Updated April 16, 2024

The dentist employment agreement is a contract between a licensed practitioner and a professional entity for the employment of services for salary, percent of the business, or on a partnership level. The dentist will be required to work a minimum amount of hours, commonly 30-40 hours per week, and have their payment be based on the type of services that are being provided.

Types of Dentists

- Endodontist – For root canals and nerve endings.

- Orthodontist – For braces and straightening teeth.

- Pediatric Dentist – For children.

- Periodontist – For gum health.

- Prosthodontist – For “fake” or prosthetic teeth.

Verify a Dentist’s License

Verify a dentist by using the State’s professional licensure database to ensure an individual is authorized to practice.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Video

How to Write

Download: PDF, Microsoft Word (.docx) or Open Document Text (.odt)

1 – Download The Template To Document An Employee Agreement With A Practitioner

You can obtain this form as either a pdf document or a word processing file. You may download either version or both at your discretion. It is generally suggested that you prepare this contract onscreen with the information that defines the agreement between the Employer and the Practitioner involved then print it for signing. However, in cases where no editing software is available, the pdf version can be viewed, downloaded, and printed with your browser. To gain access to the PDF version locate the button labeled “PDF” (below the image) or the link above, then select it with your mouse. Similarly, you can also find the “Word” button and link above as well.

