Updated June 02, 2022

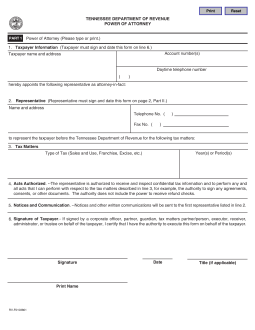

A Tennessee Tax Power of Attorney (Form RV-F0103801) is used when you intend to delegate the authority to handle tax filings, inquiries, and a few other functions the Tennessee Department of Revenue requires of its taxpayers. Naturally, in order to appoint an individual to represent you in such matters with this entity, you will need to first gain its permission to do so. This task will be addressed by filling out this form then submitting it once it is signed by all the relevant parties. Your agent (usually an accountant, attorney, or similarly qualified entity) will only be able to carry out the functions you have assigned him or her upon the Tennessee Department of Revenue’s approval of this paperwork. It should be noted this form is also sometimes referred to as the “Tennessee Department of Revenue Power Of Attorney.”

How to Write

1 – Download And Fill Out The Paperwork Provided To Designate Principal Tax Powers In Tennessee

A copy of the paperwork required to appoint an Agent with the Principal Powers required represent a Taxpayer can be downloaded by clicking on one of the buttons furnished underneath the image. Download a copy then fill it out. Make sure the information supplied is as accurate as possible before filing it.

