Updated March 12, 2024

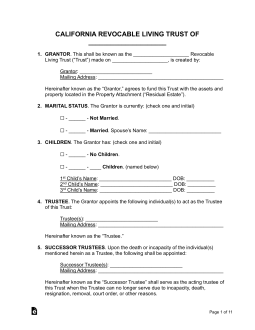

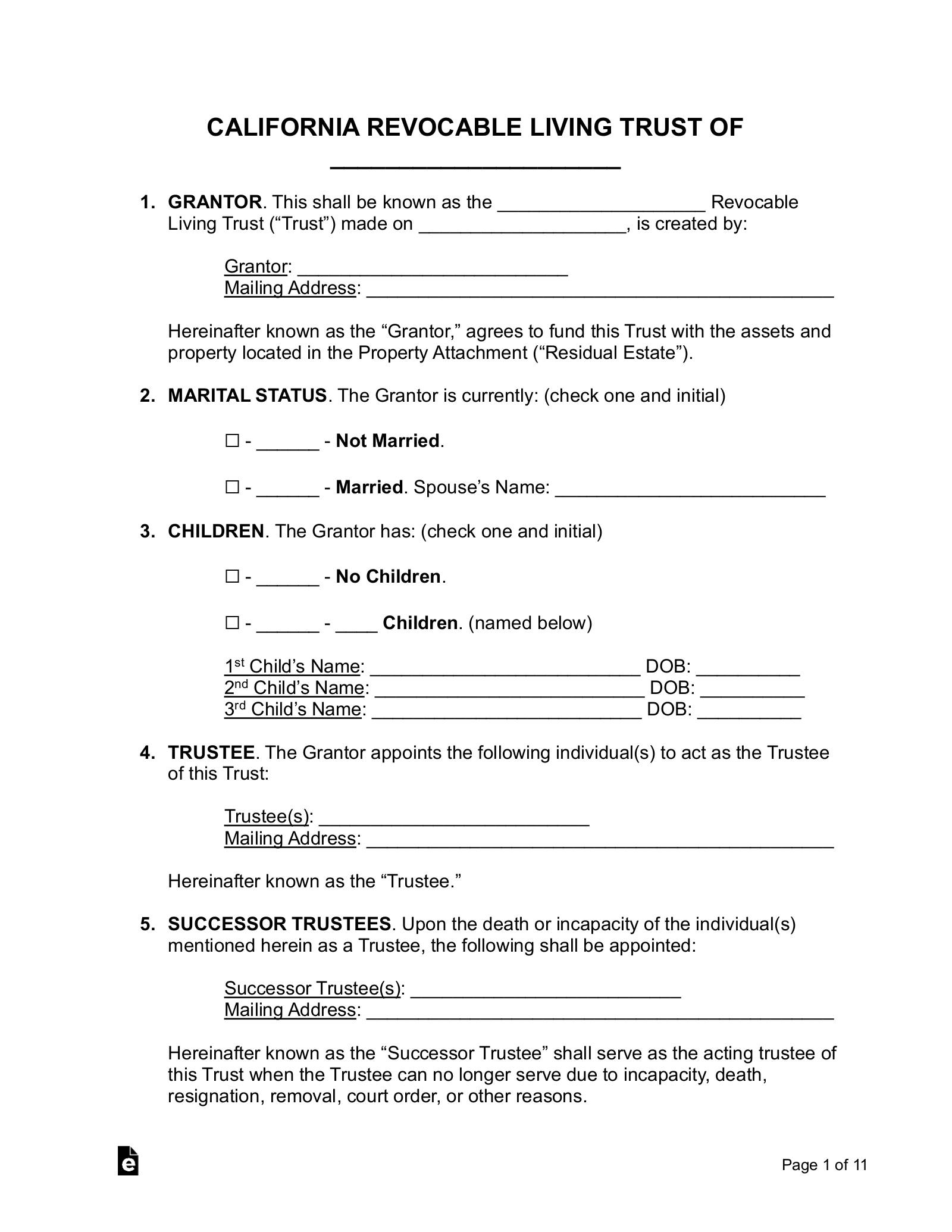

A California living trust is a legal document that enables an individual (the grantor) to place their personal property and real estate within a trust to be distributed to a beneficiary after the grantor’s death. A revocable trust allows the grantor to also act as the trustee and therefore manage their assets during their lifetime.

Requirements (3)

Registration

Charitable trustees are required to register with the California Attorney General within 30 days of initially receiving property.[4]

Laws

Amending/Revoking – Unless the written instrument expressly states that the trust is irrevocable, the grantor may revoke or modify the trust.[5]

Bond Requirement – A trustee is not required to give a bond unless a bond is required by the trust instrument or ordered by the court. If the trustee was appointed by the court rather than named in the instrument, then a bond is required.[6]

Certification of Trust – The trustee may present a certification of trust instead of the written instrument in order to confirm the existence or terms of the trust. This certification may also include the identities of the grantor and trustees, a description of any interest in real property held in the trust, and whether the trust is revocable.[7]

Co-Trustees – Unless the written instrument establishes otherwise, co-trustees may only act unanimously.[8] However, if any co-trustee is temporarily unavailable to perform their duties, the remaining trustee or trustees may continue to act for the trust without waiting for the co-trustee to become available.[9]

Contesting a Trust – If the grantor of the trust dies, the heir has 120 days after receiving notice from the trustee in which they may contest the trust.[10]

Costs Related to the Trust – A trustee may only incur costs that are appropriate and reasonable in relation to the assets within the trust and its overall investment strategy.[11]

Jurisdiction – A court may make an order accepting the transfer of a trust from another jurisdiction to the state of California.[12]

Oral Trusts – An oral trust can only be established by “clear and convincing evidence,” which must include more than only the oral declaration of the grantor.[13]

Pet Trusts – A trust may be established to care for an animal after the grantor’s death until that animal has died. The care of an animal is considered to be a lawful noncharitable purpose for a trust.[14]

Signing Requirements – The written must be signed by either the trustee or the grantor if the trust is in relation to real property.[15]

Trustee’s Compensation – If the trustee’s compensation is not specified in the trust instrument, they are entitled to reasonable compensation under the circumstances.[16]

Trustee’s Duties – The trustee has a duty to administer the trust according to the terms of the written instrument[17] or the written direction of the grantor.[18] The trust must only be administered in the interest of the beneficiaries.[19]

Trustee’s Powers – The trustee can exercise any powers conferred by the written instrument or by statute.[20] At the same time, the exercise of these powers is subject to the trustee’s fiduciary duties.[21]

Sources

- Cal. Prob. Code § 15201

- Cal. Prob. Code § 15202

- Cal. Prob. Code § 15205(a)

- Cal. Gov. Code § 12585(a)

- Cal. Prob. Code § 15400

- Cal. Prob. Code § 15602(a)

- Cal. Prob. Code § 18100.5

- Cal. Prob. Code § 15620

- Cal. Prob. Code § 15622

- Cal. Prob. Code § 16061.7(h)

- Cal. Prob. Code § 16050

- Cal. Prob. Code § 17451(a)

- Cal. Prob. Code § 15207

- Cal. Prob. Code § 15212(a)

- Cal. Prob. Code § 15206

- Cal. Prob. Code § 15681

- Cal. Prob. Code § 16000

- Cal. Prob. Code § 16001

- Cal. Prob. Code § 16002

- Cal. Prob. Code § 16200

- Cal. Prob. Code § 16202