Updated April 12, 2024

A Vermont deed is used to document the transfer of ownership in real estate from one party (the “seller” or “grantor”) to another (the “buyer” or “grantee”). Both parties will need to enter their names, mailing addresses, and marital status (i.e. single or married). After a detailed legal description has been made the form may be authorized by the Seller. A signature must be made in front of a Notary Public with their signature or acknowledgment placed on the form as well. Afterward, the real estate taxes must be paid to the Dept. of Taxation and then the form may be filed with the County Clerk’s Office.

Laws – Title 27 (Property), Chapter 5 – Conveyance of Real Estate

Real Estate Taxes (Form PT-172) – For the deed to be processed the Real Estate Taxes needs to be filed with the Department of Taxation. After payment, this form should be attached to the Quit Claim Deed and can be filed online.

Recording – All deeds are to be filed in the County Clerk’s Office in the jurisdiction of where the property is located.[1]

Signing – All deeds in the State of Vermont are to be acknowledged before a notary public.[2][3]

Deed Types (3)

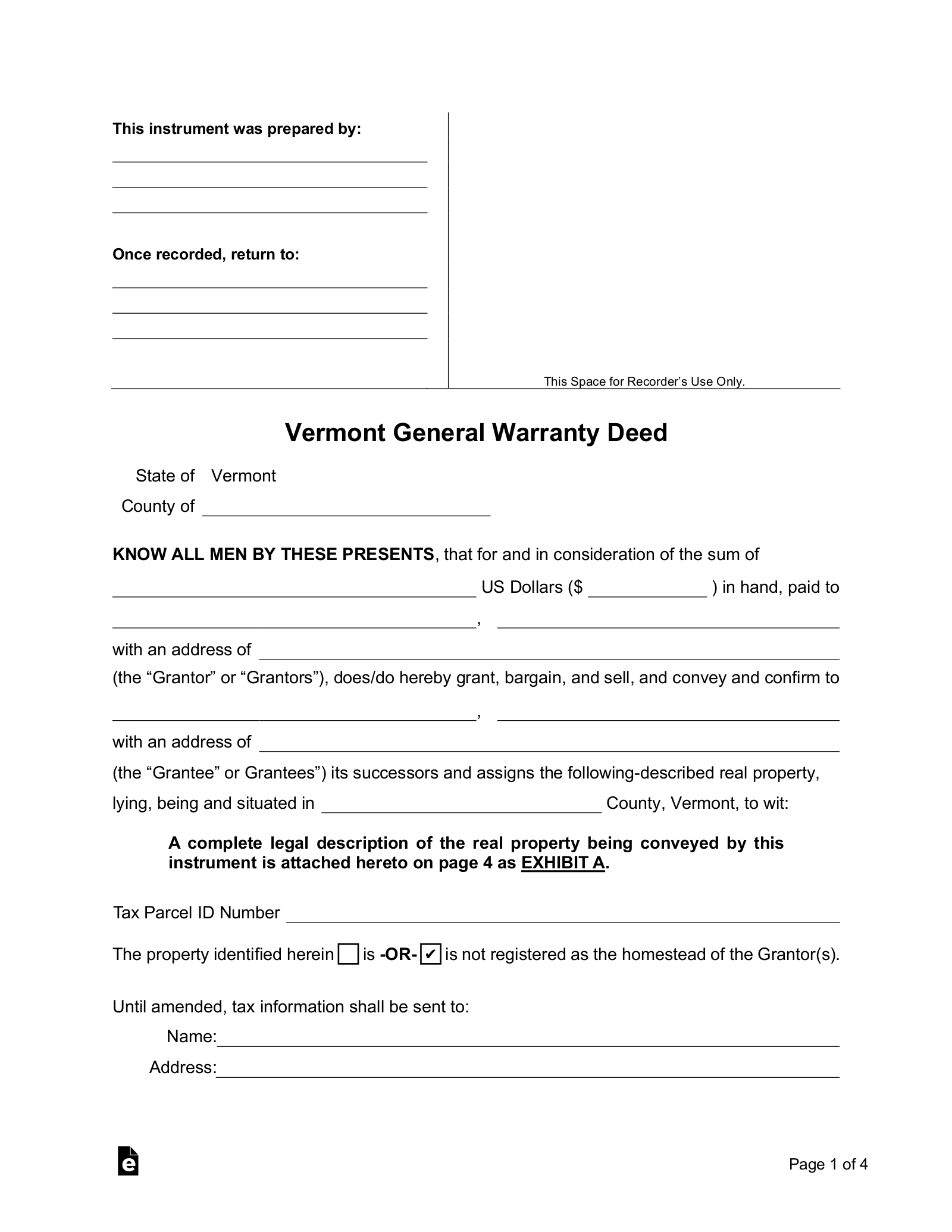

General Warranty – The most secure way to convey a title. This option guarantees that the grantor is the owner of the property with no other interest from outside parties.

General Warranty – The most secure way to convey a title. This option guarantees that the grantor is the owner of the property with no other interest from outside parties.

Download: PDF, MS Word, Open Document