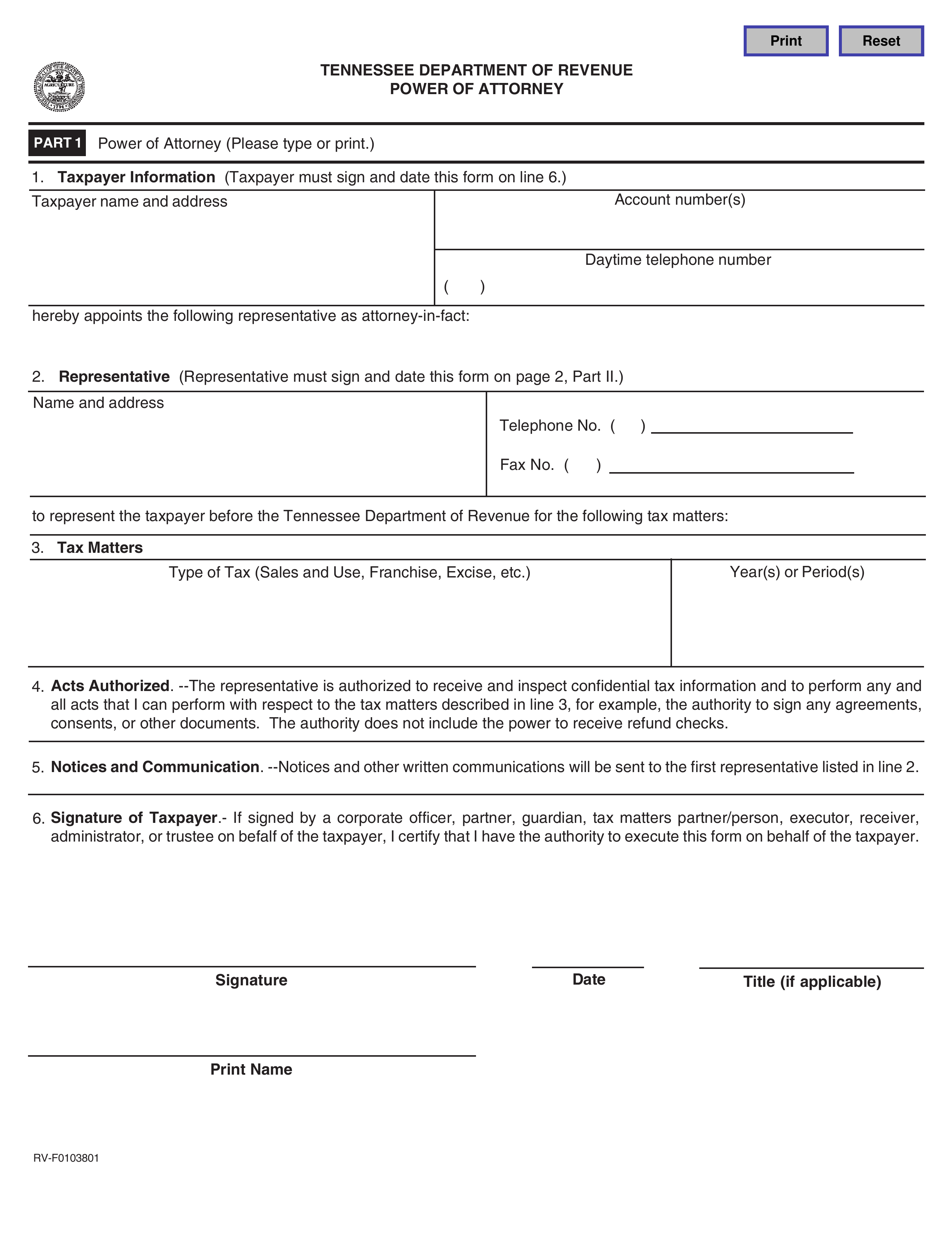

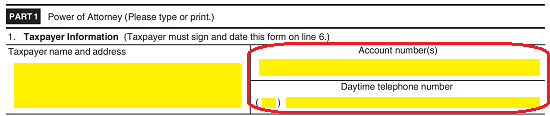

2 – State The Principal Identity In The “Taxpayer Information” Table

The first table on this page will focus its attention on the Taxpayer appointing an Agent with Principal Power. Use the area labeled “Taxpayer Name And Address” to document the Taxpayer’s Legal Name (First, Middle, Last Name, and any applicable Title). Then, in the same box below the reported Name, document the Principal Taxpayer’s Address.  The next boxes in this area will request the Principal Taxpayer’s Account Number and Daytime Telephone Number.

The next boxes in this area will request the Principal Taxpayer’s Account Number and Daytime Telephone Number.

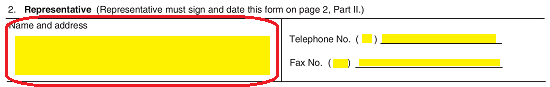

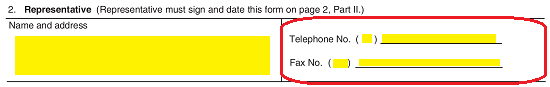

3 – Utilize The Second Table To Clearly Identify The Tax Representative

The party being designated with the Taxpayer’s Powers will also have an area where his or her identity must be solidified. The box labeled “Name And Address” in the section labeled “2. Representative”  The remaining two boxes in this table will call for the Agent’s current “Telephone No.” and “Fax No.”

The remaining two boxes in this table will call for the Agent’s current “Telephone No.” and “Fax No.”

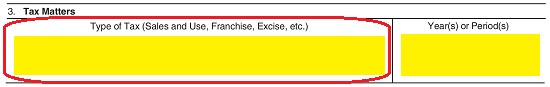

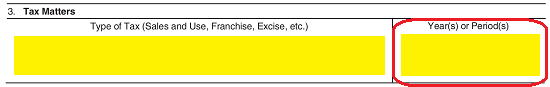

4 – Name Which Tax Matters And When The Tax Representative Can Wield Principal Power Over

The subject matters the Agent will receive Principal Powers over must be documented before the Principal Taxpayer signs his or her Name. The third table “3. Tax Matters” will present two boxes specifically for this purpose. In the box labeled “Types Of Tax (Sales ANd Use, Franchise, Excise, Etc.)” provide a list of Tax Matters the Agent will be appointed Principal Power over.  Then, in the box labeled “Year(s) Or Period(s),” record the Time Frame for each listed Tax Matter when the Agent will be able to wield Principal Authority.

Then, in the box labeled “Year(s) Or Period(s),” record the Time Frame for each listed Tax Matter when the Agent will be able to wield Principal Authority.

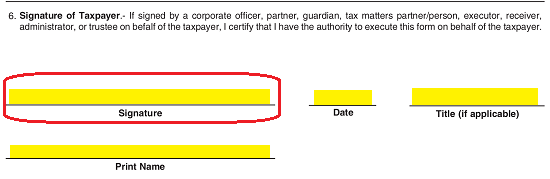

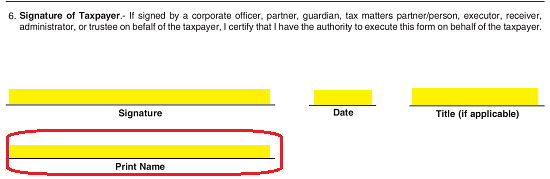

5 – The Taxpayer’s Signature Is A Required Tool Of Execution

In the last section of this document “Signature of Taxpayer,” a verification of the Taxpayer’s intention to deliver his or her Principal Power to the Agent. He or she should locate the line labeled “Signature,” in this section, then sign it.  After signing his or her Name, the Taxpayer will need to enter the Date he or she signed this on the “Date” line.

