Updated August 11, 2023

A Louisiana power of attorney, or “mandate,” permits an individual to legally and officially designate a representative (“mandatory”) to act on their behalf when necessary. The term “mandatory” is used in Louisiana instead of “agent” or “attorney-in-fact” as used generally in the other 49 States. A principal may use a power of attorney form for financial, medical, parenting, tax, or other related reasons. Once signed under the requirements set by Louisiana, the form is immediately available for use.

By Type (9) |

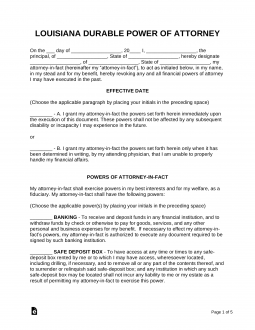

Durable (Financial) Power of Attorney – This type allows a person to designate a mandatory or agent to act on financial and other matters even if they become incapacitated. Durable (Financial) Power of Attorney – This type allows a person to designate a mandatory or agent to act on financial and other matters even if they become incapacitated.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 2993): No specific requirements, however, two (2) witnesses or notary public are recommended. |

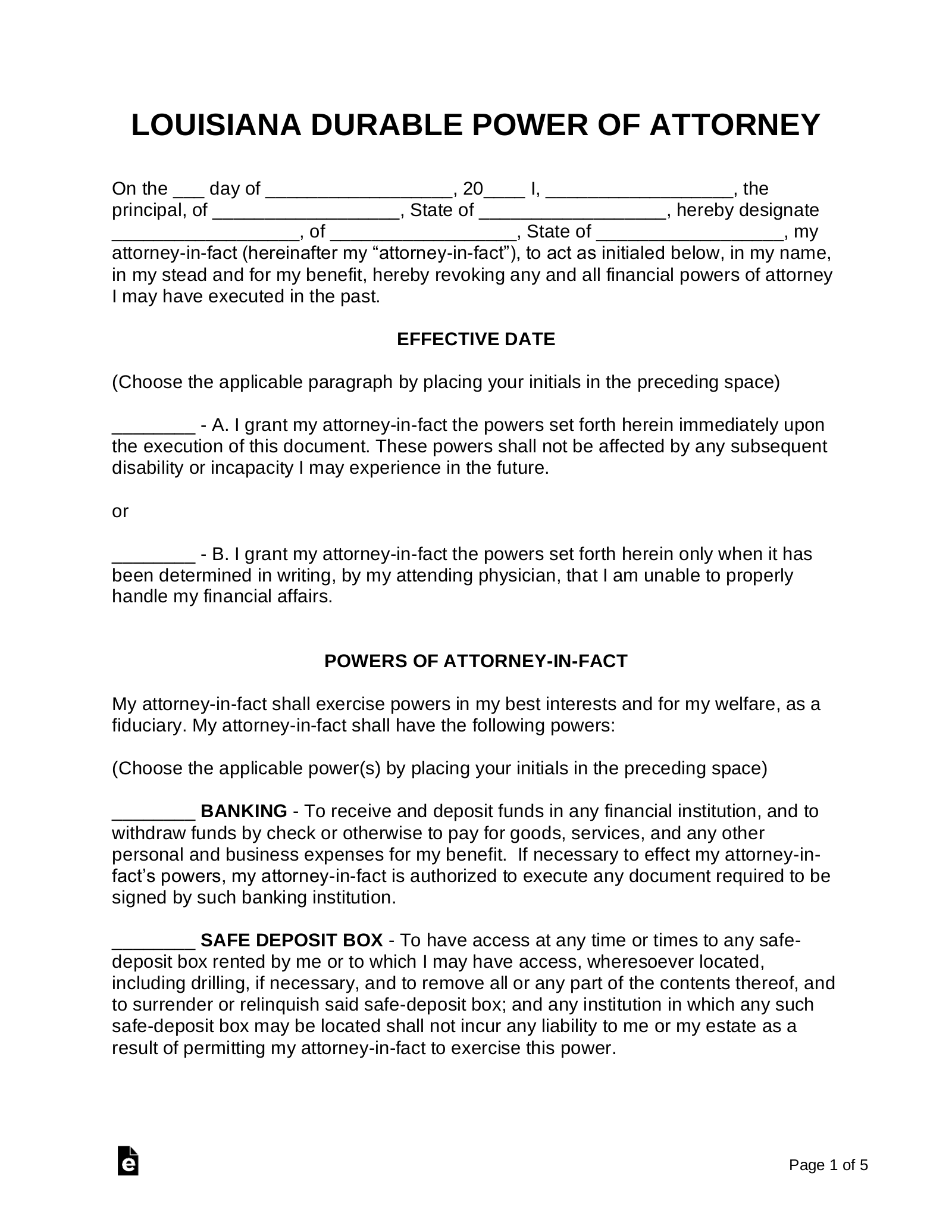

