Updated June 02, 2022

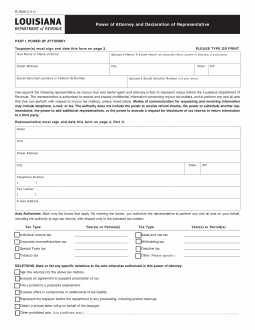

A Louisiana tax power of attorney (Form R-7006) is a form that allows a person to appoint a representative or representatives to make filings, obtain information, and otherwise act on their behalf in front of the Louisiana Department of Revenue.

How to Write

1 – The Louisiana Tax Representative Declaration Should Be Accessed On this Page

This form may be found underneath the image through the buttons presented. Select your preferred file type to open this form, then download it on your machine. You may work on it online or offline provided you have compatible software

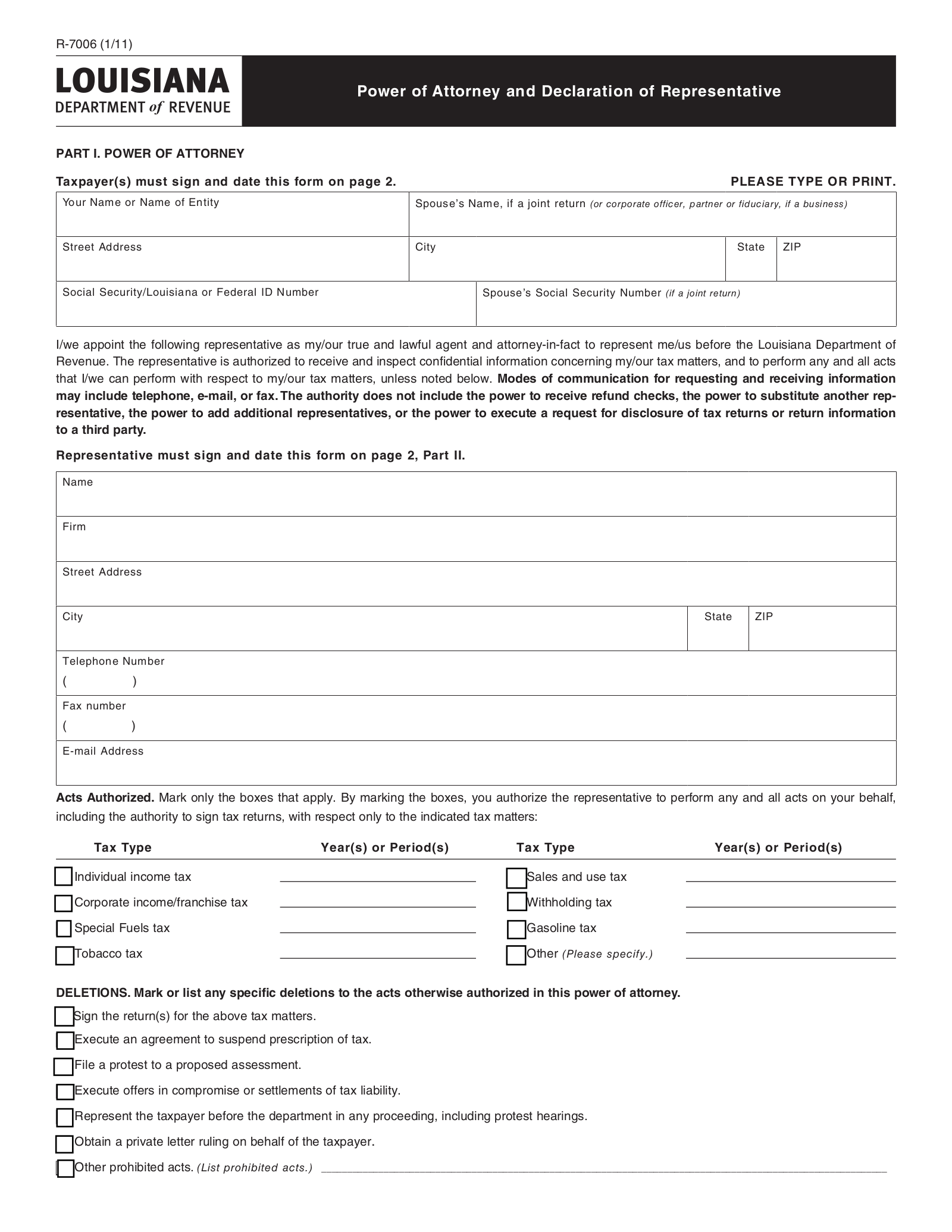

2 – The First Part Of This Form Requires The Principal Taxpayer’s Information

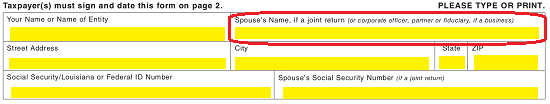

There will be a table presented in Part 1. Here, the Full Legal Name of the Principal Taxpayer will need to be entered in the box labeled “Your Name or Name of Entity.” In some cases, it may be a business entity seeking to delegate representative Powers to the Representative. Make sure the Name entered here is the Full of Name of the individual or entity who is delegating representative Powers to another individual or entity.

