Updated August 09, 2023

New Jersey power of attorney forms are documents people can use to grant authority to another individual to handle affairs related to financial, medical, and other personal matters on their behalf. The person giving power (“principal”) will have the choice of handing over limited or unrestricted power to the other person (“agent”). In addition, the principal may also elect to have the form be “durable”.

By Type (8) |

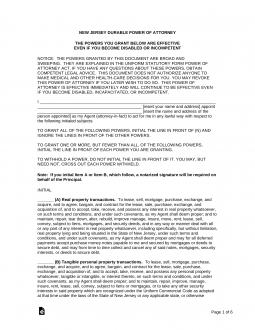

Durable (Financial) Power of Attorney – Conveys general powers over one’s property and assets to another. It will stay in effect even if the person creating it can no longer make his or her own decisions. Durable (Financial) Power of Attorney – Conveys general powers over one’s property and assets to another. It will stay in effect even if the person creating it can no longer make his or her own decisions.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 46:2B-8.9): Notary public. |

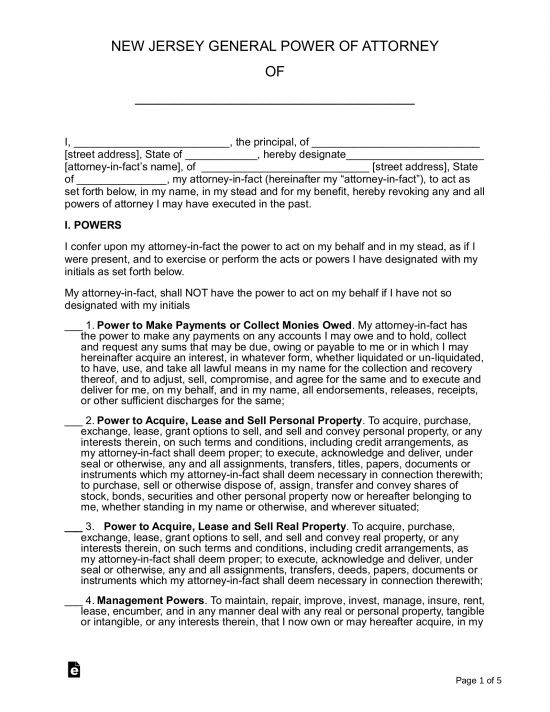

General (Financial) Power of Attorney – Just like the durable form in that it conveys certain powers over property and assets, but instead of staying in effect upon the principal’s incapacity, it becomes void, upon incapacity. General (Financial) Power of Attorney – Just like the durable form in that it conveys certain powers over property and assets, but instead of staying in effect upon the principal’s incapacity, it becomes void, upon incapacity.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 46:2B-8.9): Notary public. |

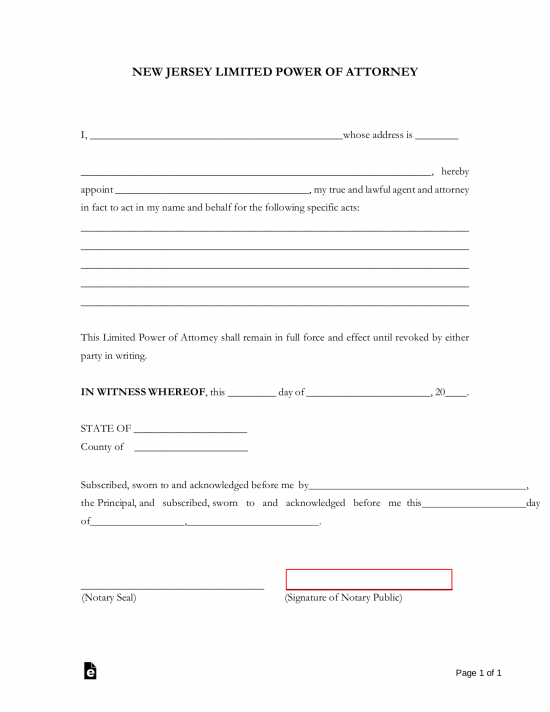

Limited Power of Attorney – Use for specifically defined transactions or time periods. It is only in effect for the intended transaction and is void thereafter. Limited Power of Attorney – Use for specifically defined transactions or time periods. It is only in effect for the intended transaction and is void thereafter.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 46:2B-8.9): Notary public. |

Medical Power of Attorney – Allows a person to appoint someone to act on their behalf with regard to health care decisions. Medical Power of Attorney – Allows a person to appoint someone to act on their behalf with regard to health care decisions.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 26:2H-56): Notary public or two (2) witnesses. |

