Updated April 10, 2023

A mortgage gift letter (gift affidavit) is a sworn statement that verifies funds being used to purchase a property were gifted and not an undisclosed loan. Lenders require gift letters as proof that no repayment obligations are attached to the gift and that no conflicts of interest exist. Gift funds can be used for the down payment or closing costs.

Main Purpose

To provide evidence to a lending institution that the funds being gifted are not an undisclosed loan. Therefore, the money given does not impact the borrower’s ability to pay their mortgage.

Table of Contents |

What is a Mortgage Gift Letter?

A mortgage gift letter is an affidavit that acknowledges money was given to a recipient for a downpayment, closing costs, or other expenses related to purchasing a property.

It is required to be signed by both the giving party and the recipient to verify the funds are not part of a loan or separate agreement.

Donor Relationship

Gift funds for a mortgage can’t come from just anyone. Instead, major lenders require donors and recipients to share a familial relationship. Acceptable donors include direct relatives and non-relatives with close ties to the recipient, such as former family members, godparents, or domestic partners.

The donor may not be affiliated with any party to the real estate transaction (other than the recipient), including developers, agents, or any other interested individual or organization.

Eligible Donors

- Direct relatives/family members

- Former family members

- Engaged spouses

- Domestic partners

- Legal guardians

- Godparents

Not Eligible

- Donors affiliated with ANY other party involved in the property transaction, including:

- Developers

- Brokers

- Sellers

- Real estate agents

What to Include

A valid mortgage gift letter should include the donor’s information, details about the gift, statements attesting to the nature of the gift and disclaiming any conflict of interest, and corroborating documents.

Donor Information

Mortgage gift letters should always include the donor’s basic contact information, including a telephone number (required by Fannie Mae and other lenders).

Recipient Information

The recipient’s full name and the nature of their relationship with the donor should be stated in the letter.

Gift Details

The letter should include the exact dollar amount of the gift and the date of transfer. The donor should also disclose the source of the gift funds, including the institution name, account name, and account number. Additional supporting documents may be required.

Donor Affirmations

The donor must affirm in writing that:

- No repayment in any form is to be made now or in the future;

- The gift is neither conditional nor bargained for;

- The donor is not, and has no association with, an interested party in the transaction.

Signatures

Both the donor and the recipient should sign the gift letter. The document does not need to be notarized.

Minimum Borrower Contributions

Federal loan guarantors such as Fannie Mae and Freddie Mac limit the percentage of funds that can be applied as a gift. For some types of mortgages, borrowers must contribute at least 5% of their personal funds.

In addition, Freddie Mac imposes additional restrictions on investment properties and shared equity mortgages.

| LTV Ratio* | Mortgage Type | Minimum Borrower Contribution |

| 80% or less |

|

None (all funds for a transaction may be gift funds) |

| More than 80% |

|

None (all funds for a transaction may be gift funds) |

| More than 80% |

|

5% of value |

| N/A |

|

5% of value |

| N/A |

|

100% (all funds must come from borrower) |

* The loan-to-value ratio used to assess the risk level of the mortgage loan

Required Documents

Most lenders require evidence of the gift transfer in addition to the gift letter. Proof of electronic transfer or a copy of the check and deposit slip are typically accepted. Borrowers should check with their lender to ensure all required documents are submitted along with the gift letter.

Mortgage Gifts and Taxes

In general, mortgage gifts below a certain threshold do not need to be reported to the IRS. The annual exclusion for gifts is $17,000 per person for the tax year 2023, meaning gifts of $17,000 or below don’t need to be reported.

For gifts above the exclusion threshold, the donor is required to file a gift tax return. However, the donor will not owe taxes on this amount if they fall below the lifetime gift tax exemption of over twelve million dollars.

It’s important to consult a tax professional regarding gift transfers as special rules may apply to individual situations.

