Updated March 19, 2024

A general power of attorney (GPOA) form allows a person (principal) to choose and give an agent powers over their financial matters. It is non-durable, which means if the principal becomes mentally incompetent (incapacitated), the agent’s powers terminate.

Determining Disability

Disability is described as the inability of a principal to manage their personal and business affairs and is determined by a licensed physician.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a General Power of Attorney (GPOA)?

General power of attorney is the act of allowing another individual, known as the agent, to make specified financial decisions on the principal’s behalf. The form can be customized to match the specific financial needs of the principal.

(Video)

Common (Financial) Powers

- Power to make or collect payment;

- Power to acquire, lease, or sell real estate;

- Deposit or withdraw on bank accounts;

- Motor vehicle ownership or registration;

- Gifts;

- Filing taxes;

- Borrowing or lending money;

- Signing contracts;

- Run a business;

- Handle insurance claims;

- Make legal decisions; and

- Access a safe deposit box.

How to Get a General POA (3 steps)

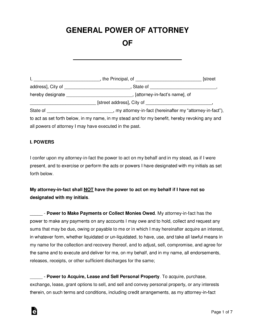

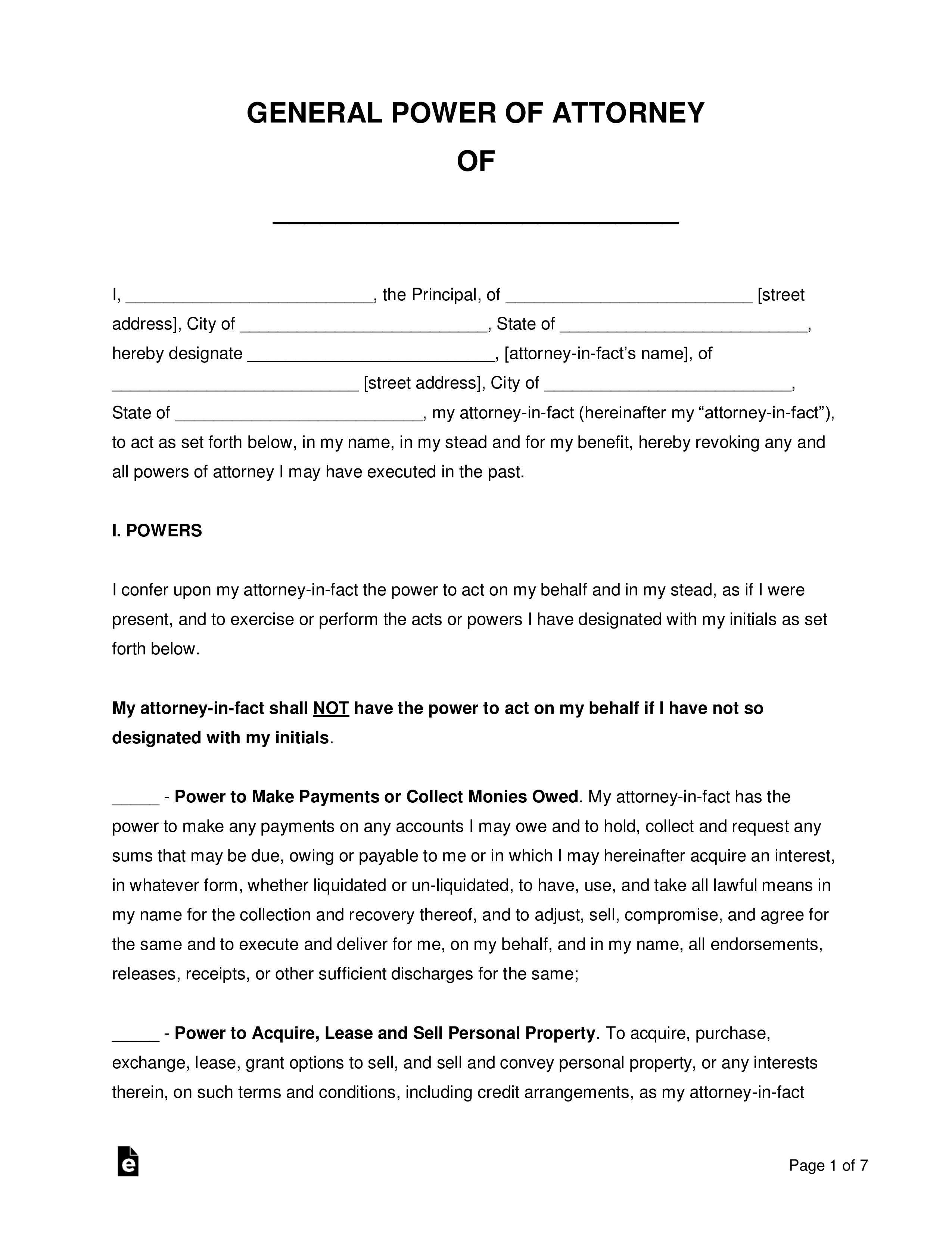

1. Powers

Obtaining a general power of attorney starts with knowing the “power” you wish to grant your agent (attorney-in-fact). Because this is a “General” power of attorney, the principal needs to carefully read through the general power of attorney form and initialize in the blank underline to the left of the paragraph explaining the power. There are 16 powers to choose from; if you do not see the power you need, initialize next to “Other” and manually describe the power you wish to give to the agent.

