Updated June 02, 2022

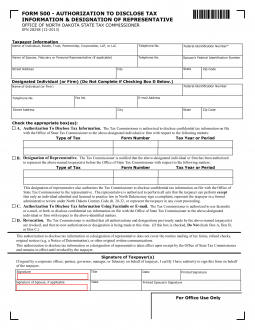

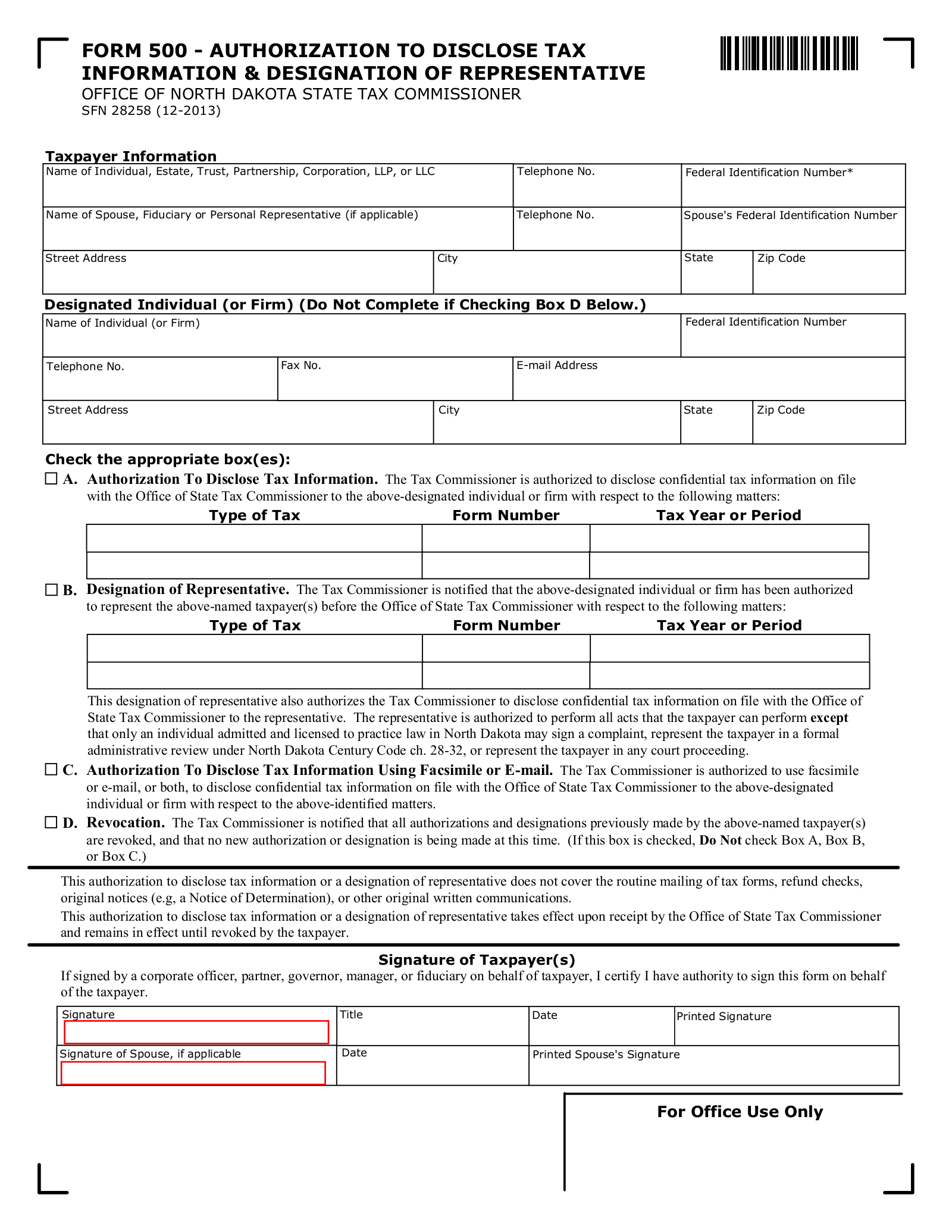

A North Dakota tax power of attorney (Form 500), otherwise known as the “Office of North Dakota State Tax Commissioner Authorization to Disclose Tax Information and Designation of Representative Form,” is used to designate a person as a representative of your interests in tax matters before the concerned tax authority. This person will be authorized to receive your information and make filings for your benefit. In addition to submitting your information through this form, you will need to disclose the agent’s identity, the matters in which he or she will have representational powers with your taxes, along with your preferences on a few other matters. It is suggested that you set aside some time after supplying this information to review it for accuracy before submitting the completed paperwork.

