Updated June 02, 2022

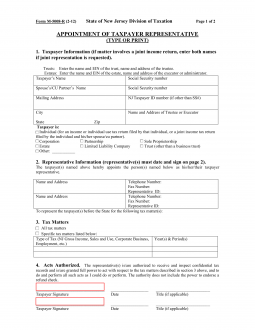

A New Jersey tax power of Attorney (Form M-5008-R), otherwise known as the Division of Taxation Appointment of Taxpayer Representative, may be used to designate a tax professional or another trusted person to handle tax matters with the Division of Taxation. This document enables such an entity to act as your representative to obtain your tax filings, make filings and discuss your situations with the tax authorities. The principal delivering such power will be able to impose his or her limitations at-will whenever necessary.

Generally, previously issued power documents concerning any of the subject matters (or years) where the agent is assigned principal authority will automatically be terminated by this document’s execution. In such cases, it would be considered wise to make sure such an Agent is aware of his or her termination through a written revocation. If the principal chooses to, he or she may also keep previously issued power appointments in place so long as this intent is documented here on this form before its execution.

How to Write

1 – Open The Taxpayer Appointment Form

The Tax Appointment Form required should be accessed from this page by clicking on the button under the first-page preview image of this form.

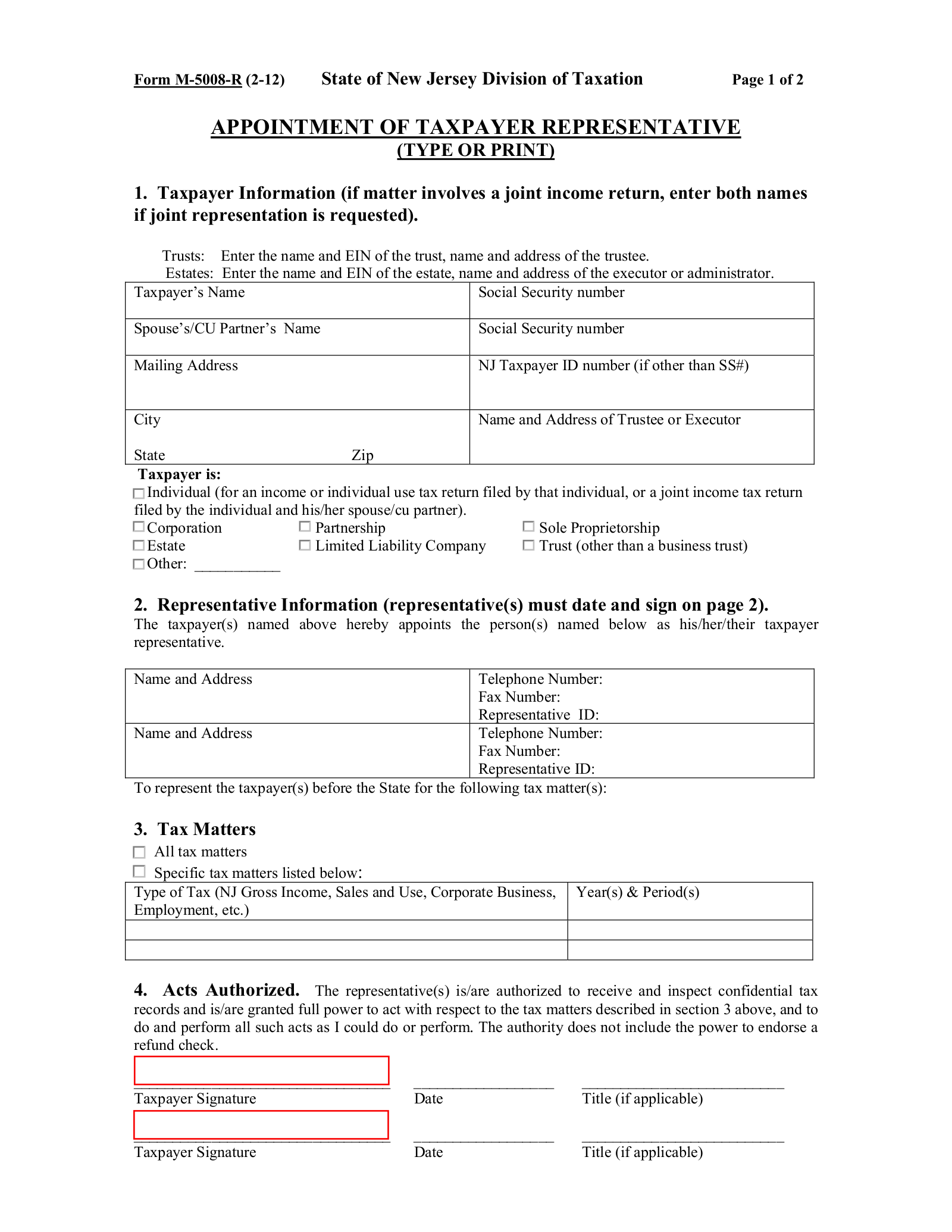