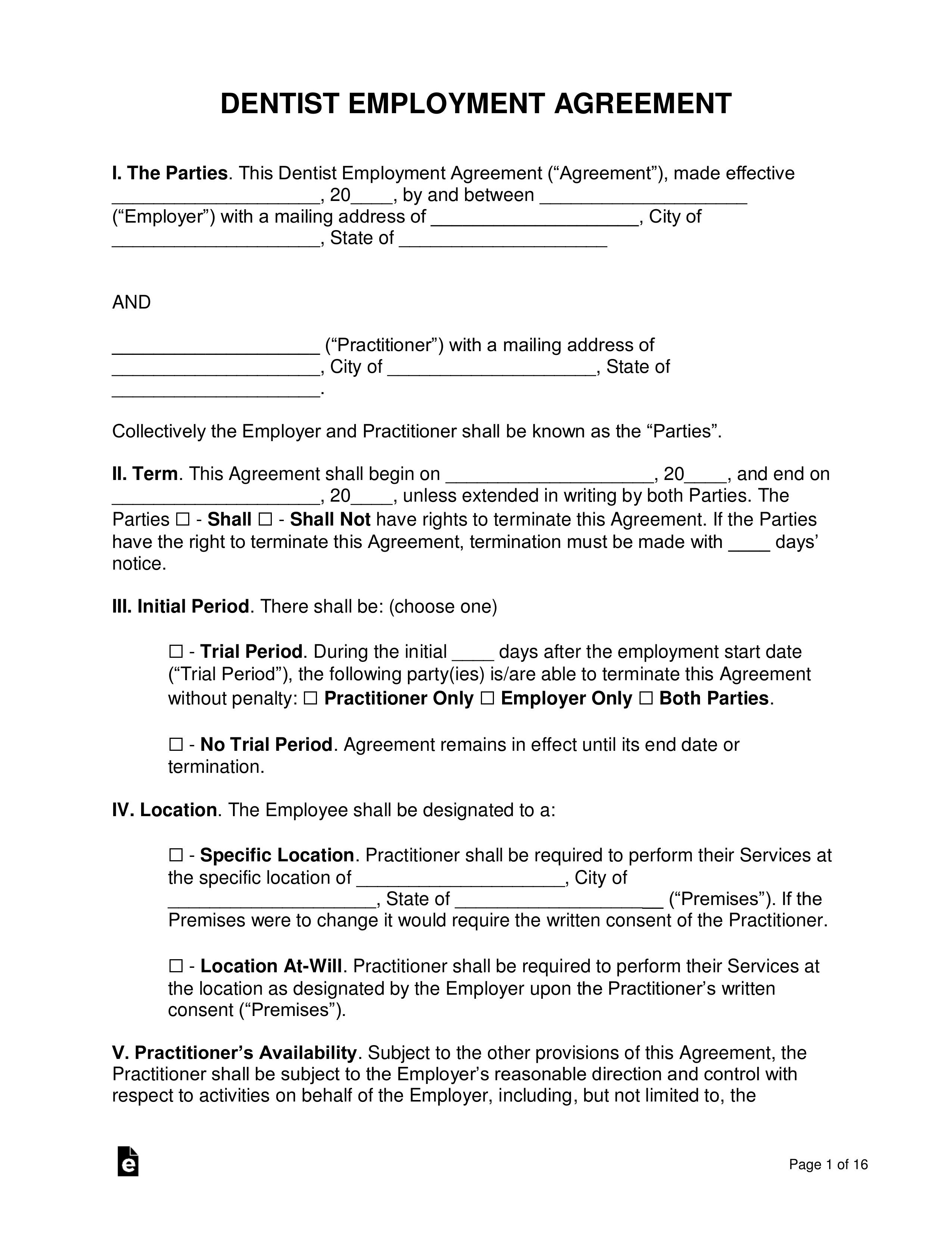

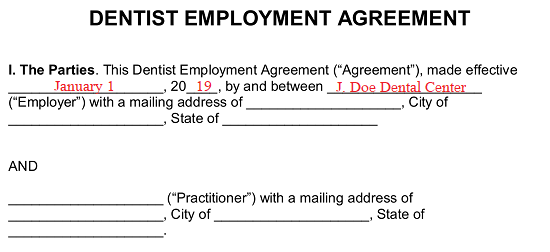

2 – Identify The Dental Practice And The Practitioner Being Hired

Once all the relevant parties have determined the specifics of employment, we will need to furnish such facts to this template where requested. The first task will be to date this paperwork in the statement “I. The Parties.” You may do so by entering this document’s effective date (when it becomes an active agreement) as a calendar month and two-digit calendar day on the first blank space and the two-digit year on the second blank line.  Next, the full name of the Employer should be presented on the empty line after the words “…By And Between.” If this is an entity as opposed to an individual (such as a practice) make sure to include any necessary, suffix as status attached to the official name of the Employer.

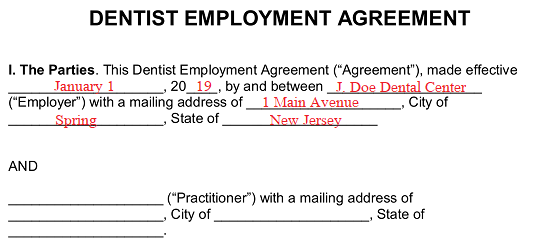

Next, the full name of the Employer should be presented on the empty line after the words “…By And Between.” If this is an entity as opposed to an individual (such as a practice) make sure to include any necessary, suffix as status attached to the official name of the Employer.  The Employer’s mailing address will also have to be supplied to this statement. The three blank spaces after the “… (Employer) With A Mailing Address Of” will accept this information as a street address, a city/town, and the state.

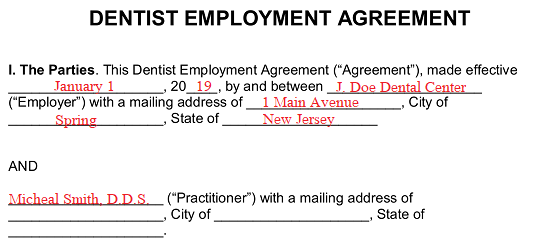

The Employer’s mailing address will also have to be supplied to this statement. The three blank spaces after the “… (Employer) With A Mailing Address Of” will accept this information as a street address, a city/town, and the state.  The remainder of this statement, below the capitalized word “AND,” will seek to define the Dentist, or Practitioner, being hired by the Employer named above. Utilize the blank line attached to the parenthesis label “Practitioner” to record the full name of this Practitioner. Keep in mind this must be his or her full name thus if a specific status applies (“D.D.S.”) make sure to include it in this area.

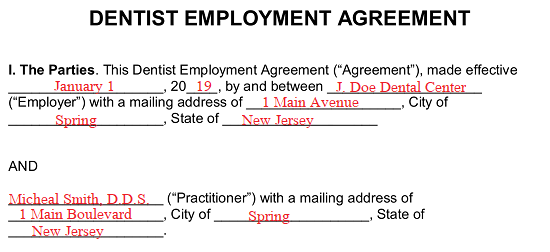

The remainder of this statement, below the capitalized word “AND,” will seek to define the Dentist, or Practitioner, being hired by the Employer named above. Utilize the blank line attached to the parenthesis label “Practitioner” to record the full name of this Practitioner. Keep in mind this must be his or her full name thus if a specific status applies (“D.D.S.”) make sure to include it in this area.  Finally, we must report the Practitioner’s mailing address using the remaining portion of this statement.

Finally, we must report the Practitioner’s mailing address using the remaining portion of this statement.

3 – Discuss The Job’s Term, Location, And Required Availability

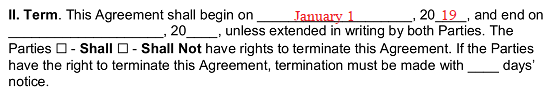

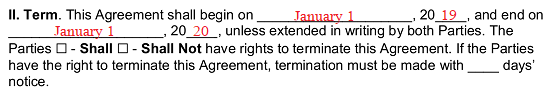

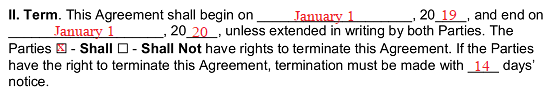

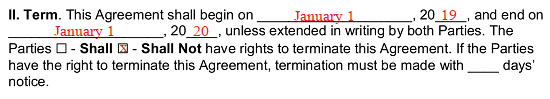

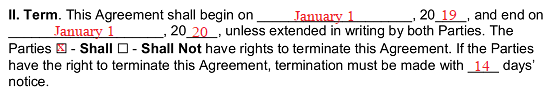

This employment agreement’s second article (“II. Term”) provides some standard language we can use to define when the Practitioner will start working for the Employer and when this arrangement will conclude. Begin by supplying the first calendar date when the Employer/Practitioner working relationship officially begins across the first two blank spaces of this article.  The next two spaces require the final calendar date of work the Practitioner is expected to provide the Employer.

The next two spaces require the final calendar date of work the Practitioner is expected to provide the Employer.  If both parties will retain the right to terminate this agreement prematurely then, mark the first checkbox (“Shall”) in the next sentence.

