Updated August 08, 2023

An Illinois durable power of attorney is a statutory form that allows a person to select someone else to act in their benefit for financial-related decision-making. The term “durable” refers to the form remaining valid even if the person who handed over power becomes incapacitated or mentally not able to speak for themselves. It is recommended to only entrust this designation to someone known to be honest and reliable.

Table of Contents |

Versions (3)

Download: PDF, MS Word, OpenDocument

Download: PDF

Download: PDF

Laws

Chapter 755, Act 45 (Power of Attorney Act)

Definition of “Durable”

The Illinois Compiled Statutes do not define “durable,” but refer to enduring through “incapacity” in the Act’s section on Durable Powers of Attorney

Definition of “Power of Attorney”

The Illinois Compiled Statutes do not define “power of attorney,” but refer to an “agency” relationship in the Act’s section on Durable Powers of Attorney

Signing Requirements

The principal must sign with one (1) witness and a notary public. The agent must sign on the last page located on the Agent’s Certification (755 ILCS 45/3-3.6)

Statutory Form

The Illinois Compiled Statutes do contain a statutory form for a Durable Power Attorney available in 755 ILCS 45/3-3.

How to Write

Download: PDF, MS Word, OpenDocument

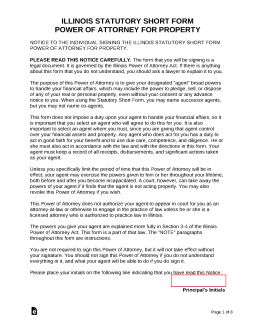

Introduction

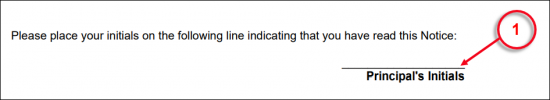

The Principal who intends to use this template to grant an Attorney-in-Fact the authority he or she possesses in one or more matters must read through the introduction then initial the blank line at the bottom of the page as confirmation to his or her comprehension to this material.

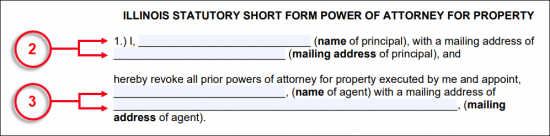

Section 1. Appoint An Attorney-in-Fact In Illinois

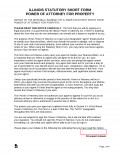

(2) Principal Identity. The Illinois Party seeking to designate an Agent with the principal power to act in his or her name should be identified as the Principal behind this document.

(3) Principal Mailing Address.

(4) Attorney-in-Fact Identity. The Agent That shall accept the authority to carry out the Principal’s directives must be identified in the Attorney-in-Fact role.

(5) Attorney-in-Fact Address.

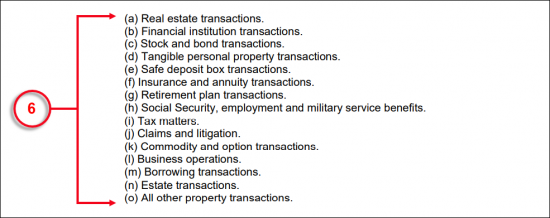

Allowable Principal Powers

(6) Power Review. Every type of principal power that can be legally delivered to the Attorney-in-Fact (in the State of Illinois) so that he or she can conduct the affairs of the Principal is listed for review and approval. The Principal should read through this list of powers. Any type of power the Illinois Principal does not wish to grant the Attorney-in-Fact should be struck through with a horizontal line to cancel its effect. This results in a list of principal powers that shall be considered a type of authority the Attorney-in-Fact will be allowed to wield in the Principal’s name.

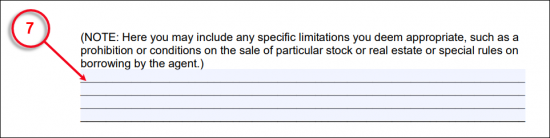

Section 2. Modifying Or Limiting The Agent’s Principal Power

(7) Power Limits. The actions the Attorney-in-Fact engages in on behalf of the Principal can have long-lasting effects. At times, the Principal may be unavailable (i.e. due to extended travel or extenuating circumstances) thus leaving the Attorney-in-Fact without specific direction in unforeseen situations. If desired, the Principal can use this form to impose conditions on or limit the level of authority of the powers being granted. If more room is needed, a separate document can be used to list all such Principal limitations or directives as long as it is properly titled, named in the appropriate section of the appointment form, and physically present with this form at the time of signing and every other time this directive is viewed.

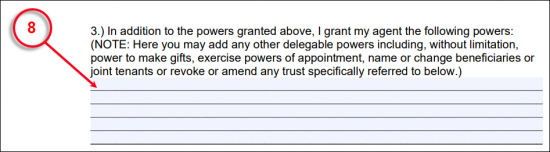

(8) Extensions Of Power. If additional principal powers are to be conveyed to the Attorney-in-Fact, they must be listed in this document. For instance, the ability to handle the Principal’s trusts and beneficiaries is a specific power that must be approved directly by the Principal.