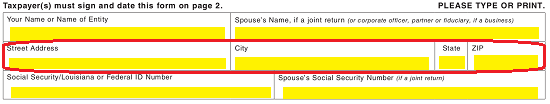

If this is an individual, then some Principal Taxpayers may have filed jointly with a spouse. In the case of a Business Entity, the Name of the Corporate Officer filing this paperwork, Partner, or Fiduciary will need to be reported. In either of these cases, use the box labeled “Spouse’s Name…” to enter the Name of a jointly filing spouse, corporate officer, partner, or fiduciary when applicable.  The next row will provide four separate boxes. Use the “Street Address,” “City,” “State,” and “Zip” boxes to report the Principal Taxpayer’s Address.

The next row will provide four separate boxes. Use the “Street Address,” “City,” “State,” and “Zip” boxes to report the Principal Taxpayer’s Address.

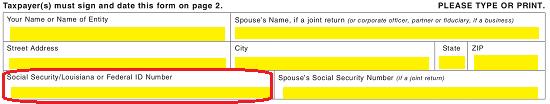

The last row in this table shall require the Social Security Number or Federal Employer Identification Number of the Principal Taxpayer recorded in the first box.

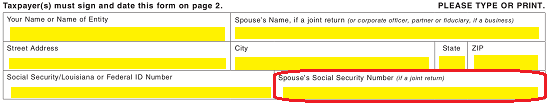

If an individual or entity was reported in the “Spouse’s Name” box above, enter this party’s Social Security Number or Federal Employer Identification Number in the second box of the last row.

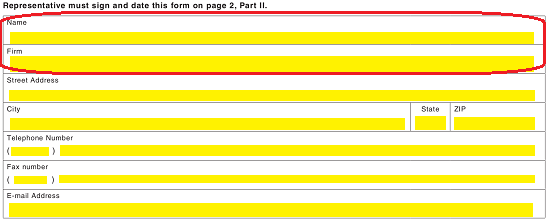

3 – The Representative Being Delegated With Principal Taxpayer Power Must Be Documented In The Second Table

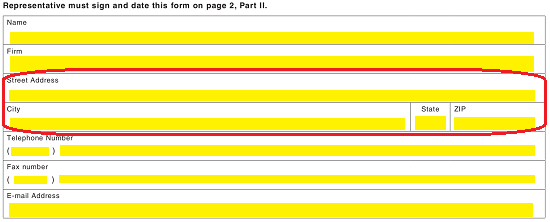

The next table in Part I requires the Full Name of the Representative being appointed with Principal Power by the Principal entered in the first row (labeled “Name”). If this individual is representing a Firm or other such entity providing Representation to the Principal, the Name of this Firm must be reported in the second row.  The next two rows will supply a defined area where the Representative’s Address must be reported. Use the boxes labeled “Street Address,” “City,” “State,” and “Zip” to report this information.

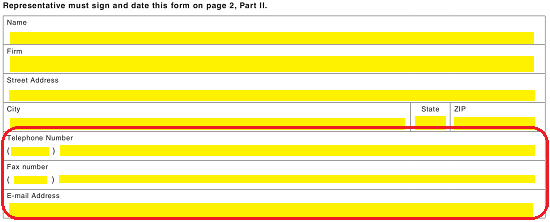

The next two rows will supply a defined area where the Representative’s Address must be reported. Use the boxes labeled “Street Address,” “City,” “State,” and “Zip” to report this information.  The last three rows in this table will need the Representative’s Contact Information documented. Here, you may use the boxes labeled “Telephone Number,” “Fax Number,” and “E-Mail Address” to present this information.

The last three rows in this table will need the Representative’s Contact Information documented. Here, you may use the boxes labeled “Telephone Number,” “Fax Number,” and “E-Mail Address” to present this information.