How to Write

1 – Download The Form Supplied On This Page

The document previewed on this page will aid the Principal in delivering his or her Authority to the determined Attorney-in-Fact. Open it using the button beneath the image then download it.

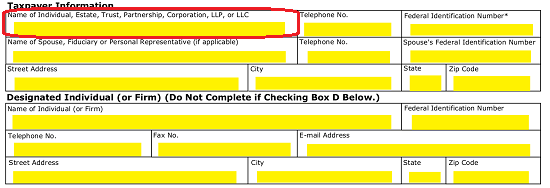

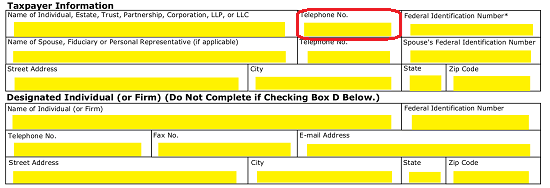

2 – The Taxpayer’s Information Must Be Accurately Supplied In The Requested Manner

The first table presented on this page, “Taxpayer Information,” will provide three boxes on the first row to record the Taxpayer’s Legal Name. This should be supplied in the box with the words “Name Of Individual, Estates, Trust, Partnership, Corporation, LLP, Or LLC”  The next box on the first row, “Telephone No.,” document the current Daytime Telephone Number where the Taxpayer can be contacted when necessary.

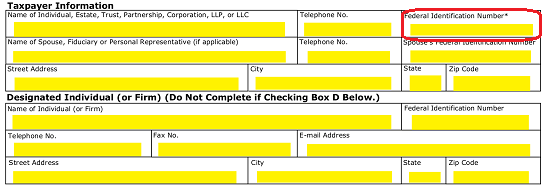

The next box on the first row, “Telephone No.,” document the current Daytime Telephone Number where the Taxpayer can be contacted when necessary. The “Taxpayer Identification Number” box must be satisfied regardless of the type of entity the Taxpayer is. Thus, if this is a Business Entity, enter its Federal Identification Number in this box. If this is an individual, then report his or her Social Security Number in this box.

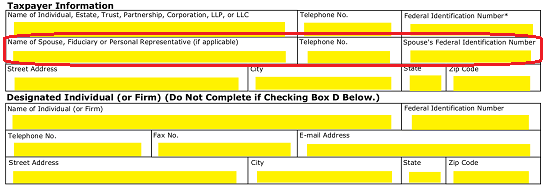

The “Taxpayer Identification Number” box must be satisfied regardless of the type of entity the Taxpayer is. Thus, if this is a Business Entity, enter its Federal Identification Number in this box. If this is an individual, then report his or her Social Security Number in this box. The second row has been supplied in the event another entity is involved with the Taxpayer’s paperwork. For instance, a Spouse that has filed jointly or a Fiduciary. Use the second row to record the Name, Telephone Number, and Federal Identity Number of such an entity.

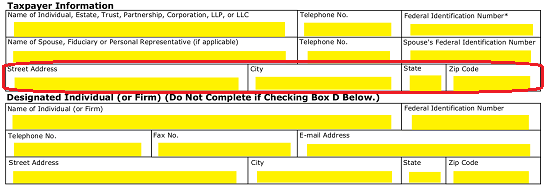

The second row has been supplied in the event another entity is involved with the Taxpayer’s paperwork. For instance, a Spouse that has filed jointly or a Fiduciary. Use the second row to record the Name, Telephone Number, and Federal Identity Number of such an entity. The third row has been supplied so the Taxpayer’s “Street Address,” “City,” “State,” and “Zip Code” can be reported.

The third row has been supplied so the Taxpayer’s “Street Address,” “City,” “State,” and “Zip Code” can be reported.