General (Financial) Power of Attorney – This type is similar to the durable form except that instead of continuing effect upon the principal’s incapacity, it becomes void and ineffective. General (Financial) Power of Attorney – This type is similar to the durable form except that instead of continuing effect upon the principal’s incapacity, it becomes void and ineffective.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 2993): No specific requirements, however, two (2) witnesses or notary public are recommended. |

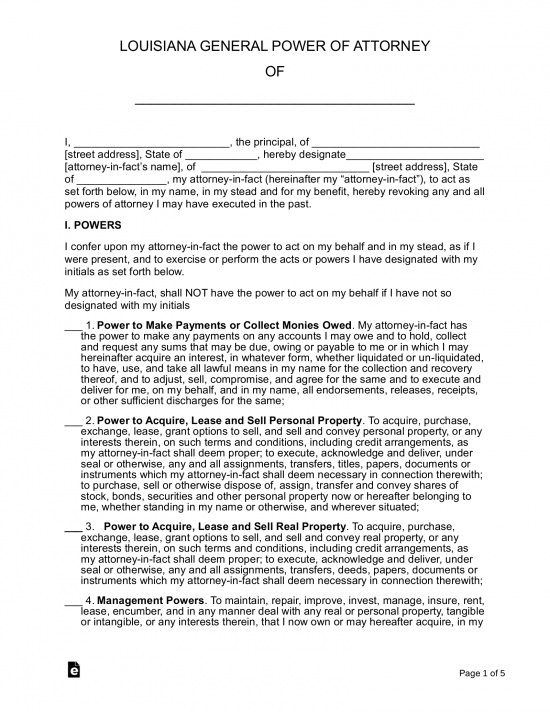

Limited Power of Attorney – A special type can only be used in a specific situation. Limited Power of Attorney – A special type can only be used in a specific situation.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 2993): No specific requirements, however, two (2) witnesses or notary public are recommended. |

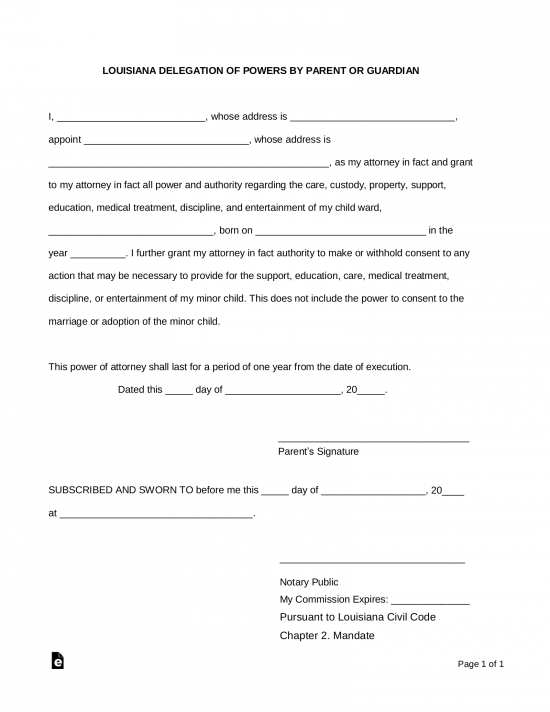

Minor (Child) Power of Attorney – This form is used when you need to have someone in place to represent your child’s interests in the event you are unavailable to do so. Minor (Child) Power of Attorney – This form is used when you need to have someone in place to represent your child’s interests in the event you are unavailable to do so.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 2993): No specific requirements, however, two (2) witnesses or notary public are recommended. |

