Updated March 18, 2024

A Connecticut power of attorney legally allows an individual (principal) to nominate another person (agent) to act in their place for financial or medical activities. Depending on the type of power of attorney, the agent can also care for a principal’s child, handle real estate transactions, and file taxes on another’s behalf.

Advance Directive – Allows an individual to select their preferred treatment preferences for when they cannot do so themselves (living will), as well as a health care agent (medical power of attorney). Advance Directive – Allows an individual to select their preferred treatment preferences for when they cannot do so themselves (living will), as well as a health care agent (medical power of attorney).

Download: PDF Signing Requirements (Sec. 19a-575a) – Two (2) witnesses |

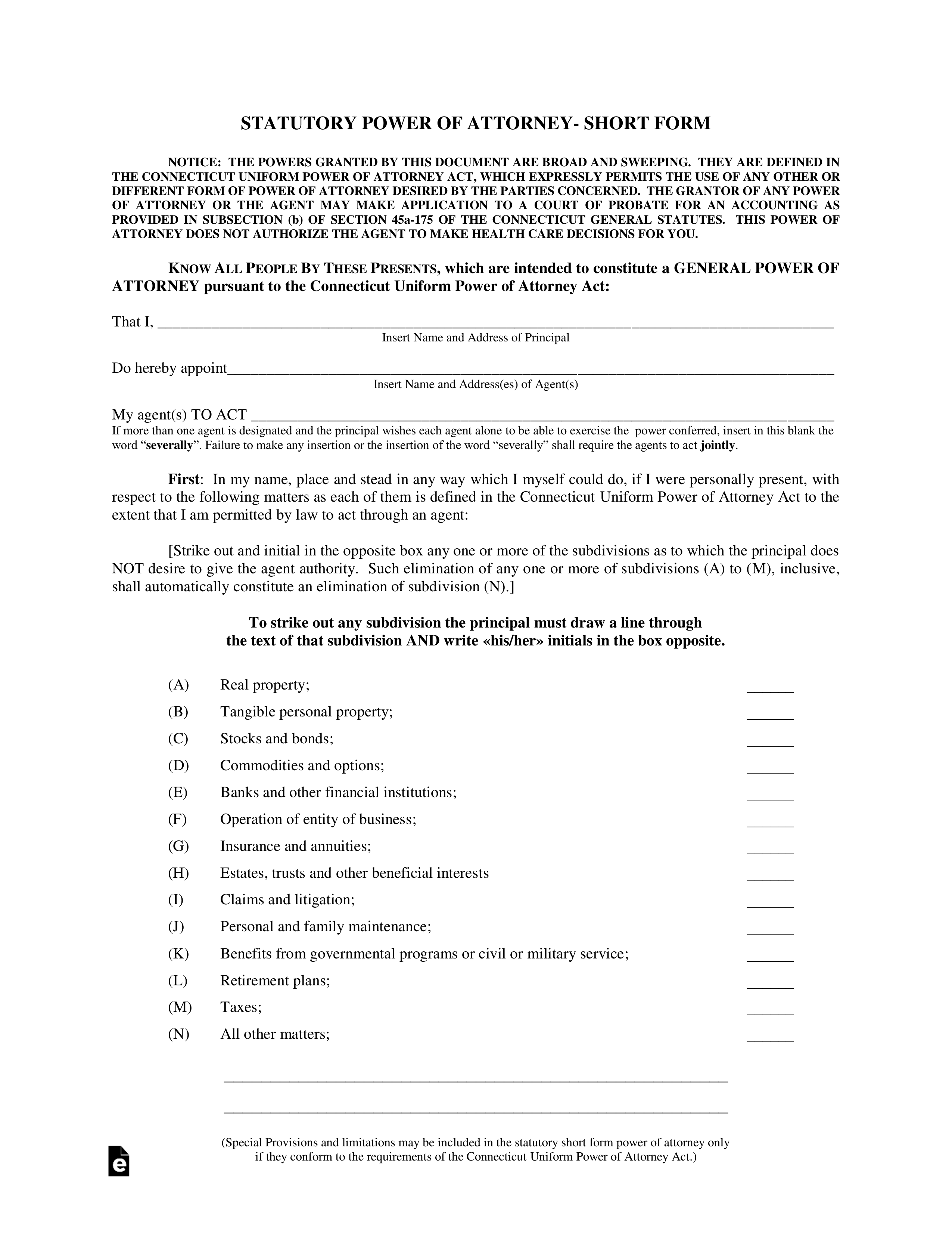

Durable (Statutory) Power of Attorney – Allows an individual to appoint an agent to make financial decisions on their behalf, even if the principal becomes ill and can no longer make decisions. Durable (Statutory) Power of Attorney – Allows an individual to appoint an agent to make financial decisions on their behalf, even if the principal becomes ill and can no longer make decisions.

