Updated April 22, 2024

An affidavit of heirship is a legal document used to identify the rightful heirs of a deceased person’s properties and assets. It is typically used when the decedent dies without creating a valid will or a trust. Most states and counties have their own laws and procedures governing the affidavit of heirship.

Common Uses

- To transfer property ownership of a deceased person without a will

- To provide proof of heirship as part of probate proceedings

- To overwrite a will that was not probated within the required timeframe

Table of Contents |

What is an Affidavit of Heirship?

An affidavit of heirship is a written statement made under oath naming all the surviving heirs of a deceased person (“decedent”). It is filed with the court to initiate the distribution of the decedent’s estate if they died intestate, meaning they did not leave a last will and testament.

Specific requirements can vary across different states and counties. In some states, such as Texas, an affidavit of heirship can be used to bypass the lengthy probate process to transfer ownership of the decedent’s real property.[1]

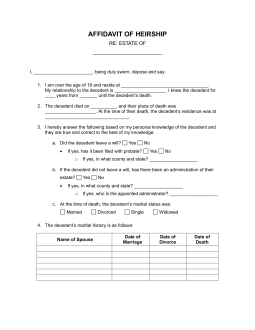

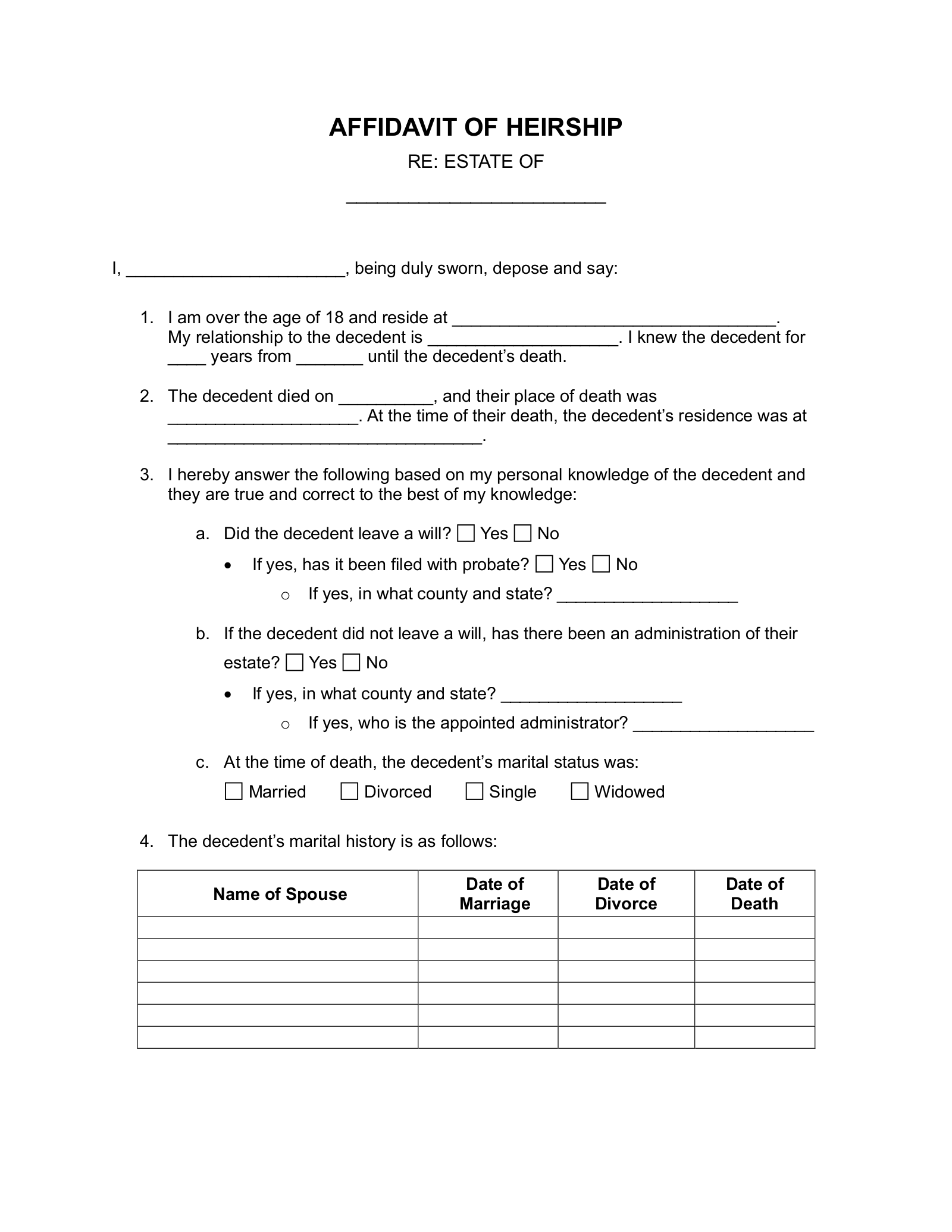

What Should Be Included?

An affidavit of heirship commonly includes the following information:[2]

- The decedent’s name, address, date and place of death

- The decedent’s surviving spouse and former spouses — names and addresses

- All known surviving relatives, including children, grandchildren, siblings, parents, nieces, and nephews — names and addresses

- The decedent’s deceased relatives and their date of death

- The affiant (person filling out the affidavit)’s contact information and signature

