Updated March 16, 2024

A uniform power of attorney act (UPOAA) statutory form is adopted by 32 States to use the same form allowing an individual (principal) to transfer financial responsibilities to someone else (agent) while they are alive. Otherwise known as a durable power of attorney, it must be notarized by the principal to go into effect.

Uniform Power of Attorney Act (UPOAA)

The Uniform Power of Attorney Act (UPOAA) was created by the National Conference of Commissioners on Uniform State Laws (ULC) and has been adopted by 32 States since 2007.[1]

Definition of “Durable”

Durable,” with respect to a power of attorney, means not terminated by the

principal’s incapacity.[2]

Financial Powers Granted

The principal may grant the following standard financial powers:[3]

- Real property – The buying, selling, and leasing of real estate;

- Tangible Personal Property – The selling or leasing of personal items;

- Stocks and Bonds – Selling shares of stock or bonds;

- Commodities and Options – Making transfers of financial items or derivatives;

- Banks and Other Financial Institutions – To have complete control over bank accounts, personal or business;

- Operation of Entity or Business – To make any decision for a business or entity;

- Insurance and Annuities – The option to cancel, upgrade, or redeem insurance or an annuity;

- Estates, Trusts, or Other Beneficial Interests – To control the language of an estate, trust, or other entity that transfers to the principal’s beneficiaries after death;

- Claims and Litigation – To decide on any current claims or outstanding litigation matters;

- Personal and Family Maintenance – Deciding and budgeting the amount of money to pay for the principal and any family members being supported;

- Benefits from Governmental Programs or Civil or Military Service – To make claims for any government benefit or subsidy;

- Retirement Plans – To amend any retirement plan.;

- Taxes – To file or amend taxes.

Signing on Behalf of the Principal

The agent is required to sign for the principal in the following format:[4]

(Principal’s Name) by (Your Signature) as Agent

Sample Signature

Agent’s Duties

The agent must act in the following manner:[6]

- To principal’s expectations while performing in their best interest;

- In good faith;

- Only with the scope of authority within the power of attorney.

- To act without a conflict of interest to be able to make decisions on behalf of the principal’s best interest;

- To keep records of all receipts, disbursements, and transactions made on behalf of the principal;

- To cooperate with any agent that has the power to make health care decisions for the principal; and;

- In preserving the principal’s estate plan to the extent known by the agent, such as:

- Maintaining the value of the principal’s property;

- Upkeeping with the principal’s obligations for maintenance;

- Minimizing their tax liability, including income, estate, inheritance, generation-skipping transfer, and gift taxes; and

- Eligibility for any benefits under a statute or regulation.

Agent’s Liability

The agent has liability in regard to:[7]

- Restoring the value of the principal’s property to the extent of what it would have been if the violation had not occurred; and

- Reimburse the principal or their successors in interest for the attorney’s fees and other costs related to obtaining a judgment against the agent.

Revocation

The agent’s duties can be terminated in any of the following ways:[8]

- Death of the principal;

- A revocation form authorized by the principal;

- The occurrence of a termination event;

- The purpose of the power of to be accomplished or completed;

- If married and the spouse is the agent, and a court action is filed to end the marriage unless specific language exists in the power of attorney allowing such legal action without terminating the document.

UPOAA States

The following 32 States have adopted the Uniform Power of Attorney Act:

