Updated January 12, 2024

Use ContractsCounsel to draft this LOI!

A letter of intent to donate is a formal declaration of one’s desire to submit a donation to an organization or business. The letter will describe the type of donation being offered (e.g., clothing, canned food, motor vehicle) and the donor’s preferences regarding how their contribution should be utilized once received by the donee.

All monetary donations should be identified as a one-time, monthly, or annual pledge. If the donee accepts the proposal exhibited in the letter, both parties may sign the document to indicate their intention to progress into a legally binding agreement.

Donation Types

- Cash

- Food

- In-Kind (personal property)

- Vehicles

Letter of Intent to Donate – Sample

DONATION LETTER OF INTENT

Effective Date: Sep. 7, 2019

Re: Donation to Qualified Organization

This donation letter of intent, (the “Letter of Intent”), represents the basic terms for an agreement that shall be considered binding. After this Letter of Intent has been made a formal agreement may be constructed to the benefit of the Parties involved.

I. The Donor: Sandra Barnes (the “Donor”).

II. The Donee: Mission Charity (the “Donee”).

III. The Donation: The Donor wishes to make a one-time monetary donation to the Donee in the amount of $5000.

IV. Donation Designation: The above-described donation should be used for the following purpose(s): To help further the contruction of the new recreation facility.

V. Alterations to Donation Designation: The Donee may need to alter the donation designation to ensure that current priorities are met. Should this be required, the Donee will respect the initial intent of this letter as closely as possible.

VI. Donation Recognition: The Donor agrees to be recognized for the donation under the following name(s): Sandra Barnes and Stewart Smith.

VII. Method of Payment: Check made payable to Mission Charity.

VIII. Organization Type: The Donee is an organization that is classified as a 501(c)(3) non-profit organization by the standards of the Internal Revenue Service (IRS). Therefore, the donation may be tax-deductible to the extent allowed by law.

IX. Currency: All mentions of currency or the usage of the “$” icon shall be known as referring to the US Dollar.

X. Governing Law: This Letter of Intent shall be governed under the laws of the State of Michigan.

XI. Acceptance: If you are agreeable to the aforementioned terms, please sign and return a duplicate copy of this Letter of Intent by no later than October 1, 2019.

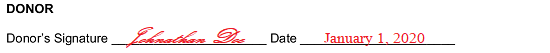

DONOR

Donor’s Signature ______________________ Date ______________________

Print Name ______________________

DONEE

Authorized Signature ______________________ Date ______________________

Print Name ______________________

How to Write a Letter of Intent to Donate

Download: PDF, MS Word OpenDocument

Step 1 – Save This Template To Issue Your Intention To Make A Donation

When you wish to issue your letter of intent to make a donation to a specific organization or party, decide upon the editing program you would like to use to develop one, then select your choice from the buttons designated with the words “PDF,” “Word,” or “ODT”

Step 2 – Indicate Where A Response May Be Mailed

Open the template with the editing program you wish to use then select the first empty line at the top of the page. This line will need the full name of the Sender input for display and the three that follow need the complete address of this Party. It is important to note that in most cases the Recipient of this letter will use this address to respond to the Sender in an official capacity by mail. ![]()

Step 3 – Solidify The Donation Letter’s Effective Date

The “Effective Date” line is the next labeled area. This line expects your documentation of the first calendar date when this letter is formally issued with your stated intentions. This sets the paperwork as being an active document as of your entry. ![]()

Step 4 – Document How This Letter Will Be Directed

The intended Recipient of this letter along with the formal mailing address where it will be received must be produced for display directly under this document’s “Effective Date.” Locate the three available lines placed just above this letter’s topic and below the date, you recorded then enter the Recipient’s legal name. Remember to include any status suffix that is needed to identify this entity on paper especially if this is a 501(c)3 nonprofit. ![]()