Quit Claim – Offers no guarantee that the grantor is the owner of the property. This implies that the owner owns the property and that they are conveying any interest they “may have” in the property.

Quit Claim – Offers no guarantee that the grantor is the owner of the property. This implies that the owner owns the property and that they are conveying any interest they “may have” in the property.

Download: PDF, MS Word, Open Document

Special Warranty – Offers a limited warranty with the owner guaranteeing a clear title only during the tenure of their ownership.

Special Warranty – Offers a limited warranty with the owner guaranteeing a clear title only during the tenure of their ownership.

Download: PDF, MS Word, Open Document

Vermont Property Search (4 steps)

In order to complete the deed you have selected from above the Legal Description that describes the property will need to be located. This can be completed by following the instructions below.

Step 1

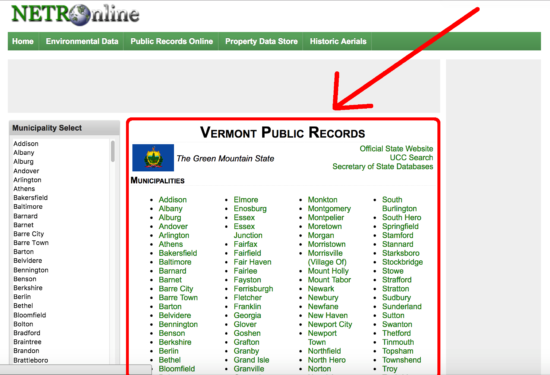

Go to this online public records database.

Step 2

Every jurisdiction is different and you may need to contact your County Assessor in order to obtain your information.

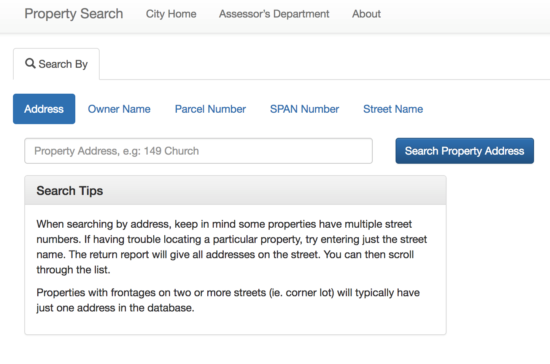

For this Example we are going to be using the City of Burlington.

Step 3

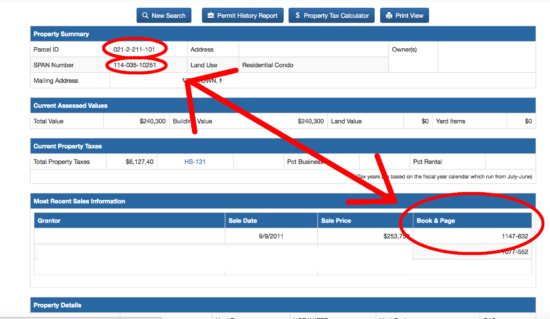

In most jurisdictions you are able to search by the Property Owner’s Name or Address. For the City of Burlington (for example) we can perform a lookup by Address, Owner’s Name, Parcel Number, SPAN Number, Street Name.

Step 4

Now you will be able to look up the Book/Page Numbers along with the Property IDs to help legally describe the property for recording.