Updated August 09, 2023

Tennessee power of attorney forms allow a person to choose a representative to substitute for them and act in their place for many types of situations. The person giving power (“principal”) can choose the specific rights to hand over to their representative (“agent”) ranging from medical decision-making to the handling of their financial affairs. The designation may last for a limited period or during the lifetime of the principal. To make any power of attorney document valid, it must be signed in accordance with State law.

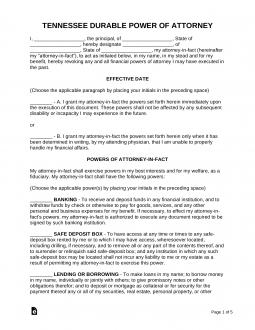

Durable (Financial) Power of Attorney – Allows a principal to choose an agent to make financial decisions and actions on their behalf. Remains valid if the principal becomes mentally disabled. Durable (Financial) Power of Attorney – Allows a principal to choose an agent to make financial decisions and actions on their behalf. Remains valid if the principal becomes mentally disabled.

Download: PDF, MS Word, OpenDocument Signing Requirements: No laws; however, it is recommended to be signed in the presence of two (2) witnesses or a notary public. |

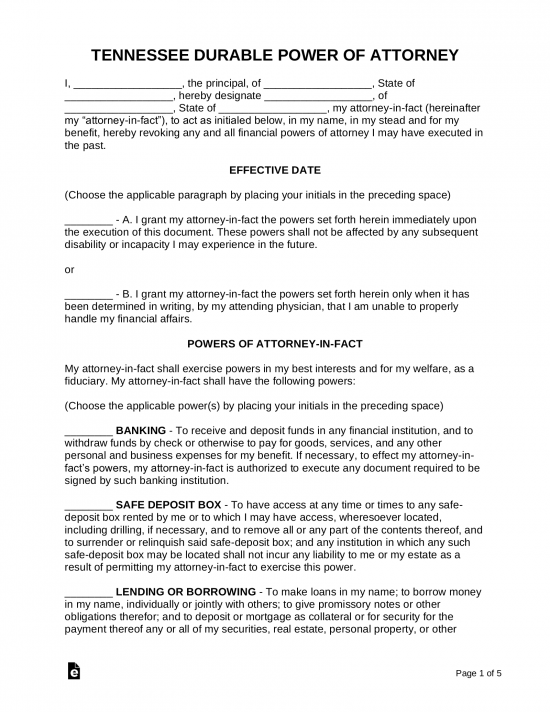

General (Financial) Power of Attorney – Allows a principal to select an agent to make financial actions and decisions on their behalf. Unlike the durable form, it does not remain valid if the principal becomes mentally disabled. General (Financial) Power of Attorney – Allows a principal to select an agent to make financial actions and decisions on their behalf. Unlike the durable form, it does not remain valid if the principal becomes mentally disabled.

Download: PDF, MS Word, OpenDocument Signing Requirements: No laws; however, it is recommended to be signed in the presence of two (2) witnesses or a notary public. |

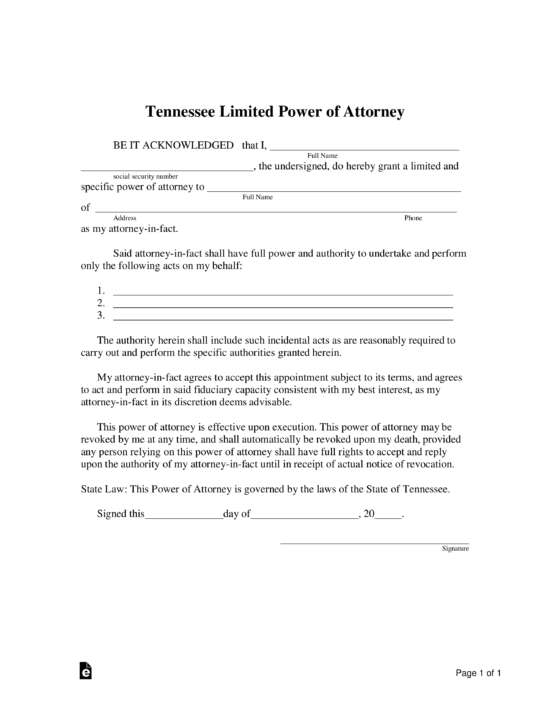

Limited Power of Attorney – This form is for a principal to appoint an agent from a limited transaction or a discrete time period. Limited Power of Attorney – This form is for a principal to appoint an agent from a limited transaction or a discrete time period.

Download: PDF, MS Word, OpenDocument Signing Requirements: No laws; however, it is recommended to be signed in the presence of two (2) witnesses or a notary public. |

Medical Power of Attorney – Allows a person to nominate someone else to be their surrogate in the chance a medical condition does not allow them to make health-related decisions for themselves. Medical Power of Attorney – Allows a person to nominate someone else to be their surrogate in the chance a medical condition does not allow them to make health-related decisions for themselves.