If both parties will retain the right to terminate this agreement prematurely then, mark the first checkbox (“Shall”) in the next sentence. If not, then mark the checkbox labeled “Shall Not.”

If not, then mark the checkbox labeled “Shall Not.”  Now, if these parties have a right to terminate this relationship prematurely, we will need to address how much notice should be given. That is the minimum number of days before the actual termination date when the terminating party must inform the other of the intent to end this agreement on that date. Supply the number of days’ notice that must be given on the last blank line of this statement.

Now, if these parties have a right to terminate this relationship prematurely, we will need to address how much notice should be given. That is the minimum number of days before the actual termination date when the terminating party must inform the other of the intent to end this agreement on that date. Supply the number of days’ notice that must be given on the last blank line of this statement.  The third item is titled “III. Initial Period.” Here we will indicate if a trial period will start this working relationship or if it will begin immediately without any trials. Two checkbox statements have been included in this article requiring that one be selected to apply to the terms of this contract. Read through both statements then mark the checkbox corresponding to the more accurate statement.

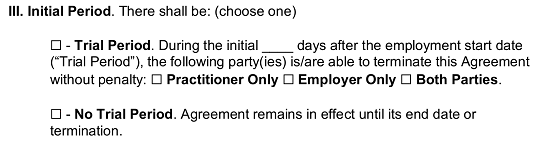

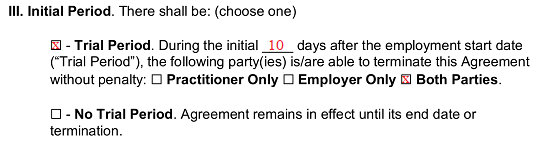

The third item is titled “III. Initial Period.” Here we will indicate if a trial period will start this working relationship or if it will begin immediately without any trials. Two checkbox statements have been included in this article requiring that one be selected to apply to the terms of this contract. Read through both statements then mark the checkbox corresponding to the more accurate statement.

If there will be a “Trial Period” then mark the first checkbox statement. This statement will need further definition if selected. First, enter the number of “Days After The Employment Start Date” when this trial period can be considered in effect. Then mark the checkbox in this statement to indicate which party may freely terminate this contract during this period. You may mark the first checkbox if only the Practitioner can terminate this contract, the second checkbox if only the Employer may terminate this agreement, or the third checkbox if either party may terminate this contract at will during the trial period. In the example below, both the Practitioner and Employer can terminate this arrangement during a ten-day trial period.  If there will be no trial period, then mark the checkbox statement with the bold label “No Trial Period.”

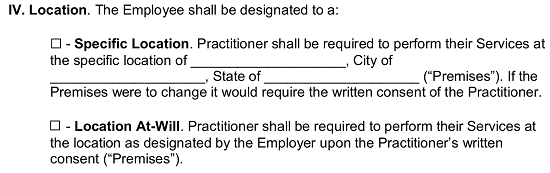

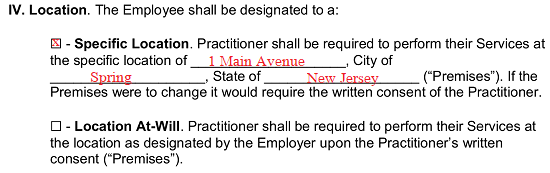

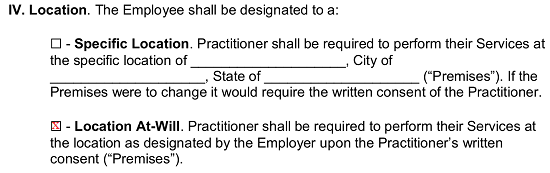

If there will be no trial period, then mark the checkbox statement with the bold label “No Trial Period.”  The fourth article, “IV. Location,” allows us to quickly document where the Practitioner will work for this Employer. Two statements have been supplied to this statement, “Specific Location” and “Location At-Will,” of which you will need to choose one to apply.

The fourth article, “IV. Location,” allows us to quickly document where the Practitioner will work for this Employer. Two statements have been supplied to this statement, “Specific Location” and “Location At-Will,” of which you will need to choose one to apply.  If the Practitioner is required to work at a “Specific Location” for this Employer then, mark the first checkbox. You must furnish the street address, city, and state of the premises where the Practitioner must be physically present across the three blank spaces in this section.

If the Practitioner is required to work at a “Specific Location” for this Employer then, mark the first checkbox. You must furnish the street address, city, and state of the premises where the Practitioner must be physically present across the three blank spaces in this section.  If the Employer will choose where the location where the Practitioner must be physically present to work and assign it on a project by project basis, then mark the “Location At-Will” statement.

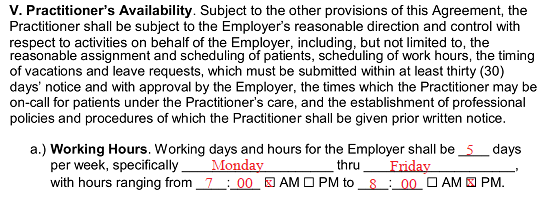

If the Employer will choose where the location where the Practitioner must be physically present to work and assign it on a project by project basis, then mark the “Location At-Will” statement.  The fifth article, “V. Practitioner’s Availability,” will deliver some valuable information regarding the requirements and limitations this document places on the when the Employer requires the Practitioner to work. Both parties should read through this section adequately. In the item labeled “A.) Working Hours,” report the number of days per week when the Employer’s business is open for work, the timeframe during the week when the Employer is usually open and document the daily working hours when the Employer is open for business.