Step 5 – Introduce The Donor

The first order of business in the body of this letter will be to solidify the identity of the “Donor.” Typically, this is the Sender of this paperwork, however, this may not always be the case (i.e. a Representative of the Donor may be set to receive responses). “The Donor” identity requested (in the first article) is that of the individual or entity carrying the intent to submit a predetermined donation to the Donee we will discuss later. Locate the blank space just before the parentheses label “The Donor” and fill in the full name of this individual or entity. ![]()

Step 6 – Introduce The Donee

The Donee of this letter will be the entity that will accept the sum of money or property being contributed by the Donor. Locate the next article in this letter (“II. Donee”) then fill in the full name of this entity on the blank space provided. ![]()

Step 7 – Discuss The Intended Donation

The third section will handle the topic of “The Donation” by requesting that you choose one of several checkbox statements to properly represent the donation being made. If this is a “One-Time Monetary Donation” then mark the first checkbox in this article and enter the dollar amount (numerically) that the Donor will contribute to the Donee. ![]() If the Donor intends to make a donation once every month, then mark the second checkbox and record the monthly donation on the first blank line.

If the Donor intends to make a donation once every month, then mark the second checkbox and record the monthly donation on the first blank line. ![]() This second checkbox statement will also seek a time frame for these payments. Thus (if selected) input the first month when the Donor will contribute the sum reported on the second blank space of this statement. If the contribution will only go on for a limited amount of time, then you must mark the checkbox attached to the word “Ending” and record the last month when the Donor will submit this sum on the blank line after this word.

This second checkbox statement will also seek a time frame for these payments. Thus (if selected) input the first month when the Donor will contribute the sum reported on the second blank space of this statement. If the contribution will only go on for a limited amount of time, then you must mark the checkbox attached to the word “Ending” and record the last month when the Donor will submit this sum on the blank line after this word. ![]() Next, enter the total amount of money expected over the months when donations will be made onto the next blank space.

Next, enter the total amount of money expected over the months when donations will be made onto the next blank space. ![]() If the donation will be “Ongoing Until Further Notice,” mark the second checkbox. Be advised that if you may not mark the checkbox “Ending” (and filling in the last two blank lines) if this is an ongoing payment.

If the donation will be “Ongoing Until Further Notice,” mark the second checkbox. Be advised that if you may not mark the checkbox “Ending” (and filling in the last two blank lines) if this is an ongoing payment. ![]() If the Donor desires to make an “Annual Pledge” (once a year) then mark the third checkbox. This will also nee the donation amount to be made every year on the first blank line.

If the Donor desires to make an “Annual Pledge” (once a year) then mark the third checkbox. This will also nee the donation amount to be made every year on the first blank line. ![]() In the case of a yearly donation, you must input the number of years that make up the time period when the contributions will be made along with the first year produced on the next blank space.

In the case of a yearly donation, you must input the number of years that make up the time period when the contributions will be made along with the first year produced on the next blank space. ![]() Finally, add the total dollar amount of donations that will be submitted over the number of years you have indicated on the final blank line.

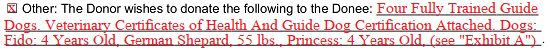

Finally, add the total dollar amount of donations that will be submitted over the number of years you have indicated on the final blank line. ![]() If neither of the previous descriptions can be applied to the donation amount and how it will be submitted then mark the box bearing the word “Other.” The blank lines supplied here can be employed to detail the contribution arrangements the Donor prefers.

If neither of the previous descriptions can be applied to the donation amount and how it will be submitted then mark the box bearing the word “Other.” The blank lines supplied here can be employed to detail the contribution arrangements the Donor prefers.

