Updated April 26, 2024

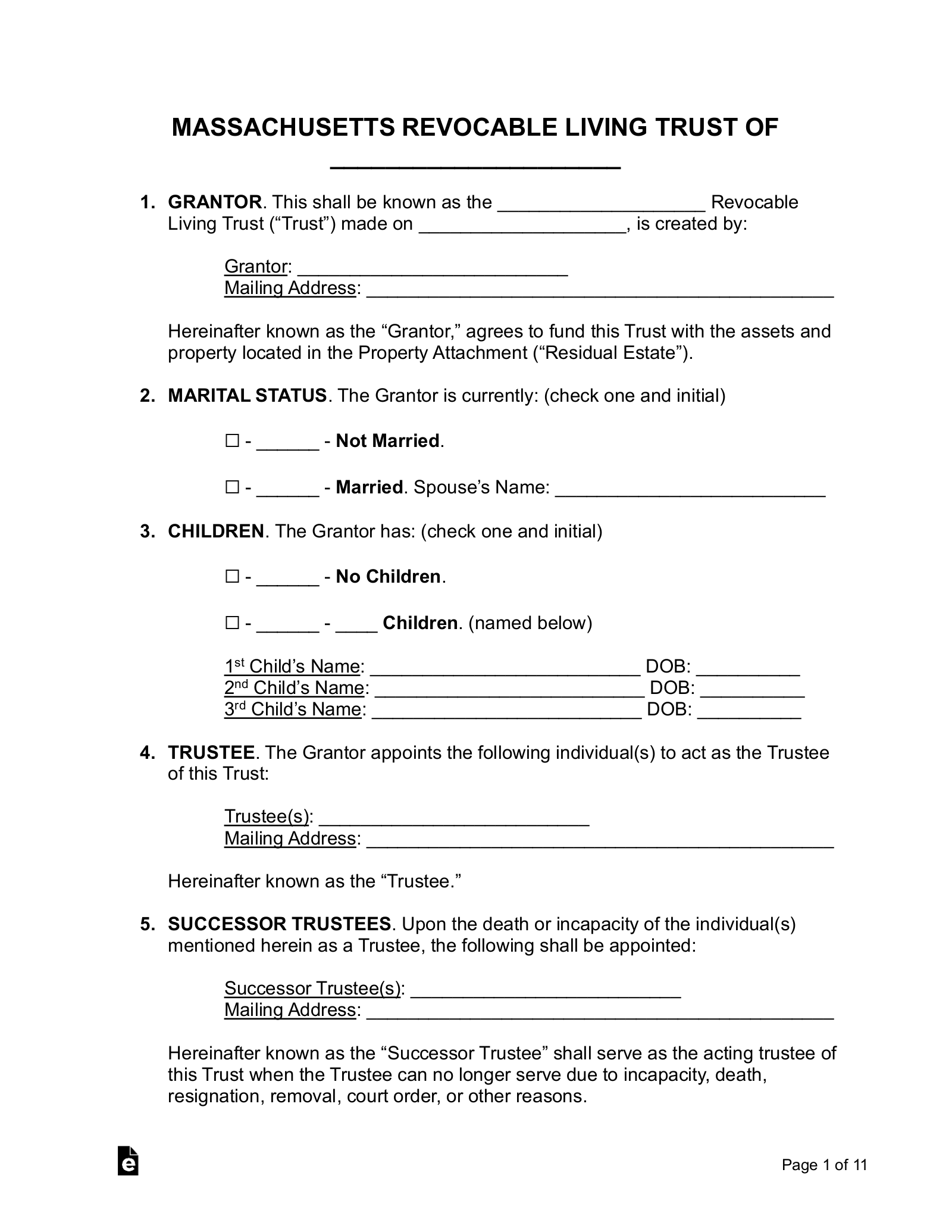

A Massachusetts living trust is a legal document wherein a grantor places their assets in a trust to be distributed to designated beneficiaries in the event of the grantor’s death. A living or revocable trust allows the grantor to also act as the trustee, retaining control over their assets during their lifetime.