The fifth article, “V. Practitioner’s Availability,” will deliver some valuable information regarding the requirements and limitations this document places on the when the Employer requires the Practitioner to work. Both parties should read through this section adequately. In the item labeled “A.) Working Hours,” report the number of days per week when the Employer’s business is open for work, the timeframe during the week when the Employer is usually open and document the daily working hours when the Employer is open for business.

4 – Address The Monetary Obligations Solidified By This Agreement

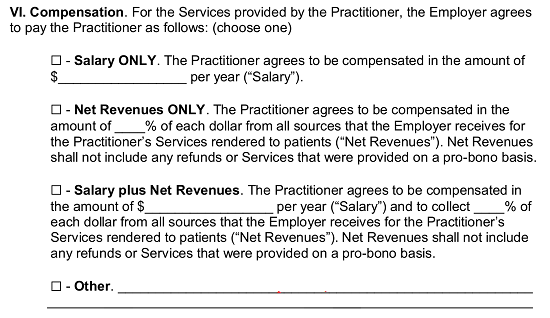

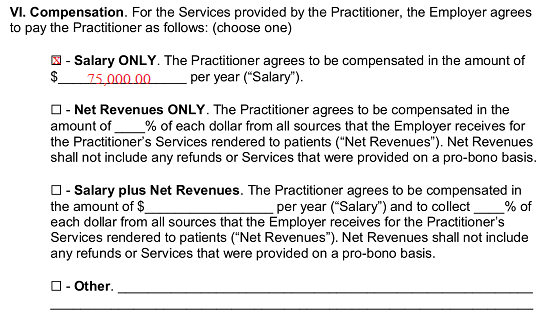

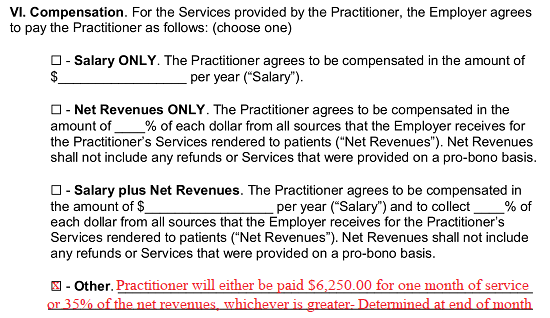

Naturally, as with most if not all professional relationships, the Employer will agree to pay the Practitioner a predetermined amount for his or her work. We will define such payment in the sixth article (“VI. Compensation”) using one of four checkbox statements.  Mark the first checkbox if the Practitioner will only be entitled to a yearly salary for his or her work for the Employer. Make sure to record the full dollar amount the Employer will pay the Practitioner every year on the blank space in this statement.

Mark the first checkbox if the Practitioner will only be entitled to a yearly salary for his or her work for the Employer. Make sure to record the full dollar amount the Employer will pay the Practitioner every year on the blank space in this statement.  If the Employer intends to pay the Practitioner a percentage “Of Each Dollar” of revenue the Practitioner brings to the business then, mark the checkbox “Net Revenues Only” and record the percentage amount on the blank space provided.

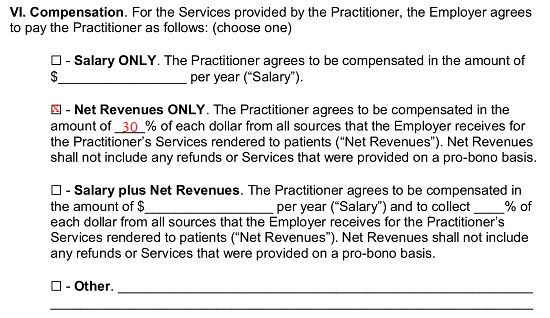

If the Employer intends to pay the Practitioner a percentage “Of Each Dollar” of revenue the Practitioner brings to the business then, mark the checkbox “Net Revenues Only” and record the percentage amount on the blank space provided.  In some cases, the Employer will pay the Practitioner a yearly salary as well as a percentage of each dollar of revenue the Practitioner brings to the business. If this is such an instance, then mark the “Salary Plus Net Revenues” checkbox. You must supply the full dollar amount the Employer will pay the Practitioner per year on the first blank space of this statement and the percentage of net revenue he or she will be paid on the second blank space.

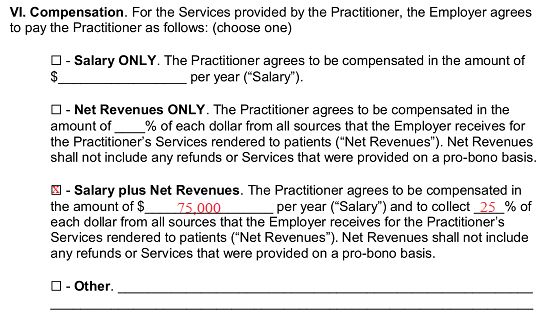

In some cases, the Employer will pay the Practitioner a yearly salary as well as a percentage of each dollar of revenue the Practitioner brings to the business. If this is such an instance, then mark the “Salary Plus Net Revenues” checkbox. You must supply the full dollar amount the Employer will pay the Practitioner per year on the first blank space of this statement and the percentage of net revenue he or she will be paid on the second blank space.  If none of the above statements accurately define how the Employer will compensate the Practitioner for his or her services, then mark the checkbox labeled “Other” and provide this description directly to the blank lines provided. Keep in mind, this will be a description of precisely how the Employer will compensate the Practitioner for as long as this contract remains in effect, thus, there should be no room for misinterpretation when providing such a description. If more room is required for this task, you may either continue an attachment or simply use an editing program to add additional space as required.

