must disclose the date that the trust was executed, the identities of the grantor and trustee, the powers of the trustee, and whether the trust is revocable or irrevocable.[5]

Co-Trustees – If co-trustees are unable to reach a unanimous decision regarding the management of the trust, the group may instead act by majority decision.[6] If a co-trustee is unavailable to perform their duties, the other trustees may act in their absence.[7]

Contesting a Trust – An action to contest a revocable trust cannot be started until the trust has been made irrevocable either by its terms or by the death of the grantor.[8] A person must begin their action within six months of having been given notice by the trustee of the trust’s existence and of the trustee’s name and address.[9]

Costs Related to the Trust – The trustee may only incur expenses that are reasonable given the purposes of the trust and the property being held.[10]

Jurisdiction – A trust established in another state is valid as long as it was executed in accordance with that state’s laws.[11]

Oral Trusts – An oral trust may be established so long as there is “clear and convincing evidence” of its valid creation.[12]

Pet Trusts – A trust created to provide for the care of an animal or animals alive during the grantor’s lifetime is valid. The trust terminates upon the death of the last surviving animal.[13]

Signing Requirements – Certain aspects of a revocable trust, including those provisions that deal with the transfer of property to a beneficiary on the grantor’s death, are invalid unless the trust instrument is signed by the grantor.[14]

Spendthrift Provision – A spendthrift provision is only valid if it restrains both the voluntary and involuntary transfer of a beneficiary’s interest.[15]

Trustee’s Compensation – If the trustee’s compensation is not specified in the terms of the trust, they are otherwise entitled to receive reasonable compensation for managing the trust.[16]

Trustee’s Duties – The trustee has a duty to administer the trust in good faith, in alignment with its stated purposes and terms, and in the interests of the beneficiaries.[17]

Trustee’s Powers – A trustee has the power to collect, acquire, sell, exchange, or otherwise change the nature of trust property.[18] The trustee is also generally authorized to exercise any powers conferred by the terms of the trust or by Florida statute.[19]