Updated August 08, 2023

Minnesota power of attorney forms are documents used to appoint a representative to handle the decision-making and affairs of someone else. The powers are only valid while the person is alive. Power of attorney can be immediately after it is written and signed under the laws of Minnesota. The form must be presented and shown to any third (3rd) party when the agent acts on the principal’s behalf.

By Type (9) |

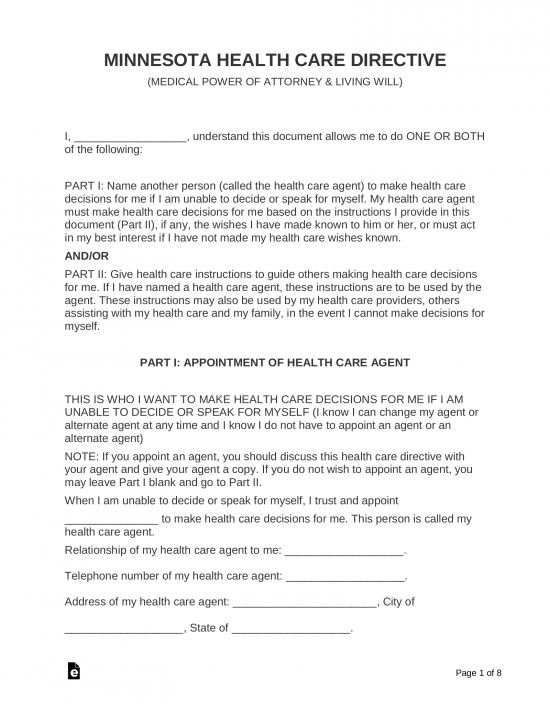

Advance Directive – For any person seeking to have someone else speak on their behalf in case they cannot. For medical decisions only. Advance Directive – For any person seeking to have someone else speak on their behalf in case they cannot. For medical decisions only.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 145C.03): One (1) witness or a notary public. |

Durable (Statutory) Power of Attorney – Allows an agent to act on behalf of a principal for financial purposes only. Remains valid if the principal becomes incapacitated. – Allows an agent to act on behalf of a principal for financial purposes only. Remains valid if the principal becomes incapacitated.

Download: PDF Signing Requirements (§ 523.01): Notary public. |

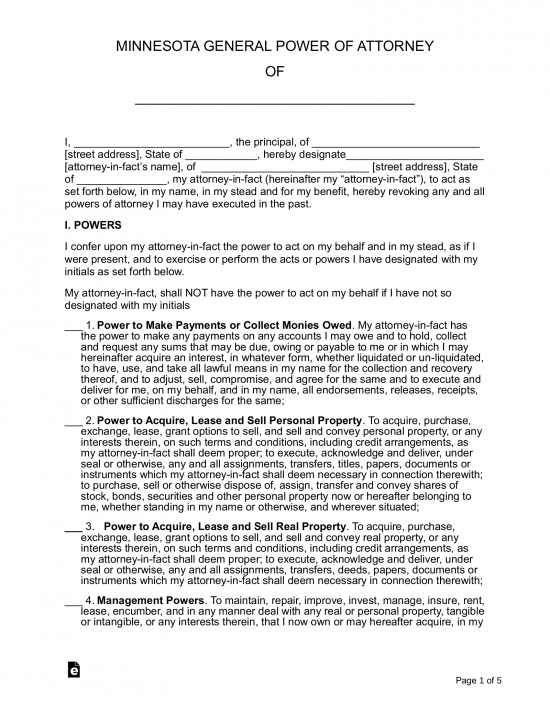

General (Financial) Power of Attorney – Allows an agent to act on a principal’s behalf for financial purposes but becomes invalid if the principal becomes incapacitated. General (Financial) Power of Attorney – Allows an agent to act on a principal’s behalf for financial purposes but becomes invalid if the principal becomes incapacitated.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 523.01): Notary public. |