Section 4. Powers Of Delegation

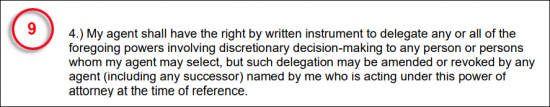

(9) Agent’s Power Of Delegation. Currently, the Agent will be able to grant the principal powers under his or her command to other Parties (as per Section 4). To restrict this power of appointment from the Attorney-in-Fact’s principal power, its paragraph description must be crossed out or struck-through.

Section 5. Right to Compensation

(10) Compensation For Services. By default, this document shall set the Attorney-in-Fact or Agent’s services as billable to the Principal (when appropriate). If the Attorney-in-Fact will not require compensation or should not be able to use principal authority to seek/gain compensation for the time and services required for this role then the statement in the fifth section should be invalidated by striking through it.

Section 6. Setting The Date Of Effect

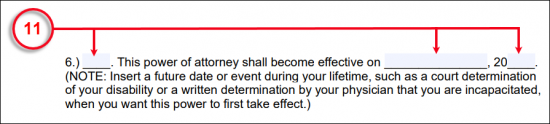

(11) Start Date. If a specific start date is to be set to activate the Attorney-in-Fact’s principal powers then it will require the Principal’s approval through his or her initials and a definition. The first calendar day that the Attorney-in-Fact can wield authority must be documented. If an event should be used to trigger this power document’s effect, then define it directly below the sixth declaration or (suggested) make a specific reference in an attachment, otherwise name the first date of this document’s effect written out as a month, two-digit calendar day, and the last two digits of the applicable year

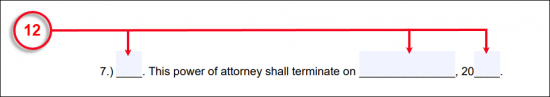

Section 7. The Terminating Of Principal Powers

(12) Termination Date. To set a termination date for the powers granted, the approving initials of the Principal must be presented in the seventh section. In addition, the final date that the Attorney-in-Fact possesses the authorization to wield principal powers should be recorded. The Principal will retain the right to revoke these powers at any time. If he or she does not revoke this document, whatever termination date the Principal names within it will set these powers to naturally expire.

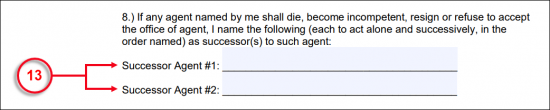

Section 8. Naming The Successor Agents

(13) Attorney-in-Fact Successors. If the Attorney-in-Fact is unable or cannot act in the role the Principal assigned (for any reason including revocation), then the Principal can be left without the aid he or she requires with certain financial actions. This can be avoided by naming two Agents who can assume the authority to carry out the Principal’s directives in the State of Illinois. The first Successor Agent appointed with this role will only be able to wield this power if the Attorney-in-Fact steps down, has his or her power revoked, is unable to represent the Principal, or can no longer do so. Similarly, the Second Successor Agent will only be able to assume the Attorney-in-Fact role if the originally named Illinois Agent or Attorney-in-Fact and the First Successor Agent both become ineligible or unable to wield principal power.

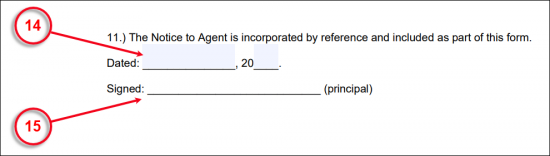

Section 11. Executing The Illinois Appointment

(14) Illinois Signature Date. The day when the Principal signs this paperwork to delegate his or her authority to the Attorney(s)-in-Fact in the State of Illinois must be reported the day of the signing by the Principal.

(15) Principal Signature. The Principal must sign the completed appointment (making sure all relevant attachments are present) before at least one Witness as well as a Notary Public.

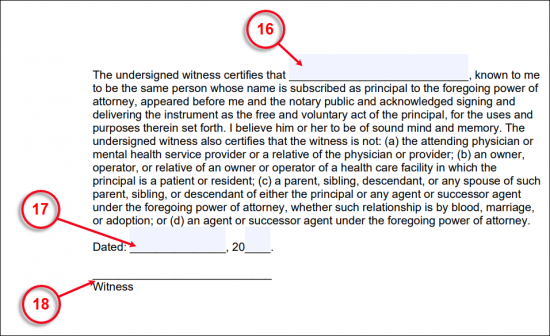

Witness 1 Testimony

(16) Witness 1 Name. Only one Witness to the Principal’s signature is required to sign this form to execution in the State of Illinois. His or her full name should be presented beforehand in print.

(17) Witness 1 Signature Date.

(18) Witness 1 Signature.

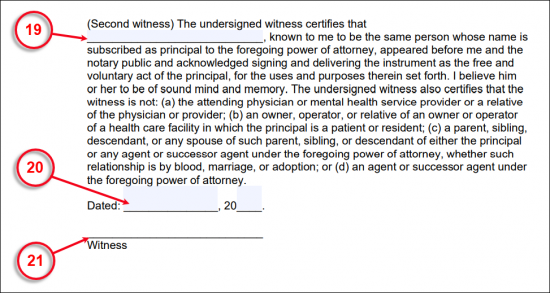

Witness 2 Testimony

(19) Witness 2 Name. Quite a few jurisdictions will require a second Witness to verify the Principal’s signature thus, it is recommended to sign this document before two Witnesses (if possible). In such a case, the Second Witness must also print his or her name to properly testify to the Principal’s signature.