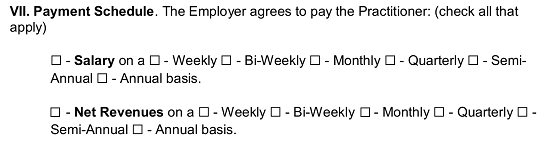

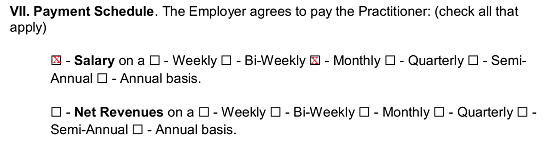

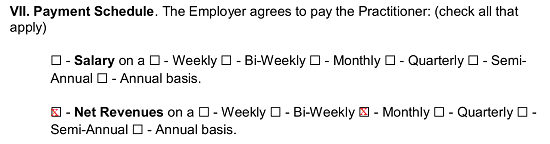

If none of the above statements accurately define how the Employer will compensate the Practitioner for his or her services, then mark the checkbox labeled “Other” and provide this description directly to the blank lines provided. Keep in mind, this will be a description of precisely how the Employer will compensate the Practitioner for as long as this contract remains in effect, thus, there should be no room for misinterpretation when providing such a description. If more room is required for this task, you may either continue an attachment or simply use an editing program to add additional space as required.  Next, in “VII. Payment Schedule,” a detail on when and how often the Employer will pay the Practitioner must be delivered. There will be two basic categories each with a series of checkboxes defining a frequency of pay. You must mark each checkbox that applies.

Next, in “VII. Payment Schedule,” a detail on when and how often the Employer will pay the Practitioner must be delivered. There will be two basic categories each with a series of checkboxes defining a frequency of pay. You must mark each checkbox that applies.  If the Practitioner will be paid a steady salary, then mark the checkbox attached to the bold word “Salary.” In addition, select the checkbox labeled “Weekly,” “Bi-Weekly,” “Monthly,” “Quarterly,” “Semi-Annual,” and “Annual” to document how often the Employer will compensate the Practitioner.

If the Practitioner will be paid a steady salary, then mark the checkbox attached to the bold word “Salary.” In addition, select the checkbox labeled “Weekly,” “Bi-Weekly,” “Monthly,” “Quarterly,” “Semi-Annual,” and “Annual” to document how often the Employer will compensate the Practitioner.  If the Employer has agreed to pay the Practitioner “Net Revenues” then, mark the second selection and indicate how often such payment will be submitted by selecting “Weekly,” “Bi-Weekly,” “Monthly,” “Quarterly,” “Semi-Annual,” or “Annual Basis.”

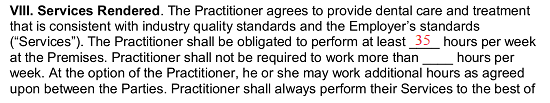

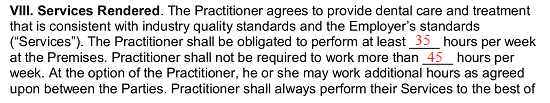

If the Employer has agreed to pay the Practitioner “Net Revenues” then, mark the second selection and indicate how often such payment will be submitted by selecting “Weekly,” “Bi-Weekly,” “Monthly,” “Quarterly,” “Semi-Annual,” or “Annual Basis.”  Some additional information regarding the Practitioner’s availability will be discussed in “VIII. Services Rendered.” This statement will provide all the language necessary for this contract but will require the minimum number of work hours per week the Practitioner will be expected to work for the Employer.

Some additional information regarding the Practitioner’s availability will be discussed in “VIII. Services Rendered.” This statement will provide all the language necessary for this contract but will require the minimum number of work hours per week the Practitioner will be expected to work for the Employer.  Next, furnish the maximum number of work hours per week the Employer may request of the Practitioner to the second blank space in this article.

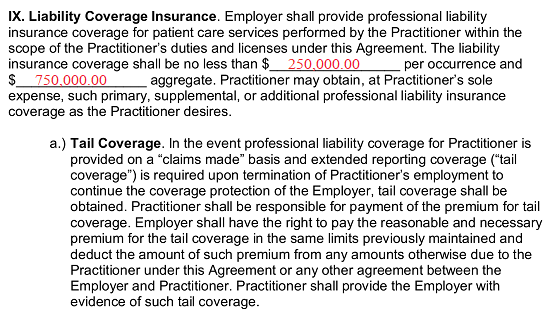

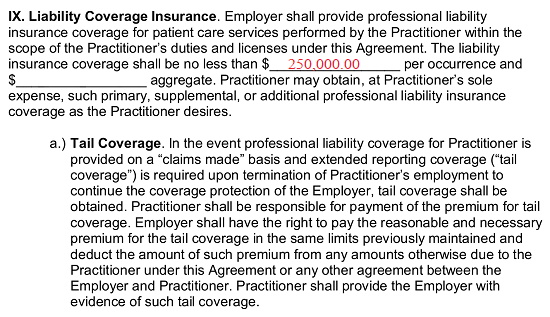

Next, furnish the maximum number of work hours per week the Employer may request of the Practitioner to the second blank space in this article.  In “IX. Liability Coverage Insurance,” we must provide some basic information regarding the insurance policy the Employer maintains. Locate the blank space after the words “…Coverage Shall Be No Less Than” then document the minimum coverage amount the Employer must maintain for the Practitioner’s business services (when working for the Employer) for each occurrence where a claim must be filed.

