Updated September 26, 2023

An at-will employment contract allows an employer to terminate an employee for any reason (without cause) while also allowing an employee to quit at any time. The term “at-will” or “without cause” means to terminate an employee for any reason other than disability, sexual or racial discrimination, retaliatory, or violation of public policy.

Table of Contents |

What is At-Will Employment?

At-will employment, in its purest form, is when an employer and employee may terminate their relationship at any time and for any reason with no advance notice. If there is no written agreement between the employee and employer, the employee may be able to claim that the termination was not justified due to exceptions as regulated by State law.

Federal Exceptions

Under federal laws, an employer cannot terminate an employee for any of the following:

- Discrimination – Based on race, religion, gender, age, or national origin.[1]

- Lie Detector Testing – Employer cannot suggest or require the employee to take part in a polygraph test.[2]

- Alien Status – Based on their immigration status as long as the employee is permitted to work in the United States.[3]

- OSHA Requirements – Workplace or other hazards that are reported to OSHA.[4]

State Exceptions (3 types)

Public Policy Exception

If a state offers the public policy exception to at-will employment, employers may not fire an employee if the termination involves an employee’s compliance with state policy, such as refusing to engage in illegal activity at the employer’s request or exercising a legal right.

The public policy exception is widely recognized and is offered in all but the following seven (7) states: Alabama, Florida, Georgia, Louisiana, Maine, Nebraska, New York, and Rhode Island.

Implied Contract Exception

An employer can’t fire an employee when an implied contract (such as oral suggestions regarding job security or procedures) has formed between the employer and employee, even though no written document may exist. Cases of implied employment contracts can also arise from the language in an employee handbook that describes termination policies, such as a policy declaring that employees will not be fired except for good cause.

The implied contract exception is active in all but the following twelve (12) States: Delaware, Florida, Georgia, Indiana, Louisiana, Massachusetts, Missouri, Montana, North Carolina, Pennsylvania, Rhode Island, Texas, and Virginia.

Good Faith Exception

The good faith and fair dealings covenant forbid employers from firing or demoting an employee when the termination is a result of employer malintent. If an employer fires an employee in an act of bad faith, the former employee may have grounds for a wrongful termination suit.

An example application of the good-faith exception is K Mart Corp. v. Ponsock, where an employee was terminated just before they were about to reach retirement age.[5] This exception is only valid in the following eleven (11) States: Alabama, Alaska, Arizona, California, Delaware, Idaho, Massachusetts, Montana, Nevada, Utah, and Wyoming.

At-Will Exceptions – By State (Table)

Below is a table that reveals the State laws for exceptions in regards to at-will employees without a written agreement.

| State | Public Policy Exception | Implied-Contract Exception | Good-Faith Exception |

| Alabama | No | Yes | Yes |

| Alaska | Yes | Yes | Yes |

| Arizona | Yes | Yes | Yes |

| Arkansas | Yes | Yes | No |

| California | Yes | Yes | Yes |

| Colorado | Yes | Yes | No |

| Connecticut | Yes | Yes | No |

| Delaware | Yes | No | Yes |

| Florida | No | No | No |

| Georgia | No | No | No |

| Hawaii | Yes | Yes | No |

| Idaho | Yes | Yes | Yes |

| Illinois | Yes | Yes | No |

| Indiana | Yes | No | No |

| Iowa | Yes | Yes | No |

| Kansas | Yes | Yes | No |

| Kentucky | Yes | Yes | No |

| Louisiana | No | No | No |

| Maine | No | Yes | No |

| Maryland | Yes | Yes | No |

| Massachusetts | Yes | No | Yes |

| Michigan | Yes | Yes | No |

| Minnesota | Yes | Yes | No |

| Mississippi | Yes | Yes | No |

| Missouri | Yes | No | No |

| Montana | Yes | No | Yes |

| Nebraska | No | Yes | No |

| Nevada | Yes | Yes | Yes |

| New Hampshire | Yes | Yes | No |

| New Jersey | Yes | Yes | No |

| New Mexico | Yes | Yes | No |

| New York | No | Yes | No |

| North Carolina | Yes | No | No |

| North Dakota | Yes | Yes | No |

| Ohio | Yes | Yes | No |

| Oklahoma | Yes | Yes | No |

| Oregon | Yes | Yes | No |

| Pennsylvania | Yes | No | No |

| Rhode Island | No | No | No |

| South Carolina | Yes | Yes | No |

| South Dakota | Yes | Yes | No |

| Tennessee | Yes | Yes | No |

| Texas | Yes | No | No |

| Utah | Yes | Yes | Yes |

| Vermont | Yes | Yes | No |

| Virginia | Yes | No | No |

| Washington | Yes | Yes | No |

| West Virginia | Yes | Yes | No |

| Wisconsin | Yes | Yes | No |

| Wyoming | Yes | Yes | Yes |

| Source: “Employment at Will” | |||

How to Write

Download: PDF, Microsoft Word (.docx), or Open Document Text (.odt).

1 – This Employment Agreement Template Should Be Saved To Your Machine

Any of the three buttons beneath the preview image will deliver the agreement pictured in the preview image. Select the file format that is most compatible with the software environment on your machine. If you have a program that can edit a PDF or word processing document then, you may use it to prepare this paperwork on screen before printing it to be signed. Otherwise, you may simply open the PDF with your browser and print it at your discretion to fill out manually. Keep in mind, once this form is completed each party must initial the bottom of each page during the review process. ![]()