- A list of the decedent’s real properties and debts (if applicable)

- A statement that the decedent did not have a will

Who Can Fill Out an Affidavit of Heirship?

In most states, the affidavit of heirship must be completed by a disinterested third party who:

- Is familiar with the decedent’s family history and tree; and

- Will not benefit from the decedent’s estate.

The affiant — the person filing the affidavit — can be a close friend of the decedent, a family friend, or a neighbor. A last resort can be another family member with no financial interest in the estate.

Depending on the jurisdiction, the affiant may be required to have known the decedent for ten years or more.

Signing Requirements

An affidavit of heirship must be sworn and signed by the affiant in the presence of a notary public. Depending on the jurisdiction, an additional disinterested witness may be required to sign the document.

Where to File

It is typically filed and recorded in the county records office in the county where the decedent’s estate is located. Depending on the jurisdiction, it may also be filed with the local probate or surrogate’s court.

How to File (4 steps)

- Gather Required Information

- Complete the Affidavit of Heirship Form

- Get the Affidavit of Heirship Notarized

- File the Affidavit of Heirship

1. Gather Required Information

The affidavit of heirship requires detailed information about the decedent’s marital history and family tree, including the full names and contact information of all possible heirs and facts about the decedent’s death. It may be helpful to obtain the decedent’s death certificate.

It is also recommended to double-check with the county clerk to verify that the decedent did not record a last will and testament.

