Updated February 08, 2024

An employment separation agreement is a legal document outlining the termination between employer and employee. Its purpose is to establish that no party has any claims or liability to the other. If an employee is terminated, particularly without cause, it is common for the employer to pay severance in the form of one or two weeks’ pay.

New Law

On Feb. 21, 2023, the National Labor Relations Board issued a decision that may limit what can be included in severance agreements. The board ruled that offering severance agreements containing overly broad confidentiality and non-disparagement terms violated employees’ rights under the National Labor Relations Act.

The decision is likely to be appealed, but employers who have previously offered severance agreements to their employees may want to verify that their documents comply with current rules.

Table of Contents |

Main Purpose

The main purpose of a separation agreement is to indemnify or protect both the employer and the employee from claims of wrongdoing. On both sides, there is a chance that either party could be accused of any type of misconduct, whether warranted or not.

Each party should be on guard for common liability that is present in common workplace atmospheres:

Employer’s Liability

- Discrimination

- Harassment

- Job-related accidents

- Worker’s compensation

Employee’s Liability

- Negligence

- Harassment

- Solicitation

- Non-compete & non-disclosure

How to Terminate an Employee (5 steps)

- Identify the Terms of Termination

- Plan When to Terminate

- Decide Employee’s Last Day

- Request a Separation Agreement

- Offer to Assist in the Transition

1. Identify the Terms of Termination

Honesty is always the best policy. Gather occurrences or testimonials from their co-workers and outline their faults and why they are no longer a fit for the company or organization. In order to help the person, it’s the duty of the employer to help the terminated individual help themselves.

2. Plan When to Terminate

Plan a time to speak with the individual. Unless the employee is working abroad, it’s recommended for all parties to leave on good terms by approaching and informing them in person. Furthermore, the best is to do this one-on-one. People tend to react differently around other people and both parties will have a better chance at an honest conversation if there isn’t an audience.

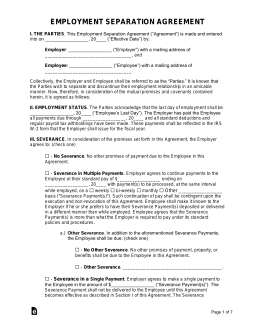

4. Request a Separation Agreement

In order to indemnify both parties, the parties should authorize a separation agreement that states that no party is guilty of any wrongdoing and that the employee’s termination was due solely based on their actions. In addition, if there is severance due to the employee the payments and amounts should be listed in this agreement.

5. Offer to Assist in the Transition

The last remaining obstacle for the terminated individual will be to finalize their termination and move on to the next chapter of their life. The best way for an employer to help is by offering to write a recommendation letter. Furthermore, it should be noted that if the employer is contacted that a positive endorsement will be given to any requests for information about the former employee.

Due to every employment situation being unique and personal relationships that may develop through one’s career, it’s best to also provide any emotional support if possible. Having a “going away party” or another event that assists in the transition will help give the person the peace of mind they need to leave on good terms.

Severance

In exchange for the employee to honor the separation agreement, the employer must make some type of consideration. Consideration is an amount that can be legitimately passed as payment for an individual or entity to fulfill an obligation. For it to be considered legitimate, it must make sense in the context of what is being asked. For example, a $100 payment to the employee for a list of demands that severely impair the employee’s ability to find new employment may not seem fair in the eyes of any court.

- Recommended Severance – It’s advised to give any former employee two weeks’ severance upon the termination of their employment as long as he or she signs a separation agreement.

Employment Discrimination

In most agreements, there are two types of discrimination laws that the employer will want to be exempt from — federal and state — which protect employees from discrimination based on:

- Disability

- Race

- Religion

- Color

- Sex

- Sexual orientation

- Age

- National origin

- Ancestry

Severance agreements often include language waiving claims of discrimination. Under the Age Discrimination in Employment Act (U.S.C. Title 29, Chapter 14), these waivers are valid only if they allow employees to revoke them for at least seven days after they have been signed.

Related Forms

Employment Termination Checklist – Use as a guide when terminating an employee.

Employment Termination Checklist – Use as a guide when terminating an employee.

Download: PDF, MS Word, OpenDocument