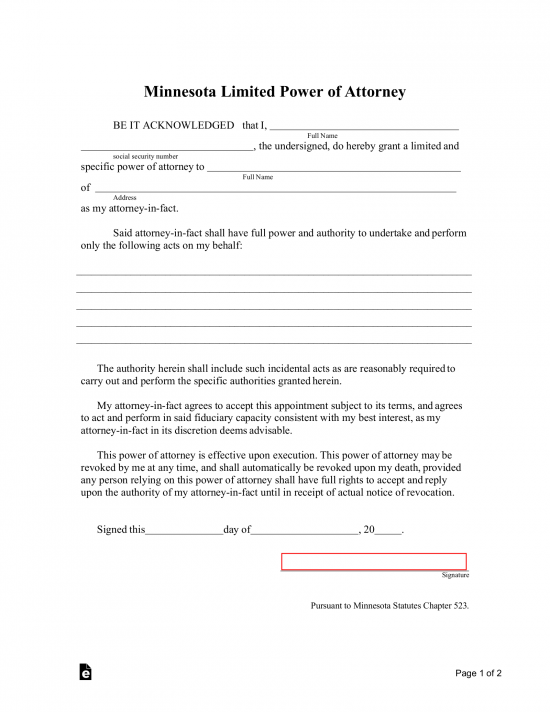

Limited Power of Attorney – This type is used when you have a short-term situation where you need someone to act on your behalf for a specific transaction. Limited Power of Attorney – This type is used when you have a short-term situation where you need someone to act on your behalf for a specific transaction.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 523.01): Notary public. |

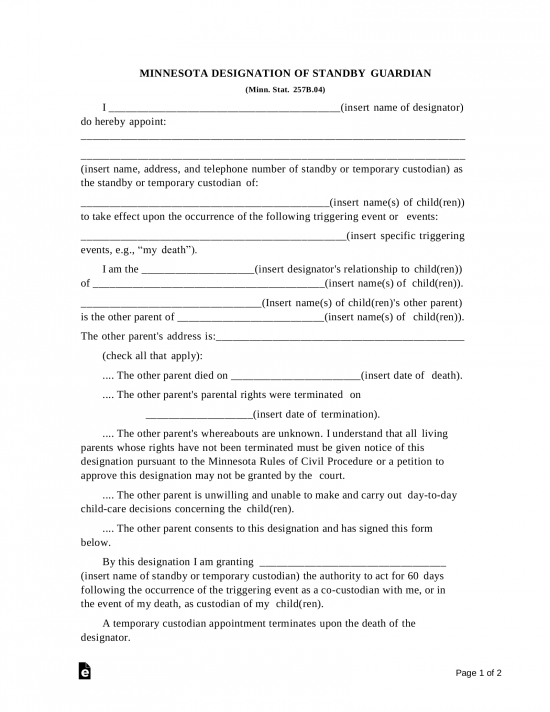

Minor (Child) Power of Attorney – In the event that you anticipate being away from your children and want to make sure the caretaker is able to act on their behalf while you are away, this form could come in handy. Minor (Child) Power of Attorney – In the event that you anticipate being away from your children and want to make sure the caretaker is able to act on their behalf while you are away, this form could come in handy.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 257B.04): Two (2) witnesses. |

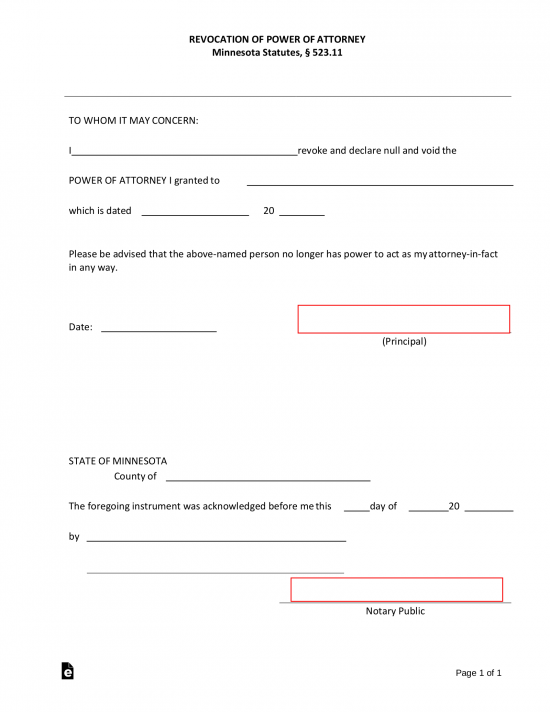

Revocation of Power of Attorney – Sometimes it becomes necessary to terminate a POA. It is important that you let all interested parties know in writing. That is where this form is helpful. Revocation of Power of Attorney – Sometimes it becomes necessary to terminate a POA. It is important that you let all interested parties know in writing. That is where this form is helpful.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 523.11): Notary public. |