| State | Year Enacted | Bill |

| Alabama | 2011 | SB 53 |

| Arkansas | 2011 | SB 887 |

| Colorado | 2009 | HB 09-1198 |

| Colorado | 2009 | HB 09-1198 |

| Connecticut | 2015 | Public Act No. 15-240 |

| District of Columbia | 2023 | B24-0121 |

| Georgia | 2018 | HB 897 |

| Hawaii | 2014 | SB 2229 |

| Idaho | 2008 | SB 1335 |

| Iowa | 2014 | SF 2168 |

| Kentucky | 2020 | HB 124 |

| Maine | 2009 | LD 1404 |

| Maryland | 2010 | SB 309 |

| Michigan | 2024 | HB 4644 |

| Montana | 2011 | HB 374 |

| Nebraska | 2012 | LB 1113 |

| Nevada | 2009 | SB 314 |

| New Hampshire | 2017 | SB 230 FN |

| New Mexico | 2007 | HB 231 |

| North Carolina | 2017 | SB 560 |

| Ohio | 2012 | SB 117 |

| Pennsylvania | 2014 | HB 1429 |

| South Carolina | 2016 | SB 778 |

| South Dakota | 2020 | SB 148 |

| Texas | 2017 | HB 1974 |

| Utah | 2016 | HB 74 |

| Vermont | 2023 | H. 227 (Act 60) |

| Virginia | 2010 | HB 719 |

| Washington | 2016 | SB 5635 |

| West Virginia | 2012 | HB 4390 |

| Wisconsin | 2010 | AB 704 |

| Wyoming | 2017 | SB 105 |

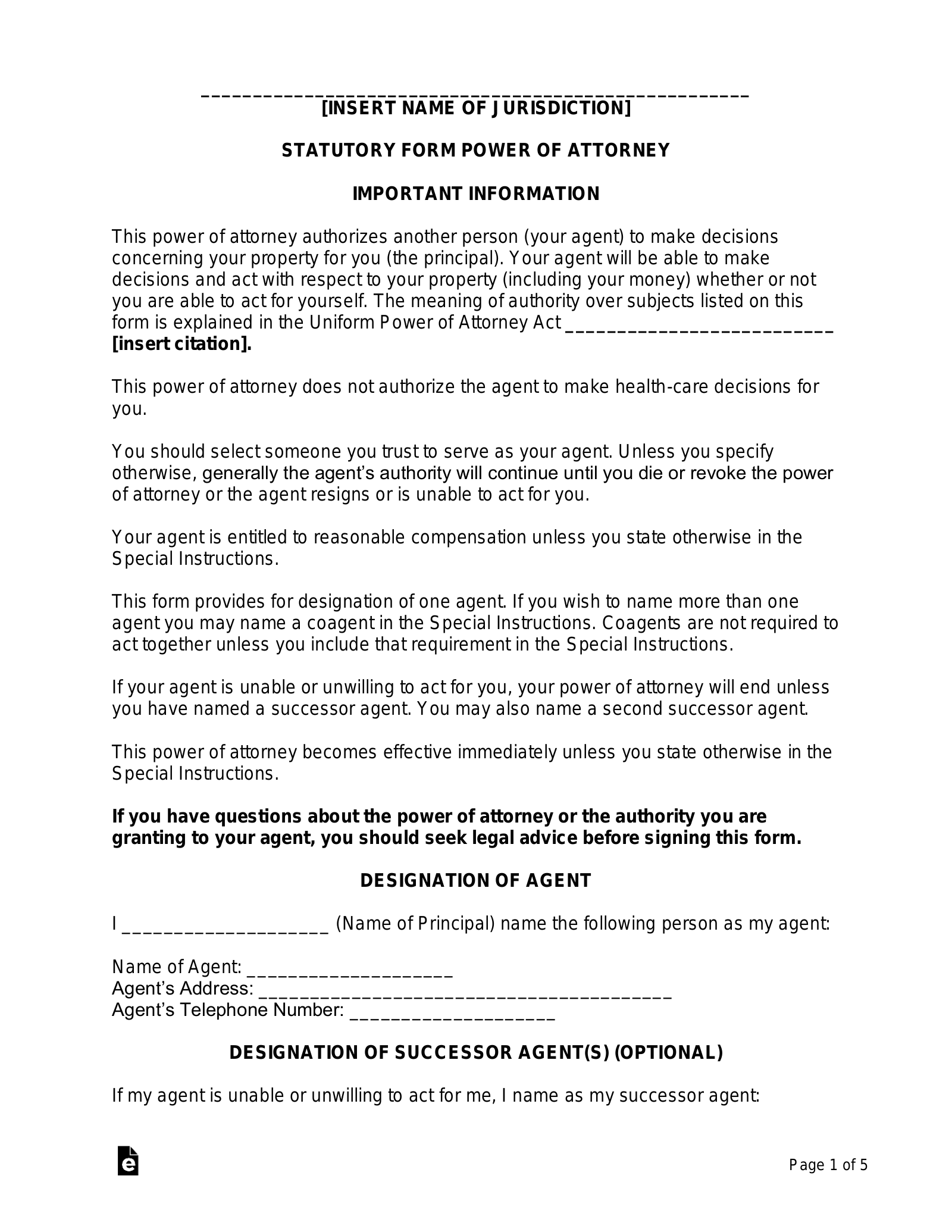

Sample

Download:[9] PDF, MS Word, ODT

DURABLE POWER OF ATTORNEY FORM

IMPORTANT INFORMATION

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself. The meaning of authority over subjects listed on this form is explained in the Uniform Power of Attorney Act.