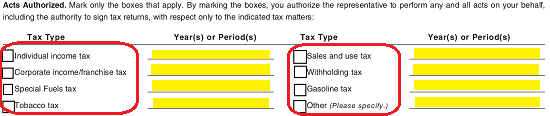

4 – The Taxpayer Powers Being Delegated Must Be Defined In this Form By The Time Of Signature

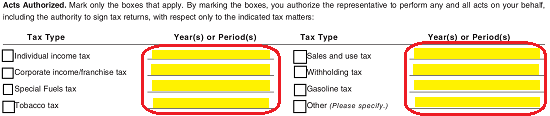

The next area will provide several boxes and blank lines under the headings “Tax Type” and “Year(s) or Period(s).” Mark each checkbox that defines a Tax Matter the Principal Taxpayer wishes the Representative to have Principal Powers in. You may delegate such Powers by marking one, some, or all the boxes: Individual Income Tax, Corporate Income/Franchise Tax, Special Fuels Tax, Tobacco Tax, Sales and Use Tax, Withholding Tax, Gasoline Tax, or Other. If you choose “Other,” make sure to specify the Tax Matter the Representative is being delegated Powers in.  Then, use the corresponding blank line in the next column, “Year(s) or Period(s),” to report the Time-Period when the Representative may exert Principal Power in that Tax Matter.

Then, use the corresponding blank line in the next column, “Year(s) or Period(s),” to report the Time-Period when the Representative may exert Principal Power in that Tax Matter.  After the Tax Matter area, you may use the checklist below the word “Deletions” to document what actions or matters the Principal Taxpayer does not Authorize the Representative to wield Principal Power in.

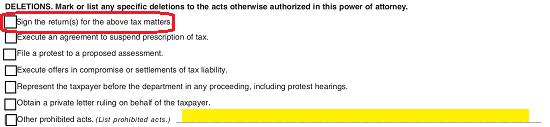

After the Tax Matter area, you may use the checklist below the word “Deletions” to document what actions or matters the Principal Taxpayer does not Authorize the Representative to wield Principal Power in.

To prevent the Representative from signing the Principal Taxpayer’s Returns, place a mark in the first checkbox.

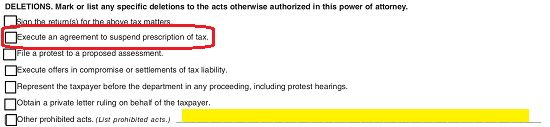

If the Representative may not execute any agreements to suspend Tax Prescriptions, then mark the second statement third statement should be marked if the Principal Taxpayer does not wish the Representative to file a Protest to Proposed Assessments.

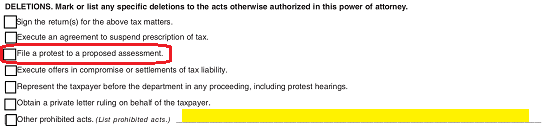

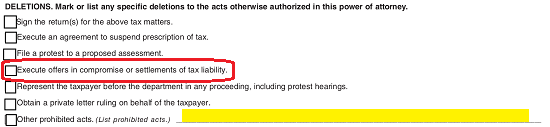

third statement should be marked if the Principal Taxpayer does not wish the Representative to file a Protest to Proposed Assessments. If the Principal Taxpayer does not wish the Representative to execute any offers of compromise or settlements regarding Tax Liability, then mark the fourth statement.

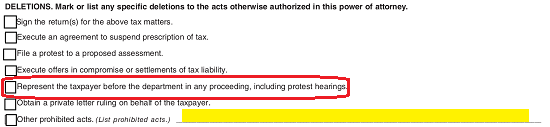

If the Principal Taxpayer does not wish the Representative to execute any offers of compromise or settlements regarding Tax Liability, then mark the fourth statement.  If the Representative does not have the Principal Authority to represent the Taxpayer in any department proceedings, the fifth statement should be marked.

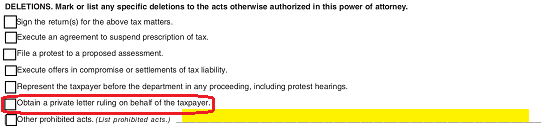

If the Representative does not have the Principal Authority to represent the Taxpayer in any department proceedings, the fifth statement should be marked.  The Representative will be prevented from obtaining private letter rulings on the Principal Taxpayer by marking the sixth statement.

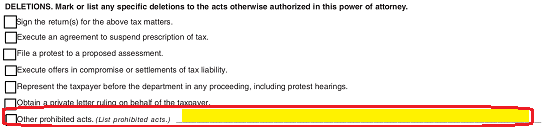

The Representative will be prevented from obtaining private letter rulings on the Principal Taxpayer by marking the sixth statement.  The Principal Taxpayer may withhold other actions or Principal Powers from the Representative by marking the last statement and listing the forbidden Powers on the blank line provided.

The Principal Taxpayer may withhold other actions or Principal Powers from the Representative by marking the last statement and listing the forbidden Powers on the blank line provided.