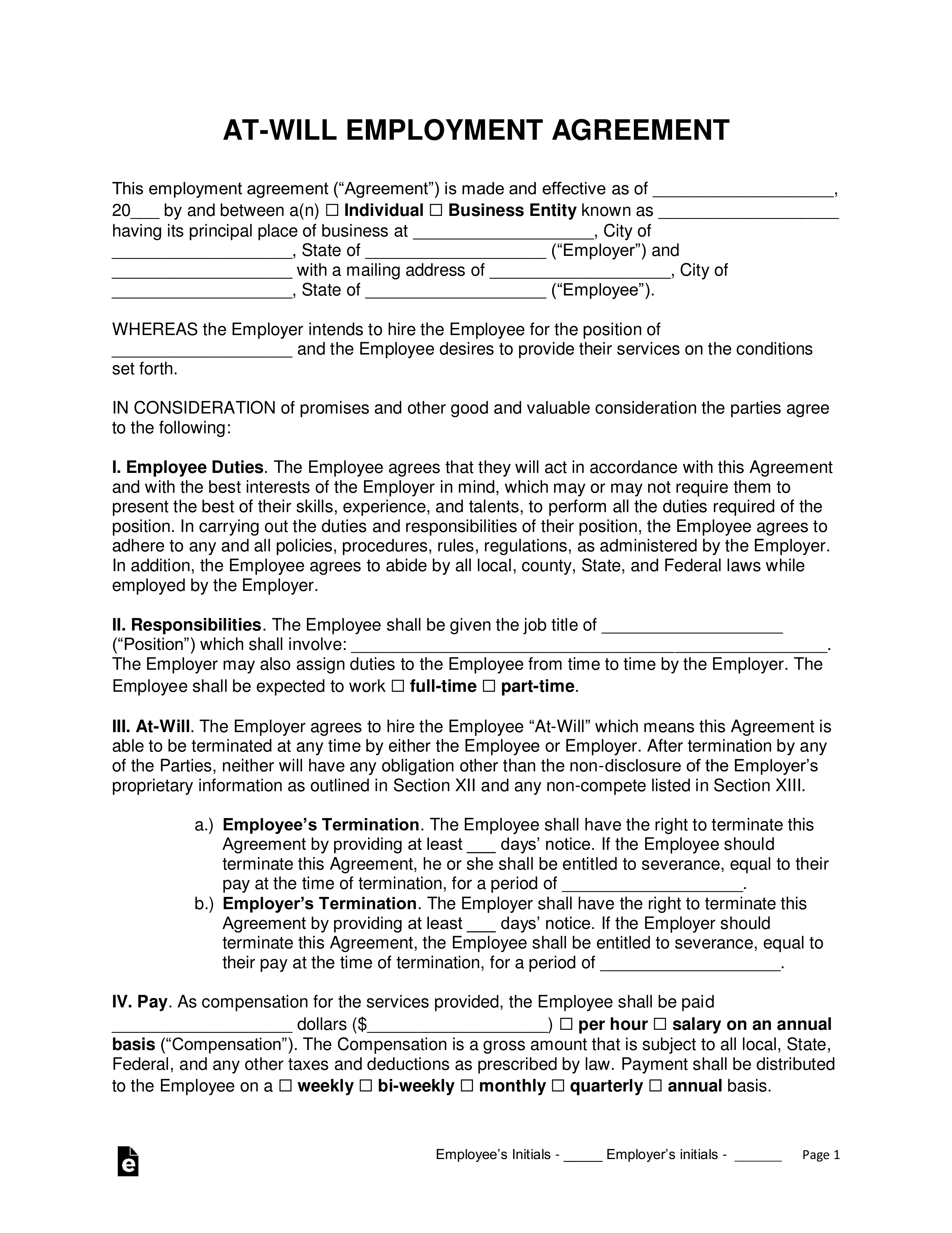

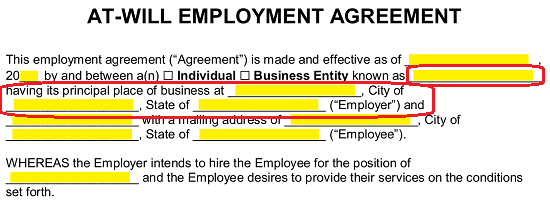

2 – Introduce The Employer And The Concerned Employee

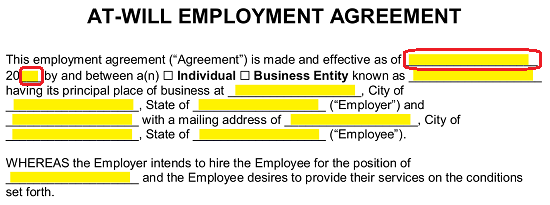

The initial statement will frame the basic goal of this paperwork. Here, we will define the agreement by naming its effective date, and the two entities involved. Begin by entering the month and calendar day of when this agreement goes in effect on the first blank space. Continue by entering the two-digit year of the calendar date when this agreement is effective on the second blank space.  Next, we will name both the entities involved beginning with the Employer. Locate the two checkboxes in this statement (“Individual” and “Business Entity”). Then either mark the first checkbox if the employer is a person or the second checkbox is the Employer is an entity such as a corporation or company.

Next, we will name both the entities involved beginning with the Employer. Locate the two checkboxes in this statement (“Individual” and “Business Entity”). Then either mark the first checkbox if the employer is a person or the second checkbox is the Employer is an entity such as a corporation or company.  Now, locate the term “…Known As” after the checkboxes. Use the first blank space following this phrase to report the legal name of the Employer. You will also need to make sure the Employer’s street address is supplied to the blank line after the words “Principal Place Of Business At.” The next two blank lines have been reserved to record the city and state where the Employer’s street address is located. This must be the Employer’s legal business address such as a corporation’s headquarters.

Now, locate the term “…Known As” after the checkboxes. Use the first blank space following this phrase to report the legal name of the Employer. You will also need to make sure the Employer’s street address is supplied to the blank line after the words “Principal Place Of Business At.” The next two blank lines have been reserved to record the city and state where the Employer’s street address is located. This must be the Employer’s legal business address such as a corporation’s headquarters.  We must also introduce the Employee in this statement. The Employee’s full name should be furnished to the first blank space after the Employer information you entered. As with the Employer, make sure to document the Employee’s official street address, city, and state in this statement using the last three blank spaces of this statement.