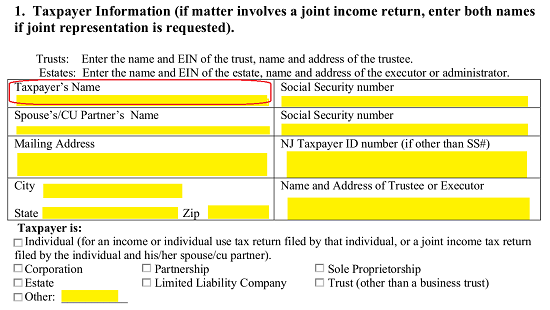

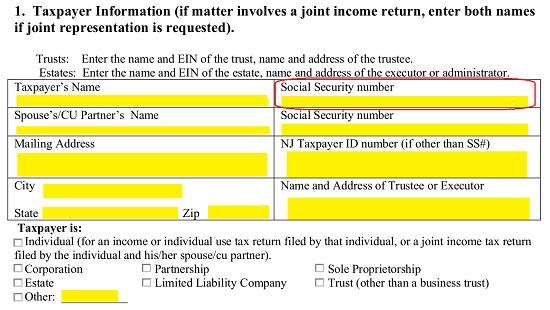

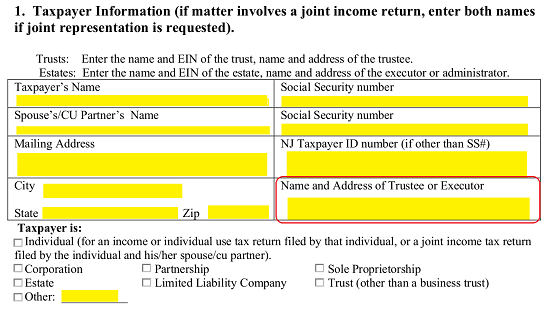

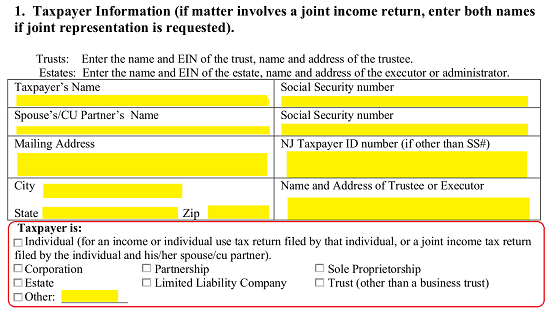

2 – The Taxpayer Identity Should Be Established In The First Section

The Principal Taxpayer’s Legal Name must be entered in the first box in section one.  Use the box next to this, labeled “Social Security Number” to enter the Taxpayer’s Social Security Number.

Use the box next to this, labeled “Social Security Number” to enter the Taxpayer’s Social Security Number.

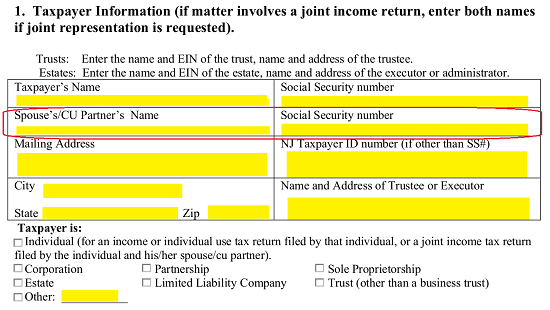

If the Taxpaying Principal has filed jointly with his or her Spouse or CU Partner, there will be two boxes on the next line for this party’s Name and Social Security Number to be reported as well.

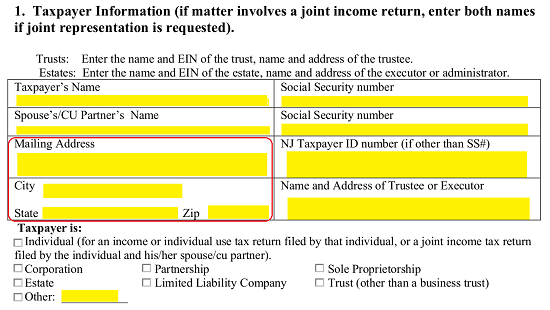

Use the boxes labeled “Mailing Address” and “City State Zip” to document the Principal Taxpayer’s Mailing Address, City, State, and Zip Code. Make sure this contact information is up to date.

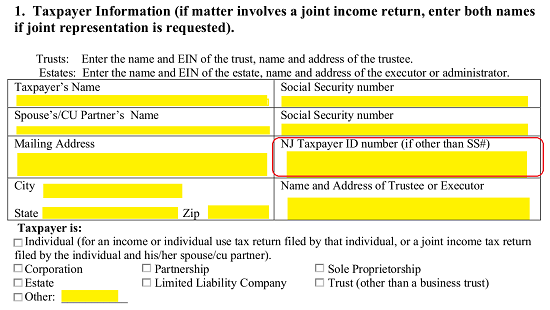

In the next column, record the Principal Taxpayer’s ID Number in the box labeled “NJ Taxpayer ID Number.” Generally, the Principal’s Social Security is identical to his or her NJ Taxpayer ID Number, however if the Principal Taxpayer has a separate NJ Taxpayer ID Number, it should be reported.