(20) Witness 2 Signature Date.

(21) Witness 2 Signature.

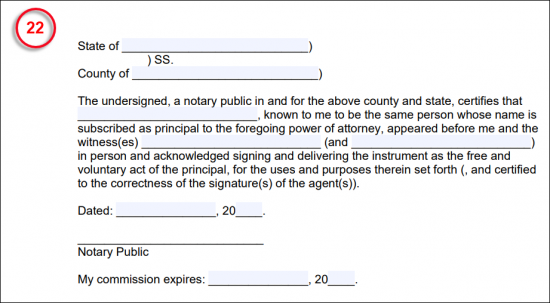

Notary Public

(22) Notarization. As discussed, in addition to the confirmation of at least one Witness, the Principal’s act of singing must be verified through a Notary Public recognized by the State of Illinois. He or she will complete the notarization area of this form when satisfied with the signing that has occurred.

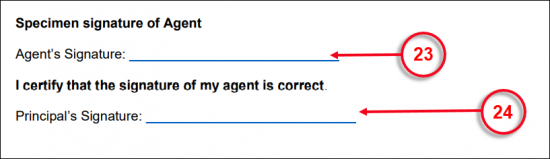

Specimen Signature of Agents

(23) Attorney-in-Fact Acknowledgement. While not required, it is suggested the Attorney-in-Fact read through this appointment of power then acknowledge his or her role (as defined above and by the State of Illinois) with the signing of his or her name.

(24) Principal Verification. If the option to include the Attorney-in-Fact’s acknowledgment has been engaged, the Principal’s signature confirmation as to the validity of the Attorney-in-Fact signing must be included.

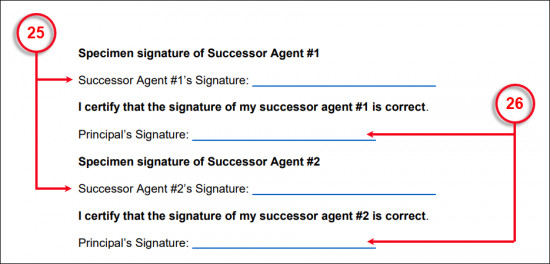

(25) Successor Agent Acknowledgment. It is also suggested that each Successor Agent review this paperwork as it may call upon him or her to act on the Principal’s behalf one day. If the Successor Agents agree to living up to this role then each should sing his or her name to show this intent.

(26) Principal Authentication. After the Successor Agent(s) has completed the specimen signature, the Principal should review these items then sign this area to verify the Successor Agent signature(s) provided.

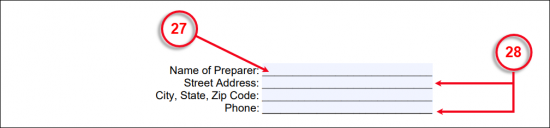

Preparer

(27) Name Of Preparer. The Party who has supplied this template with the information above must self-report.

(28) Preparer Contact Information. The complete address and the phone number needed to contact the Preparer of this document should be listed.

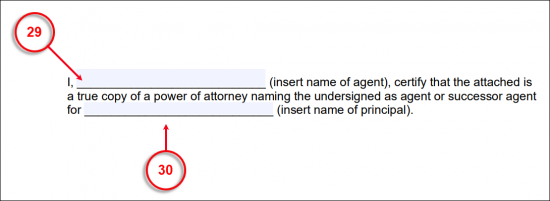

Agent’s Certification And Acceptance Of Authority

(29) Agent’s Full Name. A statement of certification has been provided for the Agent’s use. This additional paperwork enables the Principal’s Agent to verify the powers just granted as authentic and to verify his or her understanding of this position.

(30) Principal’s Name. This document should specifically name the Principal who has granted this Agent authority.

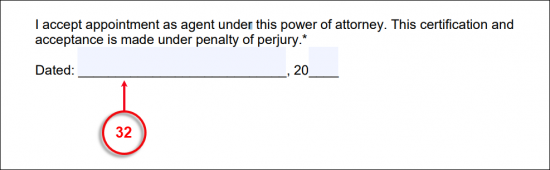

(31) Date Of Certification. The date this document is signed by the Agent is the same day this declaration becomes a valid.

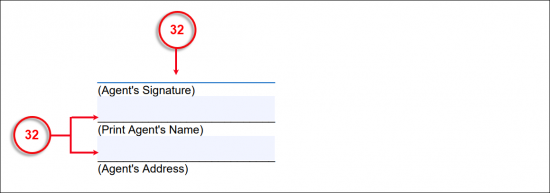

(32) Agent’s Signature. Once this document’s language has been completed, the Agent should sign his or her name to testify to its accuracy.

(33) Name And Address. The printed name of the Agent with his or her address is the final requirement for this signing.

Related Forms

Download: PDF

Download: PDF, MS Word, OpenDocument