Updated March 21, 2024

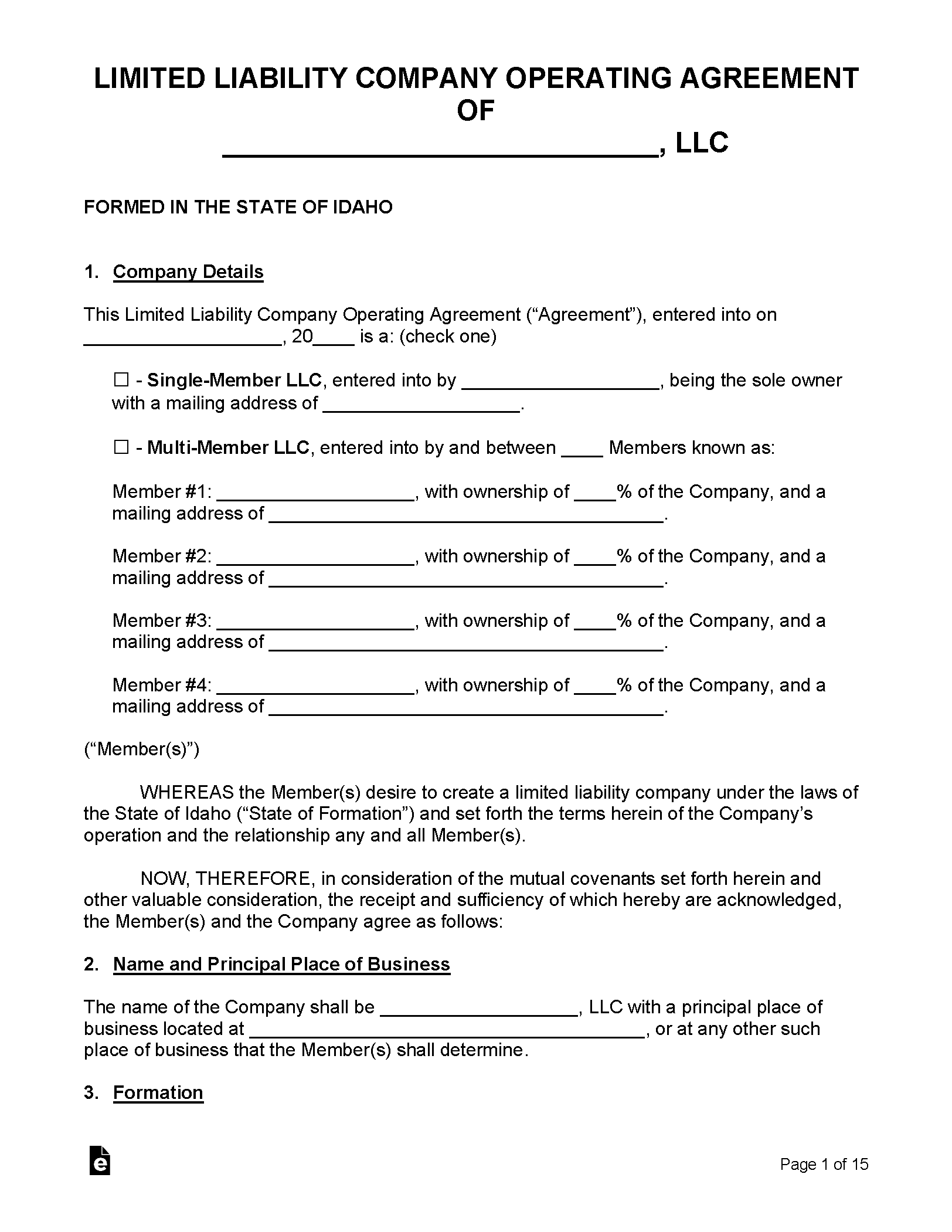

An Idaho LLC operating agreement is a legal document that allows the company to establish policies, operating procedures, and the ownership of each member. It is not required under State law nor is it filed with any government office. The agreement becomes legally binding and in effect after being signed by all parties and can only be changed through written amendment.

Is an Operating Agreement REQUIRED in Idaho?

No. Idaho state law does not require businesses to implement an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – For use by a business with only the owner serving as management, who would like to establish in writing the daily business and operating procedures.

Single-Member LLC Operating Agreement – For use by a business with only the owner serving as management, who would like to establish in writing the daily business and operating procedures.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by an entity with multiple members who would like to establish member-management policies and procedures in writing.

Multi-Member LLC Operating Agreement – For use by an entity with multiple members who would like to establish member-management policies and procedures in writing.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

How to Form an LLC in Idaho (5 steps)

- Nominate a Registered Agent

- Complete the Filing

- Filing Fee

- LLC Operating Agreement

- Employer Identification Number (EIN)

Prior to filing your LLC in the State of Idaho, it is recommended that you conduct a Preliminary Search of the Secretary of State records to ensure the availability of your preferred business name. The Secretary of State will reject all applications submitted with duplicate or similar names. You may proceed to file your LLC once you have confirmed that your operating name is indeed available.

