Updated March 06, 2024

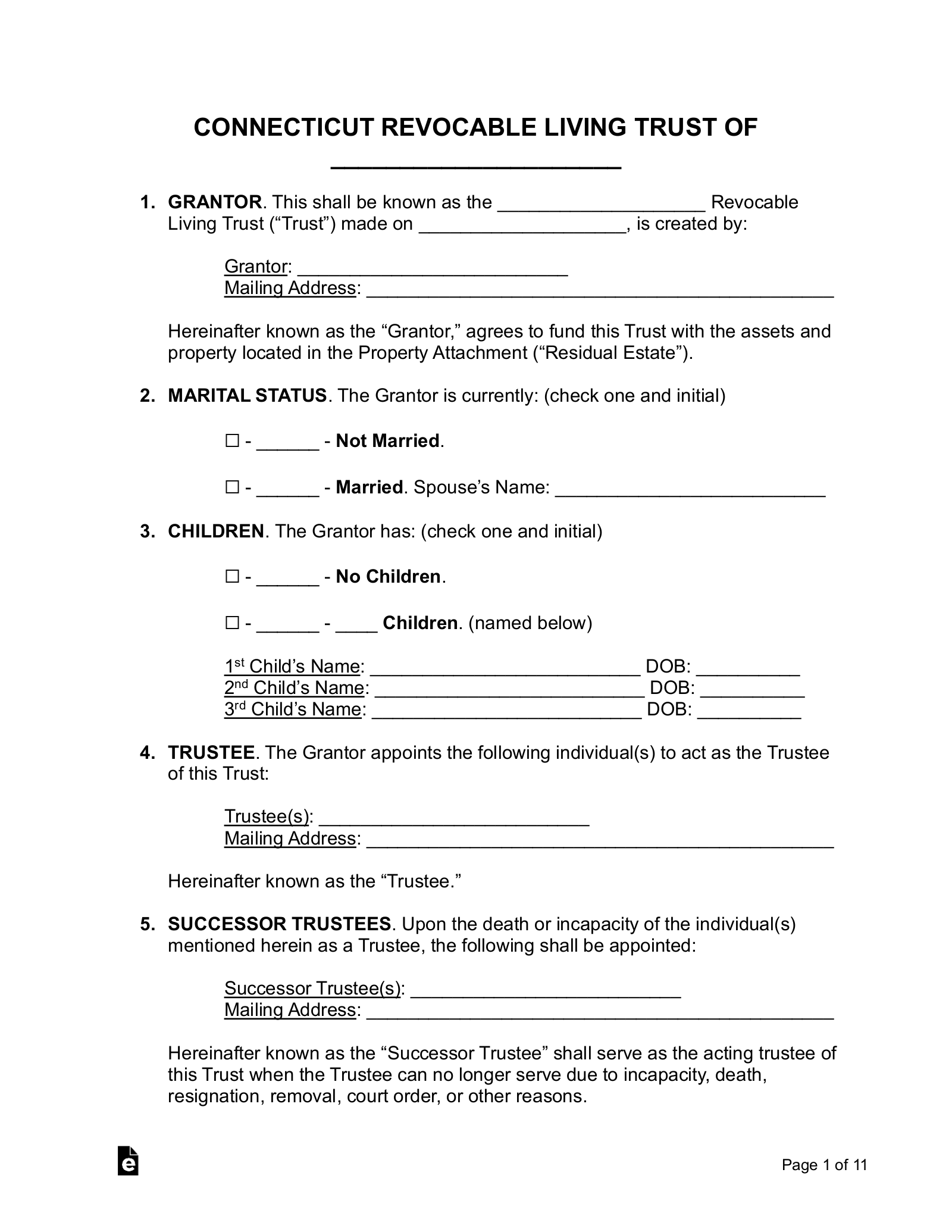

A Connecticut living trust is an estate planning document that transfers assets and property into a trust during the owner’s lifetime. The owner, or “settlor,” often serves as the trustee, remaining in control of the assets. A living trust takes effect upon signing and can be modified as long as the settlor is of sound mind.

Requirements (3)

- Clear Intention: The settlor must be of sound mind to create the trust with clear, demonstrated intent.

- Definite Beneficiary: The trust must have one or more specific beneficiaries (can be a person, a charity, or an animal).

- Trustee Duties: The trustee must have tasks to perform in managing the trust.[1]

Registration

There is no requirement to register a trust in Connecticut. Once the trust is properly documented and funded, it is legally vaild.[2]

Laws

Amending/Revoking – It is within the settlor’s discretion to revoke or amend the trust, so long as the terms of the trust do not expressly provide that the trust is irrevocable.[3]

Bond Requirement – A trustee is not required to give bond unless directed by the terms of the trust or by court order.[4]

Co-Trustees – If there are co-trustees who cannot agree unanimously on a decision, decisions are determined by majority vote.[5]

Distribution of Trust’s Assets – A beneficiary or other entitled party can only contest the trust within one year of the settlor’s death or 120 days after receiving a copy of the trust, whichever is earlier.[6]

Oral Trusts – A trust need not be in writing if otherwise established by “clear and convincing evidence.”[7]

Pet Trust – A trust created for the care of an animal must designate a trustee whose sole duty is to act on the animal’s behalf. The trust will terminate upon the animal’s death.[8]

Signing Requirements – There are no statutory signing requirements, though signing in the presence of two witnesses and a notary public is recommended.

Spendthrift Provisions – Spendthrift provisions are permitted to restrain voluntary and involuntary transfers of a beneficiary’s interest.[9]

Trustee’s Compensation – Trustees are entitled to “reasonable compensation” if no compensation is outlined in the terms of the trust.[10]

Trustee’s Powers – Trustees have the legal authority to, consistent with fiduciary duties and the powers outlined in the trust itself, take actions necessary to achieve the appropriate investment, management, and distribution of assets therein.[11]