This power of attorney does not authorize the agent to make health-care decisions for you.

You should select someone you trust to serve as your agent. Unless you specify otherwise, generally the agent’s authority will continue until you die or revoke the power of attorney, or the agent resigns or is unable to act for you.

Your agent is entitled to reasonable compensation unless you state otherwise in the Special Instructions.

This form provides for designation of one agent. If you wish to name more than one agent, you may name a coagent in the Special Instructions. Coagents are not required to act together unless you include that requirement in the Special Instructions.

If your agent is unable or unwilling to act for you, your power of attorney will end unless you have named a successor agent. You may also name a second successor agent.

This power of attorney becomes effective immediately unless your state otherwise in the Special Instructions.

If you have questions about the power of attorney or the authority you are granting to your agent, you should seek legal advice before signing this form.

1. DESIGNATION OF AGENT

I, [PRINCIPAL’S NAME], name the following person as my agent:

- Name of Agent: [AGENT’S NAME]

- Agent’s Address: [AGENT’S ADDRESS]

- Agent’s Phone: [AGENT’S PHONE]

2. DESIGNATION OF SUCCESSOR AGENT(S) (OPTIONAL)

If my agent is unable or unwilling to act for me, I name as my successor agent:

- Name of Successor Agent: [SUCCESSOR AGENT’S NAME]

- Successor Agent’s Address: [SUCCESSOR AGENT’S ADDRESS]

- Successor Agent’s Phone: [SUCCESSOR AGENT’S PHONE]

If my successor agent is unable or unwilling to act for me, I name as my second successor agent:

- Name of 2nd Successor Agent: [2ND SUCCESSOR AGENT’S NAME]

- 2nd Successor Agent’s Address: [2ND SUCCESSOR AGENT’S ADDRESS]

- 2nd Successor Agent’s Phone: [2ND SUCCESSOR AGENT’S PHONE]

3. GRANT OF GENERAL AUTHORITY

I grant my agent and any successor agent general authority to act for me with respect to the following subjects as defined in the Uniform Power of Attorney Act.

(INITIAL each subject you want to include in the agent’s general authority. If you wish to grant general authority over all of the subjects you may initial “All Preceding Subjects” instead of initialing each subject.)

______ – Real Property

______ – Tangible Personal Property

______ – Stocks and Bonds

______ – Commodities and Options

______ – Banks and Other Financial Institutions

______ – Operation of Entity or Business

______ – Insurance and Annuities

______ – Estate, Trusts, and Other Beneficial Interests

______ – Claims and Litigation

______ – Personal and Family Maintenance

______ – Benefits from Governmental Programs or Civil or Military Service

______ – Retirement Plans

______ – Taxes

______ – All Preceding Subjects

4. GRANT OF SPECIFIC AUTHORITY (OPTIONAL)

My agent MAY NOT do any of the following specific acts for me UNLESS I have INITIALED the specific authority listed below:

(CAUTION: Granting any of the following will give your agent the authority to take actions that could significantly reduce your property or change how your property is distributed at your death. INITIAL ONLY the specific authority you WANT to give your agent.)

______ – Create, amend, revoke, or terminate an inter vivos trust.

______ – Make a gift, subject to the limitations of the Uniform Power of Attorney Act and any special instructions in this power of attorney.

______ – Create or change rights of survivorship.

______ – Create or change a beneficiary designation.

______ – Authorize another person to exercise the authority granted under this power of attorney.

______ – Waive the principal’s right to be a beneficiary of a joint and survivor annuity, including a survivor benefit under a retirement plan.

______ – Exercise fiduciary powers that the principal has authority to delegate.

______ – Access the content of electronic communications.

______ – Disclaim or refuse an interest in property, including a power of appointment.

5. LIMITATION ON AGENT’S AUTHORITY

An agent that is not my ancestor, spouse, or descendant MAY NOT use my property to benefit the agent or a person to whom the agent owes an obligation of support unless I have included that authority in the Special Instructions.