The last Principal Preference that should be addressed will be in the “Notices and Communications” statement. If the Principal Taxpayer wishes the Representative to receive copies of any communications sent to him or her from the Department of Revenue then, mark the checkbox after the words “check this box.”![]()

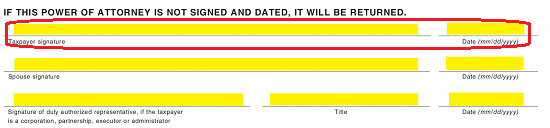

5 – The Principal Taxpayer Will Need To Sign This Delegation Of Authority

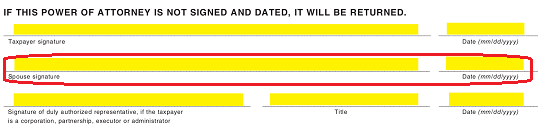

Locate the blank lines below the words “If This Power of Attorney Is Not Signed…” The Principal Taxpayer will need to sign the line labeled “Taxpayer Signature” then enter the Date he or she signed this paperwork on the blank line labeled “Date (mm/dd/yyyy).”  Below this, the individual reported in the box for “Spouse’s Name.” This signature must also have the Date it was provided on the next blank line.

Below this, the individual reported in the box for “Spouse’s Name.” This signature must also have the Date it was provided on the next blank line.

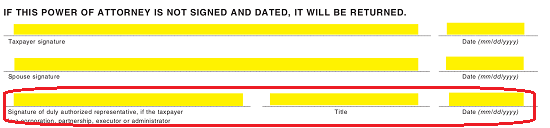

If this delegation of Authority is a business entity, an Authorized Representative must sign the blank space labeled “Signature of Duly Authorized Representative…” then, report the date he or she signed this document on the adjacent blank space.

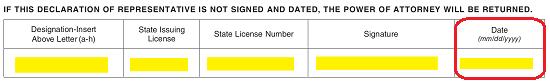

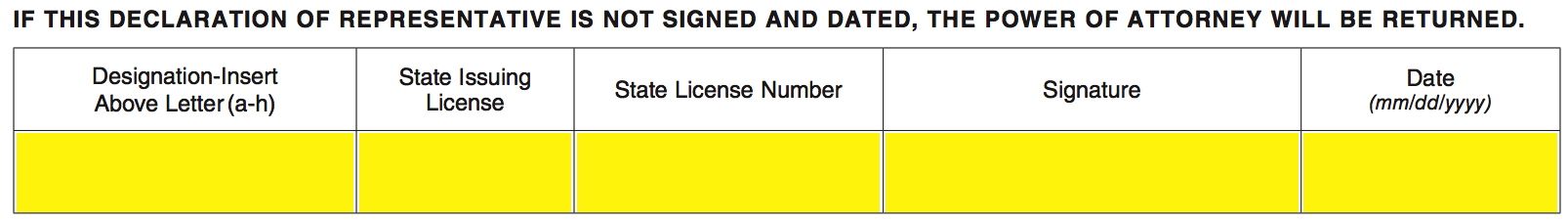

6 – The Declaration Of The Representative Must Be Filled Out And Signed By The Representative

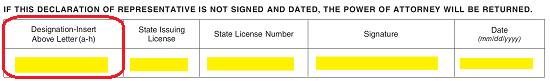

Locate Part II. Here, a brief list will be presented for the Representative’s perusal. He or she will need to agree with the bulleted statements in order to sign this document and accept the Principal Authority being delegated. Then he or she must attend to the table after carefully reviewing the lettered list of roles provided.

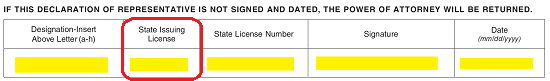

In the first column of the last table on this page, enter the letter designation of the role the Representative describes him or herself as. Note, if the letter “f” or “g” is entered here, the representative will need to enter this or her relation to the Taxpayer in “f.” If no predefined role applies and the Representative is not a Family Member, then enter the Representative’s Role on the blank space in Item “g.” If the Representative has a License that was issued by a State. Then report the issuing state in the second column (“State Issuing License).”

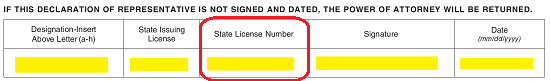

If the Representative has a License that was issued by a State. Then report the issuing state in the second column (“State Issuing License).” If the Representative has a License Number to practice his or her role, then enter this number in the column labeled “State License Number.”

If the Representative has a License Number to practice his or her role, then enter this number in the column labeled “State License Number.”

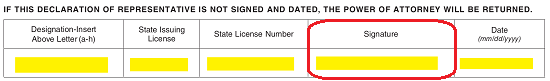

Next, the fourth column, “Signature,” must bear the Signature of the Representative.  Finally, the Date of Signature must be reported in the last column.

Finally, the Date of Signature must be reported in the last column.