Download: PDF, MS Word, OpenDocument Signing Requirements (Sec. 1-350d) – Two (2) witnesses and a notary public. |

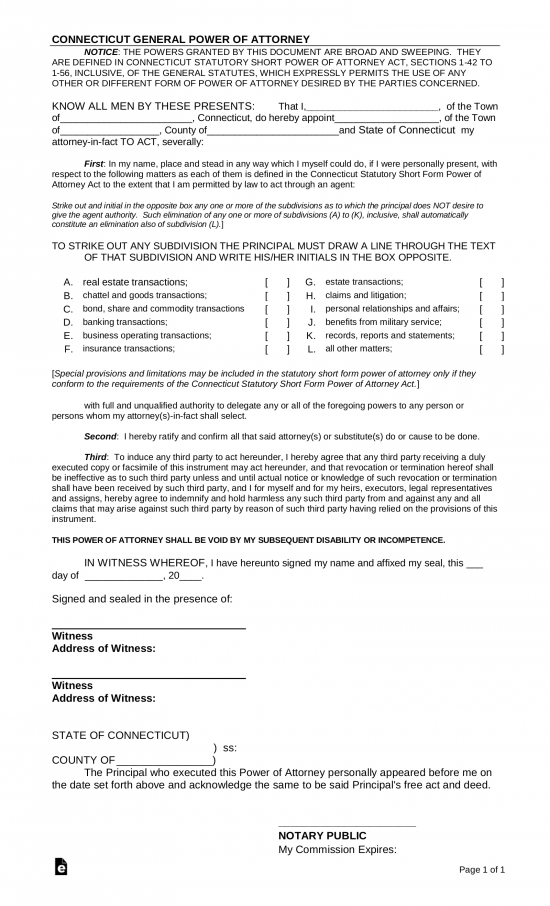

General (Financial) Power of Attorney – This type will become void if the principal becomes incapacitated and can no longer act on their own behalf. General (Financial) Power of Attorney – This type will become void if the principal becomes incapacitated and can no longer act on their own behalf.

Download: PDF, MS Word, OpenDocument Signing Requirements (Sec. 1-350d) – Two (2) adult witnesses and acknowledged before a notary public. |

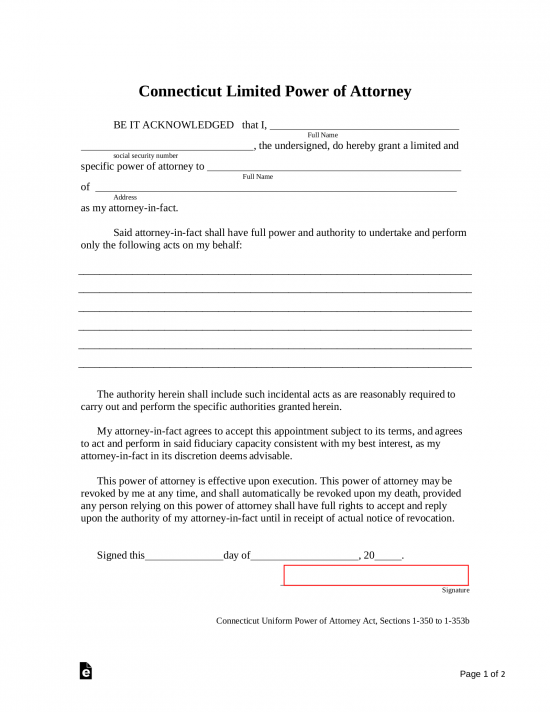

Limited Power of Attorney – Or “special” can be used for specific transaction types. It is important to describe the specific acts for which the agent can act. Limited Power of Attorney – Or “special” can be used for specific transaction types. It is important to describe the specific acts for which the agent can act.

Download: PDF, MS Word, OpenDocument Signing Requirements (§ 1-350d) – Two (2) adult witnesses and acknowledged before a notary public. |

Medical Power of Attorney – A person can select a friend or relative to determine medical treatment for when the individual is incapacitated. Medical Power of Attorney – A person can select a friend or relative to determine medical treatment for when the individual is incapacitated.

Download: PDF Signing Requirements (Sec. 19a-575a) – Two (2) adult witnesses. |

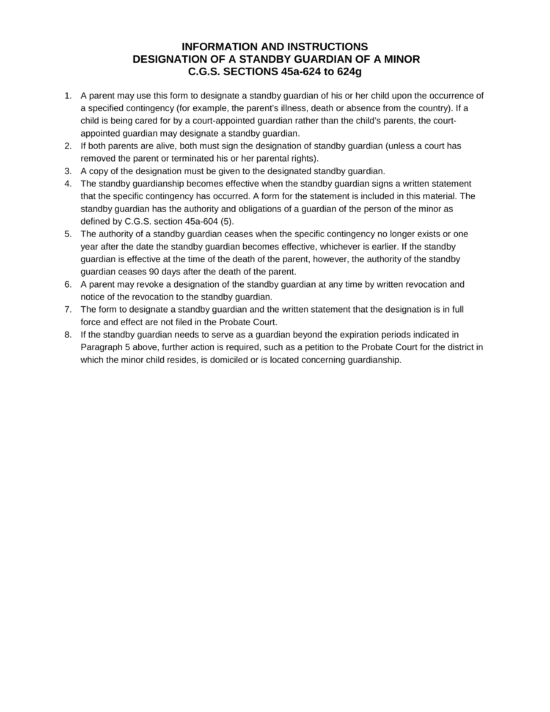

Minor (Child) Power of Attorney – This form allows a parent to designate a trusted friend or relative to take care of and make decisions on behalf of the parent’s children in the event they will be away temporarily. Minor (Child) Power of Attorney – This form allows a parent to designate a trusted friend or relative to take care of and make decisions on behalf of the parent’s children in the event they will be away temporarily.

