Updated June 08, 2023

An affidavit of successor trustee is filed when a trustee is removed or has died and is being replaced with the successor trustee. This is common in trusts (or joint tenancy) when it’s written that if anything should happen to the trustee, the successor trustee will take over ownership.

When to Use?

When the trustee has been removed for any reason, including:

- Death

- Resignation

- Incompetency

- Guardianship

- Any reason for removal of the trustee.

Where Is It Filed?

- Bonds – Use FS Form 4000.

- Real Estate – At the local Registry of Deeds.

- Stocks – Contact the investment brokerage firm.

- Vehicles – At the local Dept. of Motor Vehicles (DMV)

Sample

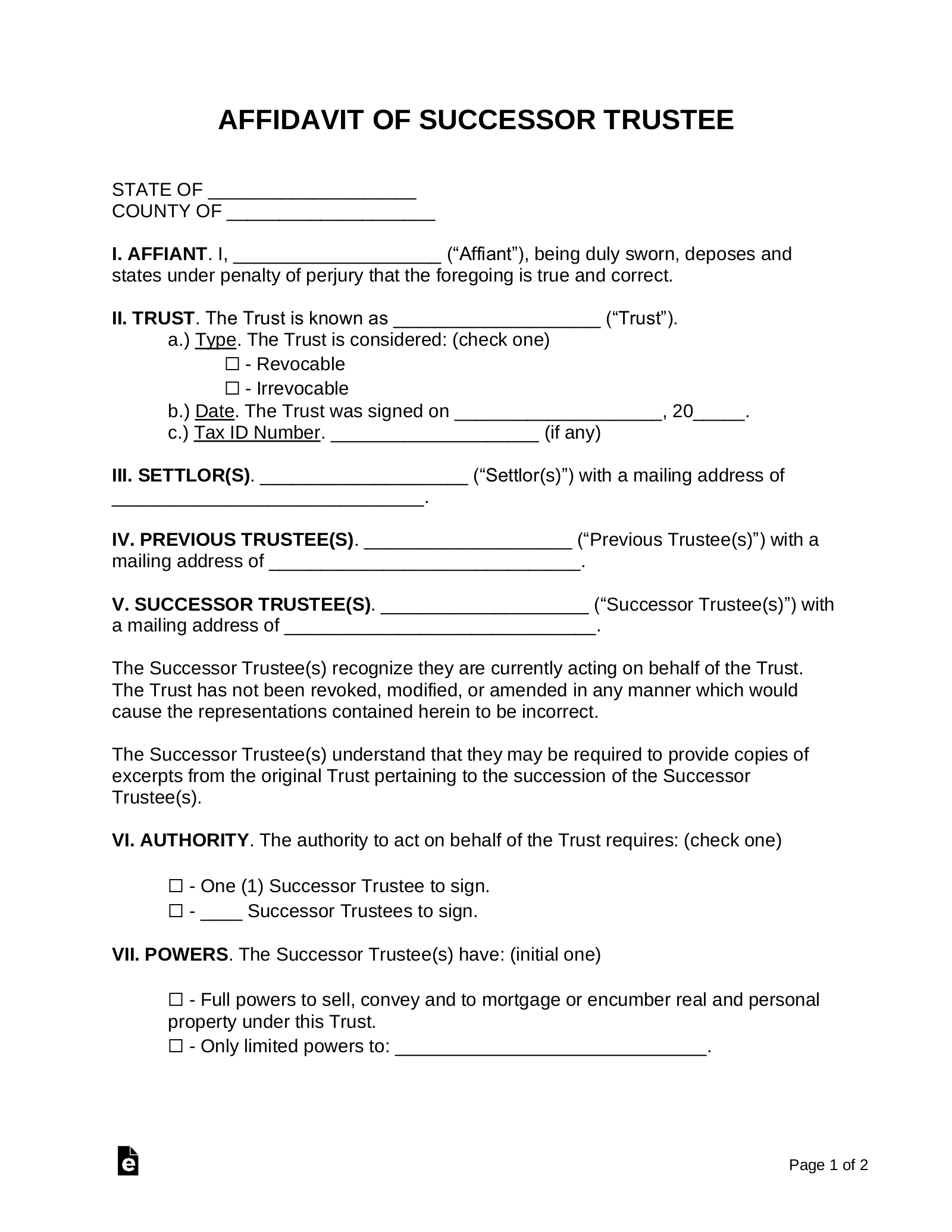

AFFIDAVIT OF SUCCESSOR TRUSTEE

STATE OF [STATE]

COUNTY OF [COUNTY]

I. AFFIANT. I, [NAME OF AFFIANT] (“Affiant”), being duly sworn, deposes and states under penalty of perjury that the foregoing is true and correct.

II. TRUST. The Trust is known as [NAME OF TRUST] (“Trust”).

a.) Type. The Trust is considered: (check one)

☐ – Revocable

☐ – Irrevocable

b.) Date. The Trust was signed on [DATE OF TRUST].

c.) Tax ID Number. [TAX NUMBER] (if any)

III. SETTLOR(S). [NAME(S) OF SETTLOR(S)] (“Settlor(s)”) with a mailing address of [ADDRESS OF SETTLOR(S)].

IV. PREVIOUS TRUSTEE(S). [NAME(S) OF TRUSTEE(S)] (“Previous Trustee(s)”) with a mailing address of [ADDRESS OF TRUSTEE(S)].

V. SUCCESSOR TRUSTEE(S). [NAME(S) OF SUCCESSOR TRUSTEE(S)] (“Successor Trustee(s)”) with a mailing address of [ADDRESS OF SUCCESSOR TRUSTEE(S)].

The Successor Trustee(s) recognize they are currently acting on behalf of the Trust. The Trust has not been revoked, modified, or amended in any manner which would cause the representations contained herein to be incorrect.

The Successor Trustee(s) understand that they may be required to provide copies of excerpts from the original Trust pertaining to the succession of the Successor Trustee(s).

VI. AUTHORITY. The authority to act on behalf of the Trust requires: (check one)

☐ – One (1) Successor Trustee to sign.

☐ – [#] Successor Trustees to sign.

VII. POWERS. The Successor Trustee(s) have: (initial one)

☐ – Full powers to sell, convey and to mortgage or encumber real and personal property under this Trust.

☐ – Only limited powers to: [LIMITED POWERS].

VIII. REAL ESTATE. The Trust includes: (initial one)

☐ – No real estate.

☐ – Real estate with a legal description of: [LEGAL DESCRIPTION].

IX. EXECUTION. I, the Affiant, declare that this certificate has been examined by me and its contents are true and correct.

Affiant’s Signature: _____________________________ Date: ______________

Print Name: _____________________________