Step 8 – Supply A Report On The Donor’s Intentions With This Contribution

The fourth article in this letter will further define the donation. Seek out the blank lines following the term “IV. Donation Designation.” Utilize this space to instruct the Donee as to how the Donor wishes the contribution to be used or spent. If the Donor has no instructions regarding the contribution then complete this area with a phrase such as “No Preference” or “As Needed.”![]()

Step 9 – Indicate How Or If The Donor Should Be Given Credit

Often the issue of recognition will need to be settled with the contribution being made. In the sixth article “Donation Recognition,” two checkboxes will allow this status to be presented. If the Donor wishes public recognition for the contribution then mark the first checkbox in this article. ![]() This decision should be documented by producing the name(s) that should be given credit (or displayed) for the discussed contribution.

This decision should be documented by producing the name(s) that should be given credit (or displayed) for the discussed contribution. ![]() If the Donor does not wish to be publically acknowledged or have his or her identity disclosed then mark the second checkbox in this article.

If the Donor does not wish to be publically acknowledged or have his or her identity disclosed then mark the second checkbox in this article. ![]()

Step 10 – Report How The Contribution Must Be Received

Now, we will need to disclose the “Method Of Payment.” Locate the seventh article. Several checkboxes are supplied here and as many as apply may be selected. The first checkbox here indicates the Donee should expect the contribution to be submitted via “Cash Or Check” and will require the Check Recipient’s name to be supplied on the blank line in this choice. ![]() If the Donor submits the contribution with a “Credit Card” payment then check the second checkbox. You must produce the Donor’s credit card information on the blank space provided.

If the Donor submits the contribution with a “Credit Card” payment then check the second checkbox. You must produce the Donor’s credit card information on the blank space provided. ![]() The Donor may be making recurring contributions as an “Automatic Withdrawal.” If so, mark the third checkbox and attach a void check. Note, the check attached should bear the routing and account numbers where the Donor wishes the funds to be withdrawn from.

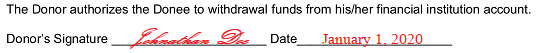

The Donor may be making recurring contributions as an “Automatic Withdrawal.” If so, mark the third checkbox and attach a void check. Note, the check attached should bear the routing and account numbers where the Donor wishes the funds to be withdrawn from. ![]() In a case where a blank check is attached for recurring withdrawals, the Donor will be required to sign the “Donor’s Signature” line then enter the current “Date.”

In a case where a blank check is attached for recurring withdrawals, the Donor will be required to sign the “Donor’s Signature” line then enter the current “Date.”

Step 11 – Define The Donee’s Organization

The eighth article “VIII. Organization Type” will focus on the Donee Organization. If the Donee can be classified as 501(c)(3) non-profit organization then mark the first checkbox. ![]() If the Donee is “Not Classified” as a 501(c)(3) non-profit then mark the second checkbox.

If the Donee is “Not Classified” as a 501(c)(3) non-profit then mark the second checkbox. ![]()

Step 12 – Produce The State Of Jurisdiction

It will be important that a solid identification of the “Governing Law” be included. In the tenth article, use the blank line to report the name of the State whose courts will rule over any disagreements that arise between the Donor and Donee regarding this paperwork. ![]()

Step 13 – Apply An Acceptance Deadline

In the eleventh article, we will discuss a second date. The blank line in “XI. Acceptance” should be used as a reporting area. ![]()

Step 14 – The Donor Must Sign This Document

The Donor must now locate the “Donor Signature” line in the section labeled “Donor” at the conclusion of the presented article. The Donor must sign this line to effectively declare his or her intention then produce the current “Date” immediately after signing this line.  The “Print Name” line below the Donor’s signature is placed here so the Donor can spell out his or her name in print.

The “Print Name” line below the Donor’s signature is placed here so the Donor can spell out his or her name in print. ![]()

Step 15 – The Donee Must Execute This His or Her Signature

The Donee is also a required signature. Generally, the Donee will be a nonprofit or for-profit business entity. This will require that a Signature Representative of the Donee sign the “Donee Signature” line then enter the current “Date” just under the “Donee” section. ![]()

The Donee should also print his or her name on the “Print Name” provided to solidify his or her identity. ![]()