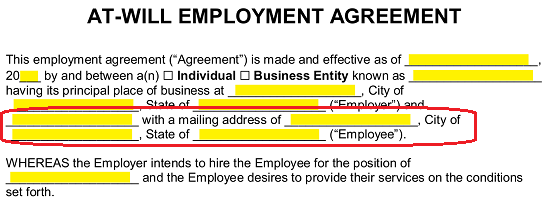

We must also introduce the Employee in this statement. The Employee’s full name should be furnished to the first blank space after the Employer information you entered. As with the Employer, make sure to document the Employee’s official street address, city, and state in this statement using the last three blank spaces of this statement.  The last piece of information requested before we define the terms will be the position or title the Employee will hold with the Employer. Produce this information on the blank space in the statement beginning with the words “Whereas The Employer Intends To Hire…”

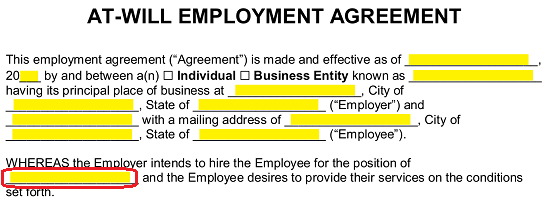

The last piece of information requested before we define the terms will be the position or title the Employee will hold with the Employer. Produce this information on the blank space in the statement beginning with the words “Whereas The Employer Intends To Hire…”

3 – Discuss The Terms Of Employment

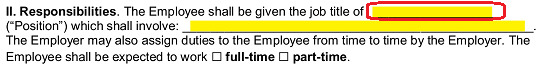

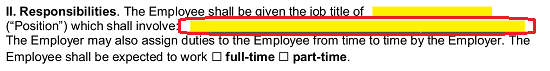

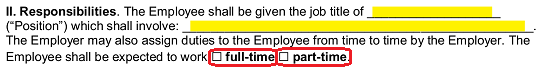

It should be kept in mind, that while every article will not require direct input, it should be considered a requirement that both signature parties read this document in full before and after it has been filled out. When you are ready, locate the second article “II. Responsibilities,” then document the official job title the Employee will hold with the employer on the first blank space.  Additionally, the second blank space has been reserved for the job description used to define the duties the Employee is being hired to perform.

Additionally, the second blank space has been reserved for the job description used to define the duties the Employee is being hired to perform.  This article will conclude with two checkboxes. Mark the first checkbox if the Employee will be considered a “Full-Time” Employee or mark the second checkbox if the Employee will be considered a “Part-Time” Employee.

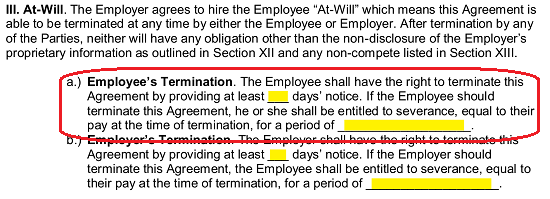

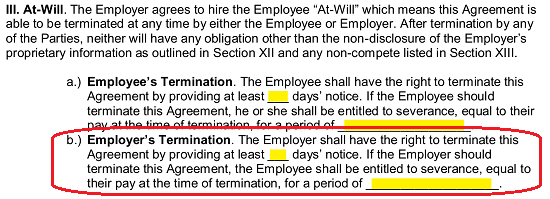

This article will conclude with two checkboxes. Mark the first checkbox if the Employee will be considered a “Full-Time” Employee or mark the second checkbox if the Employee will be considered a “Part-Time” Employee.  In article “III. At-Will,” we will go into some detail how this professional arrangement must terminate. Notice the two subsections in this area “A.) Employee’s Termination” and “B.) Employer’s Termination.” Both statements must be satisfied with information so this document can function correctly. First, provide the number of “Days’ Notice” the Employee must give the Employer if he or she decides to terminate his or her employment on the first blank space in “A.) Employee’s Termination.” If the Employee should receive severance “Equal To Their Pay At the Time” then supply the last blank space here with how long this severance pay will continue from the date of termination.

In article “III. At-Will,” we will go into some detail how this professional arrangement must terminate. Notice the two subsections in this area “A.) Employee’s Termination” and “B.) Employer’s Termination.” Both statements must be satisfied with information so this document can function correctly. First, provide the number of “Days’ Notice” the Employee must give the Employer if he or she decides to terminate his or her employment on the first blank space in “A.) Employee’s Termination.” If the Employee should receive severance “Equal To Their Pay At the Time” then supply the last blank space here with how long this severance pay will continue from the date of termination.  In “B.) Employer’s Termination,” report how many “Days’ Notice” the Employer must give the Employee (before his or her employment is terminated) on the first blank space. If the Employer chooses to provide severance pay to the Employee (equal to the current pay) then use the second blank space to document how long this severance period will continue.

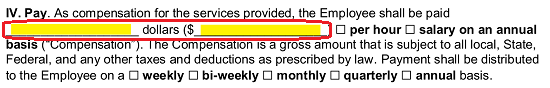

In “B.) Employer’s Termination,” report how many “Days’ Notice” the Employer must give the Employee (before his or her employment is terminated) on the first blank space. If the Employer chooses to provide severance pay to the Employee (equal to the current pay) then use the second blank space to document how long this severance period will continue.  The next article, “IV. Pay,” will also require some facts documented. Use the first two blank lines and one of the checkboxes to record how much money will be paid to the Employee. This number should be written out on the first blank line then recorded numerically in the parenthesis.

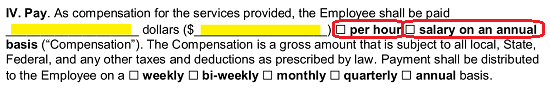

The next article, “IV. Pay,” will also require some facts documented. Use the first two blank lines and one of the checkboxes to record how much money will be paid to the Employee. This number should be written out on the first blank line then recorded numerically in the parenthesis.  Naturally, you must indicate if the amount you reported will be paid on “Per Hour” or if it is an “Annual Salary.” If the reported amount will be paid Per Hour, then mark the first checkbox. If this amount will be paid annually then mark the second checkbox.

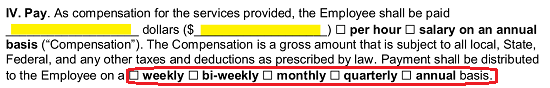

Naturally, you must indicate if the amount you reported will be paid on “Per Hour” or if it is an “Annual Salary.” If the reported amount will be paid Per Hour, then mark the first checkbox. If this amount will be paid annually then mark the second checkbox.  Now, find the four checkboxes labeled “Weekly,” “Bi-Weekly,” “Monthly,” “Quarterly,” and Annual.” Check the box that best defines how often the Employee will receive a paycheck. For instance, if the Employee will be paid four times a month then, mark the first box or if the Employee will be paid once a year, then mark the last checkbox. You may only choose one box.