Download: PDF Signing Requirements (Sec. 45a-624c) – Two (2) witnesses. |

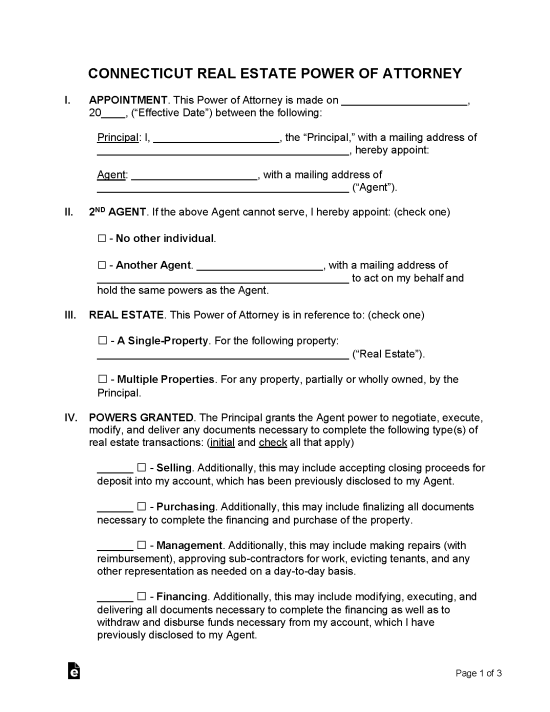

Real Estate Power of Attorney – The usage of an Attorney-in-Fact to help with either the buying, selling, or managing of property for the benefit of the owner. Real Estate Power of Attorney – The usage of an Attorney-in-Fact to help with either the buying, selling, or managing of property for the benefit of the owner.

Download: PDF, MS Word, OpenDocument Signing Requirements (Sec. 1-350d) – Two (2) adult witnesses and acknowledged before a notary public. |

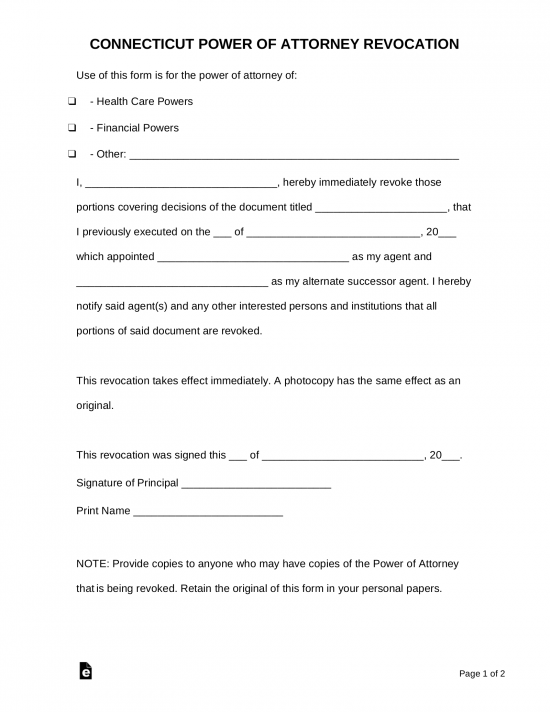

Revocation of Power of Attorney – This form can be used to revoke any power of attorney you may have created. It is very important that everyone who was part of the voided power of attorney is made aware of the canceled document. Revocation of Power of Attorney – This form can be used to revoke any power of attorney you may have created. It is very important that everyone who was part of the voided power of attorney is made aware of the canceled document.

Download: PDF, MS Word, OpenDocument |

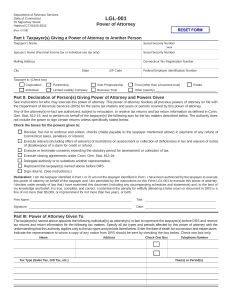

Tax Power of Attorney (LGL-001) – If you want an accountant or another financial agent to take care of tax filings on your behalf, this is the form you use. Tax Power of Attorney (LGL-001) – If you want an accountant or another financial agent to take care of tax filings on your behalf, this is the form you use.

Download: PDF Signing Requirements: Principal only |

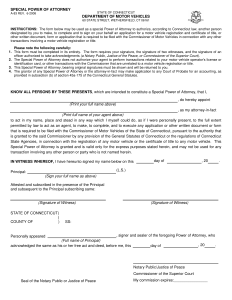

Vehicle Power of Attorney (A-83) – If you want someone to handle the purchase, sale, titling, or registration of your vehicle, you should use this form. Vehicle Power of Attorney (A-83) – If you want someone to handle the purchase, sale, titling, or registration of your vehicle, you should use this form.

Download: PDF Signing Requirements: Two (2) adult witnesses and acknowledged before a notary public. |