Obtaining a general power of attorney starts with knowing the “power” you wish to grant your agent (attorney-in-fact). Because this is a “General” power of attorney, the principal needs to carefully read through the general power of attorney form and initialize in the blank underline to the left of the paragraph explaining the power. There are 16 powers to choose from; if you do not see the power you need, initialize next to “Other” and manually describe the power you wish to give to the agent.

2. Select Agent(s)

Finding an agent is the next step which is the person who will act on the powers that you give. This person should be well trusted, coherent, and very reliable. Depending on the powers that you give, this person has the potential to cause great damage to your life if they don’t carry out the powers correctly. For extra precaution, it’s also possible to list two agents on your power of attorney. The added benefit to having two agents; if one dies or is unavailable when needed, the other can act on your behalf.

Finding an agent is the next step which is the person who will act on the powers that you give. This person should be well trusted, coherent, and very reliable. Depending on the powers that you give, this person has the potential to cause great damage to your life if they don’t carry out the powers correctly. For extra precaution, it’s also possible to list two agents on your power of attorney. The added benefit to having two agents; if one dies or is unavailable when needed, the other can act on your behalf.

3. Execute

Now that you have both the powers you want to give and the agent who will execute them for you, you can proceed to fill out your general power of attorney form. When finished, it’s mandatory that both the agent and principal sign the document while also having 2 witnesses. Note: Witnesses can’t be family-related. A notary public’s signature is also recommended. Give copies of the document to your agent and those who need to be informed and keep the original in a safe place.

Now that you have both the powers you want to give and the agent who will execute them for you, you can proceed to fill out your general power of attorney form. When finished, it’s mandatory that both the agent and principal sign the document while also having 2 witnesses. Note: Witnesses can’t be family-related. A notary public’s signature is also recommended. Give copies of the document to your agent and those who need to be informed and keep the original in a safe place.

Signing Requirements

| State | Signing Requirements | Statute |

| Alabama | Notary Public | |

| Alaska | Notary Public | |

| Arizona |

One (1) Witness and Notary Public |

|

| Arkansas |

Notary Public |

|

| California |

Two (2) Witnesses or Notary Public |

|

| Colorado |

Notary Public |

|

| Connecticut |

Two (2) Witnesses and Notary Public |

|

| Delaware |

One (1) Witness and Notary Public |

|

| Florida |

Two (2) Witnesses and Notary Public |

|

| Georgia |

One (1) Witness and Notary Public |

|

| Hawaii |

Notary Public |

|

| Idaho | Notary Public | |

| Illinois |

One (1) Witness and Notary Public |

|

| Indiana |

Two (2) Witnesses or Notary Public |

|

| Iowa |

Notary Public |

|

| Kansas |

Notary Public |

|

| Kentucky |

Notary Public |

|

| Louisiana |

Principal Only |

|

| Maine |

Notary Public |

|

| Maryland |

Two (2) Witnesses and Notary Public |

|

| Massachusetts |

Two (2) Witnesses |

|

| Michigan |

Two (2) Witnesses or Notary Public |

|

| Minnesota |

Notary Public |

|

| Mississippi | Principal Only | |

| Missouri |

Notary Public |

|

| Montana | Notary Public | |

| Nebraska | Notary Public | |

| Nevada | Notary Public | |

| New Hampshire | Notary Public | |

| New Jersey | Notary Public | |

| New Mexico | Notary Public | |

| New York | Two (2) Witnesses and Notary Public | |

| North Carolina | Notary Public | |

| North Dakota | Principal Only |

N/A |

| Ohio |

Notary Public |

|

| Oklahoma | Notary Public | |

| Oregon | Principal Only |

N/A |

| Pennsylvania |

Two (2) Witnesses and Notary Public |

|

| Rhode Island | Notary Public | |

| South Carolina |

Two (2) Witnesses and Notary Public |

|

| South Dakota | Notary Public | |

| Tennessee | Principal Only |

N/A |

| Texas | Notary Public | |

| Utah | Notary Public | |

| Vermont |

Notary Public |

|

| Virginia | Notary Public | |

| Washington |

Two (2) Witnesses or Notary Public |

|

| Washington D.C. | Notary Public | |

| West Virginia | Notary Public | |

| Wisconsin | Notary Public | |

| Wyoming | Notary Public |