Updated December 27, 2023

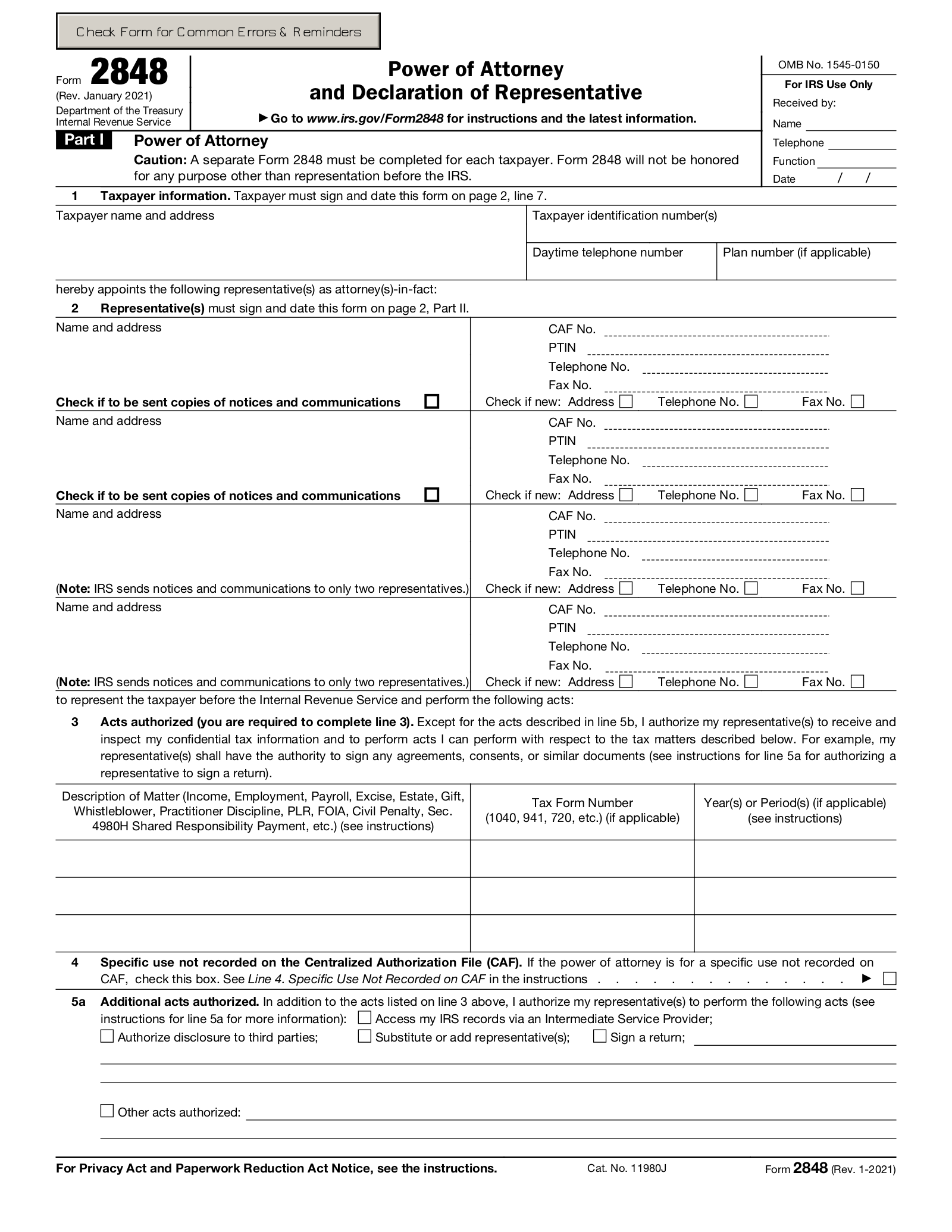

IRS power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. The acts authorized here allow a tax attorney or accountant to represent someone else and to submit taxes to the Internal Revenue Service on the principal’s behalf.

Table of Contents |

Where to File

The completed Power of Attorney and Declaration of Representative Form (IRS form 2848) can be mailed to the appropriate regional IRS office. Three national centers receive paperwork – in Tennessee, Utah, and Pennsylvania. Consult the filing directions on the IRS Website to determine where to send your form.

There are exceptions: if you are granting power of attorney for a single matter instead of giving general authorization for a return year or longer (called a “specific-use power of attorney”), then the authorization form should be mailed to the IRS office that is handling the matter.

Though the IRS records most power-of-attorney cases in their central CAF database, it is a good idea for the appointed representative to carry a copy of the form with them when they are dealing with the IRS.

Faxing

The most common and preferred way to file the form is to fax it. Depending on the filer’s location, there are one of four fax numbers listed on Page 1 of the 2848 Publication Instructions.

What Authority Does This Form Grant?

This form authorizes another person to act as a representative in a specified class of tax matters. The IRS limits who is permitted to fill this role, and the powers that they may be granted.

The pool of potential agents is restricted to those deemed “eligible to practice before the IRS.” This means people with appropriate formal credentials, such as lawyers, tax accountants, actuaries, and other professionals, family members of the primary filer, and those with appropriate tax-preparation training.

Once granted power of attorney, the agent is empowered to act as a stand-in in dealings with the IRS. Form 2848 requires that the authority that is granted is time specific – so the agent will have the power to request and view tax records, prepare and sign agreements, consents, and waivers, and tackle other administrative matters for just the specified year or years. In general, the agent may not endorse or negotiate payments in any form, grant powers of attorney to others, or release confidential records to third parties.

The primary filer has discretion in determining which powers to give to the agent. If necessary, the designated representative may be empowered to designate still others as representatives. And the representative may be granted advanced access to future records up to three years beyond the present filing year. However, form 2848 cannot be used to provide blanket authorization, and the IRS will not honor requests for unlimited access or unbounded powers.

Revocation of IRS Power of Attorney

The agent serves at the discretion of the primary filer. To revoke a power of attorney, the same form 2848 may be re-submitted to the IRS with the word “REVOKE” written across the top. A copy of this document should be saved in case of any subsequent difficulties.

Alternatively, a new document may be drawn up specifying the terms of the original authorization and indicating the powers to be withdrawn. This revocation of powers may be either partial or total.

Address Change of a Representative

An address change is easy. The designated representative should send written notification to the IRS with the updated mailing address and the representative’s signature. It is unnecessary to refile the original form.