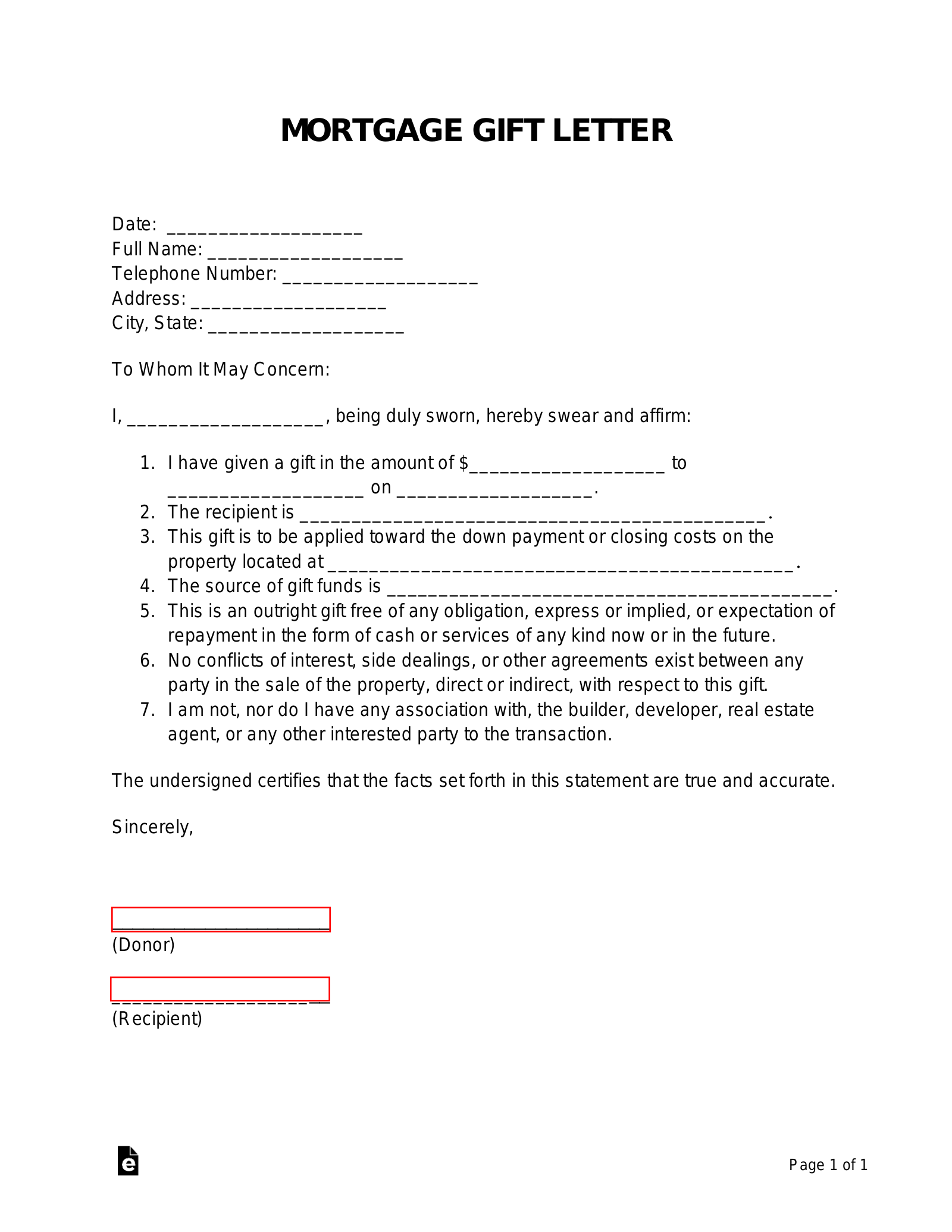

Sample

MORTGAGE GIFT LETTER

Date: [DATE]

Full Name: [DONOR’S NAME]

Telephone Number: [DONOR’S PHONE NUMBER]

Address: [DONOR’S ADDRESS – LINE 1]

City, State: [DONOR’S ADDRESS – LINE 2]

To Whom It May Concern:

I, [DONOR’S NAME], being duly sworn, hereby swear and affirm:

- I have given a gift in the amount of $[GIFT AMOUNT] to [RECIPIENT’S NAME] on [DATE OF TRANSFER].

- The recipient is [RELATIONSHIP OF DONOR TO RECIPIENT].

- This gift is to be applied toward the down payment or closing costs on the property located at [PROPERTY ADDRESS].

- The source of gift funds is [ACCOUNT NAME, ACCOUNT NUMBER, INSTITUTION NAME].

- This is an outright gift free of any obligation, express or implied, or expectation of repayment in the form of cash or services of any kind now or in the future.

- No conflicts of interest, side dealings, or other agreements exist between any party in the sale of the property, direct or indirect, with respect to this gift.

- I am not, nor do I have any association with, the builder, developer, real estate agent, or any other interested party to the transaction.

The undersigned certifies that the facts set forth in this statement are true and accurate.

Sincerely,

_____________________

(Donor)

_____________________

(Recipient)