Updated February 16, 2024

A certificate of trust legally proves that a trust exists and includes general information to verify its existence. It also grants power to a trustee to act on behalf of the trust. It’s common for financial institutions to request a certificate of trust before disbursing funds to a trustee or successor trustee.

What to Include in a Certificate of Trust

- Name of trust

- Type (revocable or irrevocable)

- Tax ID #

- Date of trust creation

- Settlor or grantor’s name

- Trustee’s name

- Trustee’s powers

- Successor’s trustee’s name

- Description of property (if real estate is included)

Table of Contents |

How to Get a Certificate of Trust (4 steps)

- Step 1 – Obtain the Trust Document

- Step 2 – Contact the Creator

- Step 3 – Copy the Details

- Step 4 – Get Notarized

Step 1 – Obtain the Trust Document

It’s best to obtain the document, either by finding it through personal files or contacting the attorney who drafted the trust.

Step 2 – Contact the Creator

When contacting the creator of the trust, make sure that there are no updates or amendments since the original version. This will help the accuracy of the certificate of trust.

Step 3 – Copy the Details

After confirmation of having the latest trust version, it’s time to copy the details onto the certificate of trust.

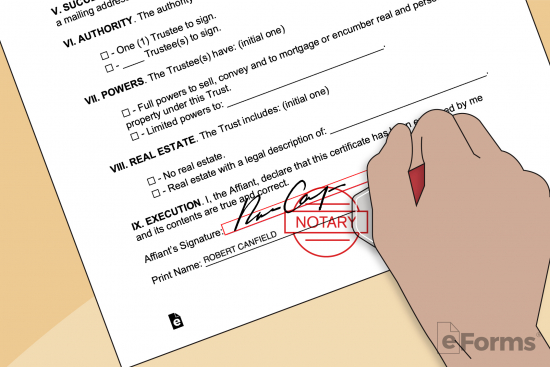

Step 4 – Get Notarized

It’s commonly required to get the certificate of trust notarized. A notary public will verify the affiant’s identification and acknowledge their statements as true and accurate.

State Laws

| State | Laws |

| Alabama | § 19-3B-1013 |

| Alaska | AS 13.36.079 |

| Arizona | ARS 14-11013 |

| Arkansas | § 28-73-1013 |

| California | PROB 18100.5 |

| Colorado | § 15-5-1013 |

| Connecticut | § 45a-499zzz |

| Delaware | § 3591 |

| Florida | 736.1017 |

| Georgia | § 53-12-280 |

| Hawaii | § NEW-1013 |

| Idaho | 68-115 |

| Illinois | 760 ILCS 3/1013 |

| Indiana | § 30-4-4-5 |

| Iowa | §633A.4604 |

| Kansas | 58a-1013 |

| Kentucky | 386B.10-120 |

| Louisiana | § 8:452 |

| Maine | §1013 |

| Maryland | § 14.5-910 |

| Massachusetts | Section 1013 |

| Michigan | 700.7913 |

| Minnesota | 501C.1013 |

| Mississippi | § 91-8-1013 |

| Missouri | 456.10-1013 |

| Montana | 72-38-1013 |

| Nebraska | 30-38,103 |

| Nevada | NRS 164 |

| New Hampshire | 564-B:10-1013 |

| New Jersey | 3B:31-81 |

| New Mexico | 46A-10-1012 |

| New York | No statute |

| North Carolina | § 36C-10-1013 |

| North Dakota | 59-18-13 |

| Ohio | 5810.13 |

| Oklahoma | §6-902 |

| Oregon | UTC 1013 |

| Pennsylvania | § 7790.3 |

| Rhode Island | § 34-4-27 |

| South Carolina | § 62-7-1013 |

| South Dakota | § 55-4-51 |

| Tennessee | § 35-15-1013 |

| Texas | § 114.086 |

| Utah | 75-7-1013 |

| Vermont | § 1013 |

| Virginia | § 64.2-804 |

| Washington | 11.98.075 |

| Washington D.C. | § 19–1310.13 |

| West Virginia | §44D-10-1013 |

| Wisconsin | § 701.1013 |

| Wyoming | § 4-10-1014 |

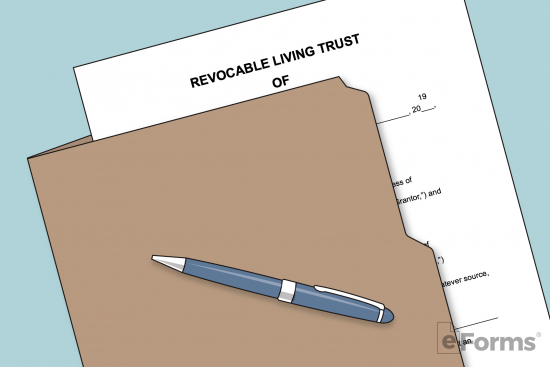

Sample Certificate of Trust

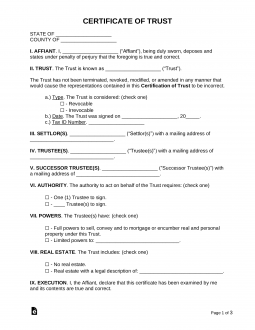

CERTIFICATE OF TRUST

STATE OF [STATE]

COUNTY OF [COUNTY]

I. AFFIANT. I, [AFFIANT’S NAME] (“Affiant”), being duly sworn, deposes and states under penalty of perjury that the foregoing is true and correct.

II. TRUST. The Trust is known as [NAME OF TRUST] (“Trust”).

The Trust has not been terminated, revoked, modified, or amended in any manner that would cause the representations contained in this Certification of Trust to be incorrect.

a.) Type. The Trust is considered: (check one)

☐ – Revocable

☐ – Irrevocable

b.) Date. The Trust was signed on [DATE]

c.) Tax ID Number. [#]

III. SETTLOR(S). [NAME OF SETTLOR] (“Settlor(s)”) with a mailing address of [ADDRESS].

IV. TRUSTEE(S). [NAME OF TRUSTEE] (“Trustee(s)”) with a mailing address of [ADDRESS].

V. SUCCESSOR TRUSTEE(S). [NAME OF SUCCESSOR TRUSTEE] (“Successor Trustee(s)”) with a mailing address of [ADDRESS].

VI. AUTHORITY. The authority to act on behalf of the Trust requires: (check one)

☐ – One Trustee to sign.

☐ – [#] Trustee(s) to sign.

VII. POWERS. The Trustee(s) have: (check one)

☐ – Full powers to sell, convey and to mortgage or encumber real and personal property under this Trust.

☐ – Limited powers to: [DESCRIPTION].

VIII. REAL ESTATE. The Trust includes: (check one)

☐ – No real estate.

☐ – Real estate with a legal description of: [DESCRIPTION].

IX. EXECUTION. I, the Affiant, declare that this certificate has been examined by me and its contents are true and correct.

Affiant’s Signature: _____________________________ Date: ______________

Print Name: _____________________________