Now, find the four checkboxes labeled “Weekly,” “Bi-Weekly,” “Monthly,” “Quarterly,” and Annual.” Check the box that best defines how often the Employee will receive a paycheck. For instance, if the Employee will be paid four times a month then, mark the first box or if the Employee will be paid once a year, then mark the last checkbox. You may only choose one box.

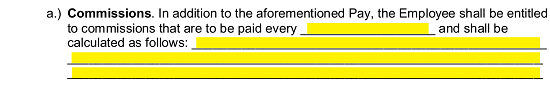

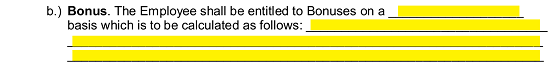

In some cases, additional monies may be expected by the Employee as per the current agreed upon arrangement. If so, we must document this as well. If the Employee is eligible for “Commissions,” then turn to the item labeled “A.) Commission.” The first empty line in this area will need the frequency of commission payments recorded. Examples include “per sale,” “weekly,” “monthly,” etc. This will be how often a commission payment is made to the Employee. Use the blank lines at the end of this statement to define how the Employee’s commission amount will be calculated.  If the Employee will be eligible to receive a bonus, then we must attend to the item labeled “B.) Bonus.” First report how often this bonus would be paid on the first blank space. Then, using the last few blank lines in this article, detail how the Employee bonus will be calculated.

If the Employee will be eligible to receive a bonus, then we must attend to the item labeled “B.) Bonus.” First report how often this bonus would be paid on the first blank space. Then, using the last few blank lines in this article, detail how the Employee bonus will be calculated.

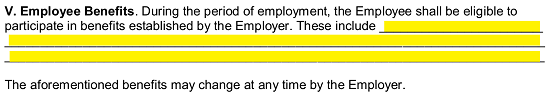

Article “V. Employee Benefits,” will define a type of compensation known as benefits. A good example of this is health or dental insurance the Employer would obtain for the Employee or pay into for the Employee. Use the blank lines in this area to define the Employee Benefits the Employee will be eligible during their employment.

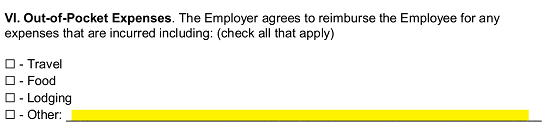

The article titled “VI. Out-of-Pocket Expenses” will address the topic of an Employee’s reimbursements for expenses he or she accrued while working. A brief checkbox list composed of the labels “Travel,” “Food,” “Lodging,” and “Other” has been provided for a quick report. Mark each checkbox item the Employer will reimburse the Employee for. If you are checking “Other” use the blank space presented to define each item eligible for reimbursement.

4 – Additional Factors Applying To The Employer And Employee Must Be Addressed

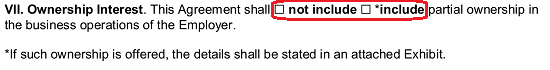

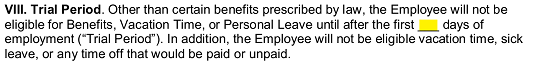

The seventh article (“VII. Ownership Interest”) will present two checkboxes. Mark the first checkbox if the terms of this agreement allow the Employee to hold partial ownership of the business operations or mark the second checkbox if no such option is available to the Employee. Note: Make sure to attach a document providing the details of any Ownership agreements between the Employer and Employee if you choose the second box.  Many Employers will wish to see the Employee perform satisfactorily for a certain amount of time after his or her start date before affording him or her access to benefits or time off. This is known as a “Trial Period” and will be addressed in the eighth article. Enter the number of days from the Employee’s start date that will constitute the Employee’s trial period on the blank space in this paragraph. Once this number of days pass to the satisfaction of the Employer, the Employee will be afforded the benefits this agreement includes.

Many Employers will wish to see the Employee perform satisfactorily for a certain amount of time after his or her start date before affording him or her access to benefits or time off. This is known as a “Trial Period” and will be addressed in the eighth article. Enter the number of days from the Employee’s start date that will constitute the Employee’s trial period on the blank space in this paragraph. Once this number of days pass to the satisfaction of the Employer, the Employee will be afforded the benefits this agreement includes.  In “IX. Vacation Time,” use the blank space after the words “…Entitled To” as a place to record how many “…Days Off Per Year” that may be counted as a vacation day every year.

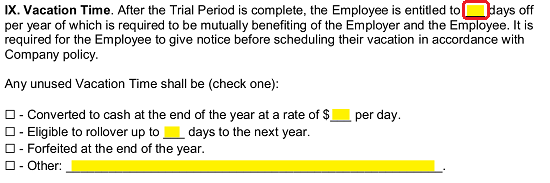

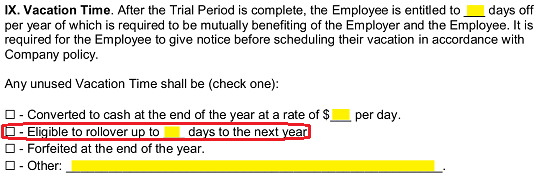

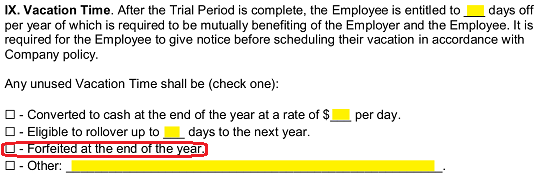

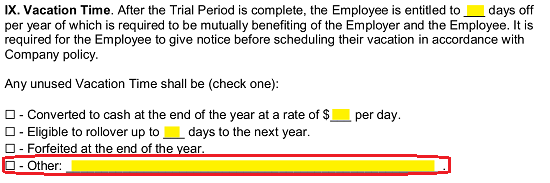

In “IX. Vacation Time,” use the blank space after the words “…Entitled To” as a place to record how many “…Days Off Per Year” that may be counted as a vacation day every year.  A checklist in this area will seek to define what happens to any vacation time that is left unused by the Employee at the end of the year. If it will be “Converted To Cash, then mark the first checkbox and disclose how much money per unused vacation day will be paid to the Employee on the blank line after the dollar sign.

