Updated April 18, 2024

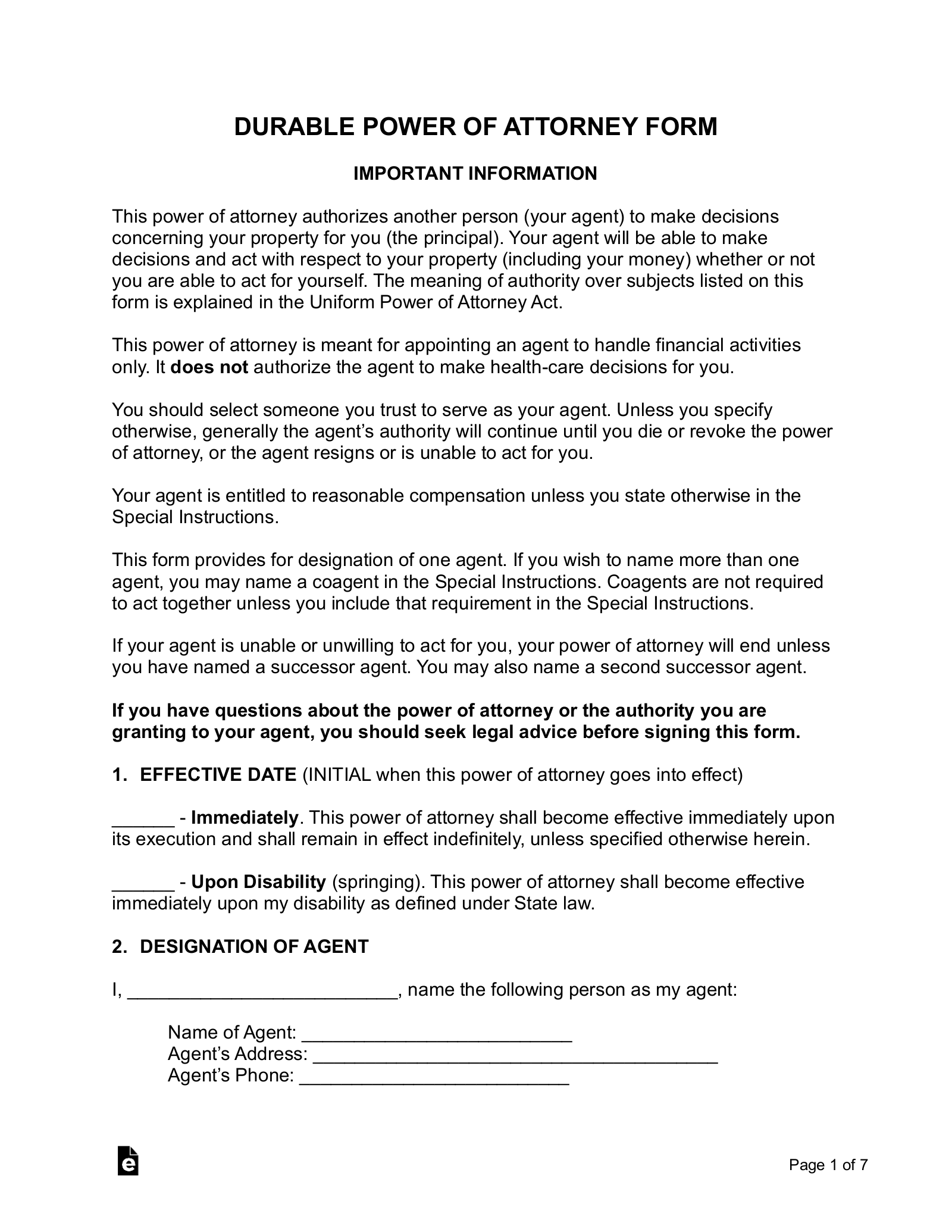

A durable power of attorney (DPOA) form allows an individual (principal) to select someone else (agent) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid even if the principal becomes incapacitated.