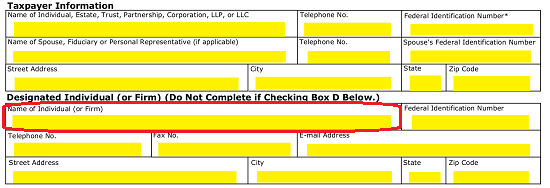

3 – Document The Attorney-in-Fact Representing Principal Interests

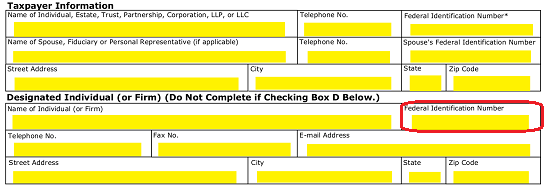

Now that we have documented the Taxpayer Information we will need to discuss the Attorney-in-Fact. Use the first box in the first row to Name the Attorney-in-Fact (under the words “Name of Individual (Or Firm)”) In the second box on the first row, enter the Attorney-in-Fact’s “Federal Identification Number.”

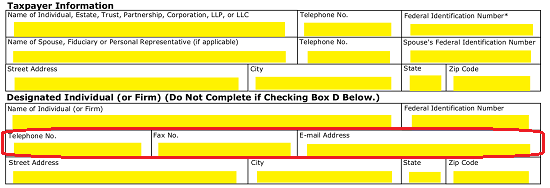

In the second box on the first row, enter the Attorney-in-Fact’s “Federal Identification Number.” The second row in this table will call for the Attorney-in-Fact’s “Telephone No.,” “Fax No.,” and “E-Mail Address” presented in the appropriate areas.

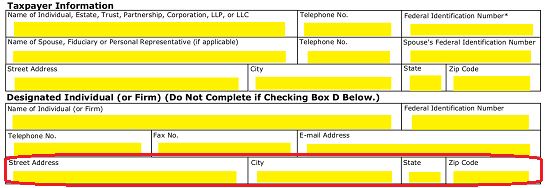

The second row in this table will call for the Attorney-in-Fact’s “Telephone No.,” “Fax No.,” and “E-Mail Address” presented in the appropriate areas. Finally, use the last row to document the Attorney-in-Fact’s “Street Address,” “City,” State,” and “Zip Code.”

Finally, use the last row to document the Attorney-in-Fact’s “Street Address,” “City,” State,” and “Zip Code.”

4 – Approve The Principal Authority Delivered To The Attorney-in-Fact

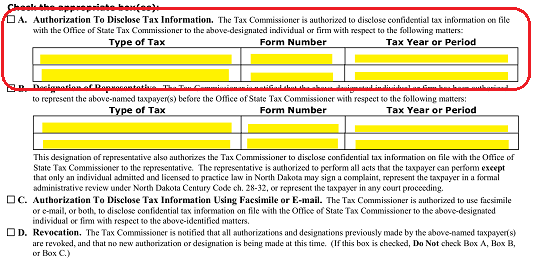

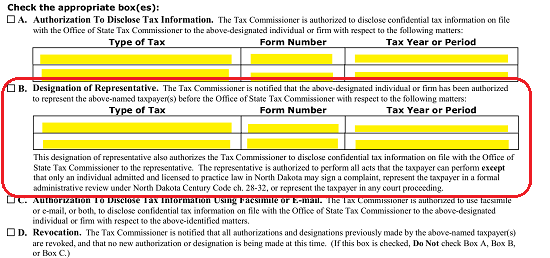

Directly below these tables will be several checkbox statements that must be reviewed and attended to. First, if the Attorney-in-Fact should receive any correspondence on behalf of the Taxpayer from the Tax Commissioner, then mark Checkbox “A. Authorization To Disclose Tax Information.” If so, then use the table in this choice to report the “Type Of Tax,” “Form Number,” and corresponding “Tax Year or Period” (more than one can be named) the Attorney-in-Fact is authorized to receive confidential Tax Information About. To inform the Tax Commissioner that the Attorney-in-Fact has been designated with Principal Powers in Tax Matters, mark Checkbox “B. Designation Of Representative,” then record the each “Type Of Tax” and “Form Number” where the Attorney-in-Fact may wield Principal Power and the corresponding “Tax Year or Period” using the table provided.