6. SPECIAL INSTRUCTIONS

You may give special instructions on the following lines: [ENTER SPECIAL INSTRUCTIONS]

7. EFFECTIVE DATE

This power of attorney is effective immediately unless I have stated otherwise in the Special Instructions.

8. NOMINATION OF [CONSERVATOR OR GUARDIAN] (OPTIONAL)

If it becomes necessary for a court to appoint a conservator or guardian of my estate or guardian of my person, I nominate the following person(s) for appointment:

Nominee for Conservator or Guardian of my Estate

- Name: [CONSERVATOR/GUARDIAN NAME]

- Address: [CONSERVATOR/GUARDIAN ADDRESS]

- Phone: [CONSERVATOR/GUARDIAN PHONE]

Guardian of my Person

- Name: [GUARDIAN NAME]

- Address: [GUARDIAN ADDRESS]

- Phone: [GUARDIAN PHONE]

9. RELIANCE ON THIS POWER OF ATTORNEY

Any person, including my agent, may rely upon the validity of this power of attorney or a copy of it unless that person knows it has terminated or is invalid.

10. SIGNATURE AND ACKNOWLEDGMENT

Principal’s Signature: __________________________ Date: _____________

Print Name: __________________________

Address: _______________________________________

Phone: __________________________

NOTARY ACKNOWLEDGMENT

State of __________________________

County of __________________________

This document was acknowledged before me on __________________________, 20____, by the principal of this document known as __________________________.

Notary Signature __________________________

Commission Expires on __________________________, 20____

This document was prepared by:

Print Name: __________________________

Address: _______________________________________

Phone: __________________________

IMPORTANT INFORMATION FOR AGENT

Agent’s Duties

When you accept the authority under this power of attorney, a special legal relationship is created between you and the principal. This relationship imposes upon you legal duties that continue until you resign or the power of attorney is terminated or revoked.

You must:

- Do what you know the principal reasonably expects you to do with the principal’s property or, if you do not know the principal’s expectations, act in the principal’s best interest;

- Act in good faith;

- Do nothing beyond the authority granted in this power of attorney; and

- Disclose your identity as an agent whenever you act for the principal by writing or printing the name of the principal and signing your own name as “agent” in the following manner:

(Principal’s Name) by (Your Signature) as Agent

Unless the Special Instructions in this power of attorney state otherwise, you must also:

- Act loyally for the principal’s benefit;

- Avoid conflicts that would impair your ability to act in the principal’s best interest;

- Act with care, competence, and diligence;

- Keep a record of all receipts, disbursements, and transactions made on behalf of the principal;

- Cooperate with any person that has authority to make health-care decisions for the principal to do what you know the principal reasonably expects or, if you do not know the principal’s expectations, to act in the principal’s best interest; and

- Attempt to preserve the principal’s estate plan if you know the plan and preserving the plan is consistent with the principal’s best interest.

Termination of Agent’s Authority

You must stop acting on behalf of the principal if you learn of any event that terminates this power of attorney or your authority under this power of attorney. Events that terminate a power of attorney or your authority to act under a power of attorney include:

- Death of the principal;

- The principal’s revocation of the power of attorney or your authority;

- The occurrence of a termination event stated in the power of attorney;

- The purpose of the power of attorney is accomplished; or

- If you are married to the principal, a legal action is filed with a court to end your marriage, or for your legal separation, unless Special Instructions in this power of attorney state that such an action will not terminate your authority.

Liability of Agent

The meaning of the authority granted to you is defined in the Uniform Power of Attorney Act. If you violate the Uniform Power of Attorney Act, or act outside the authority granted, you may be liable for any damages by your violation.

If there is anything about this document or your duties that you do not understand, you should seek legal advice.

Sources

- UniformLaws.org – Uniform Power of Attorney Act

- Uniform Power of Attorney Act – Section 102(2) (page 12)

- Uniform Power of Attorney Act – Section 301 (page 74)

- Uniform Power of Attorney Act – Section 301 (page 77)

- Uniform Power of Attorney Act – Section 302 (page 80)

- Uniform Power of Attorney Act – Section 114 (page 29)

- Uniform Power of Attorney Act – Section 117 (page 36)

- Uniform Power of Attorney Act – Section 301 (page 77)

- Uniform Power of Attorney Act – Section 301 (page 72)