Updated March 18, 2024

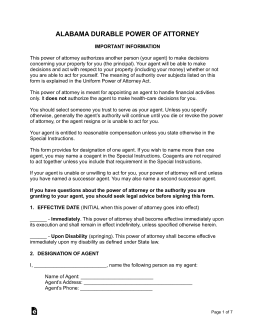

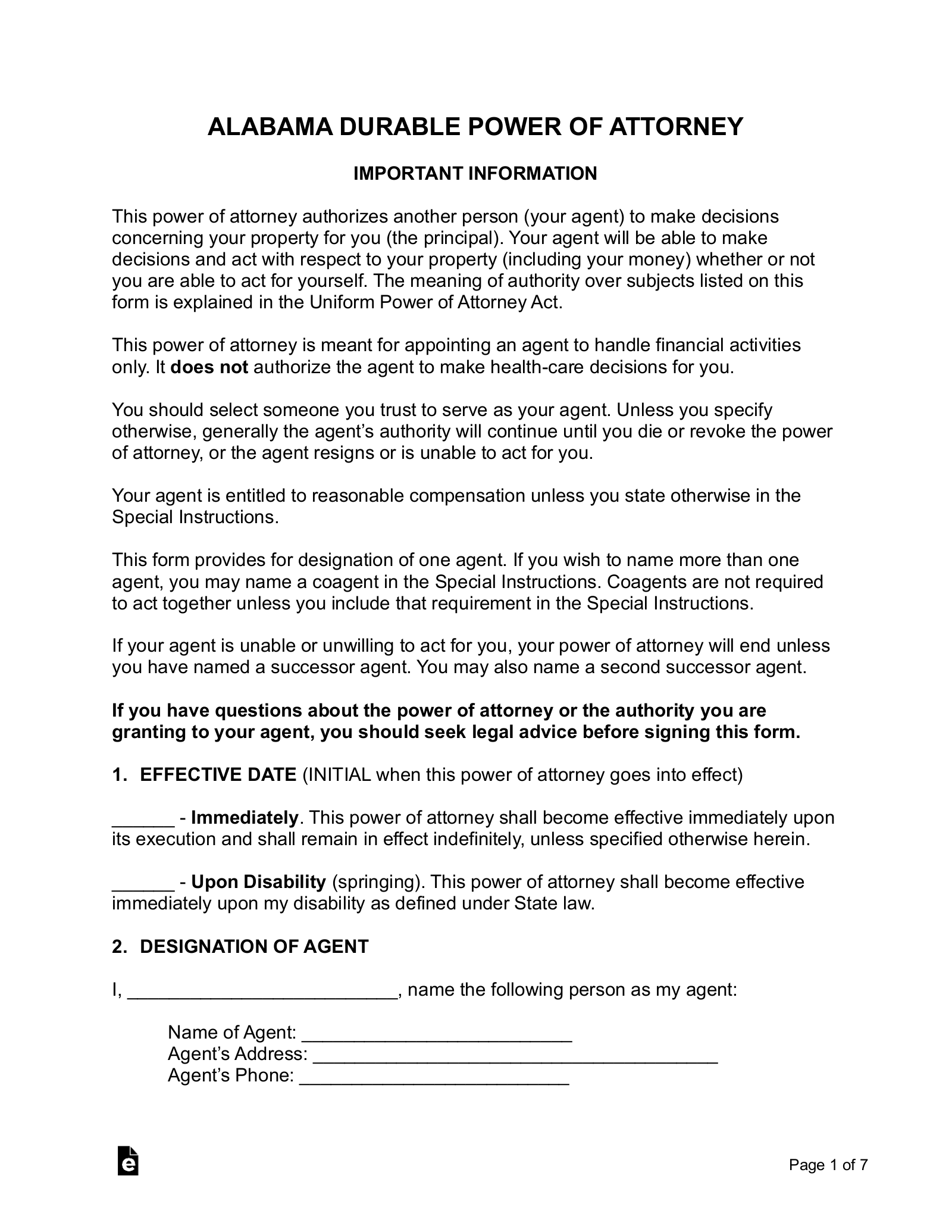

An Alabama durable statutory power of attorney form allows an individual to act in the principal’s place for broad or specific financial powers. The form has the ‘durable’ use that remains in effect even if the principal is no longer able to make decisions for themselves due to mental instability. Therefore the agent selected should be someone who can be trusted, and it’s recommended that it be a close family member or friend.

Signing Requirements

The principal is required to authorize in the presence of a notary public.[1] The agent can also have their signature acknowledged on the Agent’s Certification, which is attached to the power of attorney.[2]

Versions (2)

Download: PDF, MS Word, OpenDocument

Download: PDF

Definition of “Durable”

With respect to a power of attorney, means not terminated by the principal’s incapacity.[3]

Definition of “Power of Attorney”

Means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.[4]