Updated March 21, 2024

A Maryland LLC operating agreement consists of an arrangement made between all the members of a company regarding ownership, management, operations, and officer appointments. It is written to include the terms and conditions on how a company will operate its day-to-day activities. It is not filed with the Secretary of State and is advised for each member to copy their own copy.

Is an Operating Agreement REQUIRED in Maryland?

No. Limited liability companies in Maryland are not required to implement an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – For use by sole proprietors or single owners so that they may establish various procedures, policies, etc. This agreement would be entered into between the owner of the business and the agreement itself.

Single-Member LLC Operating Agreement – For use by sole proprietors or single owners so that they may establish various procedures, policies, etc. This agreement would be entered into between the owner of the business and the agreement itself.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by companies who will have more than one (1) contributing, managing member to properly and collectively establish the policies and procedures within the company. All members must be in unanimous agreement prior to the application of signatures within the document.

Multi-Member LLC Operating Agreement – For use by companies who will have more than one (1) contributing, managing member to properly and collectively establish the policies and procedures within the company. All members must be in unanimous agreement prior to the application of signatures within the document.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

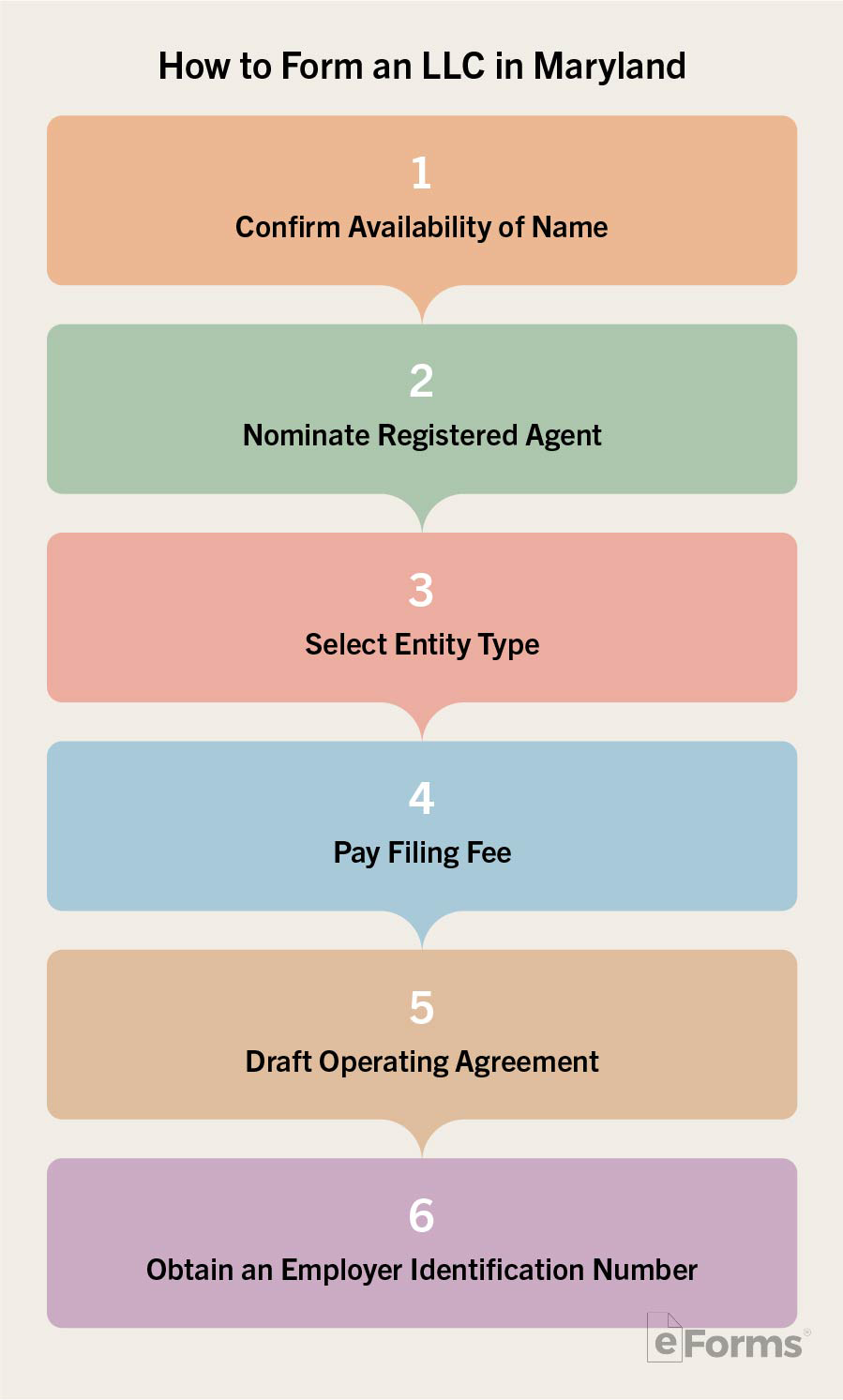

How to Form an LLC in Maryland (5 steps)

- Nominate a Registered Agent

- Entity Type

- Filing Fee

- Operating Agreement

- Employer Identification Number (EIN)

Each applicant should Confirm the Availability of their business name before officially applying for registration in Maryland. The State Department of Assessments and Taxation has provided filers with the ability to search their records to view all entities currently registered. If the searched business is listed and operated under by an active entity, the name is unavailable.

2. Entity Type

There are two fileable LLC types in the State; Domestic and Foreign. An entity formed within the State is considered a Domestic LLC while a Foreign LLC is an entity initially formed in an outside jurisdiction.Choose your entity type and filing method from the following list:

*A Certificate of Existence (or like document) must be included with all Foreign LLC applications.

3. Filing Fee

A $100 fee is required to process all LLC filings (an additional $50 may be added if you’d like to expedite the filing time).Those filing by mail should enclose a check made payable to the ‘State Department of Assessments and Taxation’ and send all articles to the following address:

State Department of Assessments and Taxation, Charter Division, 301 W. Preston Street; 8th Floor, Baltimore, MD 21201-2395

4. Operating Agreement

LLCs in the State of Maryland are not required to implement an operating agreement. However, it is recommended that one be drafted to provide legal evidence of the member(s) interest in the LLC, which is useful in the event of legal disputes between individuals of a multi-member LLC. If created, the operating agreement must be consistent with the LLC’s articles of organization.

5. Employer Identification Number (EIN)

After filing your LLC in the State, you should immediately apply for an Employer Identification Number (EIN) from the Internal Revenue Service. This number is necessary to legally hire employees and perform financial transactions under the company name. Apply for an EIN by:

- Submitting PDF Form SS-4

- Completing the Online Application

Laws

- Limited Liability Company Act – Title 4A

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating Agreement” means the agreement of the members and any amendments thereto, as to the affairs of a limited liability company and the conduct of its business.”