After signing his or her Name, the Taxpayer will need to enter the Date he or she signed this on the “Date” line.  In addition, he or she should report any Title he or she holds on the “Title (If Applicable)” line.

In addition, he or she should report any Title he or she holds on the “Title (If Applicable)” line.  Finally, the Principal must print his or her Name on the “Print Name” line.

Finally, the Principal must print his or her Name on the “Print Name” line.

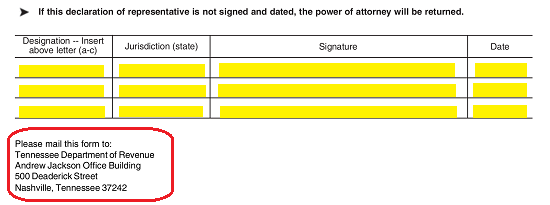

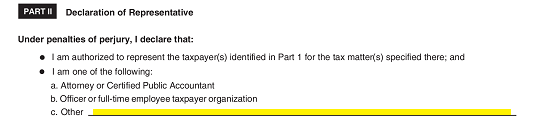

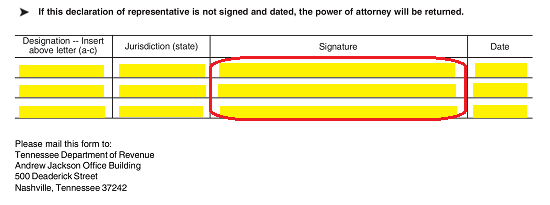

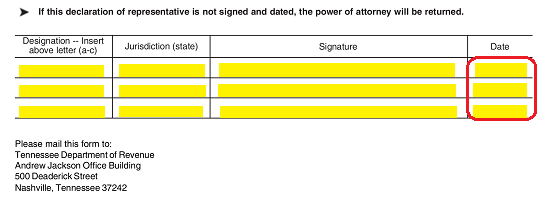

6 – A Report From The Representative Is Required Before Filing This Paperwork

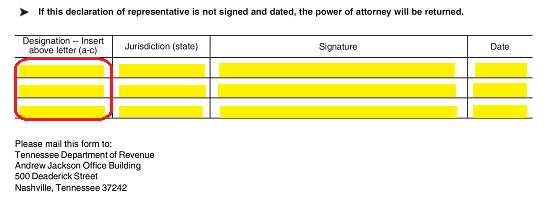

The Agent will also need to self-identify. This will be handled on the second page in the area labeled “Part II.” First, the Agent must read the bulleted checklist. Notice the second bullet contains three lettered descriptions. If the Agent is not an Attorney, Certified Public Accountant, Officer/Full Time Employee of a Taxpayer Organization, the Agent should record the role/profession that best applies to him or her on the blank line in “c” The first column of the table in this section will need each Agent to record the letter corresponding to his or her role.

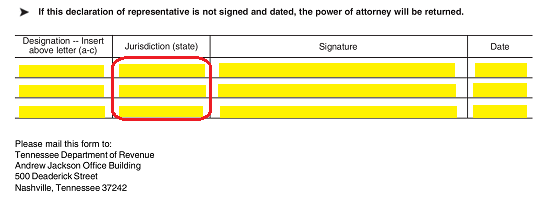

The first column of the table in this section will need each Agent to record the letter corresponding to his or her role.  In the second column, the “Jurisdiction (State)” where the Agent practices his or her Profession.

In the second column, the “Jurisdiction (State)” where the Agent practices his or her Profession.  The Agent must sign his or her name in the Signature column

The Agent must sign his or her name in the Signature column Finally, in the column with the heading “Date,” the Agent must supply the Date he or she signed this document.

Finally, in the column with the heading “Date,” the Agent must supply the Date he or she signed this document.

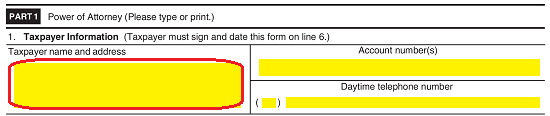

Once this document has been signed and reviewed one final time to the satisfaction of the Principal, it should be mailed to the Tennesse Department of Revenue.