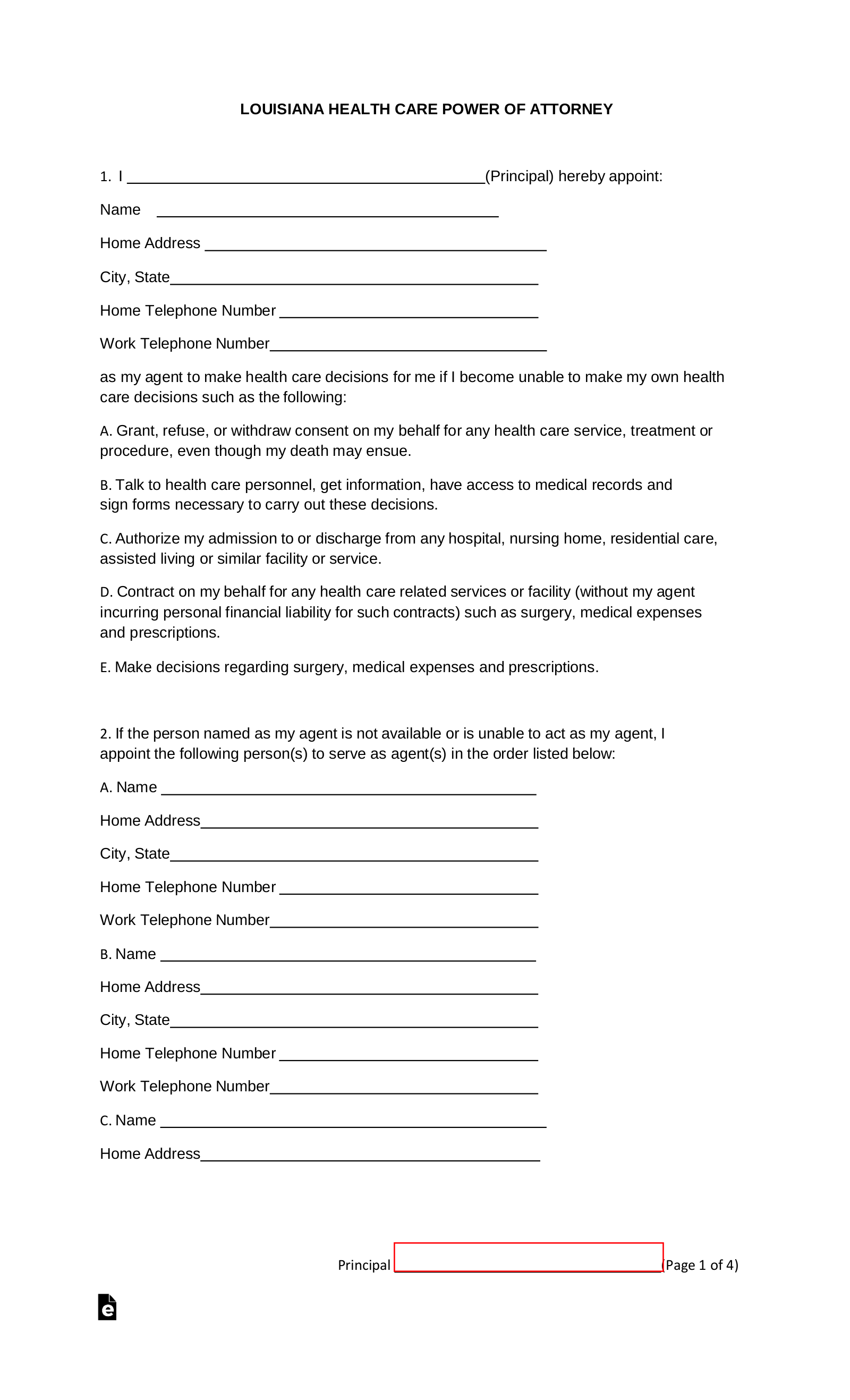

Medical Power of Attorney – This form is for use when you need someone to be available to represent your healthcare interests. Medical Power of Attorney – This form is for use when you need someone to be available to represent your healthcare interests.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 28:224): Two (2) witnesses. |