A checklist in this area will seek to define what happens to any vacation time that is left unused by the Employee at the end of the year. If it will be “Converted To Cash, then mark the first checkbox and disclose how much money per unused vacation day will be paid to the Employee on the blank line after the dollar sign.  If unused vacation days will simply be rolled over to be used the following year, then mark the second checkbox.

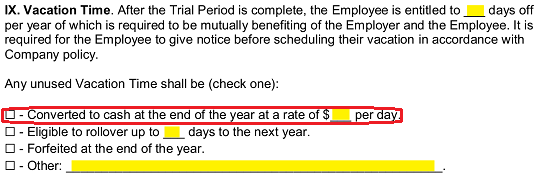

If unused vacation days will simply be rolled over to be used the following year, then mark the second checkbox.  If the Employee forfeits unused vacation days, then mark the third checkbox.

If the Employee forfeits unused vacation days, then mark the third checkbox.  In cases where the Employer has a specific process or formula that must apply to unused vacation days then mark the last checkbox and describe what happens to unused vacation days on the blank line provided.

In cases where the Employer has a specific process or formula that must apply to unused vacation days then mark the last checkbox and describe what happens to unused vacation days on the blank line provided.

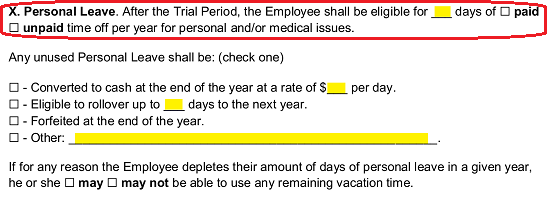

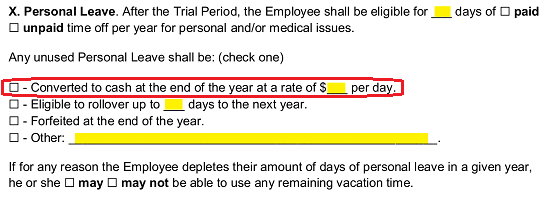

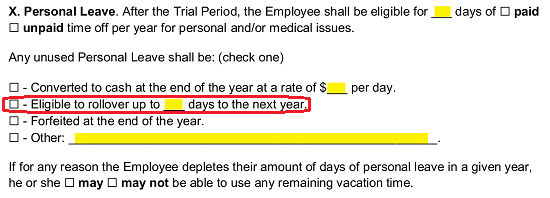

Now, we will turn our attention the tenth item, “X. Personal Leave.” Ener the number of personal days the Employee is allowed per year on the first blank space of this item. You must also indicate if the Employer will pay the Employee during personal/medical days by either marking the first checkbox (“Paid”) or will not pay the Employee during his or her personal/medical days by marking the second checkbox (“Unpaid”).  In addition, we will need to report how the Employer will treat the Employee’s unused personal/medical days. If the Employee will be paid a predetermined amount per unused personal/medical days, then mark the checkbox before the word “Converted” and enter the dollar amount the Employer will pay the Employee for each unused personal/medical day.

In addition, we will need to report how the Employer will treat the Employee’s unused personal/medical days. If the Employee will be paid a predetermined amount per unused personal/medical days, then mark the checkbox before the word “Converted” and enter the dollar amount the Employer will pay the Employee for each unused personal/medical day.  If the Employer will allow the unused personal/medical days to be applied to the next year in addition to the personal/medical days available next year, them mark the second checkbox. You will also need to record how many unused personal/medical leave days can be applied on the blank space in this choice.

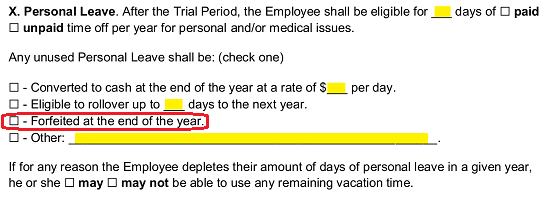

If the Employer will allow the unused personal/medical days to be applied to the next year in addition to the personal/medical days available next year, them mark the second checkbox. You will also need to record how many unused personal/medical leave days can be applied on the blank space in this choice.  If unused personal/medical days will be forfeited completely by the Employee, then mark the checkbox just before the words “Forfeited At The End Of The Year.”

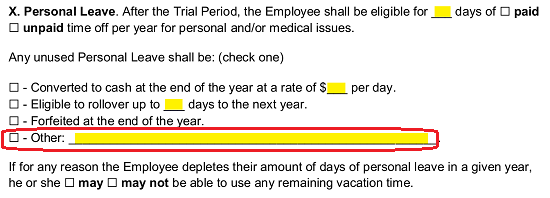

If unused personal/medical days will be forfeited completely by the Employee, then mark the checkbox just before the words “Forfeited At The End Of The Year.”  If none of these apply, then mark the last checkbox and report what will happen to unused personal/medical days on the blank line labeled “Other.”

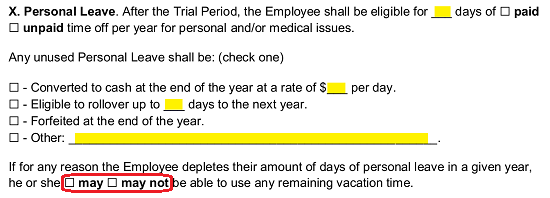

If none of these apply, then mark the last checkbox and report what will happen to unused personal/medical days on the blank line labeled “Other.”  Some Employers and Employees have an understanding that personal/medical days may be somewhat interchangeable with vacation days. If this is the case, then mark the box labeled “May” in the last statement. If not, then mark the “May Not” checkbox.

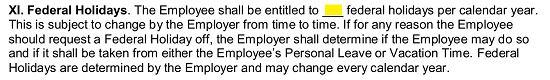

Some Employers and Employees have an understanding that personal/medical days may be somewhat interchangeable with vacation days. If this is the case, then mark the box labeled “May” in the last statement. If not, then mark the “May Not” checkbox.  Enter the number of “Federal Holidays” the Employer allows during the calendar year on the blank line in the eleventh article.

Enter the number of “Federal Holidays” the Employer allows during the calendar year on the blank line in the eleventh article.