In “IX. Liability Coverage Insurance,” we must provide some basic information regarding the insurance policy the Employer maintains. Locate the blank space after the words “…Coverage Shall Be No Less Than” then document the minimum coverage amount the Employer must maintain for the Practitioner’s business services (when working for the Employer) for each occurrence where a claim must be filed.  The second empty line requires the aggregate amount the Employer must maintain to cover the Practitioner’s work when providing services for the Employer.

The second empty line requires the aggregate amount the Employer must maintain to cover the Practitioner’s work when providing services for the Employer.

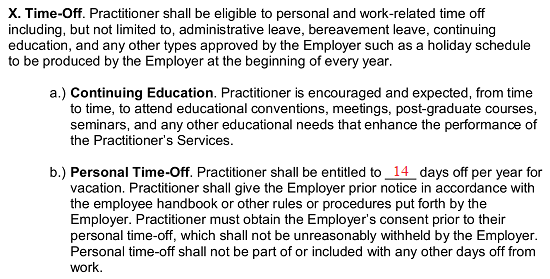

5 – Define How Time-Off Will Be Handled

Article “X. Time-Off” will handle the subject of the Practitioner’s ability to claim items such as bereavement days, sick days, etc. This statement will obligate both parties to its contents so both should be fully abreast of its contents. Item “B.) Personal Time-Off” will require the number of vacation days per year the Employer will afford the Practitioner reported on the blank line after the words “…Shall Be Entitled To.”

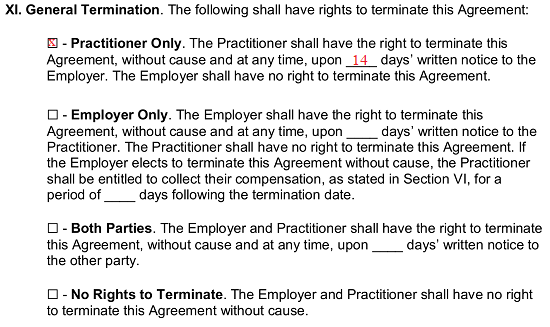

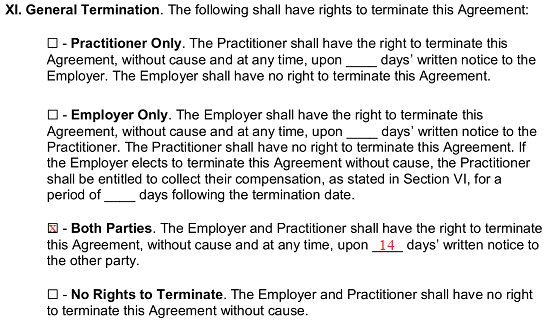

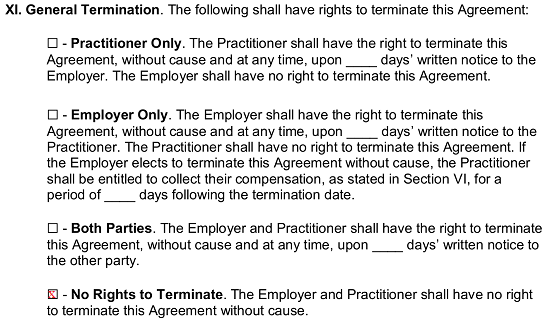

6 – Report On How This Agreement May Terminate

The topic of who and how this agreement can be terminated will need to be solidified in the area labeled “XI. General Termination.” This section requires that we give an adequate definition by marking one of the four checkbox statements it contains.  If this contract should allow the Practitioner to terminate this agreement, but not the Employer, then mark the “Practitioner Only” box. Also, record how many days’ notice the Practitioner must submit to the Employer when he or she has determined a date of termination.

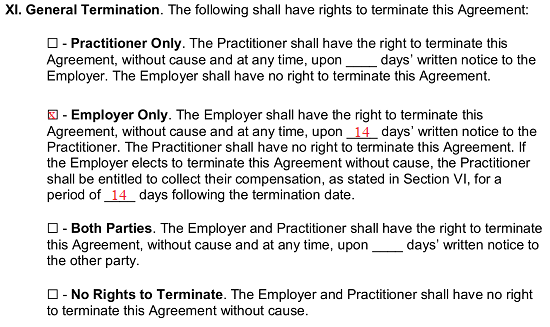

If this contract should allow the Practitioner to terminate this agreement, but not the Employer, then mark the “Practitioner Only” box. Also, record how many days’ notice the Practitioner must submit to the Employer when he or she has determined a date of termination.  If the Employer may terminate this agreement, but not the Practitioner, then mark the second checkbox. This selection requests two items of information to be delivered. The first blank space requires the number of days’ notice (written) before the intended termination date that the Employer must give the Practitioner while the second blank space requires the number of days from the termination date when the Practitioner is entitled compensation (as per Section VI).