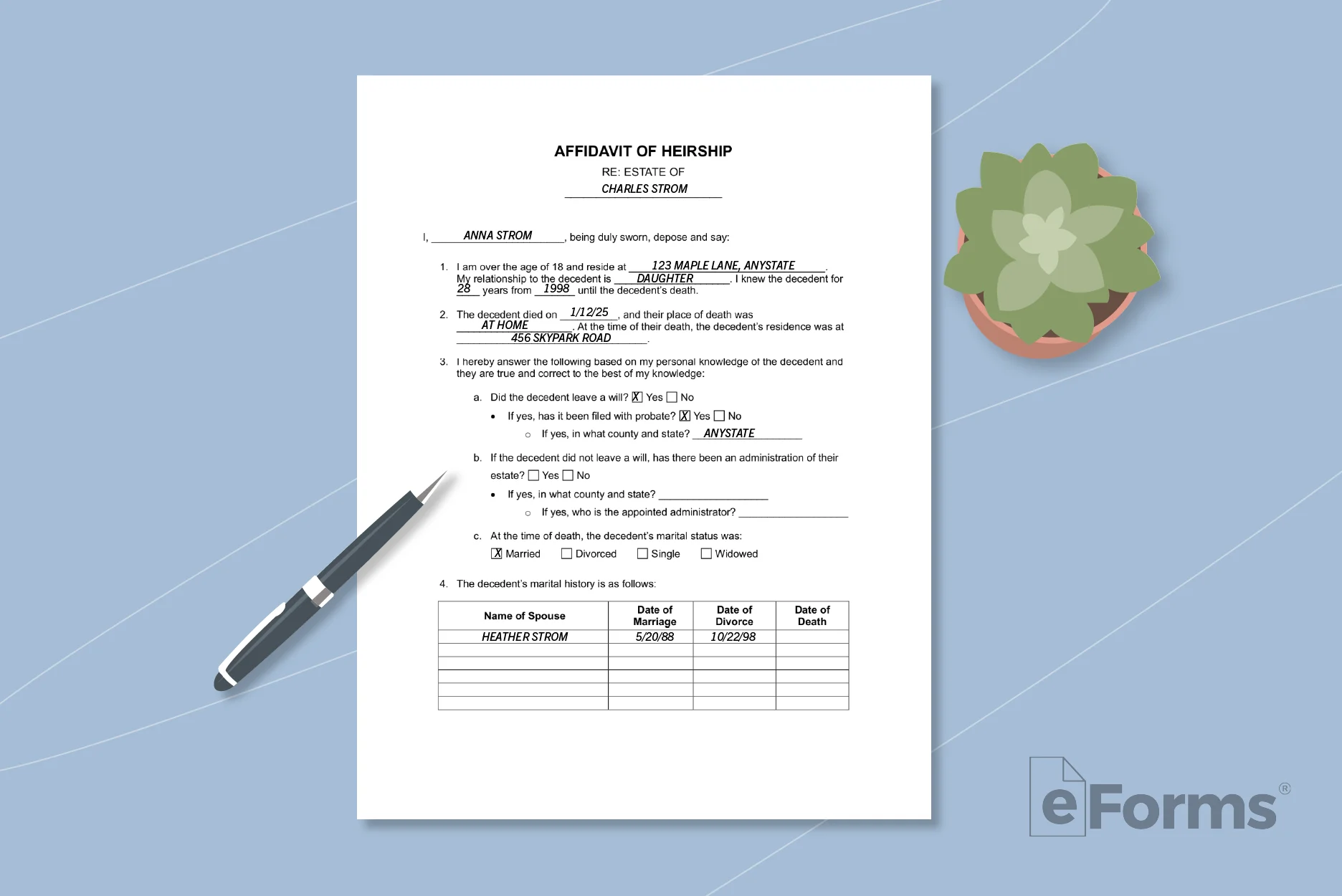

2. Complete the Affidavit of Heirship Form

All the information provided on the affidavit of heirship is sworn to be true under penalty of perjury. As such, the affiant (person signing the affidavit) must do their due diligence in acquiring and fact-checking all the information provided on the affidavit of heirship.

4. File the Affidavit of Heirship

After the affidavit of heirship is completed and notarized, it must be filed in person in the county where the decedent owned property. Because local filing procedures can vary widely between jurisdictions, it is recommended to check with the local county clerk’s office about where to file the affidavit and the cost of filing fees.

Frequently Asked Questions (FAQs)

Can I do my own affidavit of heirship?

The affidavit of heirship must be sworn to and signed by a disinterested third party who is closely familiar with the decedent’s family tree and marital history.

Does an affidavit of heirship transfer title?

It depends on the state and county. In Texas, an affidavit of heirship can be used to transfer ownership of real property to the legal heir without going through probate. In other states, an affidavit of heirship can be required as part of the probate process, meaning the affidavit alone cannot transfer title.

Can an affidavit of heirship be contested?

Yes. To contest an affidavit of heirship, the contesting party must file their own affidavit with supporting documentation to prove their claim.

Sources