5 – Document How Intellectual Property Should Be Treated

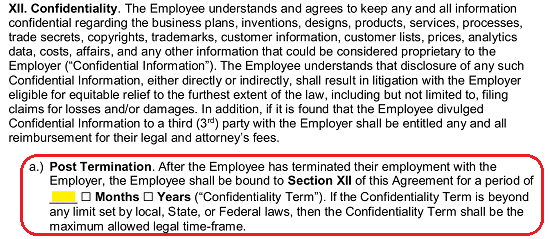

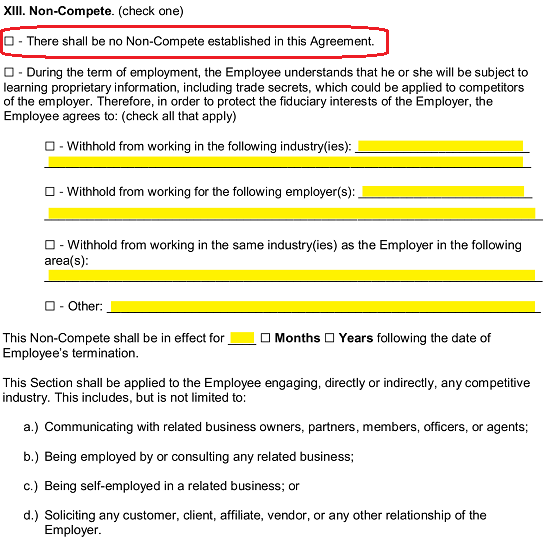

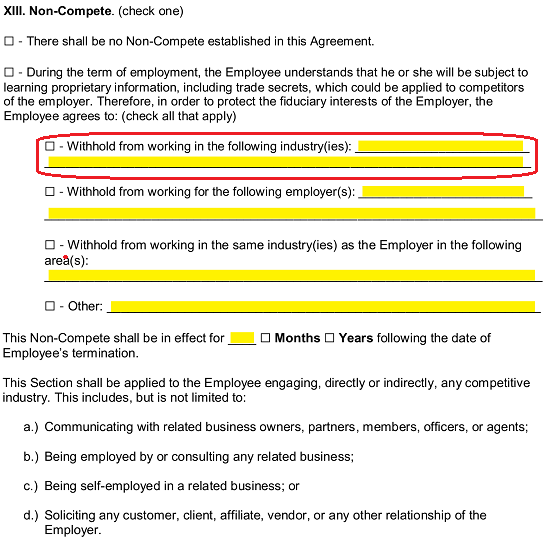

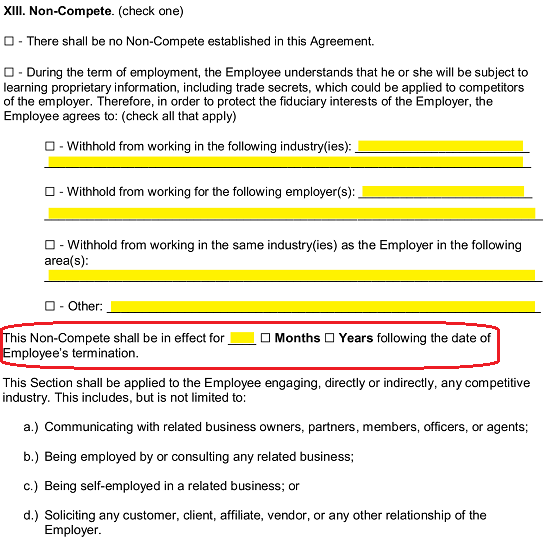

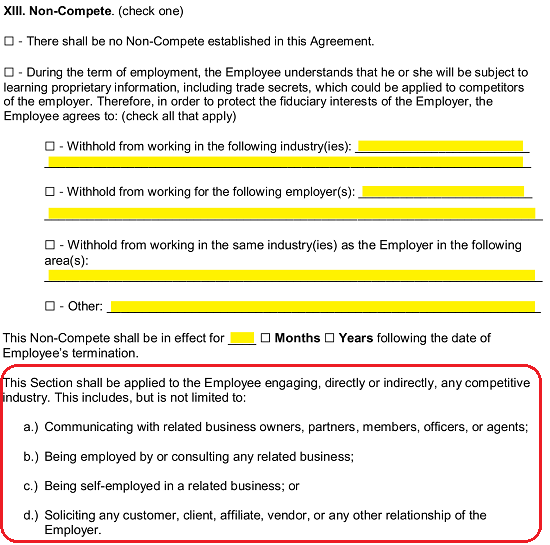

Regardless of the nature of an Employer’s business, the issue of “Confidentiality” will have to be dealt with. We will handle this issue in article XII. The terms of Confidentiality will be discussed in the bulk of this section, so this should be read thoroughly by both parties. We will need to supply some information to the second paragraph here to define how this section will apply. Use the blank space in the paragraph labeled “A.) Post Termination” to record the number of months or years after the Employees termination date when this article will apply. Indicate if you are reporting this number as “Months” or “Years” by marking either the first checkbox or the second checkbox.  In addition to article XII’s safeguards, article “XIII. Non-Compete,” will focus on how the Employee and Employer are required to operate in the business world after working together. If the neither wish to inhibit the other’s ability to compete in the current market regardless of the information each has been privy to, then mark the first check box in this section.

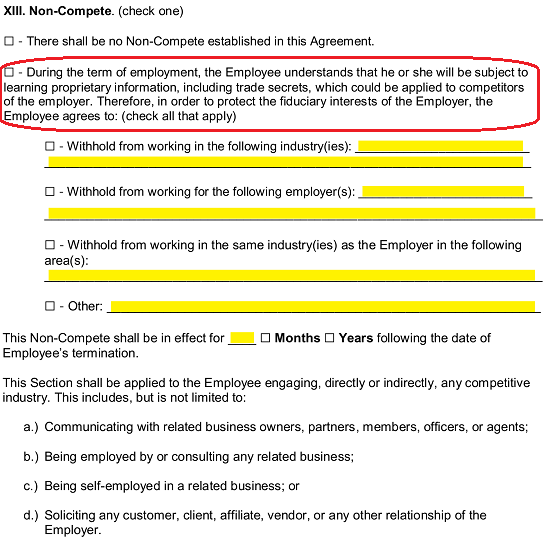

In addition to article XII’s safeguards, article “XIII. Non-Compete,” will focus on how the Employee and Employer are required to operate in the business world after working together. If the neither wish to inhibit the other’s ability to compete in the current market regardless of the information each has been privy to, then mark the first check box in this section.  If there will be a Non-Compete Agreement in place, then mark the second checkbox.

