Updated March 25, 2024

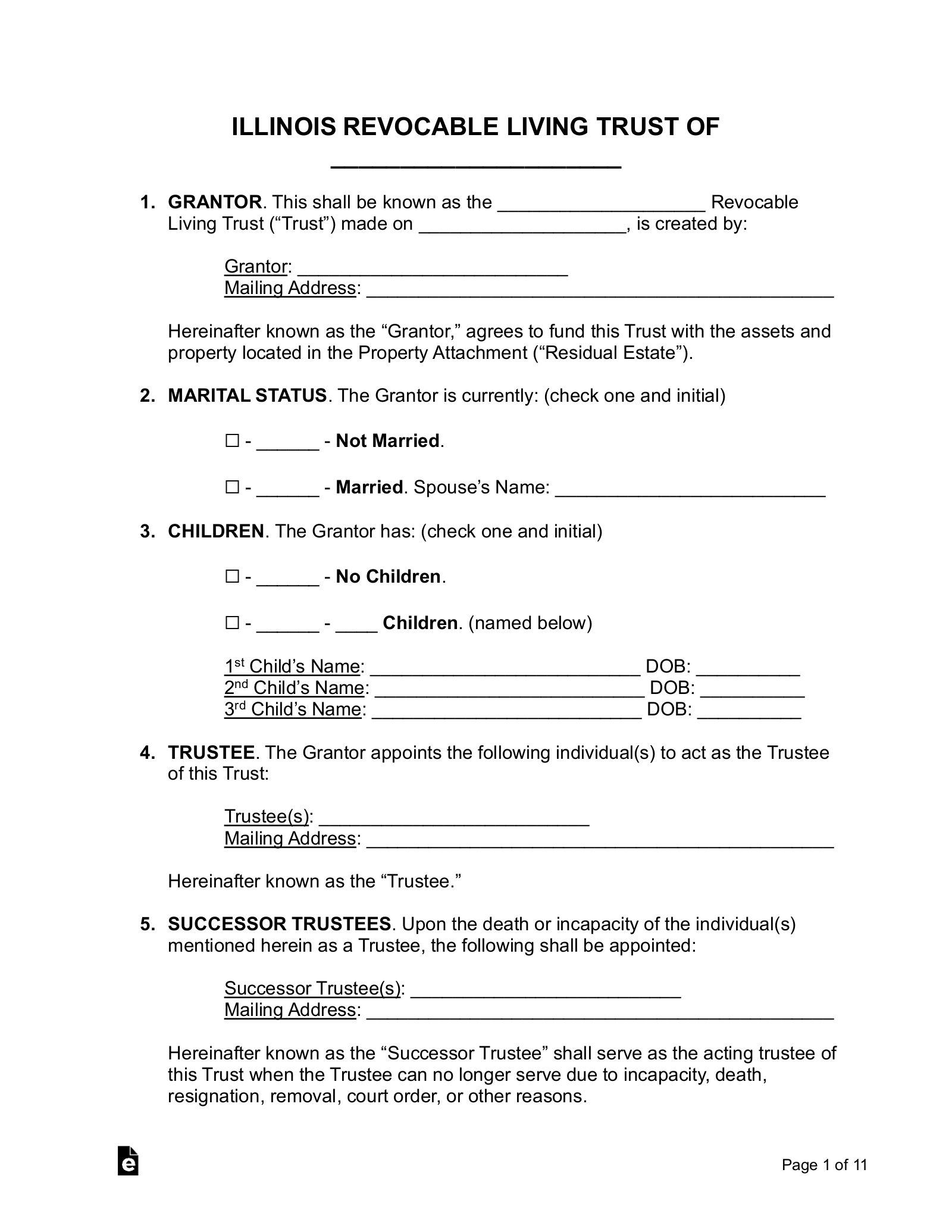

An Illinois living trust is a document that allows a grantor to transfer their property and assets into a trust to be distributed to select beneficiaries after the grantor dies. With a living trust, the grantor may revoke the trust at any time and may also serve as the trustee, retaining control over their assets during their lifetime.

Requirements (5)

- Capacity: The grantor must have the mental capacity to create a trust.

- Intention: The grantor must indicate an intention to establish a trust.

- Beneficiary: The trust, unless it is a charitable trust or a trust established for the care of an animal, must have a definite beneficiary.

- Trustee’s Duties: The trustee must have duties to perform.

- Sole Trustee Cannot be Sole Beneficiary: If there is a sole trustee and a sole beneficiary, these cannot be the same person.[1]

Registration

Only charitable trusts in which over $4,000 worth of property is held are required to register with the Attorney General’s office.[2]

Laws

Amending/Revoking – The grantor can amend or revoke a living trust only if the trust instrument explicitly states that the trust is revocable or amendable by the grantor.[3]

Bond Requirement – A trustee is only required to give a bond if they have been ordered to do so by the court, or if the trust instrument requires they give a bond to secure the performance of their duties.[4]

Certification of Trust – In lieu of a copy of the trust instrument, a trustee may furnish a certification of trust to a person other than a beneficiary. The certification may confirm the trust’s existence, identify the grantor and trustee, and detail the trustee’s powers.[5]

Co-Trustees – Co-trustees who cannot reach a unanimous decision may act by majority decision, but only after having given written notice to each other co-trustee.[6] If a co-trustee is temporarily unavailable or incapacitated, the remaining trustees may act for the trust without them.[7]

Contesting a Trust – Judicial proceedings to contest the validity of a revocable trust must be initiated within two years of the grantor’s death or within six months of the trustee having given notice of the trust’s existence, whichever is earlier.[8]

Costs Related to the Trust – The trustee has a duty to incur only reasonable costs in the administration of the trust.[9]

Jurisdiction – A trust created in a different state is valid in Illinois if it was created in compliance with the laws of the original jurisdiction in which the trust instrument was executed.[10]

Oral Trusts – “Clear and convincing evidence” is required for the establishment of a valid oral trust.[11]

Pet Trusts – A trust established for the care of a pet or other domestic animal is valid in Illinois. The trust terminates when there is no longer any living animal covered by the trust.[12]

Signing Requirements – Illinois state law does not set out a signature requirement for the creation of a revocable trust.

Spendthrift Provision – A spendthrift provision is valid if it prohibits both the voluntary and involuntary transfer of a beneficiary’s interest.[13]

Trustee’s Compensation – If the trust instrument does not specify a trustee’s compensation, the trustee is otherwise entitled to reasonable compensation.[14]

Trustee’s Duties – The trustee has a duty to administer the trust in good faith and in alignment with its intended purposes.[15]

Trustee’s Powers – In addition to any powers conferred by the trust instrument, a trustee has the power to collect, acquire, sell, or otherwise change the character of trust property in order to pursue an appropriate investment strategy for the trust.[16]