Updated August 09, 2023

A North Dakota power of attorney form allows an individual to select someone else to act on their behalf in the areas of financial, medical, or other personal decisions. The person choosing someone else, the “principal”, is recommended to select someone that is a trusted individual that will be receiving power, the “agent”. At the option of the principal, the form can be “durable” which means it will remain valid even if they should not be able to think for themselves one day (e.g. Dementia, Alzheimer’s Disease, etc.).

By Type (9) |

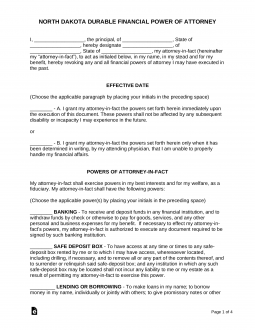

Durable (Financial) Power of Attorney – This version grants power over the property and assets of the person granting the power even after they become incapacitated. Durable (Financial) Power of Attorney – This version grants power over the property and assets of the person granting the power even after they become incapacitated.

Download: PDF, MS Word, OpenDocument Signing Requirements: None, but notarization is recommended. |

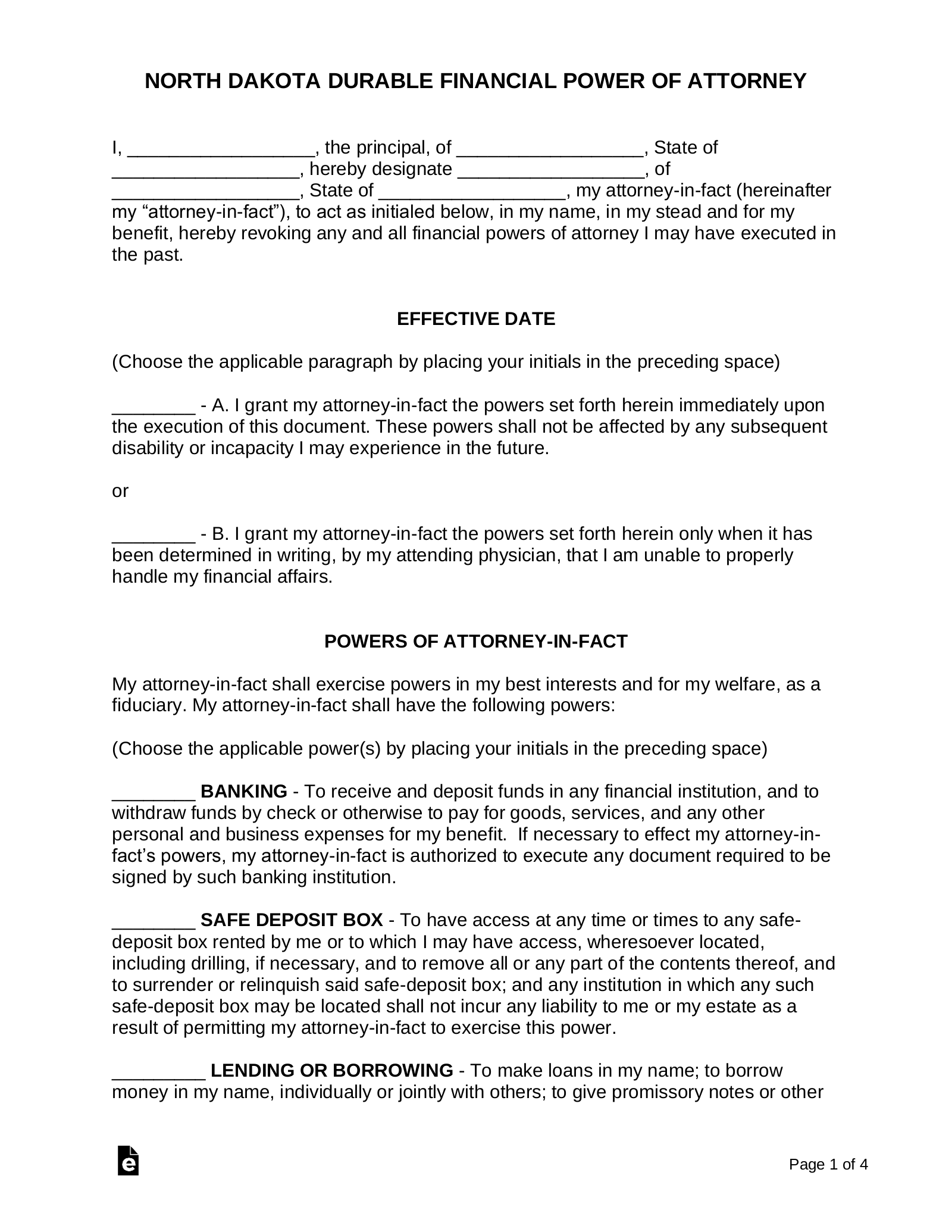

General (Financial) Power of Attorney – This version also grants general power over the property and assets of the principal, but it self-terminates upon the incapacity of the principal. General (Financial) Power of Attorney – This version also grants general power over the property and assets of the principal, but it self-terminates upon the incapacity of the principal.