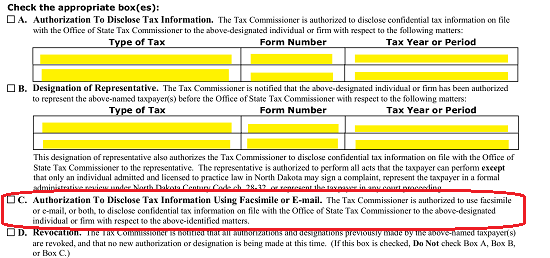

To inform the Tax Commissioner that the Attorney-in-Fact has been designated with Principal Powers in Tax Matters, mark Checkbox “B. Designation Of Representative,” then record the each “Type Of Tax” and “Form Number” where the Attorney-in-Fact may wield Principal Power and the corresponding “Tax Year or Period” using the table provided. If the Tax Commissioner should be authorized to dispense the Taxpayer’s Confidential Information, to the Attorney-in-Fact, via Fax or E-Mail, then mark Checkbox “C. Authorization To Disclose Tax Information Using Facsimile Or E-Mail.”

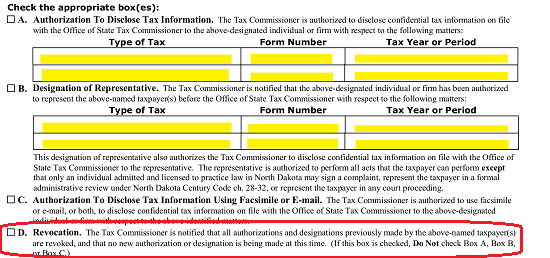

If the Tax Commissioner should be authorized to dispense the Taxpayer’s Confidential Information, to the Attorney-in-Fact, via Fax or E-Mail, then mark Checkbox “C. Authorization To Disclose Tax Information Using Facsimile Or E-Mail.” Mark Checkbox “D. Relocation,” if the only purpose this document has is to act as a Revocation of a previously issued Authority. If so, and no new Attorney-in-Fact is being appointed with Principal Powers here, make sure you have not marked any of the previous checkboxes on this list. Otherwise, if the purpose of this document is to deliver Principal Power to an Attorney-in-Fact, then leave this checkbox blank.

Mark Checkbox “D. Relocation,” if the only purpose this document has is to act as a Revocation of a previously issued Authority. If so, and no new Attorney-in-Fact is being appointed with Principal Powers here, make sure you have not marked any of the previous checkboxes on this list. Otherwise, if the purpose of this document is to deliver Principal Power to an Attorney-in-Fact, then leave this checkbox blank.

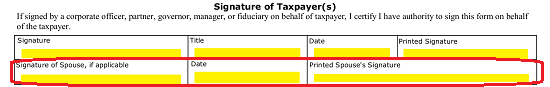

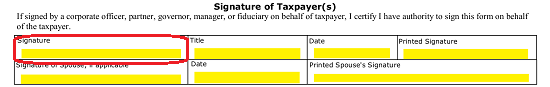

5 – The Taxpayer Must Sign This Form To Execute And Submit It

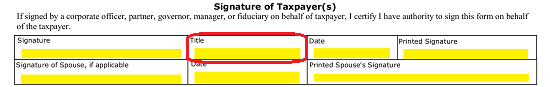

In order for any Tax Entity to give this document the weight the Taxpayer desires, the Taxpayer will need to sign it. This act will serve as a verification of the Taxpayer’s intent. The Taxpayer must find the first box in the “Signature of Taxpayer(s)” table then sign his or her name. If the Taxpayer has a “Title” this should be recorded in the second box.

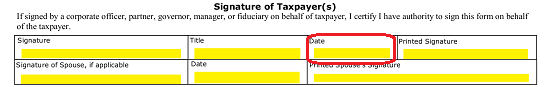

If the Taxpayer has a “Title” this should be recorded in the second box. The third box “Date” will require the Signature Date when the Taxpayer signed this paperwork.

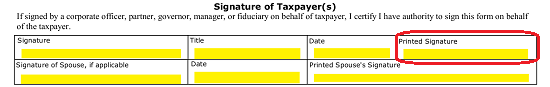

The third box “Date” will require the Signature Date when the Taxpayer signed this paperwork. The box labeled “Printed Signature” must have the Name of the Taxpayer printed in it.

The box labeled “Printed Signature” must have the Name of the Taxpayer printed in it. The second row of this table will call for the “Signature Of Spouse, If Applicable,” the Spouse’s Signature “Date,” and the Printed Name of the Spouse. If this does not apply, it may be left blank.

The second row of this table will call for the “Signature Of Spouse, If Applicable,” the Spouse’s Signature “Date,” and the Printed Name of the Spouse. If this does not apply, it may be left blank.