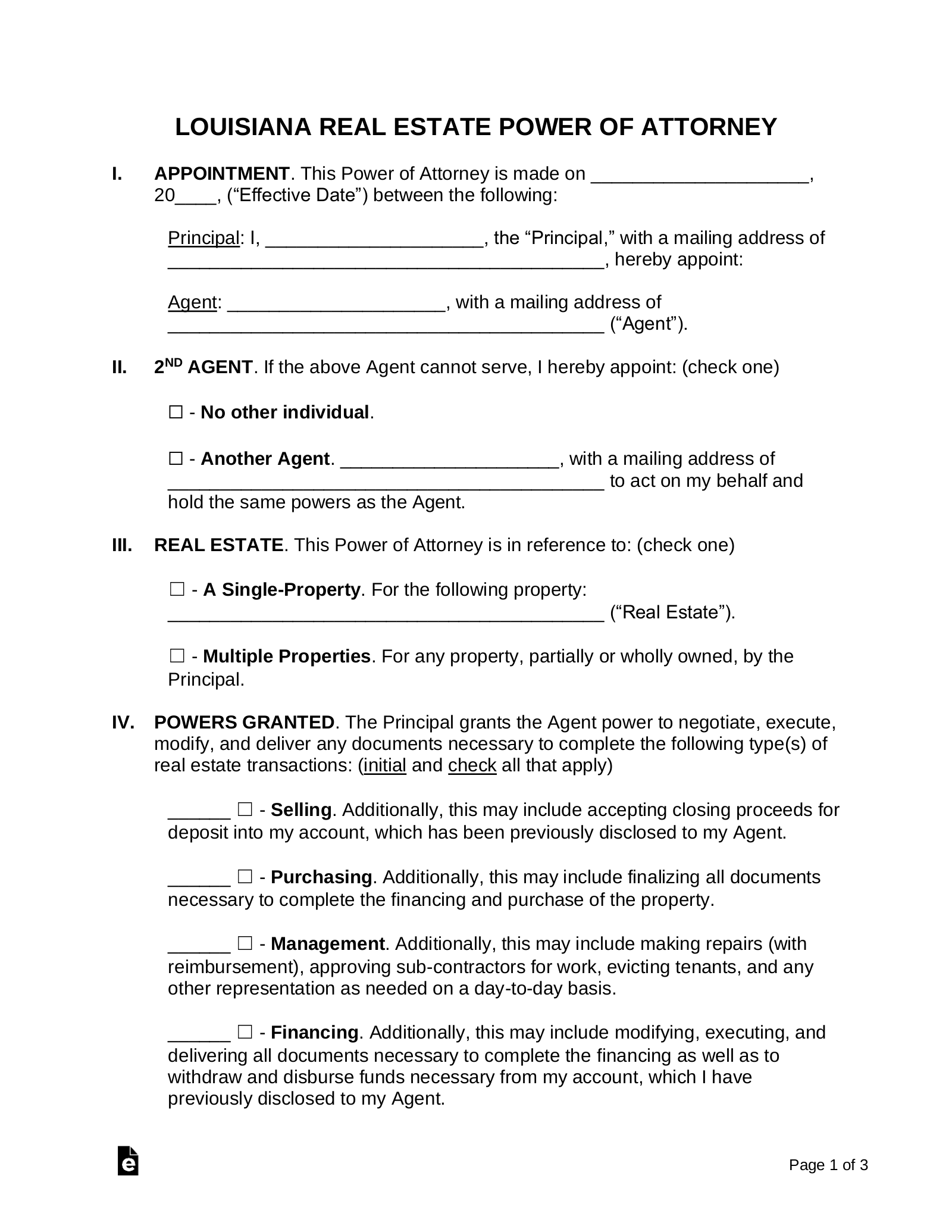

Real Estate Power of Attorney – Used to appoint a representative to execute real estate transactions on the principal’s behalf. Real Estate Power of Attorney – Used to appoint a representative to execute real estate transactions on the principal’s behalf.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 2993): No specific requirements, however, two (2) witnesses or notary public are recommended. |