Download: PDF, MS Word, OpenDocument Signing Requirements: None, but notarization is recommended. |

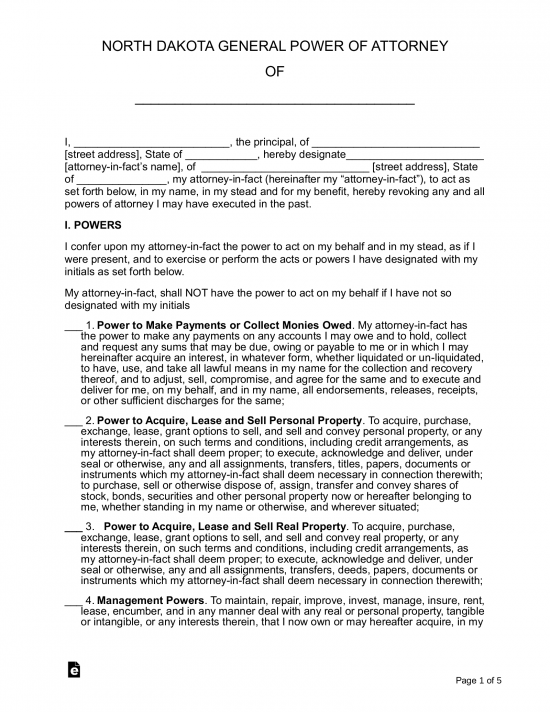

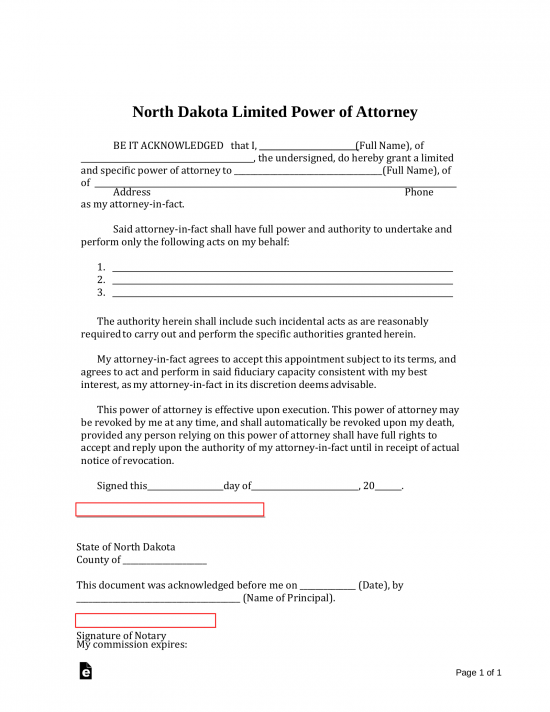

Limited Power of Attorney – This version is for use when there is a specific event or time period for which you are seeking short-term representation. Limited Power of Attorney – This version is for use when there is a specific event or time period for which you are seeking short-term representation.

Download: PDF, MS Word, OpenDocument Signing Requirements: None, but notarization is recommended. |

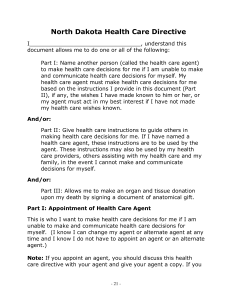

Medical Power of Attorney – Used exclusively for health care decision-making and only when the principal can’t make their own decisions. Medical Power of Attorney – Used exclusively for health care decision-making and only when the principal can’t make their own decisions.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 23-06.5-05): Notary acknowledgment or two (2) witnesses. |

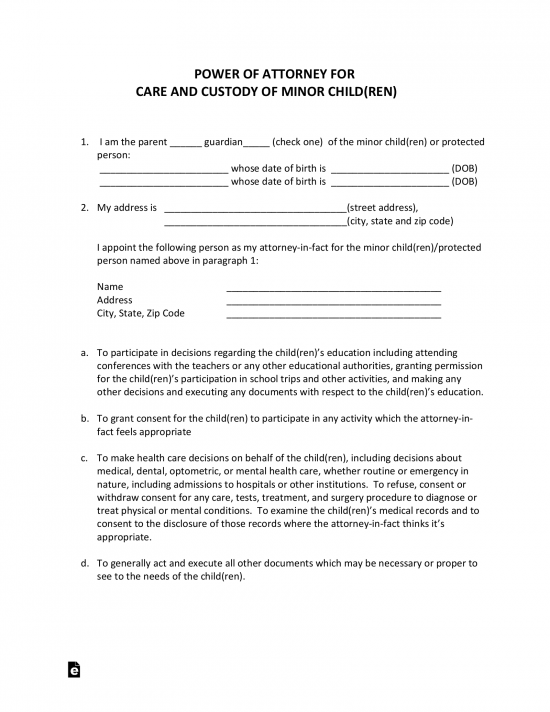

Minor (Child) Power of Attorney – This form is limited to decision-making involving the principal’s minor children. It is generally used when parents are temporarily unavailable. Minor (Child) Power of Attorney – This form is limited to decision-making involving the principal’s minor children. It is generally used when parents are temporarily unavailable.