Download: PDF Signing Requirements (§ 34-6-203(a)(3)): Notary acknowledgment or two (2) witnesses. |

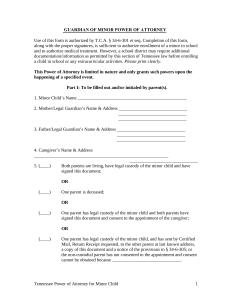

Minor (Child) Power of Attorney – Allows the parent of a minor to handle their care, education, and health care needs for a period of time (not specified by the State). Minor (Child) Power of Attorney – Allows the parent of a minor to handle their care, education, and health care needs for a period of time (not specified by the State).

Download: PDF, MS Word, OpenDocument Signing Requirements: Caregiver and notary acknowledgment. |

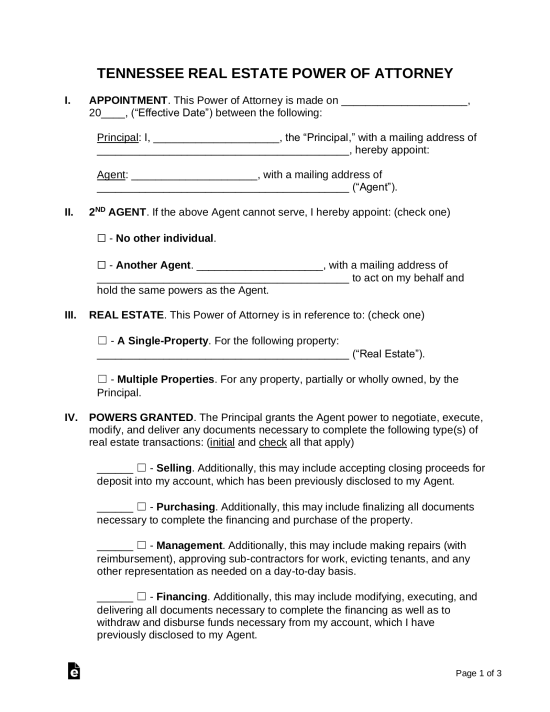

Real Estate Power of Attorney – Appoint an agent with a fiduciary duty to represent your best interests with regard to real property transactions and/or management. Real Estate Power of Attorney – Appoint an agent with a fiduciary duty to represent your best interests with regard to real property transactions and/or management.

Download: PDF, MS Word, OpenDocument Signing Requirements: No statutory definition; however, it is suggested that the document be signed in the presence of two (2) witnesses or notarized. |

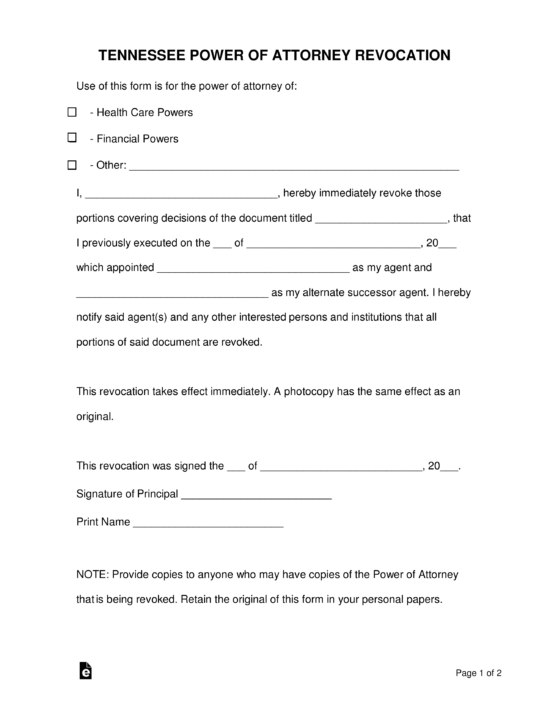

Revocation of Power of Attorney – This form is for use when a person who has previously conveyed powers power of under canceled. Revocation of Power of Attorney – This form is for use when a person who has previously conveyed powers power of under canceled.

Download: PDF, MS Word, OpenDocument Signing Requirements: No statutory definition; however, it is suggested that the document be signed in the presence of two (2) witnesses or notarized. |

Tax Power of Attorney (Form RV-F0103801) – A principal can appoint another to represent them in front of the tax authority using this form. Tax Power of Attorney (Form RV-F0103801) – A principal can appoint another to represent them in front of the tax authority using this form.

Download: PDF Signing Requirements: Agent(s) only. |

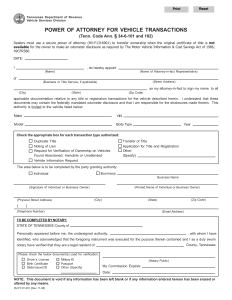

Vehicle Power of Attorney (Form RV-F1311401) – This is for use when you seek to have a representative represent your interests relating to your motor vehicle in front of the Tennessee Department of Revenue. Vehicle Power of Attorney (Form RV-F1311401) – This is for use when you seek to have a representative represent your interests relating to your motor vehicle in front of the Tennessee Department of Revenue.

Download: PDF Signing Requirements: Notary public. |