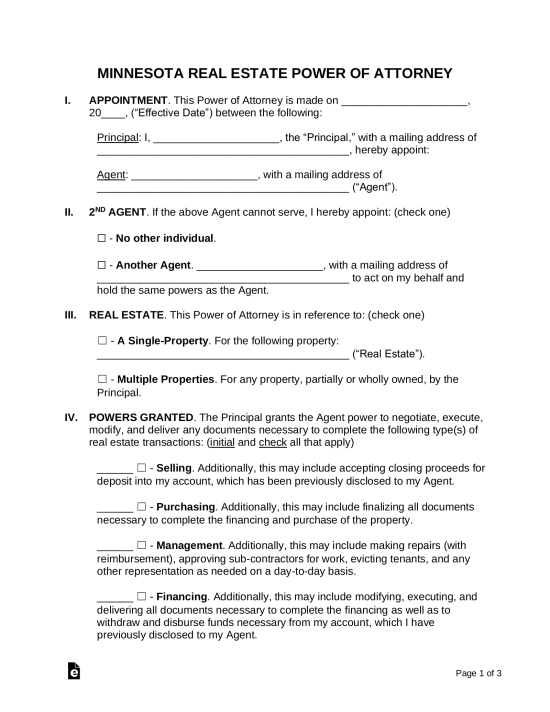

Real Estate Power of Attorney – When an owner decides to allow someone else to handle the management, sale, or purchase of real property. Real Estate Power of Attorney – When an owner decides to allow someone else to handle the management, sale, or purchase of real property.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 523.01): Notary public. |

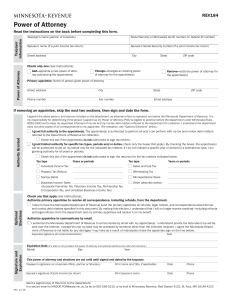

Tax Power of Attorney (Form REV184) – Sometimes it’s helpful to allow your accountant to access your tax records and make filings on your behalf. In those situations, it is important to have this type of POA in place. Tax Power of Attorney (Form REV184) – Sometimes it’s helpful to allow your accountant to access your tax records and make filings on your behalf. In those situations, it is important to have this type of POA in place.

Download: PDF Signing Requirements: Principal only. |

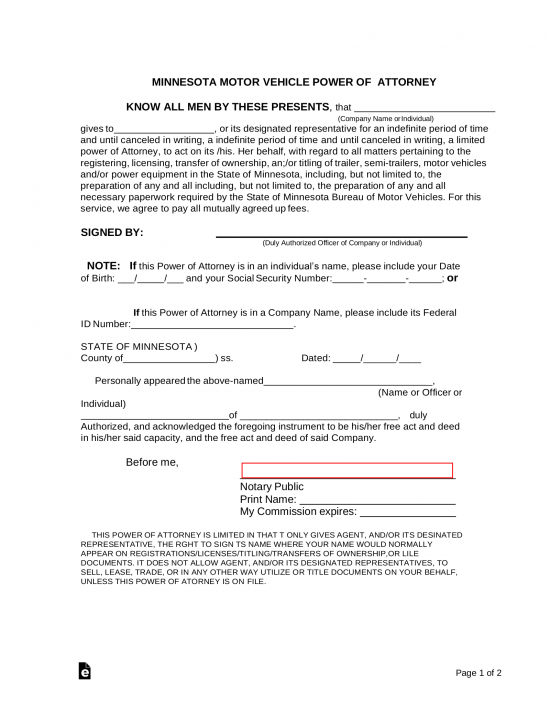

Vehicle Power of Attorney – When you want help in registering your new vehicle or obtaining a new title, you can appoint an agent to represent you with the Minnesota Department of Public Safety, Driver and Vehicle Services. Vehicle Power of Attorney – When you want help in registering your new vehicle or obtaining a new title, you can appoint an agent to represent you with the Minnesota Department of Public Safety, Driver and Vehicle Services.

Download: PDF, MS Word, OpenDocument Signing Requirements: Notary public. |