Download: PDF Signing Requirements: None, but notarization is recommended. |

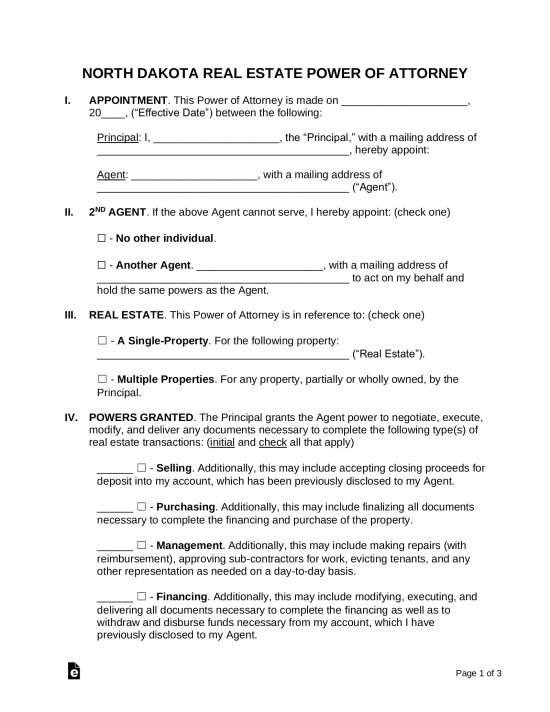

Real Estate Power of Attorney – Used to elect someone to handle all aspects of real property to the benefit of the owner in relation to its sale, purchase of another property, or management. Real Estate Power of Attorney – Used to elect someone to handle all aspects of real property to the benefit of the owner in relation to its sale, purchase of another property, or management.

Download: PDF, MS Word, OpenDocument Signing Requirements: None, but notarization is recommended. |

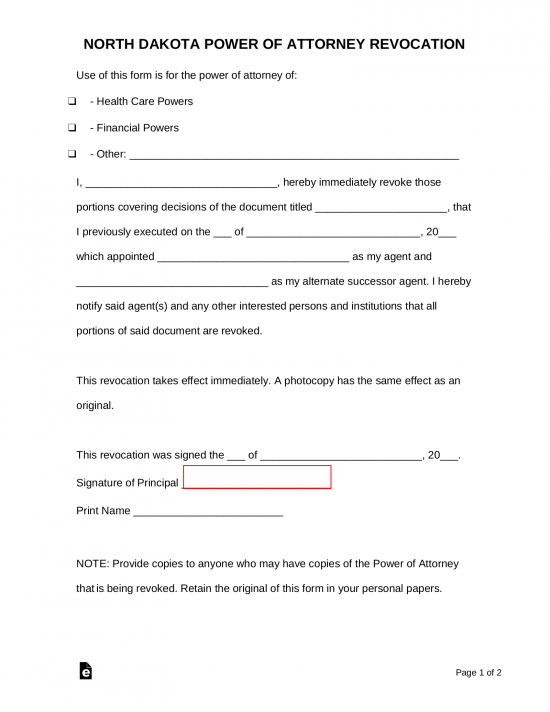

Revocation of Power of Attorney – This is used when an individual wants to cancel or terminate an existing POA. Revocation of Power of Attorney – This is used when an individual wants to cancel or terminate an existing POA.

Download: PDF, MS Word, OpenDocument Signing Requirements: None, but notarization is recommended. |

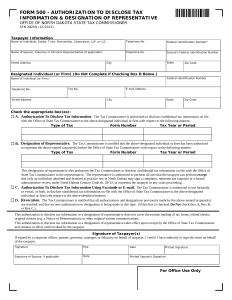

Tax Power of Attorney (Form 500) – This form is used when a person wishes to have a representative handle any tax issues with the Office of the Tax Commissioner. Tax Power of Attorney (Form 500) – This form is used when a person wishes to have a representative handle any tax issues with the Office of the Tax Commissioner.

Download: PDF Signing Requirements: Principal only. |

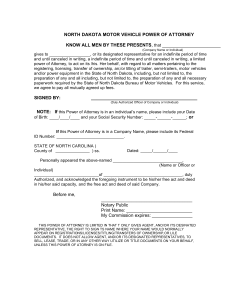

Vehicle Power of Attorney (Form MVD-11020) – This form is used when a person wishes to have an agent or designee handle motor vehicle affairs. Vehicle Power of Attorney (Form MVD-11020) – This form is used when a person wishes to have an agent or designee handle motor vehicle affairs.

Download: PDF Signing Requirements: Notary public. |