Definition of “Durable”

Durable,” with respect to a power of attorney, means not terminated by the

principal’s incapacity.[1]

USA Statistics

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

How to Get Durable Power of Attorney (5 steps)

4. Signing the Power of Attorney

A durable power of attorney must be executed with the signing requirements in the State where the principal resides.

Signing Requirements (By State)

| State | Signing Requirements | Statutes |

| Alabama | Notary Public | § 26-1A-105 |

| Alaska | Notary Public | AS 13.26.600(2) |

| Arizona | Notary Public and 1 Witness | ARS § 14-5501 |

| Arkansas | Notary Public | § 28-68-105 |

| California | Notary Public or 2 Witnesses | § 4402(c) |

| Colorado | Notary Public | § 15-14-705 |

| Connecticut | Notary Public and 2 Witnesses | § 1-350d |

| Delaware | Notary Public and 1 Witness | § 49A-105 |

| District of Columbia | Notary Public | § 21–2601.05 |

| Florida | Notary Public and 2 Witnesses | § 709.2105 |

| Georgia | Notary Public and 1 Witness | § 10-6B-5 |

| Hawaii | Notary Public | § 551E-3 |

| Idaho | Notary Public | § 15-12-105 |

| Illinois | Notary Public and 1 Witness | § 755 ILCS 45/3-3 |

| Indiana | Notary Public or 2 Witnesses | IC 30-5-4-1 |

| Iowa | Notary Public | § 633B.105 |

| Kansas | Notary Public | § 58-652(3) |

| Kentucky | Notary Public | § 457.050 |

| Louisiana | No Statute | |

| Maine | Notary Public | § 5-905(1) |

| Maryland | Notary Public and 2 Witnesses | § 17–110 |

| Massachusetts | 2 Witnesses | § 5-103 |

| Michigan | Notary Public or 2 Witnesses | § 700-5501(2) |

| Minnesota | Notary Public | § 523.01 |

| Mississippi | Notary Public | § 87-3-105 |

| Missouri | Notary Public | § 404.705(3) |

| Montana | Notary Public | § 72-31-305 |

| Nebraska | Notary Public | § 30-4005 |

| Nevada | Notary Public | § 162A.220(1) |

| New Hampshire | Notary Public | § 564-E:105 |

| New Jersey | Notary Public | § 46:2B-8.9 |

| New Mexico | Notary Public | § 45-5B-105 |

| New York | Notary Public and 2 Witnesses | § 5-1501B |

| North Carolina | Notary Public | § 32C-1-105 |

| North Dakota | No Statute | |

| Ohio | Notary Public | § 1337.25 |

| Oklahoma | Notary Public | § 3005 |

| Oregon | No Statute | |

| Pennsylvania | Notary Public and 2 Witnesses | § 5601(b)(3) |

| Rhode Island | Notary Public | § 18-16-2 |

| South Carolina | Notary Public and 2 Witnesses | § 62-8-105 |

| South Dakota | Notary Public | § 59-12-4 |

| Tennessee | No Statute | |

| Texas | Notary Public | § 751.0021 |

| Utah | Notary Public | § 75-9-105 |

| Vermont | Notary Public | 14 V.S.A. § 4005 |

| Virginia | Notary Public | § 64.2-1603 |

| Washington | Notary Public or 2 Witnesses | § 11.125.050 |

| West Virginia | Notary Public | § 39B-1-105 |

| Wisconsin | Notary Public | § 244.05 |

| Wyoming | Notary Public | § 3-9-105 |

Sources

- Uniform Power of Attorney Act – Section 102(2) (page 12)

- 2018 Merrill Report – Leaving a Legacy: A lasting gift to loved ones (page 20)

- NIH.gov – 2001 to 2003 Study (One in Seven Americans Age 71 and Older Has Some Type of Dementia)

- 2018 Merrill Report – Leaving a Legacy: A lasting gift to loved ones (page 14)

- 2022 Cambridge Trust – Bridging the Gap: The Importance of Estate Planning Through Generations