Updated July 27, 2023

A Kansas promissory note template is a set of documents used as a written promise to help protect a lender and ensure his or her loaned money is reimbursed in a timely fashion. It is important that a legal interest rate (usury rate), is selected for the note.

Table of Contents |

By Type (2)

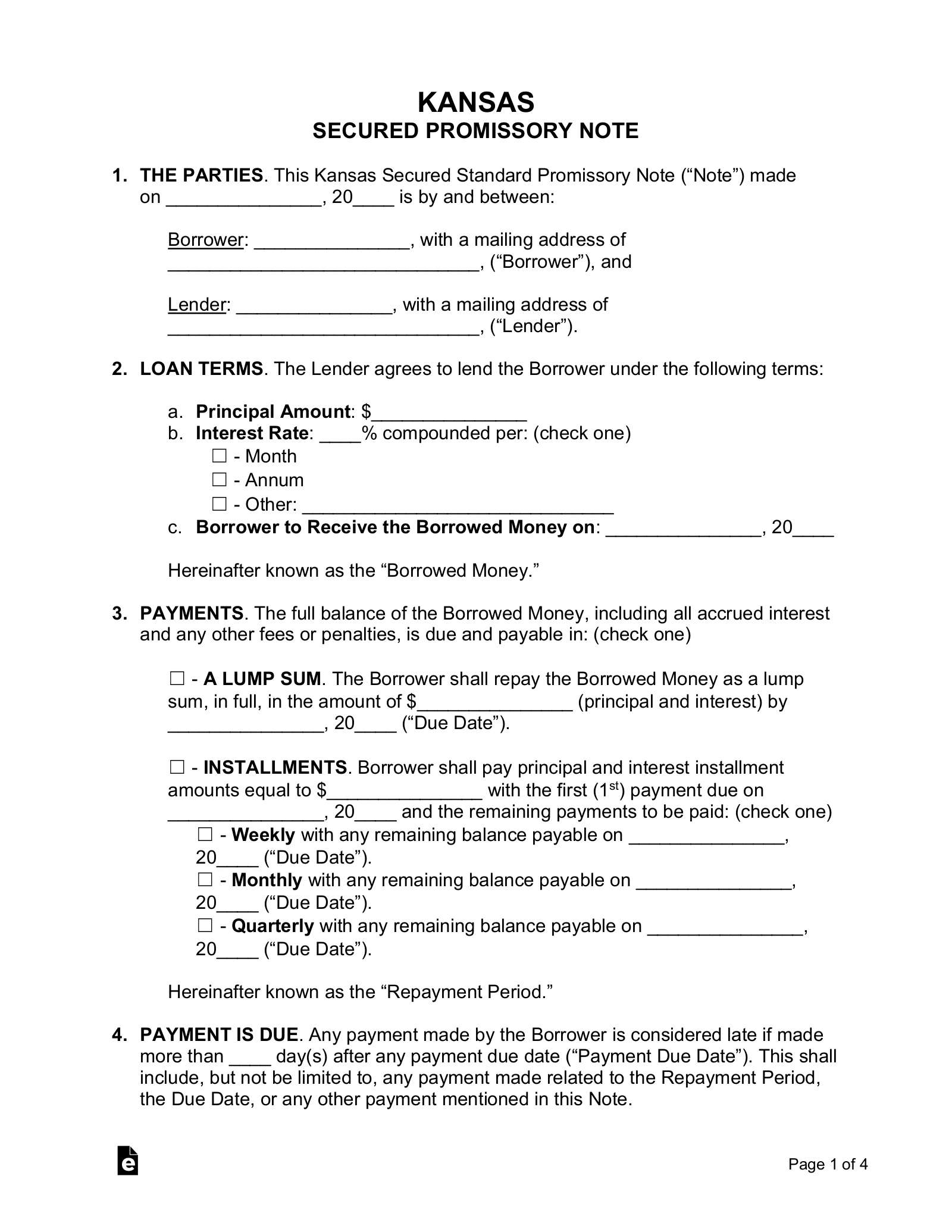

Secured Promissory Note – Protects the lender by requiring the borrower to set aside security, which consists of an item such as a home, vehicle, or boat. In the case of a default on the balance, the lender is granted the items put into security to help cover the cost of the unpaid balance.

Secured Promissory Note – Protects the lender by requiring the borrower to set aside security, which consists of an item such as a home, vehicle, or boat. In the case of a default on the balance, the lender is granted the items put into security to help cover the cost of the unpaid balance.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Far riskier to the lender than the secured version, the unsecured promissory note does not give the lender security. If a default were to occur, the lender would not have a solid plan for obtaining the money on the note.

Unsecured Promissory Note – Far riskier to the lender than the secured version, the unsecured promissory note does not give the lender security. If a default were to occur, the lender would not have a solid plan for obtaining the money on the note.

Download: PDF, MS Word, OpenDocument

Usury Statute

Creditors shall be allowed to receive interest at the rate of 10% per annum, when no other rate of interest is agreed upon, for any money after it becomes due; for money lent or money due on settlement of account, from the day of liquidating the account and ascertaining the balance; for money received for the use of another and retained without the owner’s knowledge of the receipt; for money due and withheld by an unreasonable and vexatious delay of payment or settlement of accounts; for all other money due and to become due for the forbearance of payment whereof an express promise to pay interest has been made; and for money due from corporations and individuals to their daily or monthly employees, from and after the end of each month, unless paid within 15 days thereafter.

(a) Subject to the following provision, the parties to any bond, bill, promissory note or other instrument of writing for the payment or forbearance of money may stipulate therein for interest receivable upon the amount of such bond, bill, note or other instrument of writing, at a rate not to exceed 15% per annum unless otherwise specifically authorized by law.

(b) No penalty shall be assessed against any party for prepayment of any home loan evidenced by a note secured by a real estate mortgage where such prepayment is made more than six months after execution of such note.

(c) The lender may collect from the borrower:

(1) The actual fees paid a public official or agency of the state, or federal government, for filing, recording or releasing any instrument relating to a loan subject to the provisions of this section; and

(2) reasonable expenses incurred by the lender in connection with the making, closing, disbursing, extending, readjusting or renewing of loans subject to the provisions of this section.

…