Updated April 25, 2024

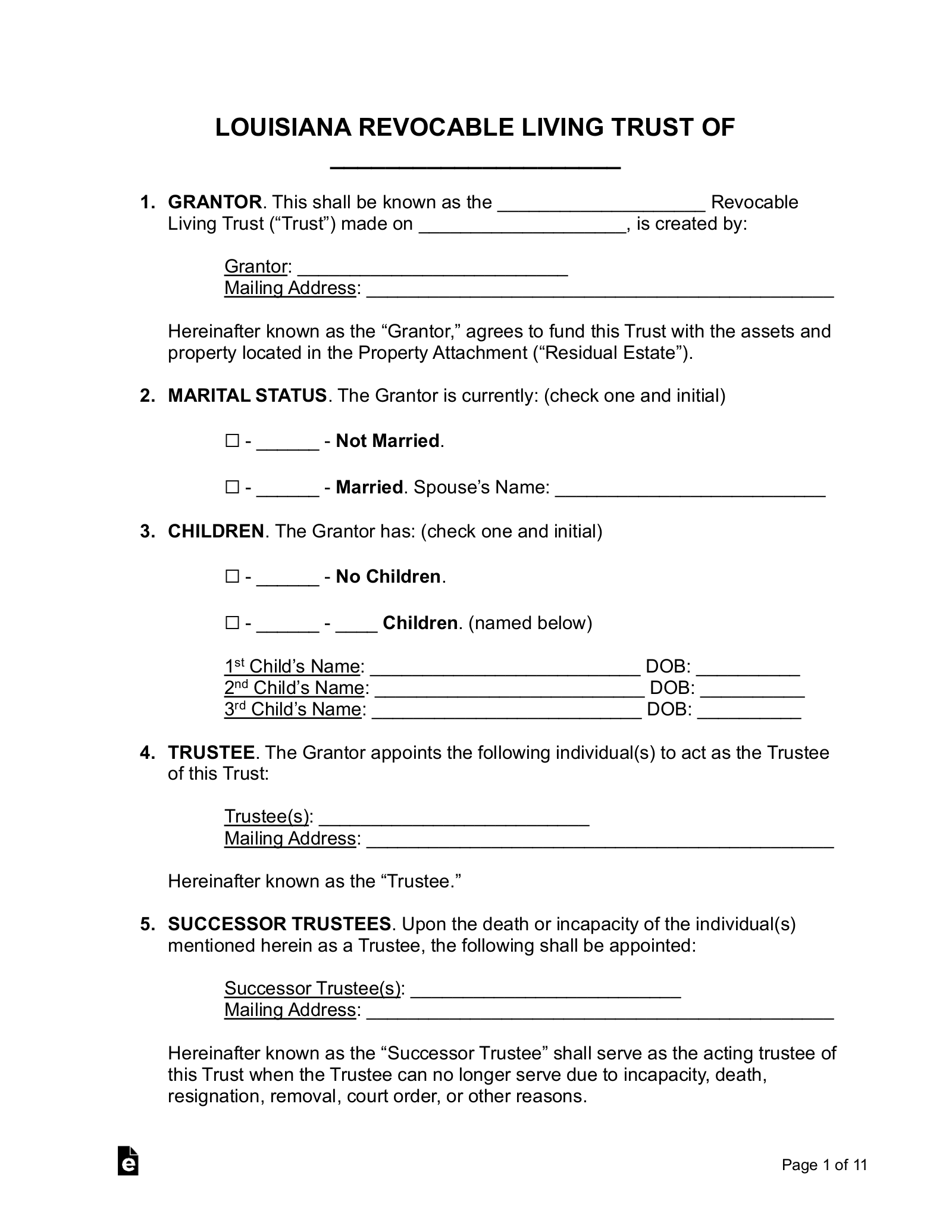

A Louisiana living trust is a document that dictates how a person’s assets are to be managed during their lifetime and after death. The creator of the trust, referred to as the “grantor”, can opt to manage the trust themselves or appoint a trustee. A living trust may be amended or revoked by the grantor at any time.

Requirements (3)

- Capacity: The grantor must have the capacity to contract by title.[1]

- Written: The trust must be executed in writing and in the presence of two witnesses.[2]

- Designated Beneficiary: Except as otherwise provided by state law, an ascertainable beneficiary must be designated in the trust instrument.[3]

Registration

Louisiana state law does not require that a revocable trust be registered.

Laws

Amending/Revoking – The grantor may amend[4] or revoke[5] a trust only if they have expressly reserved the right to do so in the terms of the trust.

Bond Requirement – An individual trustee must furnish a bond to secure the performance of their duties, unless this requirement has been waived by the trust instrument.[6]

Certification of Trust – If a revocable trust contains immovable property or property for which the title must be recorded, the trustee may file an extract of trust in lieu of the trust instrument for record in the parish where the property is located.[7]

Co-Trustees – If there are two co-trustees, they must act unanimously.[8] Three or more co-trustees may act by majority decision, unless the trust instrument states otherwise.[9]

Contesting a Trust – An action begun by a beneficiary to contest a trust must be brought within two years of receiving the final accounting from the trustee.[10]

Costs Related to the Trust – A trustee may incur expenses that are necessary for carrying out the purposes of the trust, as long as they are not forbidden by the provisions of the trust instrument.[11]

Jurisdiction – A trust created in another state or jurisdiction is considered valid in Louisiana if the trust instrument was executed in accordance with the laws of that jurisdiction or those of the grantor’s domicile.[12]

Oral Trusts – Oral trusts are not valid under Louisiana state law; the trust must be executed in writing.[2]

Pet Trusts – A trust may be created to provide for the care of one or more animals that are alive and identifiable at the time of the trust’s creation.[13]

Signing Requirements – A living trust must be signed by the grantor in the presence of two witnesses and notarized either at the time of signing or at a later date.[2]

Spendthrift Provision – A spendthrift provision is valid if the trust instrument includes a declaration that a beneficiary’s interest will be held subject to a “spendthrift trust.”[14]

Trustee’s Compensation – Unless the trust instrument establishes the trustee’s compensation rate or waives compensation entirely, the trustee is entitled to reasonable compensation for their services.[15]

Trustee’s Duties – The trustee must impartially administer the trust in the sole interest of the beneficiary or beneficiaries.[16]

Trustee’s Powers – The trustee may exercise those powers conferred upon them by the trust instrument insofar as they are necessary to carry out the purposes of the trust. They may not exercise any powers that are forbidden under the terms of the trust.[17]