Updated April 25, 2024

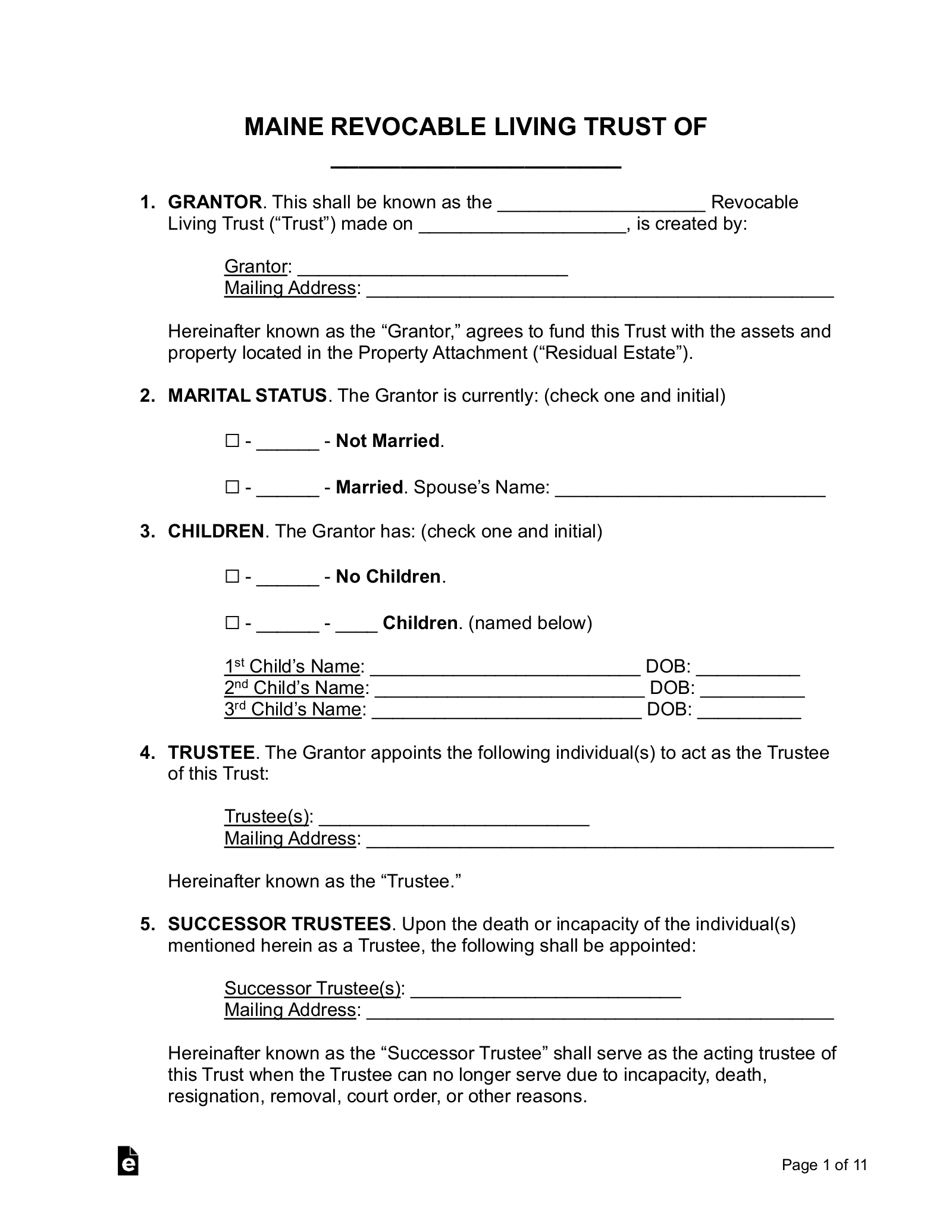

A Maine living trust is a document allowing an individual known as a “grantor” to specify how their assets should be dispersed by a designated trustee after they die. With a living or revocable trust, the grantor may also serve as the trustee, retaining the power to amend or revoke the trust during their lifetime.

Requirements (5)

- Competent: The grantor must have the capacity to create a trust.

- Intent: The grantor must indicate an intention to create the trust.

- Trustee’s Duties: The trustee is required to have duties to perform.

- Sole Trustee Cannot be the Sole Beneficiary: The same person cannot be both the sole beneficiary and sole trustee.

- Definite Beneficiary: Unless it is a charitable trust or a trust for the care of an animal, the trust must have a beneficiary that can be ascertained.[1]

Registration

Maine state statute does not require a living trust to be registered.

Laws

Amending/Revoking – A grantor may amend or revoke a trust, unless the terms of the trust explicitly provide that it is irrevocable.[2]

Bond Requirement – The trustee is only required to put forward a bond if ordered to do so by the court or if this is a requirement laid out in the terms of the trust.[3]

Certification of Trust – Instead of a copy of the trust instrument to a person other than a beneficiary, the trustee may furnish a certification of trust that discloses the trust’s existence, the identities of the grantor and trustee, and other relevant information.[4]

Co-Trustees – Co-trustees who are unable to act unanimously may act by majority decision.[5]

Contesting a Trust – A person must commence an action to contest the validity of a trust within 120 days of receiving notice from the trustee of the trust’s existence or within three years of the grantor’s death, whichever is earlier.[6]

Costs Related to the Trust – The trustee may only incur administration costs that are reasonable given the trust property, its purposes, and the skills of the trustee.[7]

Jurisdiction – A trust created in another state is valid if its creation was in compliance with the laws of the jurisdiction in which the trust instrument was executed.[8]

Oral Trusts – An oral trust is valid if its terms and existence are established by clear and convincing evidence.[9]

Pet Trusts – A trust can be created to care for one or more animals alive during the grantor’s lifetime. The trust terminates upon the death of the last surviving animal.[10]

Signing Requirements – There is no statutory requirement in Maine that a revocable trust be signed.

Spendthrift Provision – A provision providing that a beneficiary’s interest is held to a “spendthrift trust,” or words of a similar meaning, is only valid if it restrains both the voluntary and involuntary transfer of the beneficiary’s interest.[11]

Trustee’s Compensation – The trustee is entitled to reasonable compensation, unless the terms of the trust specify a compensation amount.[12]

Trustee’s Duties – The trustee must prudently administer the trust in good faith, in accordance with its stated purposes, and in the sole interest of the beneficiaries.[13]

Trustee’s Powers – In addition to those powers conferred upon them by the trust instrument, the trustee may collect, acquire, sell, and otherwise change the character of trust property.[14]