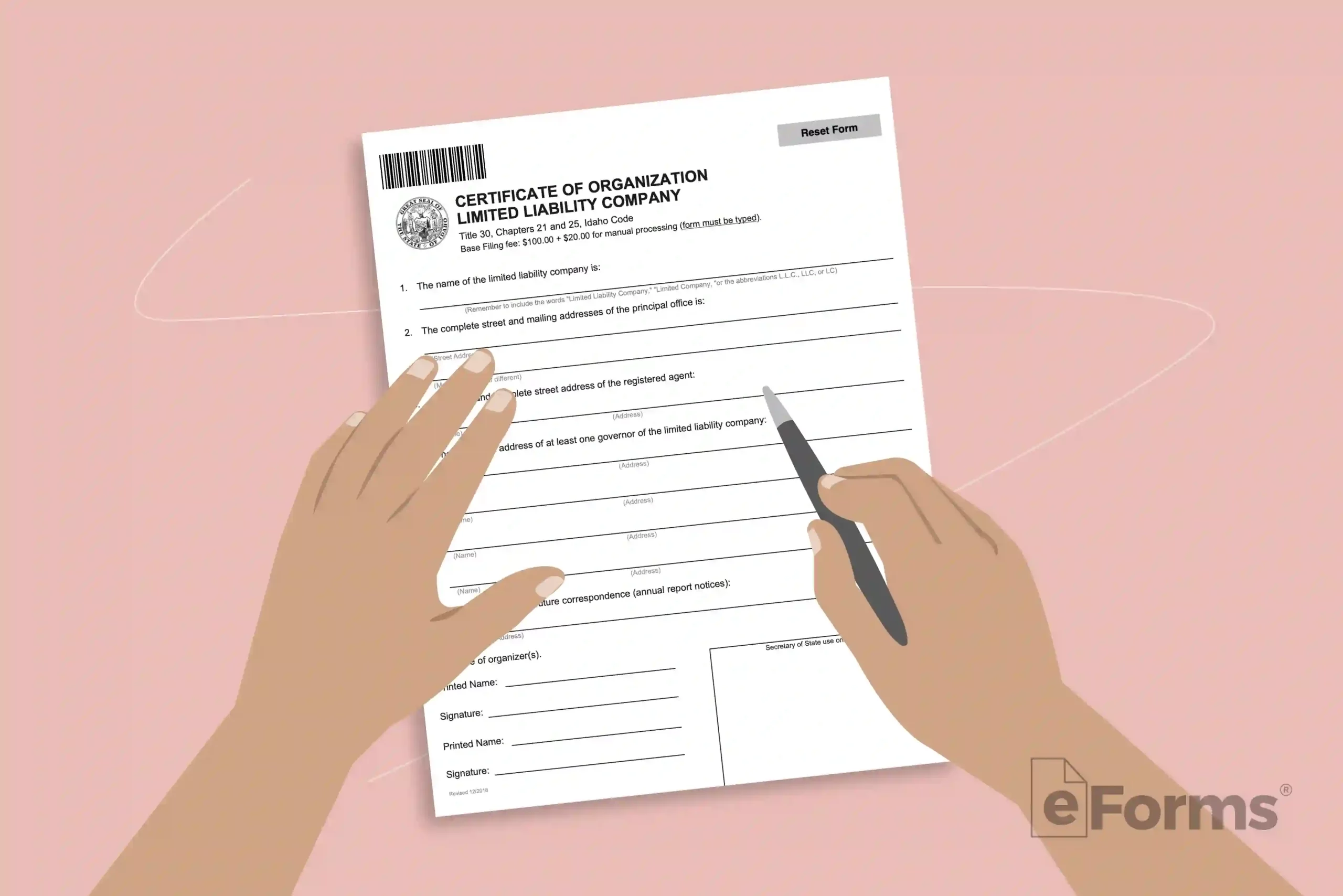

2. Complete the Filing

Download the application below which matches your particular entity type. The document may be completed on your computer or printed and filled in using black ink.

Download the application below which matches your particular entity type. The document may be completed on your computer or printed and filled in using black ink.

- Domestic – Certificate of Organization

- *Foreign – Foreign Registration Statement

*Foreign applications must be accompanied by a Certificate of Existence (or similar document) issued in the initial jurisdiction and dated no more than ninety (90) days prior to filing with the Secretary of State.

3. Filing Fee

The filing fee varies based on whether your application is typed or filled in by hand. Typed documents require a fee of $100 while those filled in by hand cost $120. Attach a check made payable to the ‘Idaho Secretary of State’ to cover the filing cost and send all articles to the below address (include an addition $20 if you’d like to expedite your filing).

Office of the Secretary of State, 450 N 4th Street, PO Box 83720, Boise, ID 83720-0080

4. LLC Operating Agreement

An LLC operating agreement may be used in the event of a legal dispute as it provides proof that the LLC and its assets are separate from those of the member(s). There is no legal obligation to file this document in the State, though it is recommended that one be drafted to help organize the structure of the LLC’s internal affairs.

An LLC operating agreement may be used in the event of a legal dispute as it provides proof that the LLC and its assets are separate from those of the member(s). There is no legal obligation to file this document in the State, though it is recommended that one be drafted to help organize the structure of the LLC’s internal affairs.

5. Employer Identification Number (EIN)

Laws

- Limited Liability Company Laws – Title 30, Chapter 25

- Operating Agreement Statutes

- § 30-25-105 (Operating agreement – scope, function, and limitations)

- § 30-25-106 (Operating agreement – effect on limited liability company and person becoming member; preformation agreement)

- § 30-25-107 (Operating agreement – effect on third parties and relationship to records effective on behalf of limited liability company)

“Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in section 30-25-105(a), Idaho Code. The term includes the agreement as amended or restated.

Each LLC in Idaho is required to elect a Registered Agent. The Registered Agent may be an individual residing in the State or a legal business entity with authorization to transact business in the State.

Each LLC in Idaho is required to elect a Registered Agent. The Registered Agent may be an individual residing in the State or a legal business entity with authorization to transact business in the State.