Requirements (5)

- Competent: The grantor must be capable of establishing a trust.

- Intent: The grantor must have the intention to create a trust.

- Trustee’s Duties: The trustee must have duties to perform.

- Definite Beneficiary: Unless the trust is a charitable trust or a trust for the care of an animal, there must be a definite beneficiary.

- Sole Trustee Cannot be the Sole Beneficiary: The same person cannot be both the sole trustee and the sole beneficiary of the trust.[1]

Registration

If registered land is held or transferred in trust, the trust instrument and a memorandum containing the words “in trust” must be filed in the Registry of Deeds. This memo must also include a reference number for the original instrument.[2]

Laws

Amending/Revoking – Unless the terms of the trust expressly state that it is irrevocable, the trust may be amended or revoked by the grantor.[3]

Bond Requirement – The trustee is only required by statute to put forward a bond if they are administering a testamentary trust.[4] In the case of a living trust, there is no statutory requirement to furnish a bond.

Certification of Trust – In lieu of a copy of the trust instrument, the trustee may furnish to a non-beneficiary a certification of trust disclosing the existence of the trust, when it was created, the identities of the grantor and trustee, and whether it is revocable.[5]

Co-Trustees – Co-trustees may act by majority decision if they are unable to reach a unanimous decision.[6]

Contesting a Trust – A proceeding to contest a trust must be initiated within 60 days of notice having been given of the trust’s existence or within one year of the grantor’s death, whichever is earlier.[7]

Costs Related to the Trust – The trustee must only incur reasonable costs in the administration of the trust.[8]

Jurisdiction – A living trust established in a different jurisdiction is valid if its creation complied with the laws of the jurisdiction where the trust instrument was executed or the laws of the jurisdiction in which the grantor was living at the time.[9]

Oral Trusts – An oral trust may be established by clear and convincing evidence; unless required by state statute, a trust instrument is not necessary.[10]

Pet Trusts – A trust may be established to provide for the care of one or more animals that are alive during the grantor’s lifetime. Unless the trust instrument provides for an earlier termination, the trust terminates upon the death of the last surviving animal.[11]

Signing Requirements – A trust concerning the transfer of land must be executed in writing and signed by the grantor or by their attorney.[12]

Spendthrift Provision – A valid spendthrift provision must restrain both the voluntary and involuntary transfer of a beneficiary’s interest.[13]

Trustee’s Compensation – If the terms of the trust do not specify the trustee’s compensation, they are otherwise entitled to reasonable compensation under the circumstances.[14]

Trustee’s Duties – The trustee must prudently administer the trust in good faith, in the sole interests of the beneficiaries, and in accordance with its stated terms and purposes.[15]

Trustee’s Powers – In addition to those powers established by the trust instrument, the trustee has the power to collect, acquire, sell, exchange, or otherwise alter the character of trust property.[16]

Sources

- Mass. Gen. Laws ch. 203E § 402(a)

- Mass. Gen. Laws ch. 185 § 72

- Mass. Gen. Laws ch. 203E § 602(a)

- Mass. Gen. Laws ch. 203E § 702

- Mass. Gen. Laws ch. 203E § 1013(a)

- Mass. Gen. Laws ch. 203E § 703(a)

- Mass. Gen. Laws ch. 203E § 604(a)

- Mass. Gen. Laws ch. 203E § 805

- Mass. Gen. Laws ch. 203E § 403

- Mass. Gen. Laws ch. 203E § 407

- Mass. Gen. Laws ch. 203E § 408(a)

- Mass. Gen. Laws ch. 203 § 1

- Mass. Gen. Laws ch. 203E § 502(a)

- Mass. Gen. Laws ch. 203E § 708(a)

- Mass. Gen. Laws ch. 203E § 801

- Mass. Gen. Laws ch. 203E § 816