If the Employer may terminate this agreement, but not the Practitioner, then mark the second checkbox. This selection requests two items of information to be delivered. The first blank space requires the number of days’ notice (written) before the intended termination date that the Employer must give the Practitioner while the second blank space requires the number of days from the termination date when the Practitioner is entitled compensation (as per Section VI).  If this agreement will allow “Both Parties” to terminate this agreement, then select the third checkbox statement and record the number of days’ written notice the terminating party must submit to the remaining party when doing so on the blank line between the words “…Anytime, Upon” and “Days’ Written Notice…”

If this agreement will allow “Both Parties” to terminate this agreement, then select the third checkbox statement and record the number of days’ written notice the terminating party must submit to the remaining party when doing so on the blank line between the words “…Anytime, Upon” and “Days’ Written Notice…”  If neither party will hold the right to terminate this agreement, then mark the checkbox labeled “No Rights To Terminate.”

If neither party will hold the right to terminate this agreement, then mark the checkbox labeled “No Rights To Terminate.”

7 – Review This Paperwork And Provide Some Additional Items

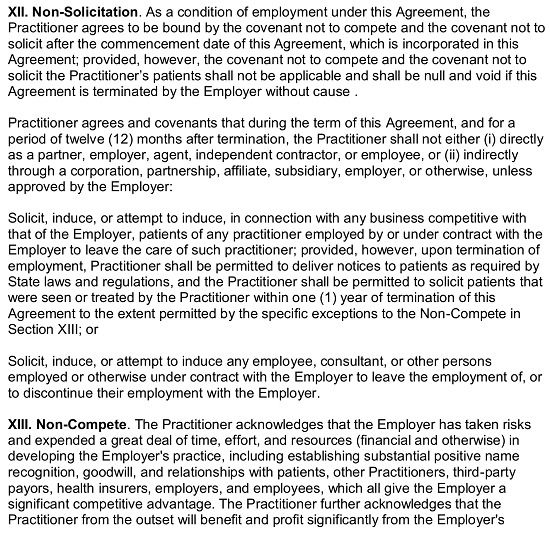

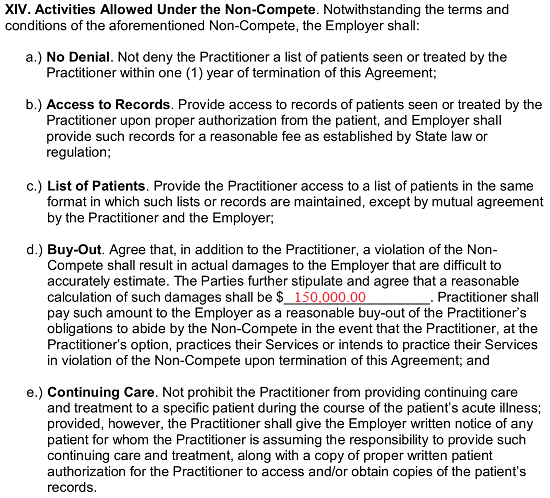

The next two articles, “XII. Non-Solicitation” and “XIII. Non-Compete,” will present some additional information that both parties should read and comprehend.  In “XIV. Activities Allowed Under The Non-Compete,” several points regarding the behavior of the Practitioner and the privacy of the Employer will be made. This area will contain an item labeled “D.) Buy-Out.” This item will require the full dollar amount the Practitioner would be required to pay the Employer should he or she violate (or intend to violate) any of the terms defined in “XIII. Non-Compete” and “XIV. Activities Allowed Under The Non-Compete.”

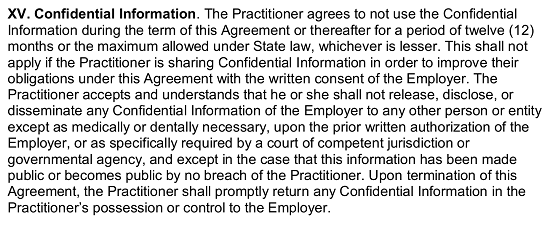

In “XIV. Activities Allowed Under The Non-Compete,” several points regarding the behavior of the Practitioner and the privacy of the Employer will be made. This area will contain an item labeled “D.) Buy-Out.” This item will require the full dollar amount the Practitioner would be required to pay the Employer should he or she violate (or intend to violate) any of the terms defined in “XIII. Non-Compete” and “XIV. Activities Allowed Under The Non-Compete.”  Articles “XV. Confidential Information” through “XXX. Termination By Practitioner” will make several disclosures regarding the obligations these parties must uphold under this agreement. Make sure each article is read and understood by each signature party.