If the Principal Taxpayer has a Trustee Or Executor, report such a party’s Name in the box labeled “Name And Address Of Trustee Or Executor.”

The area directly below the Principal Taxpayer table will present a list of Entity Types, each with a check box: Individual, Corporation, Partnership, Limited Liability Company, Sole Proprietorship, Trust, and Other. Only one of these check boxes should be marked. After the word “Other,” define what the Principal Taxpayer’s Legal Status Type is.

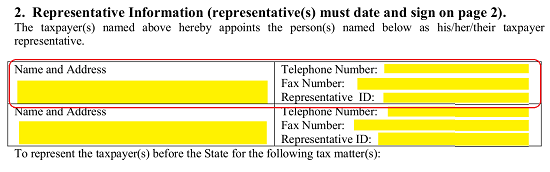

3 – Each Individual Being Named With Principal Power Must Be Identified

In the next section, Section 2, we will need to fully identify the Representative Attorney-in-Fact being named with Principal Authority. If there is more than one, each one must be reported. If there is not enough room you may continue this report on a separate document then attach that document to this form before its execution. In the first box, “Name And Address,” document the Legal Name and Legal Address of the Representative Attorney-in-Fact. The box adjacent to this will call for the Representative Attorney-in-Fact’s “Telephone Number,” “Fax Number,” and “Representative ID” number documented.

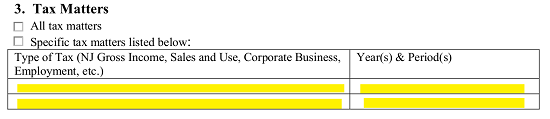

4 – The Principal Taxpayer Powers Being Granted Must Be Detailed

In Section 3 we will define what Tax Matters the Representative Attorney-in-Fact will carry Principal Power in. If the Representative Attorney-in-Fact will have Principal Power in all Matters, then mark the check box labeled “All Tax Matters.” If, however, the Representative Attorney-in-Fact will only carry Principal Power in some areas, then mark the second box. There will be a table below this where you may specify which Tax Matters and what Years the Representative Taxpayer will hold Principal Authority in if you have marked the second box.

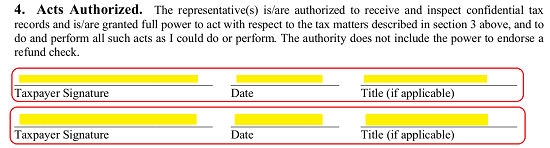

If the Principal Taxpayer intends for the Representative Attorney-in-Fact to have full access to the records pertaining to the Tax Matters in section 4 and utilize Principal Power to make Decisions and Take Action in the Tax Matters defined, then each Principal Taxpayer should Sign and Date Section 4. If the Signature Party holds a Title in his or her Name then it should be reported.

By default, the first Representative Attorney-in-Fact listed above will be authorized to receive copies of correspondence (regarding the Tax Matters defined) addressed to the Principal Tax Payer. If the Principal Taxpayer does not wish this, then mark the first check box in Section 5. If the Principal Taxpayer wishes both Representatives to receive copies of such correspondence, then mark the second check box in Section 5.

5 – If A Previous Principal Power Is In Effect Define Its Status

Locate the check box in Section 6. If there have been previous Powers of Attorney issued for some or all of the Tax Matters defined here, it will be automatically revoked at the Principal Signing. If the Principal Taxpayer needs any such previous Powers to remain in effect then mark this check box and attach a copy of the Power Document to remain in effect. Otherwise, leave this check box unmarked.

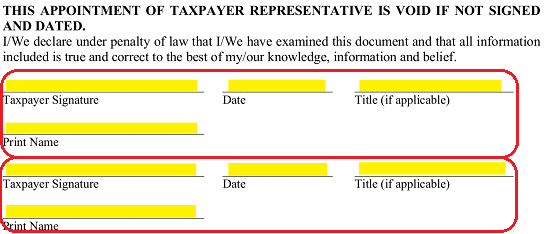

6 – The Principal Taxpayer and Representative Attorney-in-Fact Must Sign This Document To Execute It

Section 7, “Signature Of Taxpayer(s),” will provide a blank line for the “Taxpayer Signature,” “Date” of his or her Signature,” Taxpayer’s “Title,” and Taxpayer’s Printed Name to be supplied by the Principal Taxpayer. Each Principal Taxpayer should satisfy these requirements, there will be enough room for two Taxpayers to sign this area.

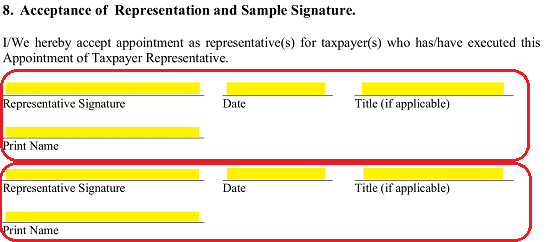

The next area requiring attention, Section 8 “Acceptance Of Representation And Sample Signature,” will provide enough room for two Representative Attorneys-in-Fact to sign the “Representative Signature” line, report the Date of Signature, provide any Title he or she holds, and Print his or her Name.