Updated April 02, 2024

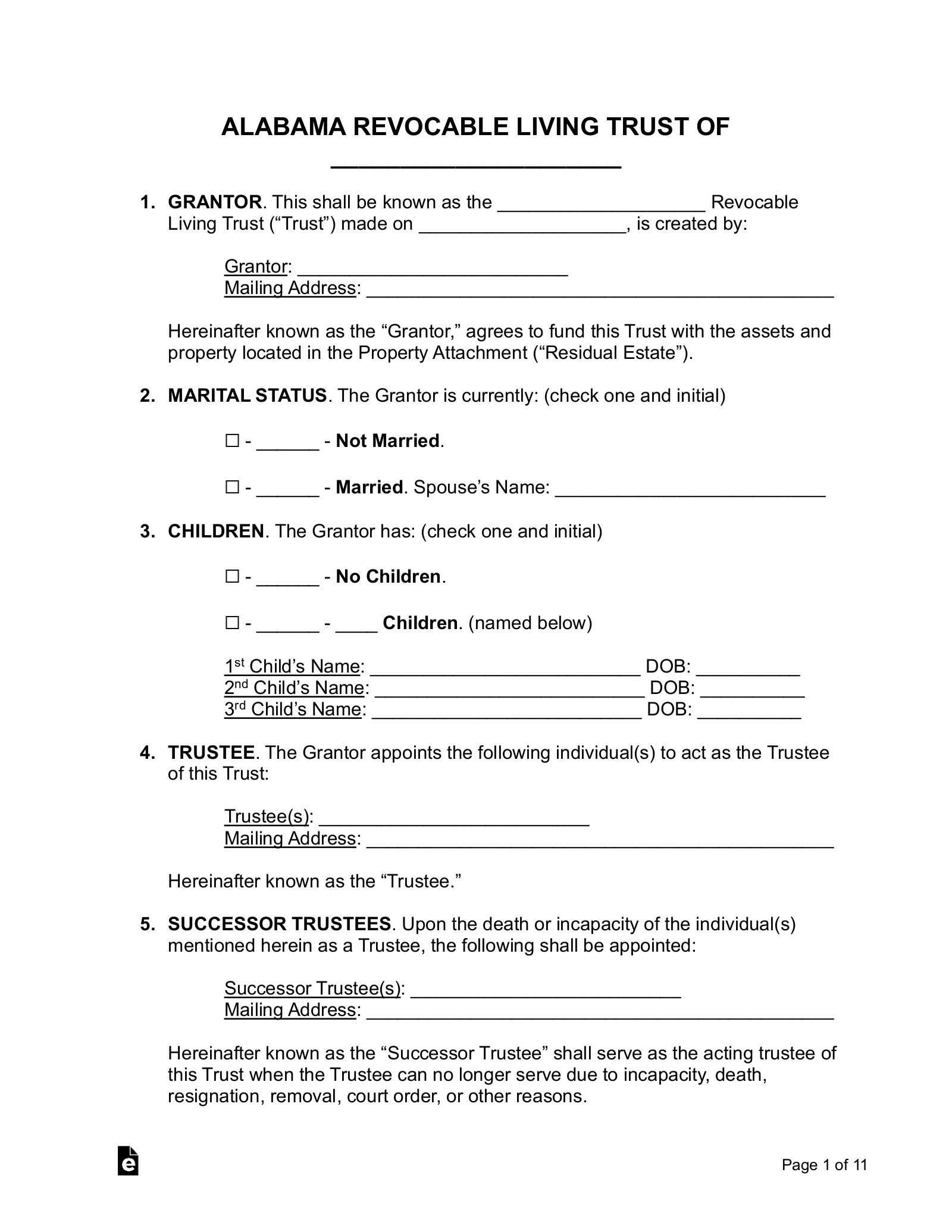

An Alabama living trust is a legal document that allows its creator (grantor) to transfer assets and property into a trust during their lifetime. It can be modified or revoked at any time if the grantor is of sound mind (not incapacitated). It is common for the grantor to act as the trustee while managing the trust’s assets, often to their benefit, until their death.

Requirements (5)

- Mental Capacity: Grantor must have the capacity (of sound mind) to make a trust;

- Intention: Must state the Grantor’s intention to make a trust.

- Beneficiaries: Must include beneficiaries who will receive the assets after the Grantor dies. This may include charitable organizations, pets, or a non-charitable purpose.

- Trustee’s Duties: The trustee must have duties outlined to perform.[1]

- Cannot be Same Person: The sole trustee cannot be the sole beneficiary.[2]

Registration

It is not required to register a trust in Alabama. However, the trustee can register it at the local county probate office where the property in the trust is located.[3]

Laws

Amending/Revoking – If the trust does not include the terms “irrevocable,” the trust can be amended. For co-trustees, it can be voided with one trustee but requires the consent of both trustees to amend.[4]

Bond Requirement – A bond is only required if a court finds it is needed to protect a trust’s assets.[5] A trust may also include bond requirements if requested by the grantor.

Co-Trustees – If co-trustees aren’t able to make a unanimous decision, the co-trustees may act with a majority decision.[6]

Creditors – The grantor’s creditors must enter a claim within 90 days after being notified of their death.[7]

Distribution of Trust’s Assets – A beneficiary can dispute their portion of the trust’s property within 30 days of notice of distribution.[8]

Oral Trusts – Legal if provided clear and convincing evidence of its existence.[9]

Pet Trust – A trust may be created for the care of an animal and terminates upon the animal’s death. If a court determines there was too much money allocated to the pet trust, or there are additional funds not used after the animal dies, such remaining monies will revert to the Grantor’s successors in interest (heirs-at-law).[10]

Signing Requirements – No signing requirements. It is recommended that it is signed in the same manner as a last will with two witnesses.[11]

Spendthrift Provisions – Valid if it restricts a beneficiary’s voluntary and involuntary interest.[12] It is unenforceable against a child support order against a beneficiary, a creditor who has performed services to a beneficiary, or a claim made by a court order.[13]

Trustee’s Compensation – If a trust does not outline compensation for an acting trustee, the trustee is entitled to “reasonable compensation” under the circumstances.[14] In addition, the trustee is entitled to be reimbursed for expenses related to payments made to protect or defend the trust.[15]

Trustee’s Powers – A trustee has the general authority to exercise powers granted to them through the trust and powers to achieve proper property investment, management, and distribution.[16] If granted specific powers under a trust, the trustee may provide any act legal under law that is in the best interest to protect the trust’s assets, property, and legal standing.[17]

Sources

- Section 19-3B-401

- Section 19-3B-402(a)(5)

- www.ryanbk.com/blog/2024/january/what-are-the-requirements-for-a-living-trust-in-/

- Section 19-3B-602

- Section 19-3B-702

- Section 19-3B-703

- Section 19-3B-505(b)(2)

- Section 19-3B-817(a)

- Section 19-3B-407

- Section 19-3B-408

- Section 43-8-131

- Section 19-3B-502

- Section 19-3B-503

- Section 19-3B-708

- Section 19-3B-709

- Section 19-3B-815

- Section 19-3B-816