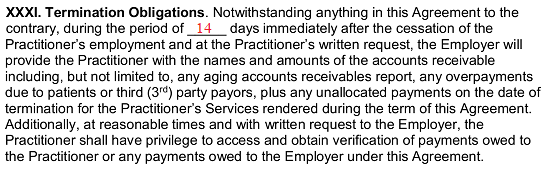

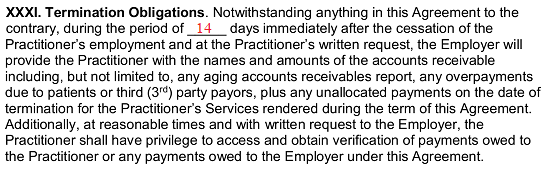

Articles “XV. Confidential Information” through “XXX. Termination By Practitioner” will make several disclosures regarding the obligations these parties must uphold under this agreement. Make sure each article is read and understood by each signature party.  The next item requiring attention is in “XXXI. Termination Obligations.” Here we will deal with a scenario where the Practitioner has successfully terminated employment in writing. When such an action is taken unpaid accounts owed to the Practitioner and other monetary concerns will need to be wrapped up. To this end, enter the number of days after the termination of this agreement when the Employer must submit such information (ranging from aging account receivables to unallocated payments) to the Practitioner.

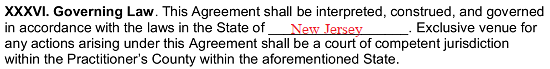

The next item requiring attention is in “XXXI. Termination Obligations.” Here we will deal with a scenario where the Practitioner has successfully terminated employment in writing. When such an action is taken unpaid accounts owed to the Practitioner and other monetary concerns will need to be wrapped up. To this end, enter the number of days after the termination of this agreement when the Employer must submit such information (ranging from aging account receivables to unallocated payments) to the Practitioner.  Each section from “XXXII. Right Of Offset” to “L. Entire Agreement” should be reviewed by both parties. One article in this area, ” “XXXV. Governing Law,” requires the name of the State that holds jurisdiction over this document and its terms. Present the name of this state on the blank line just after the words “State Of”

Each section from “XXXII. Right Of Offset” to “L. Entire Agreement” should be reviewed by both parties. One article in this area, ” “XXXV. Governing Law,” requires the name of the State that holds jurisdiction over this document and its terms. Present the name of this state on the blank line just after the words “State Of”

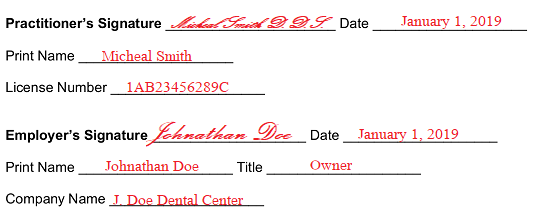

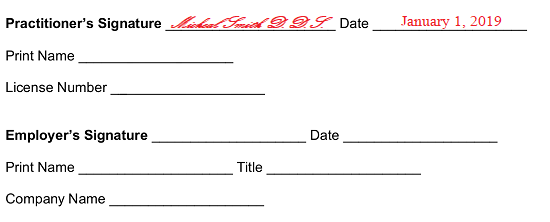

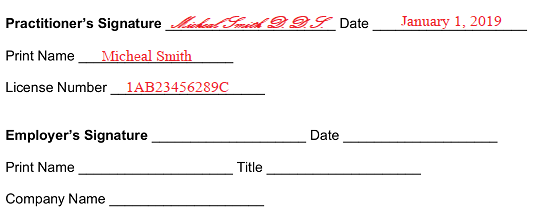

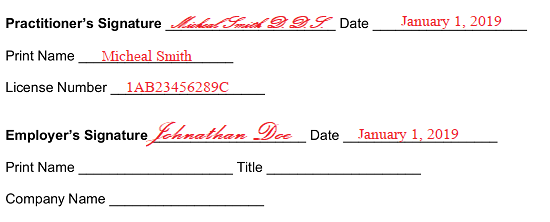

8 – The Practitioner And Employer Must Furnish A Binding Signature To Execute This Paperwork

Now that we have defined the requested items and each party has reviewed this contract for accuracy, we will need to finalize this agreement by allowing both parties to formally enter it with a binding signature. This will be handled just below the last section (“L. Entire Agreement”).  The Practitioner being hired must locate his or her signature area then sign his or her name to the space labeled “Practioner’s Signature” and record the current date on the adjacent line.

The Practitioner being hired must locate his or her signature area then sign his or her name to the space labeled “Practioner’s Signature” and record the current date on the adjacent line.  Once he or she has provided these items, the Practioner must print his or her name and present his or her license number in the area provided.

Once he or she has provided these items, the Practioner must print his or her name and present his or her license number in the area provided.  The Employer will also need to sign this form to officially set it in motion. If the Employer is a business entity, such as a dental center, then a representative of the Employer must sign his or her name. The Employer’s signature should be supplied on the blank line labeled “Employer’s Signature.”

The Employer will also need to sign this form to officially set it in motion. If the Employer is a business entity, such as a dental center, then a representative of the Employer must sign his or her name. The Employer’s signature should be supplied on the blank line labeled “Employer’s Signature.”  Next, the Employer must report the signature date when he or she signed this document on the blank line labeled “Date.”

Next, the Employer must report the signature date when he or she signed this document on the blank line labeled “Date.”  Finally, the Employer must print his or her name on the “Print Name” line. If he or she is signing this document on behalf of a company, then this signature party will also need to present the “Title” he or she holds with the Employer and the full “Company Name” using the spaces provided.

Finally, the Employer must print his or her name on the “Print Name” line. If he or she is signing this document on behalf of a company, then this signature party will also need to present the “Title” he or she holds with the Employer and the full “Company Name” using the spaces provided.