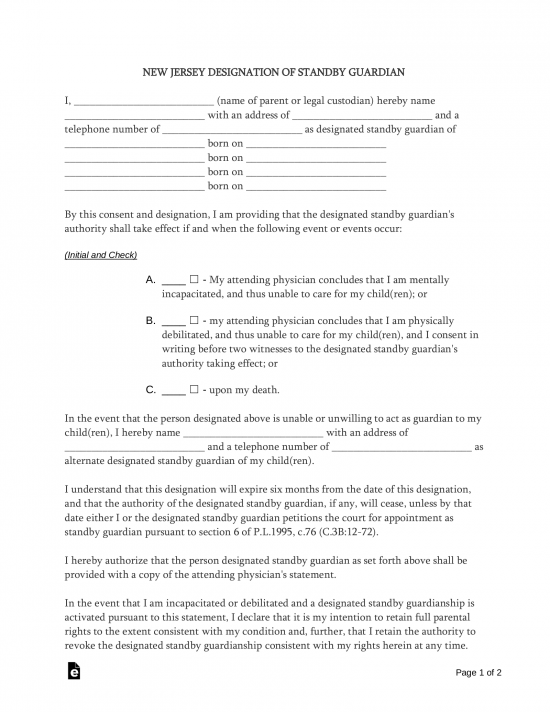

Minor (Child) Power of Attorney – This allows you to give authority to another to take care of your children in the event of your absence. Minor (Child) Power of Attorney – This allows you to give authority to another to take care of your children in the event of your absence.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 3B:12-74): Two (2) witnesses. |

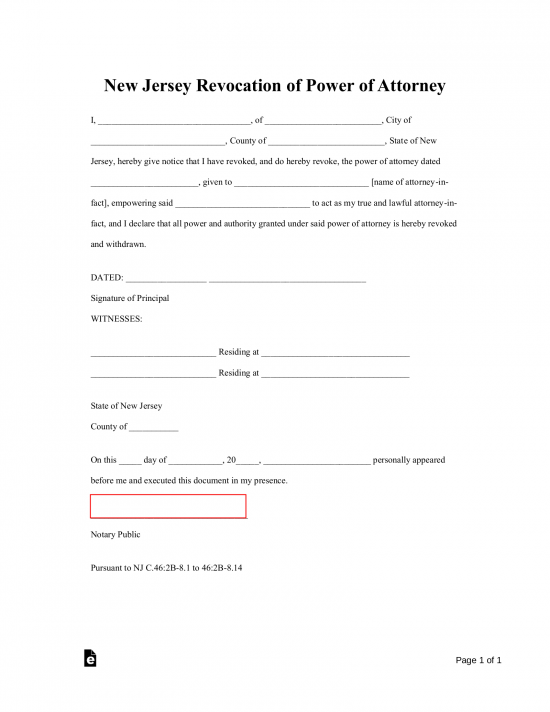

Revocation of Power of Attorney – Use to revoke a POA. It is important that this executed form is provided to the agent and any others relying on the POA so that they receive notice of its revocation. Revocation of Power of Attorney – Use to revoke a POA. It is important that this executed form is provided to the agent and any others relying on the POA so that they receive notice of its revocation.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 46:2B-8.10): Notary public. |

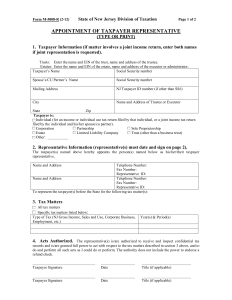

Tax Power of Attorney (Form M-5008-R) – Use to give authority to another, usually a tax professional, to represent your interests in front of the tax authorities. Tax Power of Attorney (Form M-5008-R) – Use to give authority to another, usually a tax professional, to represent your interests in front of the tax authorities.

Download: PDF Signing Requirements: Principal and their representative. |

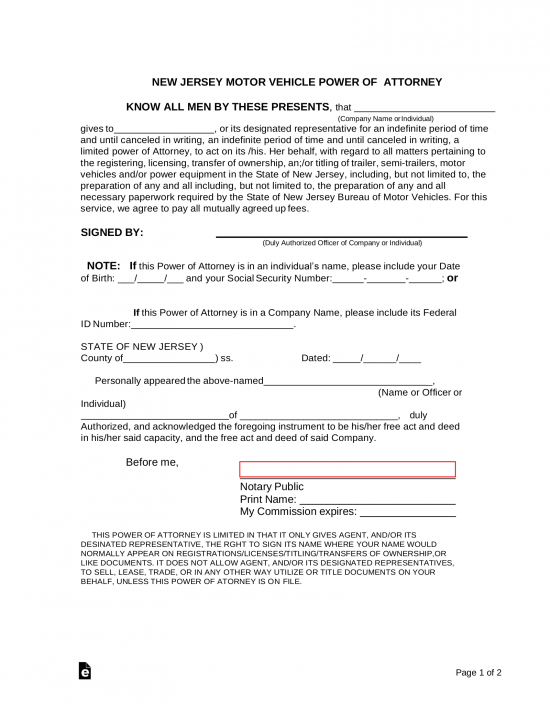

Vehicle Power of Attorney – Use to give authority to another to represent your motor vehicle interests with the motor vehicle commission. Vehicle Power of Attorney – Use to give authority to another to represent your motor vehicle interests with the motor vehicle commission.

Download: PDF, MS Word, OpenDocument Signing Requirements: Notary public. |