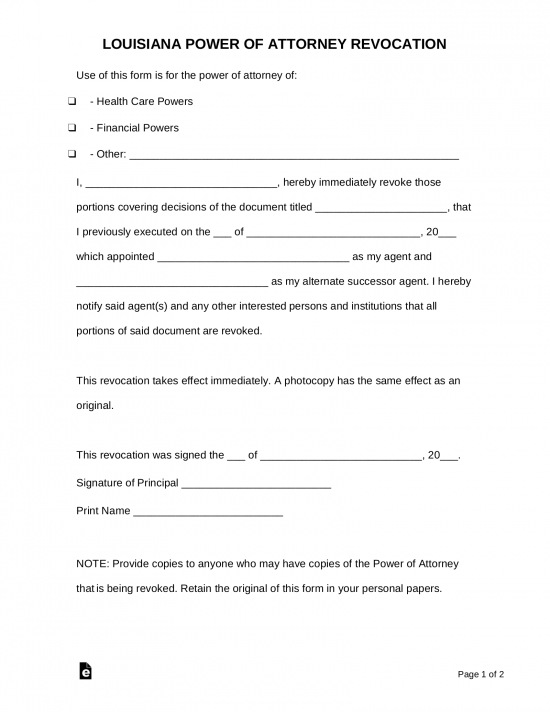

Revocation of Power of Attorney – This is used to cancel any type of power of attorney you may have created in the past. Revocation of Power of Attorney – This is used to cancel any type of power of attorney you may have created in the past.

Download: PDF, MS Word, OpenDocument Signing Requirements: No specific requirements, however, two (2) witnesses or notary public are recommended. |

Tax Power of Attorney (Form R-7006) – This form allows a person to appoint a representative to handle his or her interests in front of the state tax authorities. Tax Power of Attorney (Form R-7006) – This form allows a person to appoint a representative to handle his or her interests in front of the state tax authorities.

Download: PDF Signing Requirements: The principal and their representative. |

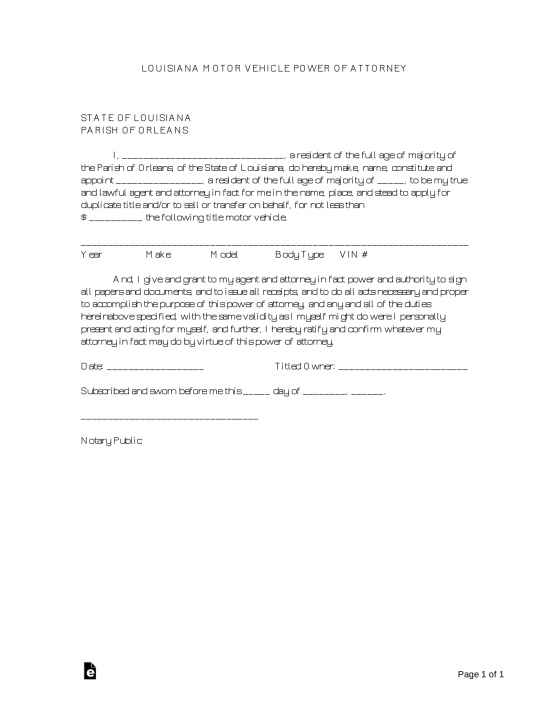

Vehicle Power of Attorney – This form is used when you need a representative to act on your behalf as it relates to your motor vehicle. Vehicle Power of Attorney – This form is used when you need a representative to act on your behalf as it relates to your motor vehicle.

Download: PDF, MS Word, OpenDocument Signing Requirements: Notary public. |