If there will be a Non-Compete Agreement in place, then mark the second checkbox.  This choice presents several opportunities to detail some obligations each party may expect. If both parties must refrain from working in certain industries, then check the box attached to the words “Withhold From Working In The Following Industry(ies)” then list each such industry forbidden to these entities. You may also list different industries for each party but must make sure to indicate as much.

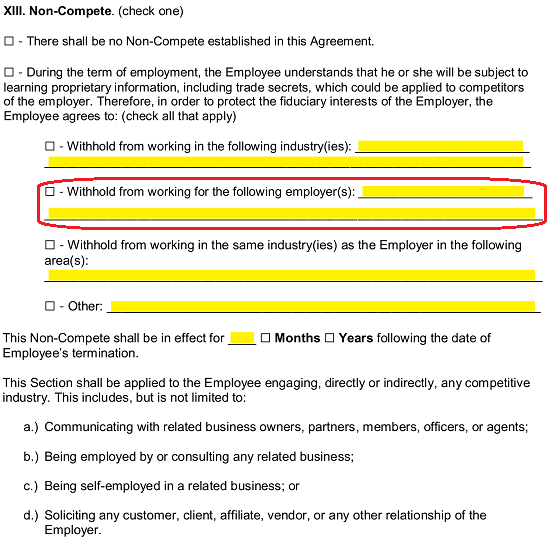

This choice presents several opportunities to detail some obligations each party may expect. If both parties must refrain from working in certain industries, then check the box attached to the words “Withhold From Working In The Following Industry(ies)” then list each such industry forbidden to these entities. You may also list different industries for each party but must make sure to indicate as much.  If the Employee should be restrained from working with certain Employers in the future, then fill in the second checkbox (in this choice) and list each Employer, the Employee may not work with on the blank lines provided.

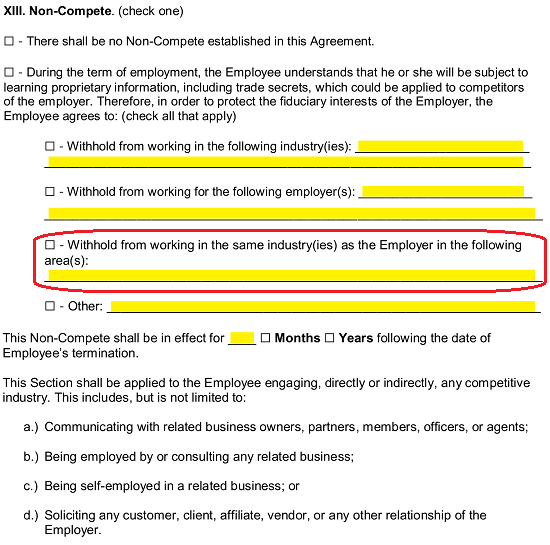

If the Employee should be restrained from working with certain Employers in the future, then fill in the second checkbox (in this choice) and list each Employer, the Employee may not work with on the blank lines provided.  If the Employee must be forbidden from working in the Employer’s area of industry altogether, then select the third checkbox and list the geographic areas where this will apply on the available empty lines. Note: Make sure the Employer and Employee are following all applicable local, state, and federal laws when defining the concerned area.

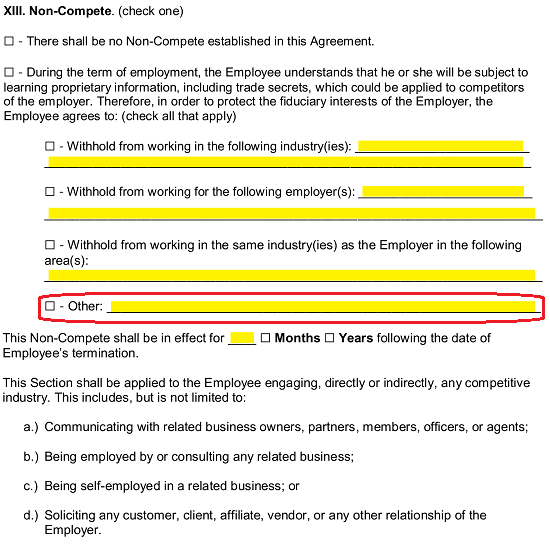

If the Employee must be forbidden from working in the Employer’s area of industry altogether, then select the third checkbox and list the geographic areas where this will apply on the available empty lines. Note: Make sure the Employer and Employee are following all applicable local, state, and federal laws when defining the concerned area.  If there are additional terms that should be imposed on either or both parties, then mark the box labeled “Other” and give a very specific account of any restrictions that must be included.

If there are additional terms that should be imposed on either or both parties, then mark the box labeled “Other” and give a very specific account of any restrictions that must be included.  It is crucial that a definitive span of time from the date of termination be defined for the Non-Compete portion of this agreement. This is because some states have some laws in place to protect the Employer, Employee, or both. Enter the number of months or years the above Non-Compete terms will be in effect on the blank space after the words “…Shall Be In Effect For.” You must also mark either “Months” or “Years” to indicate how this span of time is being reported.

It is crucial that a definitive span of time from the date of termination be defined for the Non-Compete portion of this agreement. This is because some states have some laws in place to protect the Employer, Employee, or both. Enter the number of months or years the above Non-Compete terms will be in effect on the blank space after the words “…Shall Be In Effect For.” You must also mark either “Months” or “Years” to indicate how this span of time is being reported.  Make sure to review the remainder of this article.

Make sure to review the remainder of this article.

6 – Document Some Basic Rules Governing This Agreement

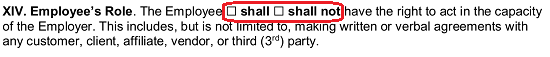

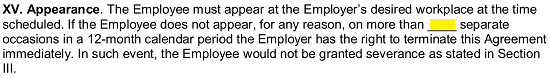

The next article requiring our attention will also deal with the subject of boundaries. Locate “XIV. Employee’s Role,” then choose the first checkbox to allow the Employee to “…Act In The Capacity Of The Employer” or choose the second checkbox to restrain the Employee from behaving in such a manner.  In article “XV. Appearance,” the Employee’s attendance will be discussed. Normally, an Employee will be given a schedule. Except for adequately arranged vacations or personal/medical days, enter the number of times the Employer will forgive the Employee’s failure to show up for work on the empty line preceding the term “Separate Occasions In A 12-Month Calendar Period…”

In article “XV. Appearance,” the Employee’s attendance will be discussed. Normally, an Employee will be given a schedule. Except for adequately arranged vacations or personal/medical days, enter the number of times the Employer will forgive the Employee’s failure to show up for work on the empty line preceding the term “Separate Occasions In A 12-Month Calendar Period…”  The next item “XVI. Disability” shall address a scenario where the Employee cannot perform his or her duties at work due to a physical or mental disability. Report the number of days’ notice the Employer must give the Employee that this agreement will be terminate on the blank line provided. Note: Such notice must be provided in writing.

The next item “XVI. Disability” shall address a scenario where the Employee cannot perform his or her duties at work due to a physical or mental disability. Report the number of days’ notice the Employer must give the Employee that this agreement will be terminate on the blank line provided. Note: Such notice must be provided in writing.  Both parties should review articles XVII and XVIII. The Employee must adhere to these articles. This will also outline what the Employer may expect from the Employee.

Both parties should review articles XVII and XVIII. The Employee must adhere to these articles. This will also outline what the Employer may expect from the Employee.  At times, the Employer and Employee may need to issue a written notice. Such paperwork should be delivered through Certified Mail (so a return receipt can be obtained). You will need to record the mailing address for such notices that should be used for the Employer and for the Employee. Supply the “Employer” address to the first set of blank lines in article “XIX Notices.” Once you have done this supply the mailing address where the “Employee” wishes to receive notices on the second set of empty lines in article XIX.

At times, the Employer and Employee may need to issue a written notice. Such paperwork should be delivered through Certified Mail (so a return receipt can be obtained). You will need to record the mailing address for such notices that should be used for the Employer and for the Employee. Supply the “Employer” address to the first set of blank lines in article “XIX Notices.” Once you have done this supply the mailing address where the “Employee” wishes to receive notices on the second set of empty lines in article XIX.  Report the state where this Employment Agreement will be enforced on the blank space provided in article “XXIII. Governing Law.”

Report the state where this Employment Agreement will be enforced on the blank space provided in article “XXIII. Governing Law.” ![]()

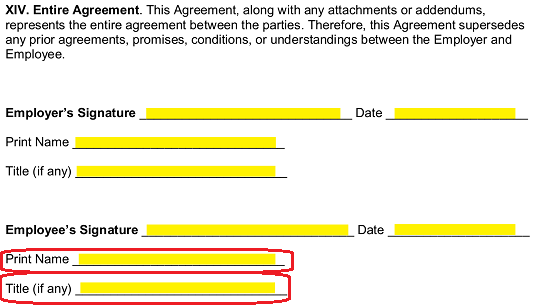

7 – This Paperwork Can Only Be Executed Through The Employer And Employee Signing

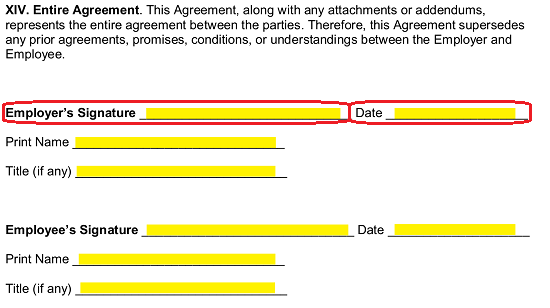

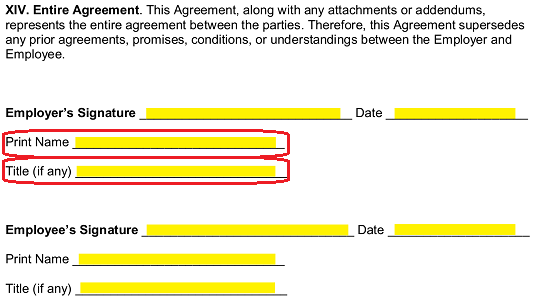

For this agreement to bind these parties to this contract both the Employer and the Employee must sign it after it has been completed and reviewed for accuracy. The Employer will be the first of these entities to be called upon for his or her signature in section “XIV. Entire Agreement.”

If the Employer is a business entity, then a representative must provide the signature. Such a representative of the Employer should be approved by the executives that are responsible for the personnel and/or operations of this business. Otherwise, the business owner or Employer should sign his or her name on the “Employer’s Signature” line then enter the “Date” when he or she supplied this signature on the next blank line.  The Employer’s Signature Party must print his or her name on the blank line under the signature and, if this is applicable, provide the “Title” he or she holds with the Employer on the last line in this area.

The Employer’s Signature Party must print his or her name on the blank line under the signature and, if this is applicable, provide the “Title” he or she holds with the Employer on the last line in this area.  The final area has been included for the benefit of the Employee. He or she must supply a dated signature by signing the line “Employee’s Signature” and providing the current calendar date on the space labeled “Date.”

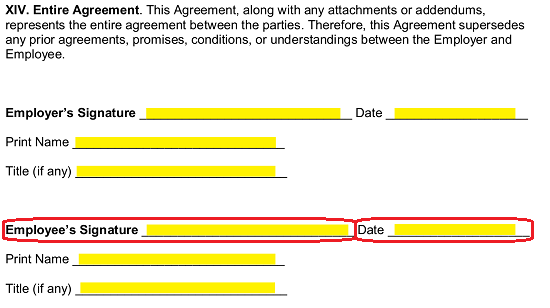

The final area has been included for the benefit of the Employee. He or she must supply a dated signature by signing the line “Employee’s Signature” and providing the current calendar date on the space labeled “Date.”  The Employee must print his or her name then document any applicable “Title” he or she holds on the “Print Name” and “Title (If Any)” lines.

The Employee must print his or her name then document any applicable “Title” he or she holds on the “Print Name” and “Title (If Any)” lines.